The American Jobs Act: What Our Economy Needs Now

EXECUTIVE OFFICE OF THE PRESIDENT

COUNCIL OF ECONOMIC ADVISERS

The American Jobs Act: What Our Economy Needs Now

Carl Shapiro

Member, Council of Economic Advisers

National Association for Business Economics Annual Meeting

Dallas, Texas

September 13, 2011

Introduction

Thank you very much for inviting me to join your annual meeting here in Dallas. I am pleased to continue the tradition whereby the CEA shares its views on the economy, and current economic policy, with NABE. I would like to count myself as a business economist, since I have been teaching at the Haas School of Business at the University of California at Berkeley for over 20 years, and since I have worked with many great American companies, and studied many American industries, over the years.

I am here today to talk about the current state of the U.S. economy and to explain why the American Jobs Act, which President Obama presented last week to Congress and the American people, is well designed for our current economic conditions. I will first set the stage by talking about how the CEA sees current economic conditions; then I will describe the American Jobs Act and its importance for boosting jobs and economic growth at this critical juncture.

Current Economic Conditions: Aftermath of the Financial Crisis

Any thoughtful evaluation of current economic conditions must start from the recognition that we are still suffering the aftershocks of the worst financial crisis since the Great Depression. Over the past three years, we truly have faced extraordinary economic conditions. We are just approaching the 3rd anniversary of one especially salient date in the financial crisis that struck our economy in 2008: the bankruptcy of Lehman Brothers (September 15, 2008).

