Strengthening the Rural Economy - Growing New Businesses in Rural America

III. GROWING NEW BUSINESSES IN RURAL AMERICA

The previous section highlighted both the strengths of rural America and the challenges it faces. The Obama Administration is committed to building on those strengths and addressing the challenges. One key set of the Administration’s policies for rural America are programs to help businesses grow and flourish in rural areas. These policies include supporting small businesses, jump-starting the transition to clean energy, and new opportunities for rural tourism and recreation.

A. Strengthening Small Business

1. Background

In the second half of the twentieth century, a diversifying rural economy gave the Federal government reason to expand its rural business programs beyond the agricultural sector. The three main organizations that house these programs are the Small Business Administration (SBA), the Department of Commerce’s Economic Development Administration, and the Department of Agriculture’s Office of Rural Development.

The Small Business Administration has supported loans to small businesses for over fifty years through numerous loan and financing programs, the biggest of which are the 7(a) and 504 loan guarantee programs. The 7(a) program has historically offered guarantees of up to 85 percent on loans to small businesses that would not otherwise be able to get funding. The 504 program is designed to help businesses get long-term financing to acquire fixed assets for expansion or modernization. Both programs work through qualified lenders and generally require fees for participation. Over 2007 and 2008, an annual average of more than $2 billion in loan guarantees by the 7(a) and the 504 programs went to rural counties, representing 12 percent of their total loan volume.

The Economic Development Administration provides a variety of services to stimulate economic development and to protect underserved businesses, including a revolving loan fund program to small business owners and entrepreneurs, a trade adjustment assistance program, and an economic adjustment assistance program for businesses affected by sudden economic changes. In fiscal year 2008, it reported investing almost 69 percent of its funds for infrastructure and revolving loan funds in rural areas.

Programs in the Department of Agriculture’s Office of Rural Development are explicitly geared towards encouraging economic development in rural communities. In 2008, these programs supported more than $1.5 billion in loans and grants, $1.4 billion of which was in the Business and Industry (B&I) Guaranteed Loan program. The B&I Guaranteed Loan program provides loan guarantees on up to 80 percent of the loan amount for loans to rural businesses.15

2. New Policies

The Administration is committed to supporting rural businesses both by providing short-term relief and by promoting long-term economic growth. Small businesses were hit particularly hard in the recession. With limited access to capital markets, small businesses rely more heavily on bank lending than large businesses do, making them vulnerable to difficulties in the banking sector. Small businesses in rural areas are no exception, and the struggles that they have faced during this recession have required timely action. The Administration and Congress reacted swiftly to the needs of small businesses by passing the Recovery Act in February 2009.

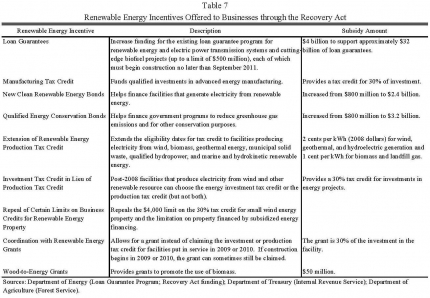

The Recovery Act included legislation that increased the resources of many of the programs that generally support small business and economic development in rural areas. The Small Business Administration’s 7(a) and 504 programs were expanded by temporarily eliminating or reducing fees and raising the guarantee rates. The Rural Development Administration’s B&I Guaranteed Loan Program was granted budget authority to support nearly $1.7 billion of new loans to rural businesses. The Economic Development Administration received $150 million to create jobs and boost development in parts of the country hit hard by the recession, and particularly those that would qualify for help under their economic adjustment assistance program. The Community Development Financial Institutions Fund also received funds to be used for technical and financial assistance for American Indian and Alaska Native communities.

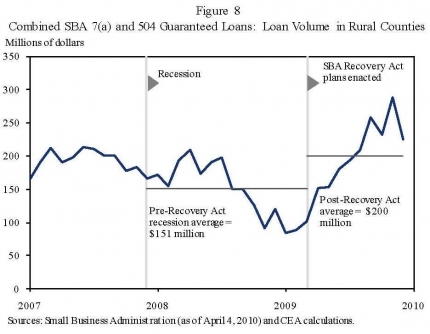

The Recovery Act provided support at a critical time for many rural small businesses. Figure 8 plots new monthly lending in the SBA’s 7(a) and 504 programs in rural counties from January 2007 through December 2009.16 There are two principal findings. First, small business SBA-backed lending in the rural sector dropped substantially during the course of the financial crisis of 2008, as banks reined in their lending (an equivalent drop occurred in the urban sector). Second, the success of the Recovery Act program to expand credit to small business is evident. The fee elimination or reduction and the higher guarantee rates coincided with a substantially increased loan volume. By December 2009, the dollar amount of loans issued in rural counties was more than 2.5 times larger than the amount issued at the low point in January 2009.

