Yesterday marked the fifth anniversary of the Affordable Care Act. Over the five years since the law passed, our health care system has seen considerable progress: a dramatic expansion of health insurance coverage that has pushed the nation’s uninsured rate to its lowest level ever; historically slow growth in health care costs that has saved billions for workers, businesses, and governments; and striking improvements in the quality of patient care that have avoided tens of thousands of patient deaths. But much remains to be done.

Notably, despite major progress facilitated by the Affordable Care Act, our health care system remains dominated by “fee-for-service” payment systems that pay doctors and hospitals based on the quantity of care they provide, not the outcomes they achieve for patients. Economists broadly agree that traditional fee-for-service payment systems increase costs and reduce the quality of care patients receive, and recent evidence has bolstered the case that alternative ways of paying providers that reward quality and efficiency can generate substantial improvements in care.

Indeed, facilitating the deployment of new payment models, like bundled payments and Accountable Care Organizations, may be the best tool we have to ensure that the exceptionally slow growth in health costs we have seen in recent years continues in the years ahead. And if deploying such models does allow us to sustain the recent slow growth in health costs, the economic gains could be immense. To illustrate that fact, consider:

-

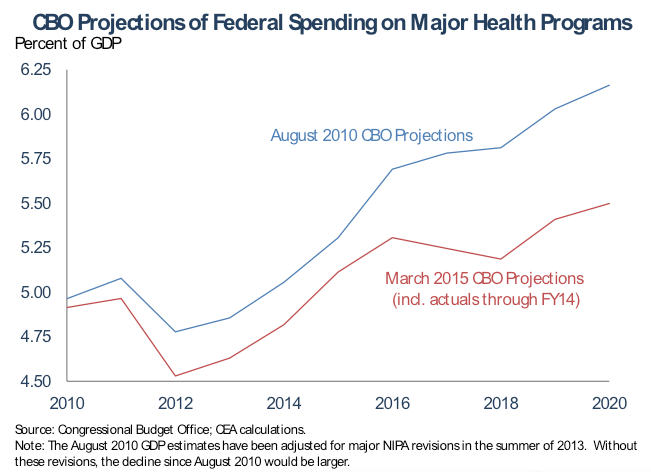

The Congressional Budget Office has concluded that a significant portion of the recent slow growth in health costs will persist in the years ahead. Largely as a result, it now projects that Federal spending on major health care programs in 2020 will be $200 billion lower than it predicted in August 2010. This frees up resources to reduce our deficit or invest in areas like education or infrastructure, boosting future economic growth.

-

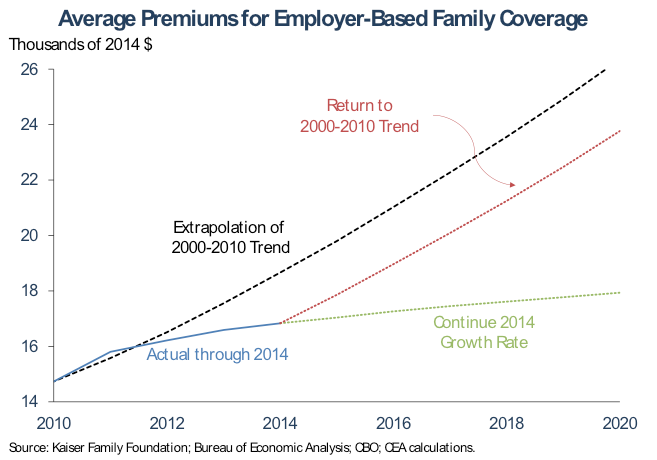

In the private sector, if we could sustain even one-third of the difference between the record-tying low growth rate in 2014 and the growth rate in the last decade, then the average premium for employer-based family coverage would be nearly $2,100 lower by 2020, generating total savings of $119 billion in that year. Those are savings that will ultimately accrue to workers as lower premiums or higher wages.

The Administration has a strategy for seizing these gains. Earlier this year, the Department of Health and Human Services (HHS) set the goal of making 30 percent of Medicare payments through alternative payment models by 2016 and 50 percent by 2018. These goals build on progress that has already been made under the Affordable Care Act; in 2014, about 20 percent of Medicare payments flowed through alternative payment models, up from essentially none before the law passed. Economic evidence demonstrates that deploying new models in Medicare is likely to facilitate adoption of those models in the private sector, just as previous Medicare innovations like prospective payment for hospital admissions did in the past.