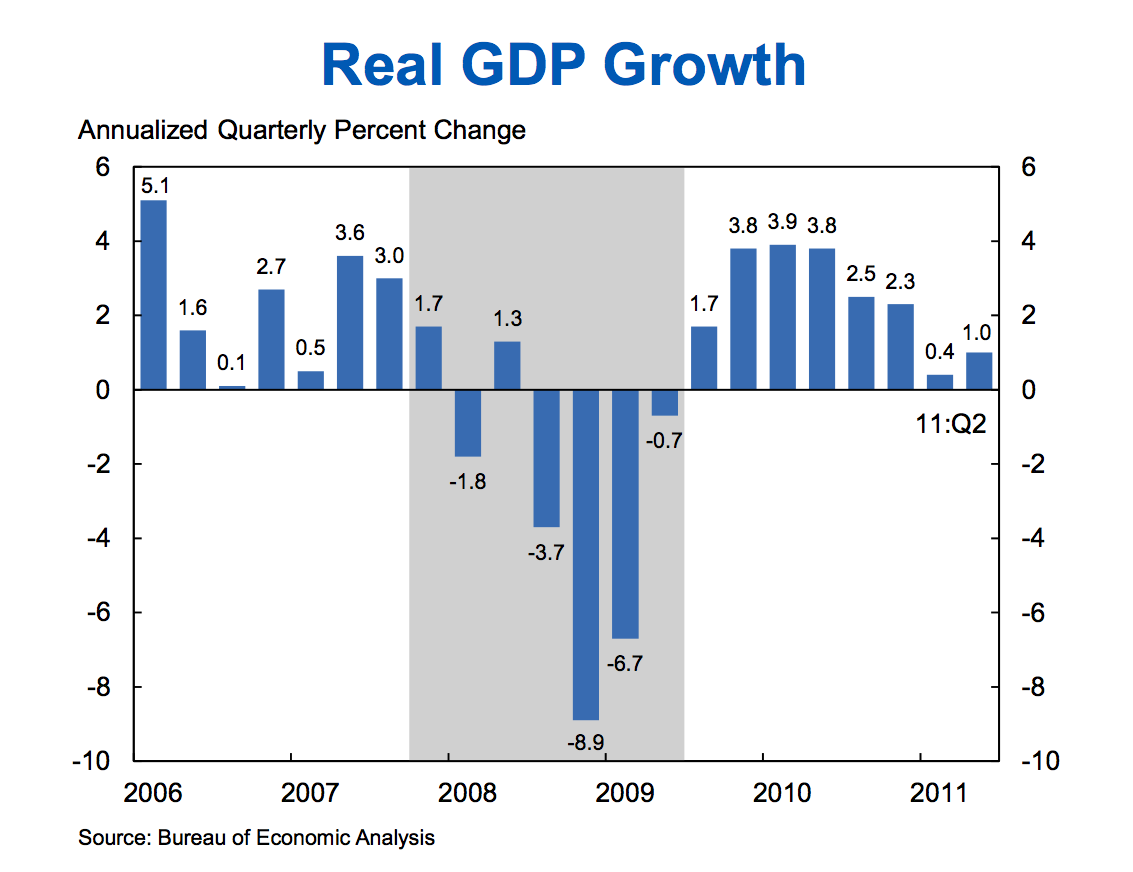

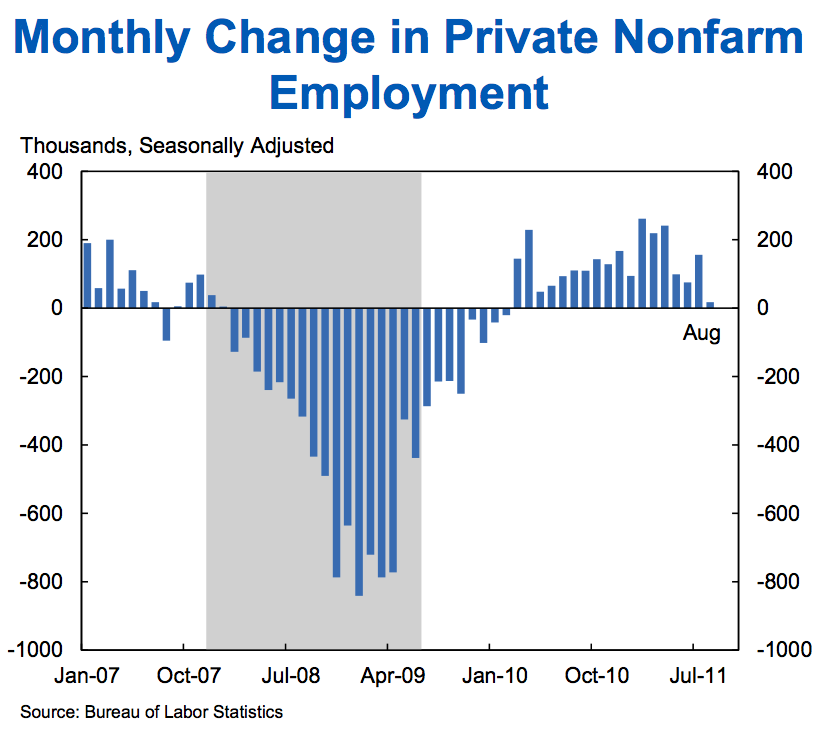

Let’s start with the basics. Our economy suffered a recession from December 2007 through June 2009, but since then we have experienced eight straight quarters of economic growth, during which time private nonfarm payrolls have posted a gain in each of the past 18 months, adding 2.4million jobs in total.

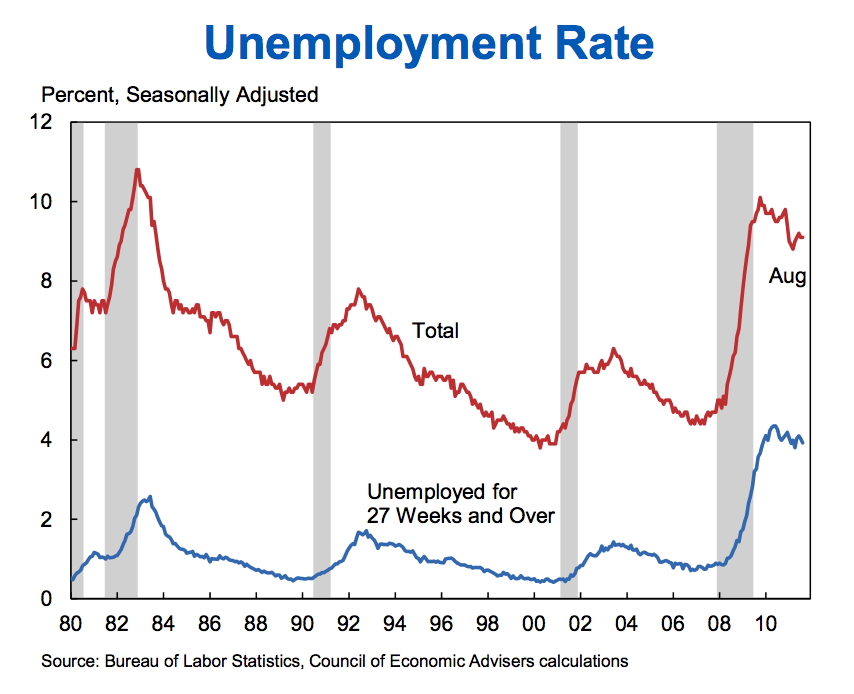

Given the magnitude of the negative shock we experienced, these achievements should not be minimized. But there is more work to do. Real GDP has yet to return to its peak level, the unemployment rate remains unacceptably elevated.

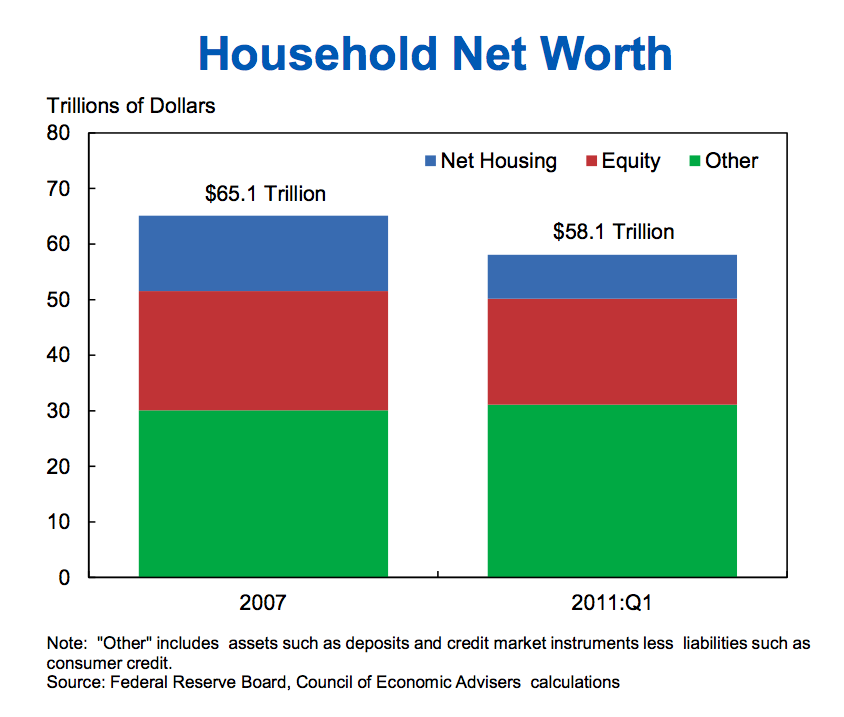

Influential work by Carmen Reinhart and Ken Rogoff shows that economic recoveries following financial crises tend to be much slower and more painful than recoveries from recessions caused by other factors.[1] The disappointing rate of economic growth during the current recovery is directly related to the financial crisis and housing bust. Between the first quarter of 2007 and the first quarter of 2011, household net worth declined by $7 trillion.[2] Over that period, housing prices fell by 31.4 percent[3] and equity prices were down, on balance, about 2.1 percent.[4]