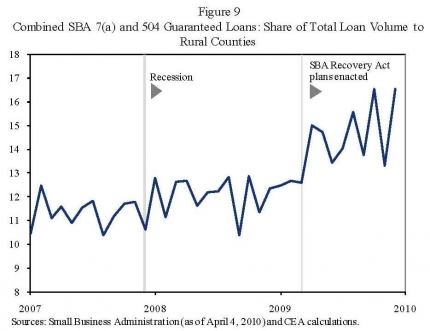

This substantial increase after the Recovery Act occurred in both rural and urban communities. However, recent SBA policies and general improvements in the lending environment appear to have especially benefited rural communities. Figure 9 shows that the percentage of SBA-backed loan dollars issued to rural counties jumped in 2009 after the Recovery Act was put into effect. The percentage of loans issued to rural counties increased to an average of 15 percent after the Recovery Act was enacted through the end of 2009, up from an average of 12 percent in 2008 and 11 percent in 2007.

The Administration’s policies are not limited to the short-term response that was essential during the recession. Long-term investment in innovation and entrepreneurship is critical for the economic health of rural communities. In addition to continuing strong support of existing programs, the Administration has introduced new policies that will foster rural revitalization. In particular, the Department of Agriculture will lead a strategy to promote economic opportunities through regional planning among Federal agencies and state and local governments through its Rural Innovation Initiative (see Box 5, in Section VI). Recognizing that rural areas often suffer from higher poverty and unemployment rates, the Department of Agriculture and the Small Business Administration recently announced their intent to work together to better coordinate development programs and increase the number of guaranteed small business loans (Small Business Administration and Department of Agriculture 2010).

The fiscal year 2011 budget also includes almost $100 million for the promotion of regional innovation clusters through the Small Business Administration and the Economic Development Administration. The Economic Development Administration will use its budget allocation to distribute regional planning and matching grants to support the creation of regional innovation hubs. The Small Business Administration will promote small business participation in regional economic clusters by awarding grants on a competitive basis to facilitate the coordination of resources through business counseling, training, and mentorships. The proposed fiscal year 2011 budget also expands the Emerging Leaders Initiative and the Minority Business Development Agency, both of which will play critical roles in supporting American Indian and Alaska Native businesses by providing technical assistance and connecting business leaders to regional networks.

B. Jump-Starting the Clean Energy Transformation

The rural economy will also benefit from policies aimed at moving the American economy toward cleaner domestic sources of energy. Existing Administration policies -- the Renewable Fuel Standard recently enacted under the Energy Independence and Security Act of 2007 (EISA) and Recovery Act incentives for the development of bio-energy -- will increase the amount of bio-based transportation fuels and renewable energy produced in rural areas. Further energy and climate legislation could greatly expand the use of energy sources located in rural areas such as bio-energy, solar, wind, biomass, and geothermal to produce electricity and transportation fuels.

1. Increased Demand for Bio-Based Feedstocks

The EISA requires that a minimum volume of renewable fuel be added to any gasoline sold in the United States. Renewable fuels are defined by statute as fuels derived from bio-based feedstocks such as corn, soy, sugar cane, or cellulose that have fewer lifecycle greenhouse gas emissions than the gasoline or diesel they replace. This provision will increase the volume of renewable fuel blended into gasoline from 9 billion gallons in 2008 to 36 billion gallons by 2022. While petroleum refiners will initially rely on conventional biofuels to meet the requirement, the EISA mandates that 58 percent of the total requirement be met by advanced biofuels in 2022.17 Fuel sources that could be used to meet this mandate in future years include sugar cane, switchgrass, agricultural residues, algae, and waste.

Greater use of biofuels is already leading to the location of bio-refineries in rural America, and this trend is expected to grow over time. The number of operating ethanol refineries in the United States more than doubled between 2005 and 2009, with capacity concentrated in the Midwest. The number of ethanol plants built each year and their average capacity also have increased over the past several years. In 2002, about six ethanol plants were built annually, each with an average capacity of 50 million gallons. In 2008, the number of ethanol plants built annually had increased to 26, each with an average capacity of 100 million gallons. Over the next decade, the Environmental Protection Agency (EPA) projects that between 10 and 15 ethanol plants will be built annually (Environmental Protection Agency 2010).