But additional steps may be needed to facilitate widespread adoption of new payment models in the private sector. Developing and deploying new models requires substantial investments, investments that individual payers may find it hard to undertake on their own, particularly since payers who succeed in deploying new models and improving care delivery in their region often end up generating “spillover” benefits for their competitors. As a step toward addressing this problem, tomorrow the White House will host the first meeting of the Health Care Payment Learning and Action Network, an HHS initiative that brings together public- and private-sector stakeholders to work collaboratively to identify and overcome barriers to deploying new payment models, share lessons learned, and find ways to better align their activities.

The success of these efforts will play an important role in shaping our economic future.

The Economic Case for Deploying New Health Care Payment Models

Shortcomings of Fee-For-Service Payment

Historically, both private insurers and public programs like Medicare have paid medical providers using “fee-for-service” payment systems. Under traditional fee-for-service payment systems, medical providers are paid based on the number and type of services they perform. For example, a primary care physician might be paid $60 each time he sees a patient for a routine office visit. Similarly, a surgeon might be paid $2,000 each time she performs a back surgery, while the hospital that provided the facilities for the patient’s surgery and recovery would receive a separate payment of perhaps $20,000, and a physical therapist who the patient saw after leaving the hospital would be paid separately as well.

Economists generally agree that traditional fee-for-service payment systems have at least three troubling consequences for the care patients receive:

- Excessive use of low-value services: Under fee-for-service, health care providers’ incomes are tied directly to the number of services they provide. This means that providers have an incentive to provide as many services as possible, even in cases where those services do not benefit patients, and that they lack an incentive to find ways to achieve the same outcomes more efficiently. These incentives unnecessarily drive up costs.

- Insufficient incentives to improve quality of care: Traditional fee-for-service payment amounts do not vary based on the quality of care patients receive, giving providers no direct financial incentive to improve quality. While health care professionals invariably want to improve quality because they care about their patients’ well-being and want to keep and attract patients, this is not always enough to ensure that all patients receive high-quality care.

- Poor coordination of care: Patients typically receive services from many different providers, and fee-for-service payment systems pay each of those providers separately. As a result, no single provider has a financial incentive to make sure that the overall package of care a patient receives fits together as a coherent whole. To make matters worse, traditional payment systems do not compensate providers for time they spend coordinating with other members of a patient’s care team. The result is missed opportunities to reduce costs and improve quality.

Linking Fee-for-Service Payments to Quality and Value Can Improve Outcomes

Increasingly, our health care system has been turning toward payment approaches that avoid these negative effects. One broad group of approaches retains the basic structure of fee-for-service payment, but encourages the delivery of efficient, high-quality care by offering higher fee-for-service payment amounts to providers who deliver efficient, high-quality care. The Affordable Care Act introduced this type of payment to several components of Medicare.

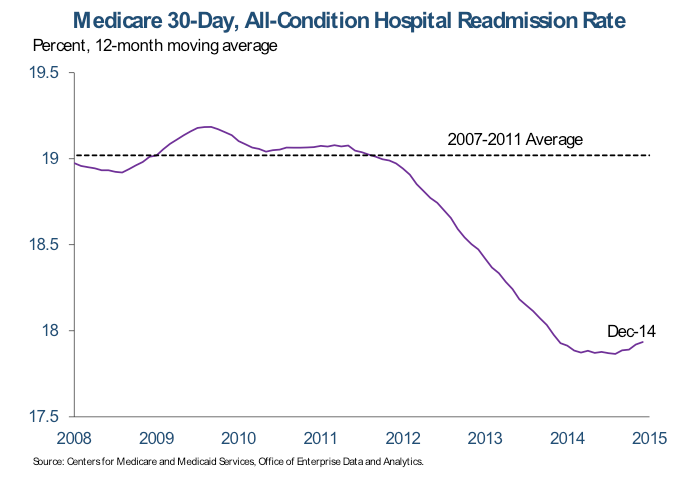

A prominent example is the Affordable Care Act’s Hospital Readmissions Reduction Program, which reduces reimbursement rates for hospitals in which a relatively large fraction of patients return to the hospital soon after discharge. Readmissions are often the result of low-quality care during an initial admission or poor planning for how a patient will receive care after discharge. Starting in the months before these incentives took effect in late 2012, 30-day readmission rates have fallen sharply. That decline translated into 150,000 avoided readmissions over the period from January 2012 to December 2013. While other efforts to reduce readmissions were also underway during this period—notably HHS initiatives that helped hospitals identify and spread strategies for reducing readmissions—the timing of the dramatic change suggests that the readmissions payment incentives deserve a substantial fraction of the credit, a powerful illustration of how changing providers’ incentives can improve patient care.

Alternative Payment Models Are Likely to Offer Larger Gains

While linking fee-for-service payments to efficiency and quality is an important step forward, more fundamental change would have a broader and more meaningful impact. This is because linking fee-for-service payments to efficiency and quality neither fully eliminates providers’ incentives to increase the quantity of services they deliver nor the barriers to care coordination that exist under traditional fee-for-service.