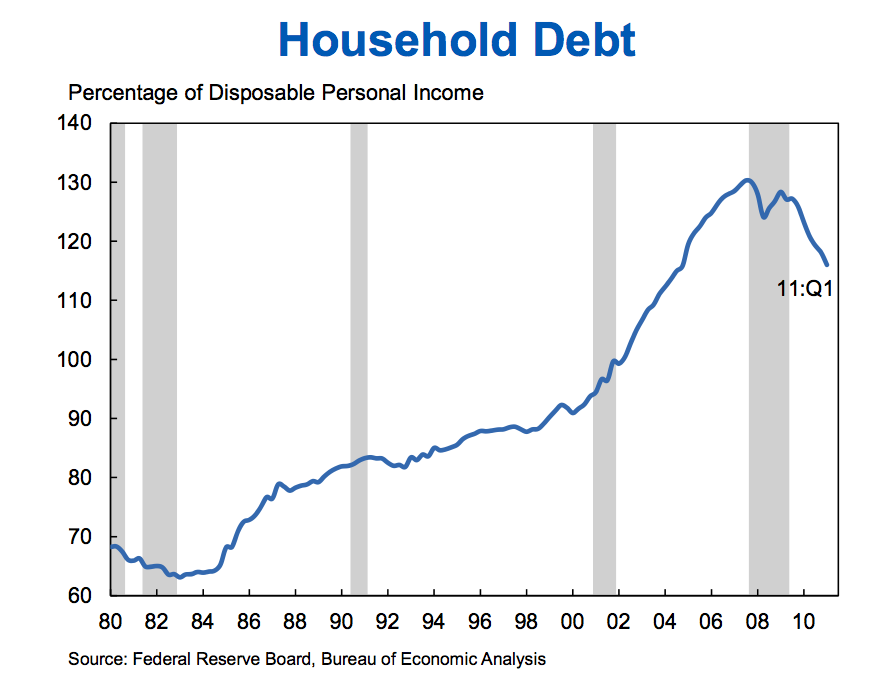

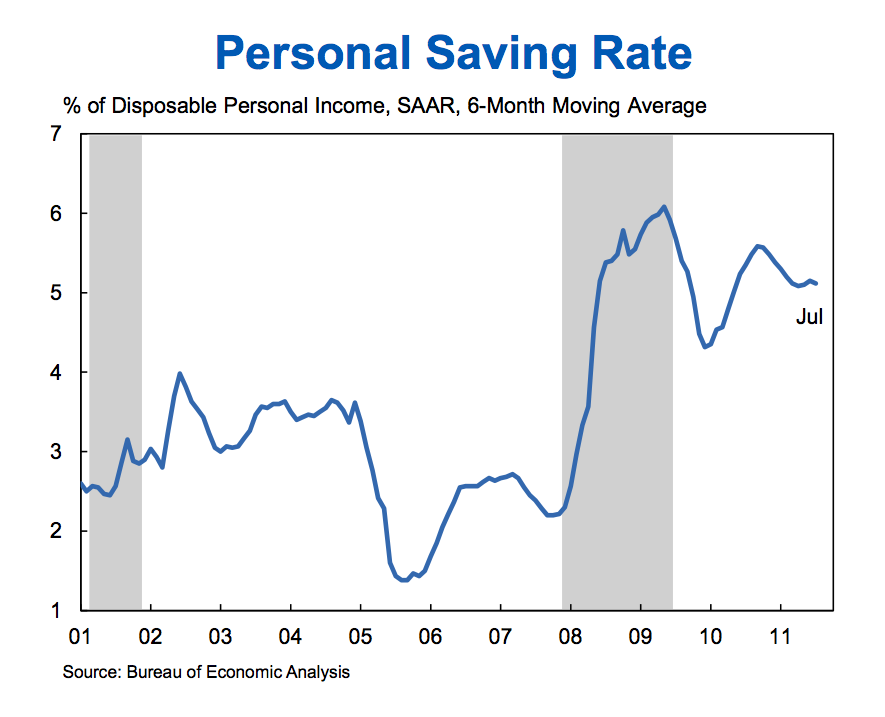

Because some households were over-extended prior to the crisis, painful adjustments were necessary as households repaired their balance sheets and deleveraged some of the debt they took on during the housing and consumption boom. As households have increased their rate of saving they have cut back on spending, with adverse effects on GDP growth and job creation.

This deleveraging materially affected the personal saving rate, which rose from about 2.5 percent in 2007 to about 5 percent in 2009; since that time, the saving rate has remained at about that level. To put this in perspective, an increase in the personal saving rate of 2.5 percentage points, spread out over two years, imposes a drag of about 1 percentage point on GDP growth in each of those years.

The financial crisis and bursting of the housing bubble reduced demand for goods and services, causing private nonfarm payrolls to plunge at an average monthly pace of about 640,000 jobs per month in the fourth quarter of 2008, intensifying to 780,000 jobs per month, on average, in January and February 2009. Other metrics of economic performance revealed similar distress. Industrial production fell sharply, stock prices plummeted, and consumer sentiment near the end of 2008 had dipped to depressed levels not seen since 1980.[5]