The increased demand for bio-based feedstocks is expected to increase net incomes in rural America. The EPA estimates that the increase in renewable fuel production due to the renewable fuel standard will result in a $13 billion increase in net U.S. farm income in 2022 (Environmental Protection Agency 2010). This represents a 36 percent increase in net income relative to what is projected to be without the renewable fuel standard. Biofuel production tends to occur relatively close to where the feedstock is grown. Thus, the employment associated with greater biofuel production from the feedstock will further increase earnings in rural areas.

2.The Recovery Act Will Spur Investment in Renewable Energy

The Energy Information Administration’s (EIA) revised Annual Energy Outlook for 2009 projects that the fraction of electricity generated from renewable energy will grow due to the renewal of Federal tax credits and the funding of new loan guarantees through the Recovery Act (Department of Energy 2009b). Wind generation is expected to be more than double what it would have been without the Recovery Act by 2012. Geothermal and biomass capacity are also projected to grow significantly more due to the Recovery Act.

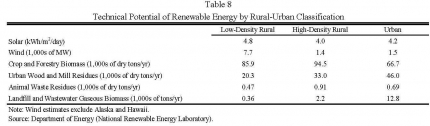

States with largely rural populations have some of the highest technical potential for renewable development and therefore will likely be the principal recipients of renewable energy projects spurred by these Federal incentives. Table 8 shows that low-density rural counties have the highest technical potential for solar and wind-based energy, while high-density rural counties have the highest technical potential for crop and forestry biomass and for renewable energy from animal waste residues. In particular, North Dakota, Montana, and other portions of the Great Plains rank highest in terms of wind intensity, while the most certain wind resources are located in the southeastern plains. States in the West – Utah, Arizona, California, New Mexico, Colorado, and Nevada – have the highest solar energy potential. Western states also tend to have the highest proportion of geothermal potential (where magma has penetrated the Earth’s upper crust).

In addition to incentives to spur investment, both the Recovery Act and the President’s proposed fiscal year 2011 budget increase funding for research and development for renewable energy, biofuels, and energy efficiency to help ensure that investments in these areas continue to contribute to future economic growth. For instance, of about $2.5 billion to support energy research and development in the Recovery Act, $400 million is allocated to the Advanced Research Projects Agency-Energy (ARPA-E). The President’s fiscal year 2011 budget proposes adding another $300 million in funding to this program. ARPA-E uses a highly entrepreneurial approach by funding potentially transformative technologies that “industry by itself is not likely to undertake because of technical and financial uncertainty” (U.S. Congress 2007). The proposed 2011 budget also includes $220 million for biofuels and biomass research and development.

3. A Market-Based Approach to Controlling Greenhouse Gas Emissions Will Spur Generation of Renewable Energy in Rural America

The President has included an economy-wide cap-and-trade program in his fiscal year 2011 proposed budget that reduces greenhouse gas emissions by more than 80 percent by 2050. The American Clean Energy and Security Act (ACES) that was passed by the House of Representatives last summer includes a cap on greenhouse gas emissions that is consistent with this goal, and the Senate is currently engaged in an effort to develop a bill.

A cap-and-trade system limits total annual aggregate greenhouse gas emissions and requires that a firm hold an allowance for each ton it emits. Trading allows firms the flexibility to meet the cap at least cost. Based on two analyses, the CEA estimates that U.S. actions consistent with the President’s emission reduction goals would reduce greenhouse gas emissions by approximately 110-150 billion metric tons (in CO2 equivalents) cumulatively by 2050 (Environmental Protection Agency 2009; Paltsev et al. 2009).

A number of analyses find that renewables such as wind, solar, geothermal, and biomass will play an important role in meeting these long-term emission goals. For instance, in its analysis of the ACES legislation, the EIA projects that renewables will make up a substantial proportion of the new generation capacity added between 2012 and 2030, representing an almost 50 percent increase over what occurs without the legislation (Department of Energy 2009a). Further, the EPA estimates that generation from biomass and municipal solid waste will increase by 44 percent and generation from wind and solar will increase by almost 70 percent in 2030 relative to what occurs without the legislation (Environmental Protection Agency 2010).

As previously discussed, technical capacity for wind and solar is highest in less-densely-populated areas. Further, land is less expensive in rural areas. Consequently, increased reliance on these technologies will likely translate into a greater number of large-scale wind farms and concentrated solar plants in these communities. Furthermore, rural communities in particular will likely benefit from revenues from increased biomass production, since large quantities of fuel will require some conversion of existing land to growing feedstocks and the use of currently fallow lands for this purpose.