This is why the Administration, using the tools created by the Affordable Care Act, has worked to deploy “alternative payment models” that orient payment around an episode of care or the patient as a whole, rather than individual services. Prior to the Affordable Care Act, such models were virtually non-existent in Medicare. By 2014, about 20 percent of traditional Medicare payments flowed through alternative payment models, all of them created or made possible by the law. HHS has set the goal of making further progress in the years ahead, with 30 percent of traditional Medicare payments flowing through these models by 2016 and 50 percent by 2018.

Alternative payment models can take a variety of forms, but two prominent examples include:

- Bundled payments: The Center for Medicare and Medicaid Innovation, created by the Affordable Care Act, is currently conducting a large-scale test of several “bundled payment” models in which Medicare makes a single payment for all services associated with an episode of care, like a hip replacement. Under the most comprehensive model being tested by the Innovation Center, the bundle includes physician and hospital services during the initial hospital stay, as well as services delivered during a period after the hospital stay. By contrast, under fee-for-service, all of these services would have been paid for separately. More than 6,000 hospitals, physician groups, and post-acute care providers are engaged in this project and initial results will become available over the coming year.

- Accountable Care Models: Across the country, medical providers have formed 424 Accountable Care Organizations (ACOs) serving 7.8 million Medicare beneficiaries through either the Innovation Center’s Pioneer ACO Program and the Medicare Shared Savings Program, both made possible by the Affordable Care Act. Under an ACO model, providers take on the responsibility for managing the cost and quality of all of a patient’s care during the year, and they have the opportunity to earn “shared savings” payments if they reduce average per-person spending below a benchmark level while also delivering high-quality care.

By orienting care around an episode of care or the patient as a whole, rather than individual services, these payment models support care coordination and provision of appropriate, rather than excessive, services. These models also generally link payment to quality performance and include provisions to provide patients with choices and ensure access to needed services.

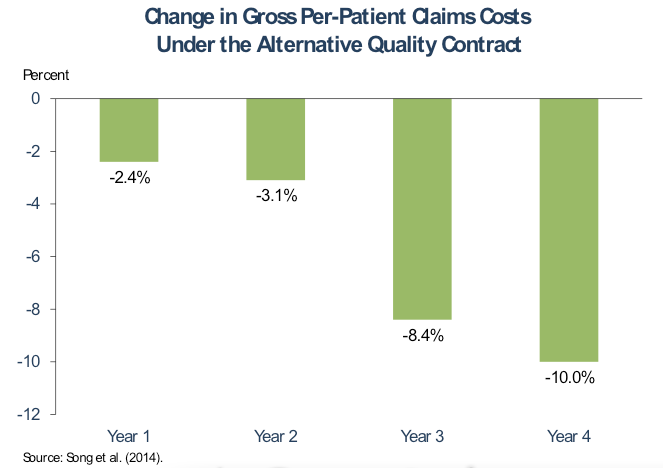

Experience with alternative payment models is still relatively limited, but the early evidence is promising. Perhaps the best evidence on the potential of such models comes from research on from Blue Cross Blue Shield of Massachusetts’ Alternative Quality Contract (AQC), which has been operating since 2009 and is similar to the two-sided risk ACO contracts offered by Medicare. This study found that the AQC found that gross per-patient claims costs of providers who participated in the AQC fell markedly relative to similar providers in comparison states, generating gross savings of 10 percent by the fourth year that the contract was in use. The quality of care for beneficiaries who received care from AQC participants increased markedly relative to the comparison group as well.

While in the early years of the AQC, the gross savings were outweighed by bonus payments to providers, by its fourth year, the AQC generated net savings. Furthermore, the structure of the AQC in its early years may have led to higher bonus payments than were actually necessary to encourage participation in the contract, suggesting that other approaches to accountable care could generate larger net savings. Regardless, the AQC experience provides strong evidence that the improved incentives created by accountable care models can generate large positive changes in medical practice.

Joint Public-Private Efforts Can Accelerate Payment Reform

The Administration’s commitment to rapidly deploying alternative payment models is an important step toward deploying them system-wide. Medicare is the nation’s single largest payer, so it has a unique ability engage providers in order to deploy new models. When Medicare deployed “prospective payment” for hospitals during the 1980s, private payers followed suit. More recently, economic research has found that when Medicare changed the structure of how it paid physicians, private payment patterns followed suit.