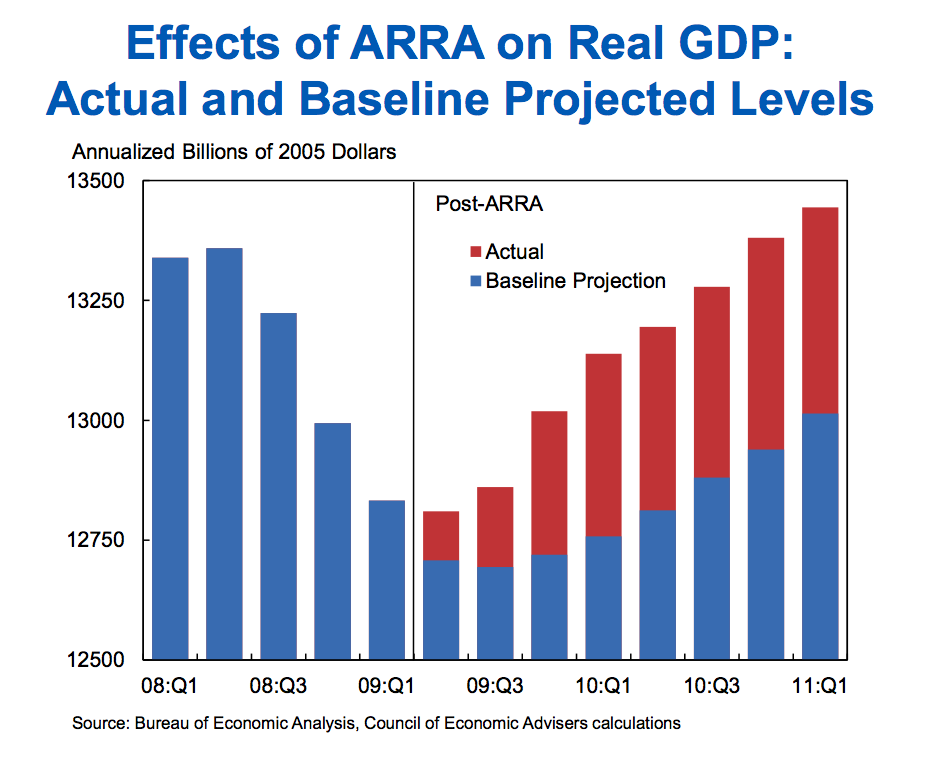

Addressing the extraordinary nature of the financial crisis and arresting the subsequent freefall in economic activity required bold action by the Federal Reserve, the Administration, and the Congress. The American Recovery and Reinvestment Act (ARRA) was part of this coordinated effort. Let me stress two points about how the economic outlook has evolved since the Recovery Act was passed.

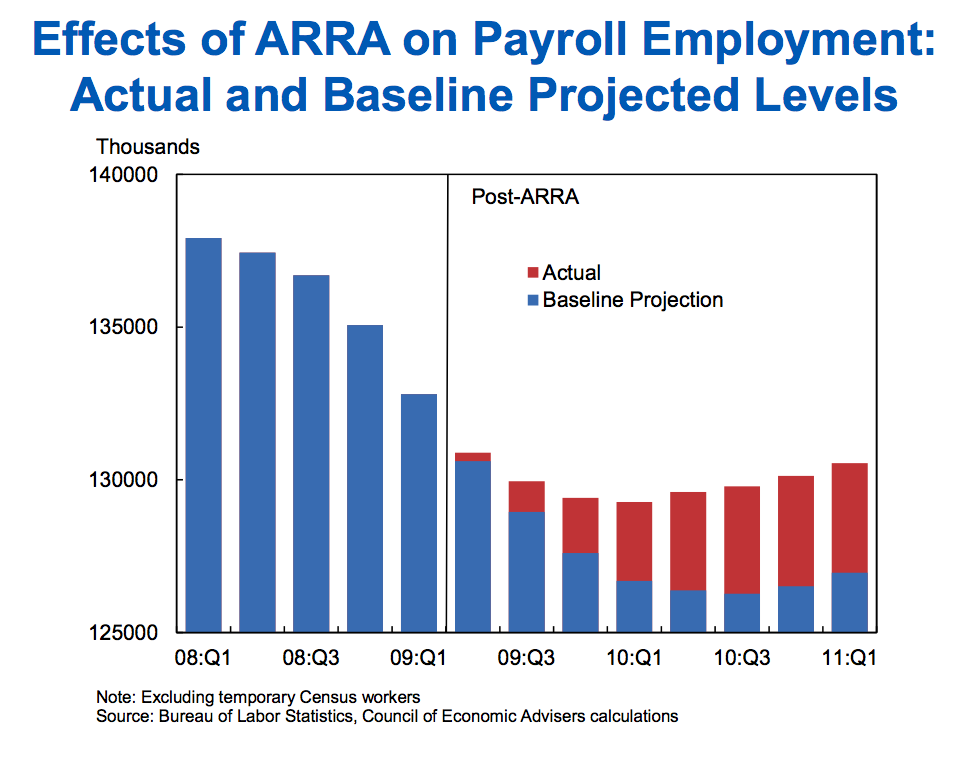

First, there is a growing body of evidence indicating that the Recovery Act has had a substantial, positive impact on GDP.[6] The CEA issues quarterly reports measuring the impact of ARRA. Our most recent report, measuring the effects of ARRA as of the first quarter of 2011, finds that ARRA has caused GDP to be 2.3 to 3.2 percent higher, and the number of jobs to be about three million higher than would otherwise be the case.[7] These figures are consistent with estimates obtained by CBO and outside forecasters.

The Recovery Act was designed to support economic growth in 2009 and 2010, which it did. The fiscal drag caused by the winding down of the Recovery Act was partially offset by the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of December 2010. That program will wind down as well at the end of this year. We estimate that, without the American Jobs Act, Federal fiscal policy would cause a fiscal drag of roughly two percentage points of GDP in 2012.

Second, it has become increasingly clear that, despite the positive impact of the Recovery Act, our economic recovery remains fragile in the aftermath of the financial crisis and housing bust.