A common feature of a cap on greenhouse gas emissions is the flexibility to purchase offsets. Offsets allow emissions sources in covered sectors of the economy to purchase a reduction in emissions from a source that is not covered. Since greenhouse gases cause the same damage no matter where they are emitted, offsets offer the appealing prospect of achieving emissions reductions specified by the cap at lower cost. For a variety of reasons, the agriculture and forestry sectors are unlikely to be covered by a cap on greenhouse gas emissions, making them eligible for offsets. Offsets represent a potential new source of income for these sectors. A recent study by Baker et al. (2010) finds that the overall impact on U.S. farmers’ net welfare of a market-based cap on greenhouse gas emissions consistent with the Administration’s emission reduction goals is positive. The gains in farm income from higher output prices, increased bio-energy use, and demand for domestic offsets outweigh any increases in input costs.

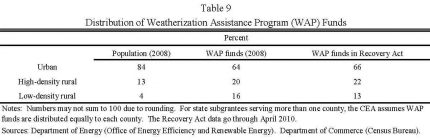

The Department of Energy’s Weatherization Assistance Program (WAP) sponsors energy efficiency upgrades for qualifying homeowners. The size of the program has increased in recent years -- the total allocation for the 2009 fiscal year was $250 million, and another $5 billion has been allocated to states as part of the Recovery Act. Through this state-administered program, low-income families receive home weatherization services that allow them to save money on their future energy bills: the cap on average per-home expenditure under the Recovery Act increased from $2,500 to $6,500, most of which is paid for by the Federal government.

Table 9 demonstrates that, relative to their share of the overall population, rural residents receive a disproportionately high share of weatherization assistance. Though each state sets the criteria for the disbursement of weatherization services, the amount of Federal funding it receives depends on three factors: low-income population share, climatic conditions, and residential energy expenditures by low-income households. The Department of Energy (2009c) estimates that weatherization services reduce the average recipient household’s annual energy bills by about $350. Thus, it produces substantial savings that accrue directly to rural residents.

C. New Opportunities in Recreation and Tourism

1. Background

America’s Federal lands are precious national assets that are an important source of employment in rural areas through their support of the tourism industry. These lands -- wildlife refuges, national parks, national forests, and Bureau of Land Management lands -- are located disproportionately in rural areas. Recently, there have been more than 620 million annual visits to these lands, including over 310 million to national parks and wildlife refuges. The Department of the Interior estimates that its lands support over 320,000 jobs in tourism and recreation (Department of the Interior 2009). Recent studies estimate that the National Park Service alone annually contributes $6.3 billion in labor income and $9 billion in value added (Stynes 2009), the wildlife refuges provide an estimated $1.7 billion in sales and $542.8 million in employment income (Carver and Caudill 2007), and recreational visits to the National Forests contribute $11.2 billion to GDP (Department of Agriculture 2010a).

America’s Federal lands support a wide variety of activities. Every year, about 7 million anglers visit national wildlife refuges, as do 2 million hunters and many millions of birders (Carver and Caudill 2007). Of those surveyed on their national forest recreation visits, the primary activities were hiking or walking, downhill skiing, viewing natural features, hunting, and fishing. Additionally, about 40 percent listed viewing wildlife as an activity in which they participated. Recreation and tourism on Federal lands is a growth industry, with the potential to increasingly benefit rural America. For example, the Department of Agriculture estimates that the number of visitors has increased at national forests from 134 million in 1964 to 206 million in 2007 (Department of Agriculture 2008, 2010b). Likewise, the number of recreation visits to the national parks has increased from 205 million in 1979 to 275 million in 2008.

Unfortunately, two problems -- deferred maintenance and damaged ecosystems -- prevent America’s Federal lands from reaching their full economic potential. In 2009, the Fish and Wildlife Service, Bureau of Land Management, National Parks Service, and Forest Service had a combined deferred maintenance project backlog of between $16 and $22 billion. The Forest Service estimates that 37 percent of its administrative facilities need major repairs or renovations (Department of Agriculture 2009). The failure to do needed maintenance leads to eroded roads, closed-off trails, and hazardous dilapidated buildings, and reduces the safety and accessibility of America’s Federal lands. In turn, this makes them less attractive tourist destinations.