But action by public programs may not be sufficient to ensure widespread adoption of new payment models in the private sector. Economic research in a variety of settings has found that when one payer changes its practices in ways that reduce costs or improve quality, other payers in the same market may benefit as well since medical providers apply the improved approaches to care delivery with all of their patients. For example, research on the AQC has found that Medicare realized “spillover” cost savings as the AQC came online in Massachusetts.

The presence of cross-payer “spillovers” means that the deployment of alternative payment models can face a classic “collective action problem,” in which all payers are better off in a world where alternative payment models are the norm, but many payers would rather let someone else do the hard work of deploying them. Collaborative effort between public and private payers may be able to help solve this problem by securing agreement from many payers to move forward together or by facilitating the spread of information in order reduce adoption costs. Collaborative efforts may also make it easier for different payers to align their new models, reducing administrative costs for providers and potentially increasing models’ efficacy. HHS’ Learning and Action Network aims to serve all of these roles.

The Economic Benefits of Deploying New Payment Models Could Be Immense

It is difficult to directly estimate how deploying alternative payment models throughout our health care system would affect health care costs and quality. While the case for shifting toward alternative ways of paying for medical care is strong, we are just getting our first glimpses at the size of the cost reductions and quality improvements that these models can achieve at scale. Although that evidence is encouraging, it is difficult to use it to estimate the long-run effects on cost and quality at the level of the nation as a whole.

However, we can get a sense of what is at stake from recent historical experience. As CEA has discussed previously, recent years have seen exceptionally slow growth in health care costs throughout our health care system, including in private insurance, Medicare, and Medicaid. Some of that slowdown reflects temporary factors like the aftereffects of the recession and a wave of prescription drug patent expirations, but the evidence implies that much of the slowdown reflects deeper — and potentially longer-lasting — structural changes in the health care system, with some of it reflecting changes in Medicare policy, as well as “spillover” effects of those changes in the private sector. Continued progress on deploying alternative payment models is likely our single best tool for ensuring that these structural changes continue in the years ahead. If we are successful in doing so, the economic benefits could be very large.

Savings in the Public Sector Could Reduce Deficits or Facilitate Investments

In the public sector, one way of gauging the potential benefits of continued slow health care cost growth is to examine recent Congressional Budget Office (CBO) projections. In recent years, CBO has concluded that a substantial portion of the slow growth in per-enrollee costs across Medicare, Medicaid, and the private sector reflects structural changes that may persist. On the basis of those estimates, CBO has made a series of downward revisions to their projections of federal spending on major health care programs (Medicare, Medicaid, CHIP, and the Marketplace subsidies). Since August 2010, those revisions to projections have totaled $200 billion in 2020 alone, the last year covered by CBO’s August 2010 estimates.

Savings of that magnitude — if they do in fact materialize — would generate large economic benefits. For example, if they are used to pay down our deficit, those savings could boost capital accumulation and reduce foreign borrowing, raising national income and workers’ wages over time. Alternatively, they could be used to finance investments in areas like education or infrastructure, increasing the nation’s productive capacity over the long run.

Savings in the Private Sector Could Generate Large Increases in Workers’ Wages

If the recent system-wide slowdown in health costs continues, it could generate major benefits in the private sector as well. From 2010 through 2014, growth in premiums for employer-sponsored family coverage has been well below the average seen over the decade from 2000 through 2010, as measured by the Kaiser Family Foundation and Health Research and Education Trust’s Employer Health Benefits Survey. In 2014, the average premium was $1,800 lower than if growth since 2010 had matched the 2000-2010 average.

Recent growth in employer premiums has been particularly slow; in 2014, growth in employer premiums matched the slowest rate since the Kaiser survey began. Suppose that we were able to sustain one-third of the difference between the low record-matching 2014 growth rate and the average from 2000 through 2010. By 2020, the average family premium would be $2,097 lower (in 2014 dollars) than if growth rates fully matched the 2000 through 2010 average. This corresponds to $119 billion in aggregate employer health insurance premium savings in 2020.[1]

Because workers pay a bit more than one-quarter of premiums themselves, some of those savings would stay directly in workers’ pockets. The remainder would accrue initially to employers, reducing employers’ compensation costs and potentially boosting hiring. Economic theory and evidence are clear, however, that employers’ savings on health insurance premiums would ultimately be passed through to workers as higher wages, meaning that workers would ultimately benefit from the full $119 billion estimated above.

[1] To compute an aggregate savings figure that is comparable to the estimated family premium savings figure, we start with average per-enrollee spending for 2014, as estimated in CMS’ National Health Expenditure Projections, then project this amount forward using the same growth rates as used for the family premium calculation and multiply by the projected number of individuals enrolled in employer coverage in 2020.

Jason Furman is the Chairman of the Council of Economic Advisers. Matt Fiedler is a Senior Economist on the Council of Economic Advisers.