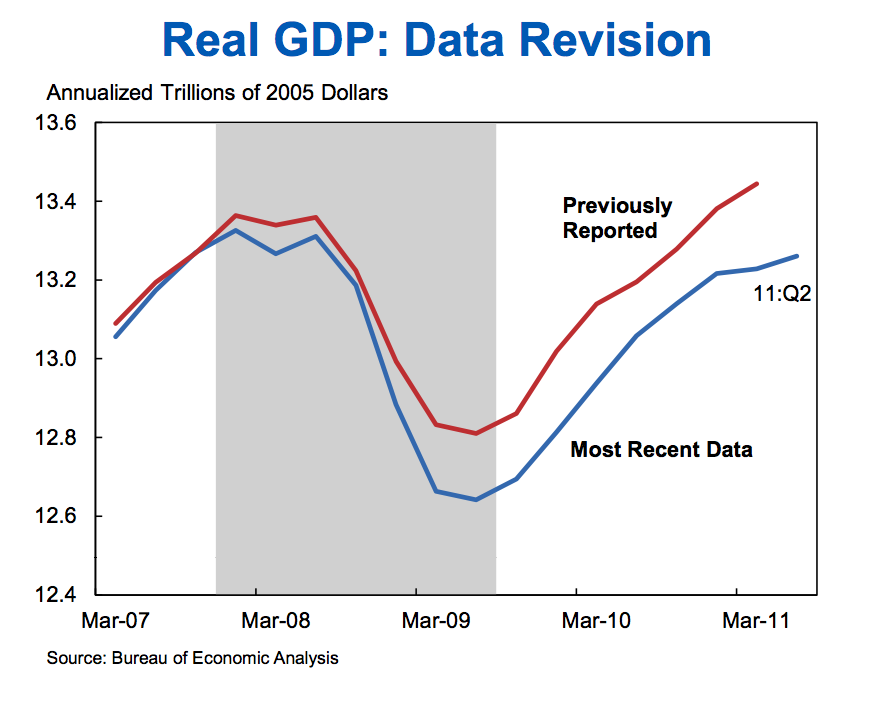

Revised data from the National Income and Product Accounts recently revealed that that the recession was deeper, and that the pace of the recovery through the first quarter of 2011 slightly slower, than previously reported. Real GDP now appears to have contracted 5.1 percent between the peak (2007:Q4) and the trough of the recession (2009:Q2), about 1 percentage point more than had been previously measured. The rise in real GDP between the trough and the first quarter of 2011 was revised down 0.4 percentage point, to 4.6 percent. In the first half of 2011, real GDP rose at an annual rate that averaged only 0.7 percent, a good bit slower than the increase of 3.1 percent during the four quarters of 2010.

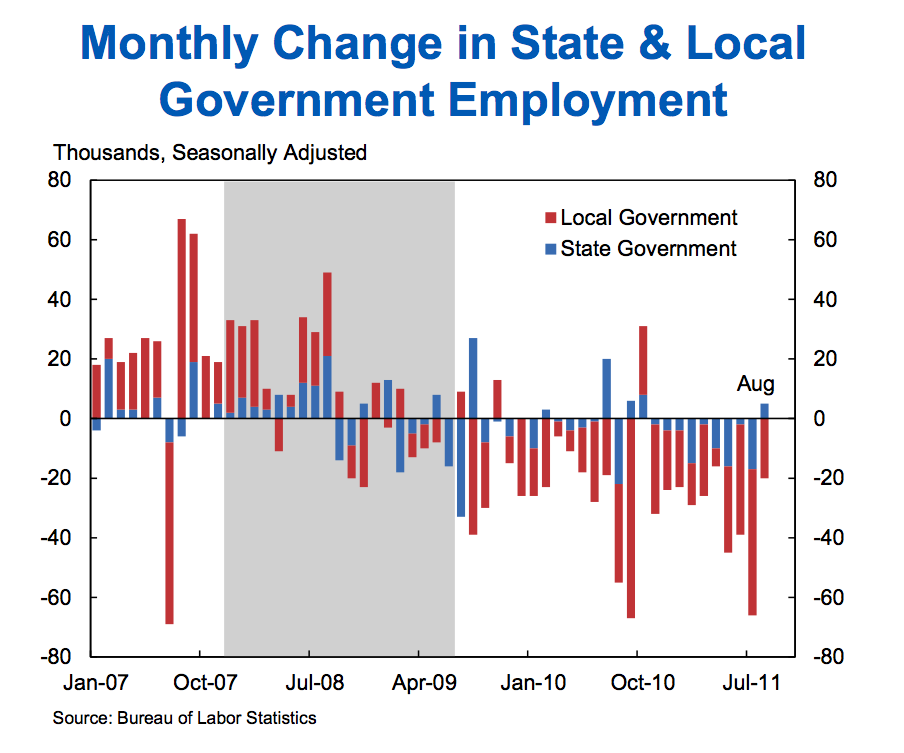

The channels by which the financial and housing crisis are continuing to hold down economic growth are all too easy to see. Just look at the components of GDP. Some components, such as exports and business investment in equipment and software, have continued to rise at a solid pace in 2011.[8] But real personal spending has slowed markedly, rising at an annual rate of only 1.3 percent in the first half of 2011. As Federal Reserve Chairman Bernanke recently noted, “One striking aspect of the recovery is the unusual weakness in household spending.”[9] He added: “Even taking into account the many financial pressures they face, households seem exceptionally cautious.” Making matters worse, state and local governments also continue to pare spending by reducing their workforce. State and local government employment has declined 1.4 percent over the first eight months of 2011.

In past recessions, residential construction has led the economy into recovery. We cannot count on that today, because the housing bubble that led up to the recession resulted in overbuilding of the housing stock. Construction activity has remained very weak in 2011, despite very low interest rates. Furthermore, State and local governments are cutting back on their investment in structures. Real investment in State and local structures has fallen at an annual rate of 17.3 percent during the first half of 2011.