Similarly, a legacy of damaged ecosystems has decreased the attractiveness of many Federal lands. Aside from the reduction in ecosystem services that these lands provide to the whole country, the harms to recreation and tourism take many forms. Whether through decreasing bird biodiversity that attracts birders, fish abundance that attracts recreational fishermen, the population of native species prized by amateur naturalists, or the quality and quantity of water available for water recreation, ecosystem degradation is harmful to tourism on Federal lands. For example, the Forest Service estimates that 25 million acres of its lands are at future risk from insects and diseases (Department of Agriculture 2009). Furthermore, a legacy of counterproductive fire suppression has led to an excessive build-up of combustible material on Federal lands, leading to more extreme wildfires which -- aside from endangering surrounding communities -- harm ecosystems and site facilities, keeping away visitors.

2. New Policies

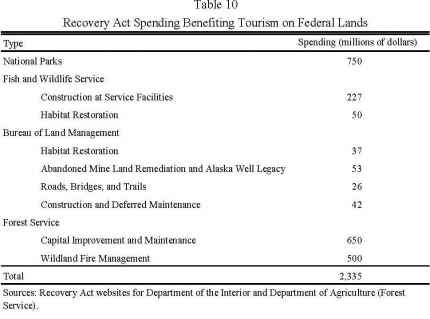

Through the Recovery Act, the Administration has increased investment on Federal lands, reducing the problems of deferred maintenance and ecosystem degradation and creating a stronger foundation for the future of rural tourism. Table 10 shows that the Recovery Act invests over $2.3 billion to preserve and improve the accessibility and experience of America’s extraordinary Federal lands. Much of this spending goes disproportionately to rural areas; for example, the CEA estimates that 65 percent of Forest Service spending has been allocated to rural counties.19 The funding is roughly evenly split between the Department of the Interior (National Park Service, Fish and Wildlife Service, and the Bureau of Land Management) and the Department of Agriculture’s Forest Service. To make parks and forests safer and more accessible, these funds will repair eroded trails and roads, close hazardous abandoned mines near tourist sites, build visitor facilities, and invest in many other assets. For example, the Forest Service is replacing unsafe and unhealthful bathrooms in Pike-San Isabel National Forest, in rural Chaffee County, Colorado, responding to the number-one complaint received from forest visitors. To improve the natural capital that draws people to Federal lands, these funds will reforest, reduce hazardous fuel build-up, remove structures preventing fish from accessing spawning and feeding areas, and remove damaging invasive species. The Department of the Interior is funding the construction of water control infrastructure that will increase the wetlands available to migratory birds at Tule Lake, in rural Siskiyou County, California, which attracts one of the largest concentrations of migratory waterfowl in the world.

The President’s proposed fiscal year 2011 budget continues to support these types of investments through a variety of targeted programs. For instance, it proposes the establishment of a Forest Service pilot program for long-term, landscape-scale forest restoration activities that emphasize resiliency, health, and sustainable economic development. Likewise, the 2011 budget proposes to fully fund the ten-year average cost of fire suppression and additional discretionary funding if the ten-year average funding is exhausted due to excess wildfire activity. Finally, the 2011 budget includes funding for conservation on private and public lands. For instance, it proposes to fund the Wetlands Reserve Program at a level that will support the conservation of almost 200,000 additional acres of wetlands; a 67 percent increase in funding over 2010 to decrease nutrient loading in the Chesapeake Bay; funding for the installation of conservation practices on 1.5 million acres of priority landscapes, including the Bay-Delta region in California and the upper Mississippi River; and a 31 percent increase in funding for the Land and Water Conservation Fund to acquire and conserve landscapes and ecosystems that lack adequate protection and improve wildlife and public enjoyment on Federal lands.

15The maximum loan amount is $25 million in most cases. Rural is defined as all areas other than cities or towns of more than 50,000 people and the contiguous and adjacent urbanized areas. Loans can be made to businesses in non-rural areas when the business is a cooperative organization, practices value-added processing, and has all members of its cooperative located within 80 miles of the facility.

16Figures 8 and 9 exclude loans not assigned to a valid county in the Small Business Administration data.

17Advanced biofuels are defined by statute as having less than 50 percent the lifecycle greenhouse gas emissions of petroleum-based fuel.

18The CEA based this estimate on a variety of National Renewable Energy Laboratory (NREL) studies of direct permanent jobs associated with different types of electric generating plants. Much of the NREL data uses a particular example of a plant to generate estimates rather than a full representation over all different plant types, which could lead to a somewhat different estimate of the ratio of solar to natural gas jobs.

19The CEA uses a dataset of Forest Service projects provided by the Department of Agriculture. For projects that covered multiple counties, the analysis allocates funding evenly across the counties.