Recovery Act Third Quarterly Report 3rd Quarterly Report - Appendix

Appendix

This appendix sets out the detailed assumptions used to estimate the spending effects that appear in the tables in the "Consumption Expenditure and ARRA Tax Relief and Payments to Individuals" section of the report.

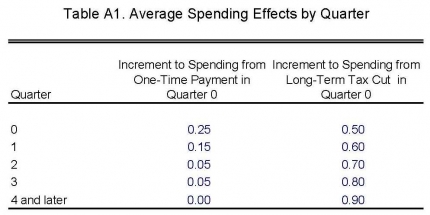

We present first our assumptions about the average spending effects of one-time and long-term tax cuts.

The table is interpreted as follows. The figure of 0.25 in the upper left corner indicates that in the quarter of a one-time tax change, the spending effect of a $1 tax change is 25 cents. One quarter later (the next row down), spending would remain higher by 15 cents than it would have been absent the tax cut, and so on. Over the course of a year (quarters 0-3), the sum of these coefficients adds up to the 0.5 (or fifty percent) annual marginal propensity to consume mentioned in the text. We conservatively assume that there is no further spending effect beyond the first year (though in reality these consumers would be very likely to have some residual spending increase even after a year).

The next column gives the corresponding estimates for a long-term tax change. We assume that for a long-term change in taxes, spending rises by 50 percent of the amount of the tax change immediately. Empirical evidence from macroeconomic research suggests that the full effect of long-term changes to income does not show up in spending immediately; consistent with this evidence, we assume that spending ramps up over the course of a year; after that time, spending is higher by 90 cents for each dollar of long-term tax cut. (The evidence in Carroll, Otsuka, and Slacalek, 2006, suggests that the transition is probably somewhat more gradual than this, but theory indicates that the final effect on spending eventually reaches one-for-one; our 0.90 figure is therefore a compromise.)

Some of the effects of the Recovery Act on income are targeted to those most directly affected by the recession and are difficult to categorize as transitory or long-term. Extended unemployment benefits and increased Supplemental Nutrition Assistance payments fall into this category. The available evidence suggests that the propensity to consume out of these kinds of payments is quite high, but precise estimates are not available (especially with respect to the time pattern of any spending effect). We have simply assumed that total spending increases by two-thirds of the payment amount in the quarter when the payments are received; the remaining one-third is spent with a one-quarter lag.