Corporate profits are strong, and business investment has at times been a bright spot over the past couple of years, but businesses are generally hesitant to make investments to expand capacity (or hire) when they do not see demand growing. Many small businesses also have reduced access to capital, due to impaired credit or reduced housing wealth. Unfortunately, these negative factors tended to reinforce each other: As households were hesitant to spend, businesses were reluctant to invest and hire, which further restrained household spending.

In the first half of 2011, growth in consumer spending was held down by the run up in global energy and commodity prices and by disruptions to the supply chains for motor vehicles following the earthquake and tsunami in Japan, which reduced sales. Unfortunately, with the economic recovery still fragile, the headwinds increased considerably in July and August. The sovereign debt crisis in Europe appears to have widened, global equity values have fallen over the summer, and volatility in financial markets has increased. Consumer sentiment declined markedly between May and August.[10] If the decline in equity values is sustained and consumer confidence remains low, households could cut back even further on spending in the coming months, putting the recovery at risk.[11] Furthermore, purchasing managers surveyed by the Institute for Supply Management indicate that the pace of growth has slowed considerably over this period.[12] Growth also appears to have slowed for many other industrialized countries.

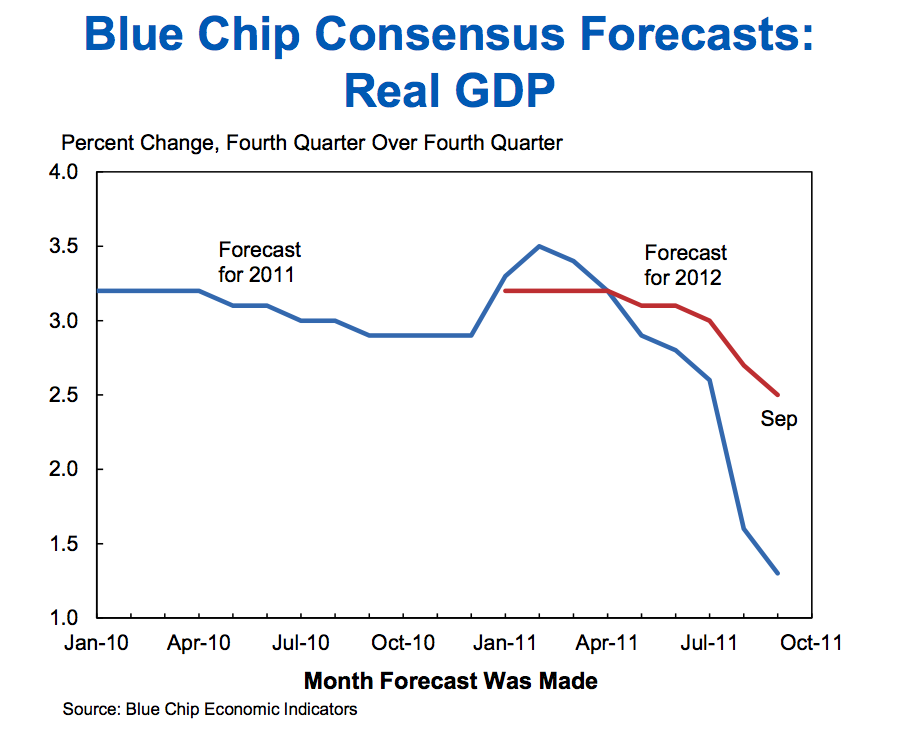

In the light of these more recent developments, and as a result of the downward revisions to reported GDP growth, the Administration recently marked down its forecasts for economic growth, as have private forecasters and the CBO.[13]

The Administration now expects real GDP to rise by 1.6 percent over the four quarters of 2011 and to increase 2.9 percent over the four quarters of 2012. Over the medium term, the Administration remains confident about prospects for economic growth in the United States, as housing prices stabilize, balance sheets recover, and confidence improves.

On top of all that, this Summer we experienced the spectacle of a disruptive side show in Washington regarding the Federal debt limit, with Congress unwilling to send the President a clean increase in the debt limit. Day after day we heard about the danger of a possible default by the U.S. government, and even after that danger passed, one of the rating agencies downgraded U.S. Treasury bonds. All of this was surely unhelpful to consumer sentiment and the economic recovery.

