We all stand to benefit by simplifying refinancing

The Plan to Help Homeowners

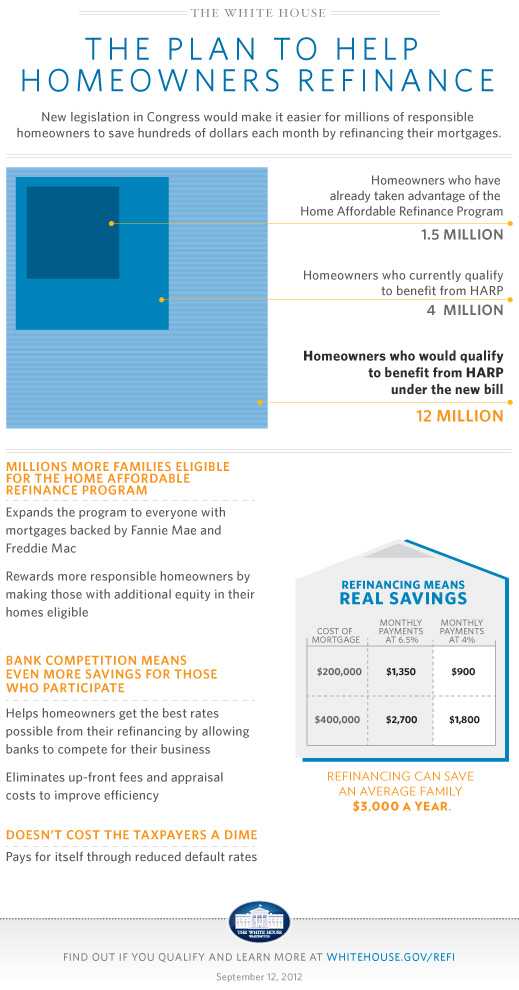

Congress is considering a plan that would help millions of responsible homeowners save hundreds of dollars each month by refinancing their mortgages.

Why refinance?

Today, home interest rates are at historic lows—on average, below 4 percent. The average homeowner could save $3,000 a year by refinancing at today’s low rates, but far too many borrowers are locked out of a chance to do so. Complicated application processes and eligibility requirements, costly appraisals, and the fact that many homeowners owe more on their mortgage than the value of their home make refinancing all but impossible for millions of Americans.

How would the proposed plan help homeowners?

The plan to expand access to refinance is simple: make it easier for millions of responsible homeowners to refinance, even if they are underwater. The proposal would establish a quick and hassle-free process for homeowners who are current on their mortgage payments and want to refinance—no more tax forms, and no more appraisals—just a lower interest rate, and lower payments each month.

What about underwater homeowners?

When the housing bubble burst, home values dropped, and millions of homeowners who did the right and responsible thing—shopped for a home, secured a mortgage, and made their payments on time each month—were left with houses worth less than they paid for them and mortgages worth more than their homes. Today, many of these homeowners are locked out of refinancing because they are underwater or because their credit took a hit.

The proposal now being considered in Congress will help millions of these families. Whether your home has fallen in value or your credit was harmed, as long as you've been paying your bills on time in recent months and your loan is backed by Fannie Mae or Freddie Mac, you will finally be able to refinance.

How does refinancing help the economy?

Millions of homeowners who refinance could see hundreds of dollars in savings each month, but that money does more than just help individual families. Those homeowners will have more money to pay bills, more money to spend in shops and restaurants in their communities, or more money to save for college or new car. In turn, this spending—made possible by refinancing—will benefit our entire economy, and help spur the growth we need.

Where's my "refi"?

President Obama’s refinancing proposal requires Congress to act, and until they do, millions of families will be prevented from refinancing and saving hundreds of dollars each month.

Speak out if you support helping homeowners.

You can use the hashtag #MyRefi to add your voice on mortgage refinance policy. Jump to the tool to see if you qualify.