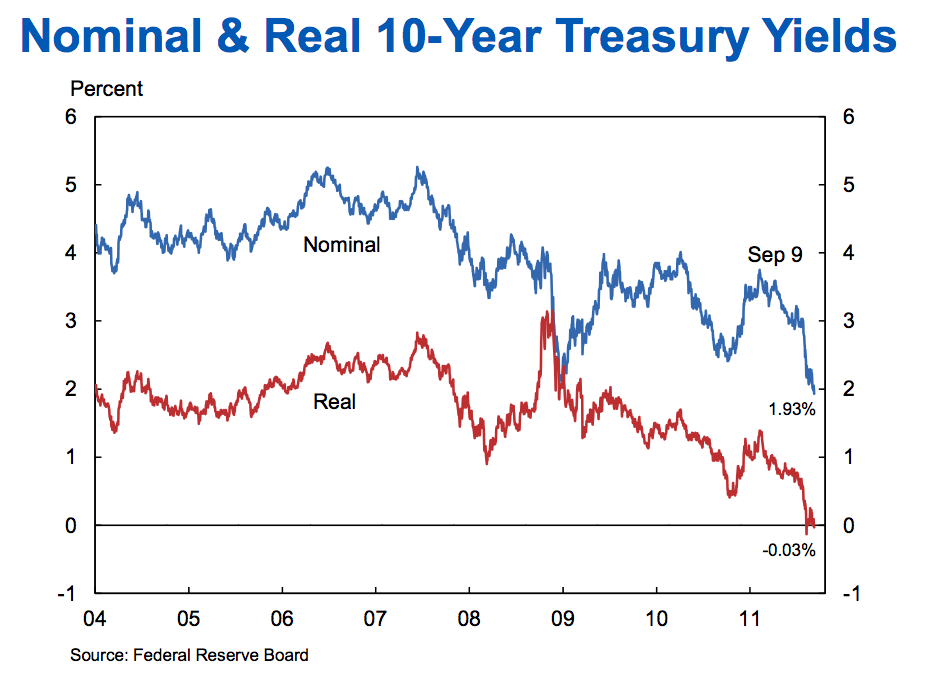

To those of us who rely on hard economic evidence, the talk of a U.S. government default was a maddening episode which distracted attention from the real issue: the need to put more Americans back to work and to get the economy growing faster again. The fundamental safety and soundness of U.S. government debt is not in doubt, and should never have been. But don’t take my word for it. Look at the bond markets, where investors are putting literally trillions of dollars on the line. The interest rate on 10-year Treasury bonds is now roughly 2.0 percent. Yes, 2.0 percent! Based on the market for Treasury’s inflation protected securities, inflation is also expected to average about 2 percent over the next decade, which suggests that real 10-year yields are currently at zero. Really. 0.0 percent. These very low interest rates are directly relevant for fiscal policy.

Ten-year Treasury bonds at 2.0 percent! What could be a clearer signal that inflationary expectations are well anchored?

Ten-year Treasury bonds at 2.0 percent! What could be a clearer signal that U.S. treasuries are safe?

Ten-year Treasury bonds at 2.0 percent! What could be a clearer signal that the U.S. government is the best placed entity in the entire world to borrow now, undertake the investments that are needed to get our economy growing again, and pay back those loans in the future at little or no real interest expense?

You are business economists. Would your company hesitate to initiate a much-needed investment project if your suppliers were eager for the work and you could borrow at 2 percent? That’s exactly the situation for our country’s infrastructure. We are all familiar with the poor condition of our nation’s infrastructure, and we need to undertake substantial infrastructure investments sooner or later. The construction industry and construction workers are eager to get to work. Why wait?

Many of you are also parents. Would you hesitate to send your children to college if you could borrow at 2 percent to finance their college education? What sense does it make to be laying off teachers when we all know that educating our children is key to making our economy more competitive in the years and decades ahead?

We should all agree that the overriding immediate need at this perilous moment is to get more Americans back to work, and this means cutting taxes and making smart investments now, paid for by credible, long-term policies that will reduce deficits in the future and ensure that debt begins falling as a fraction of GDP. That is the aim of the American Jobs Act which President Obama has asked Congress to pass right away.

The American Jobs Act

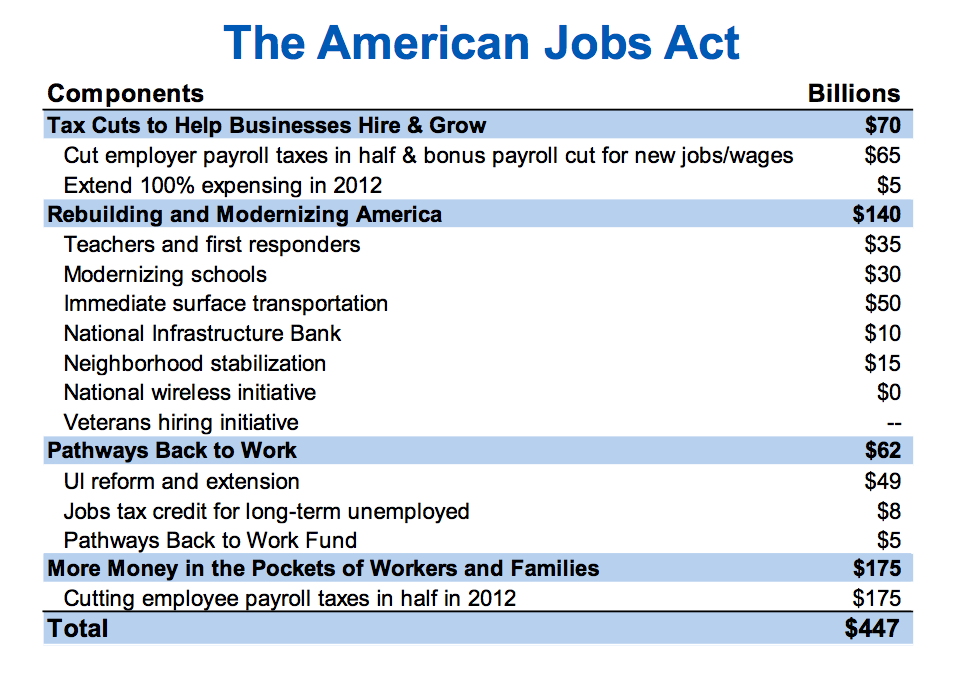

With the pace of the recovery slowing due to the headwinds previously detailed, bold and immediate action is required to restore confidence and put Americans back to work. On September 8th, the President presented Congress a jobs package called the American Jobs Act. The package targets jobs specifically through tax cuts, job training programs, and a push to invest in America’s vital infrastructure and schools. With a total budget cost of $447 billion, the plan contains many components that have attracted bipartisan support in the past. The $447 billion figure is about 3 percent of GDP, which can be compared with the gap between actual and potential GDP, which was roughly 5.5 percent of GDP in the first quarter according to the Congressional Budget Office.[14]

The President’s plan is about getting people back to work and rebuilding America. Kick-starting economic growth will improve our long-run fiscal outlook. The Administration is committed to fully paying for these measures, to ensure they will not add to the deficit in coming years. Fortunately, with nominal ten-year Treasury yields at historically low levels, financial markets have reduced considerably the tradeoffs necessary to take these important steps now. Plus, investments in public infrastructure—such as roads and schools—and investments in human capital—such as job training for the unemployed—boost productivity and carry many other lasting benefits to American households and businesses at a time when so many resources and workers are underutilized.

Each component of the President’s plan will put Americans back to work and get the economy going again.

Tax Cuts for Every Small Business to Encourage Job Growth

The President’s plan includes $70 billion in incentives for businesses to hire and invest.

Fully $65 billion of this $70 billion comes from payroll tax cuts for businesses. Instead of paying a tax of 6.2 percent on their payroll expenses, firms will pay only 3.1 percent on the first $5 million in payroll. In addition, the President’s plan completely eliminates the payroll taxes paid on added workers or wage increases for current workers.[15] This part of the President’s plan will create jobs by directly targeting hiring.

According to the National Federation of Independent Business, payroll tax cuts for businesses would help small businesses reduce cost and help keep people working during a period of sluggish economic growth.[16] And, because this plan specifically targets increases in payrolls, the number of jobs created per dollar of budget expenditure with these types of programs can be quite high. For example, CBO in 2010 called hiring credits one of the most effective way to help accelerate job growth.[17] Several distinguished economists have also supported the concept of hiring credits in the past.[18]

The second part of the President’s plan for small businesses would extend the 100 percent business expensing provision through 2012, allowing firms to deduct the full value of investment in new plants and equipment from their tax obligations in 2012. This extension would put an estimated $85 billion in the hands of businesses next year. Most of this relief would be recouped by the Treasury in future years as businesses regain their strength. Anecdotes from firms suggest these incentives played a role in supporting investment during the current recovery.

The President’s plan for small businesses also involves reforms and regulatory reductions to help entrepreneurs and small businesses access capital.

Rebuilding and Modernizing America

The second component of the President’s plan will put Americans back to work while rebuilding and modernizing America.

Starting with teachers and first responders, the American Jobs Act will invest $35 billion to prevent the layoffs of up to 280,000 teachers, while supporting the hiring of tens of thousands more and keeping police officers and fire fighters on the job. The President also believes we have an obligation to help our veterans navigate this difficult labor market, so the plan proposes a tax credit of $5,600 for firms that hire long-term unemployed veterans and increases the current tax credit for firms that hire long-term unemployed veterans with service-connected disabilities to $9,600.

The American Jobs Act supports education even further by investing $25 billion to modernize over 35,000 public schools, with 40 percent of the funds directed toward the 100 largest high-need public school districts. The funds can be used for a variety of purposes, including emergency repair and renovation projects, or to build new science and computer labs. These investments will enhance the condition of our nation’s public schools and support academic success while improving the health and safety of our children.

America’s other infrastructure also urgently requires attention, and the President’s call for more investment has been joined by leaders such as AFL-CIO President Richard Trumka and U.S. Chamber of Commerce President Thomas Donohue.[19] The President’s plan includes $50 billion in upfront investments for highway, highway safety, transit, passenger rail, and aviation activities, and $10 billion to establish a national infrastructure bank—an idea with strong bipartisan roots that replaces and consolidates the current patchwork approach to funding and maintaining America’s infrastructure. The President will also work administratively to speed infrastructure investment through a recently issued Presidential Memorandum developed with his Jobs Council.

Investing in infrastructure right now makes sense for several reasons. As noted earlier, the costs of infrastructure investment are quite low at the present time, with real interest rates very close to zero and rates of resource utilization in the construction industry at very low levels. Investments in public transportation infrastructure produce many benefits to the economy, such as improving safety, increasing land values, reducing travel times, and boosting productivity.

The President is also calling for an investment of $15 billion in a national effort to stabilize neighborhoods with high concentrations of foreclosed and vacant homes and businesses. Economists understand well the negative externalities caused by abandoned properties and the need for coordinated action at the community level.

Pathways back to Work for Americans Looking for Jobs

The number of Americans who have experienced long spells of unemployment rose sharply during the recession and has not declined much during the recovery. Elevated rates of long term unemployment pose risks to the long run growth prospects of the economy as workers’ skills erode and their attachment to the labor force weakens.

As part of an extension of unemployment insurance to prevent some 6 million Americans currently looking for work from losing their benefits, the President’s plan reforms the system, supports programs that build real skills and connect to real jobs, and helps the long-term unemployed. These reforms include changes that will reduce layoffs and give States more flexibility to use federal UI funds to get Americans who have lost their jobs back to work. The President’s plan is targeted to address long-term unemployment in an aggressive, multi-pronged way, drawing from ideas about what is working from around the country and from both parties.

First, the unemployment insurance system needs to better address the challenges of long-term unemployment. To this end, the President’s plan provides funding for states to more rigorously assess the eligibility of all new claimants in the Emergency Unemployment Compensation (EUC) program—the Federal UI program for the long-term unemployed. New EUC claimants will be offered a more intensive package of career services at “One-Stop Career Centers,” such as job search assistance, skills assessment, and referrals to occupational training, to speed their return to work.

The proposal allows states to adopt innovative programs that reduce long-term unemployment. For example, “bridge to work” programs , such as the “Georgia Works” program, allow workers to take temporary, voluntary employment to keep up their skills and train for a new occupation while still receiving unemployment insurance. The President’s plan builds on this model by authorizing states to implement “Bridge to Work” programs to connect the long-term unemployed to employers.

States may adopt other programs as well, including wage insurance to compensate workers who take new jobs that pay less than the unemployment benefits, and self-employment assistance to support unemployed workers who start their own small businesses.

The President’s plan calls for a work sharing program that lets workers receive pro-rated UI benefits as compensation for a reduction in hours at businesses that would otherwise lay workers off. Work sharing programs such as this operate in 20 states, and evidence from Germany, Italy, and Japan suggests that these programs can reduce unemployment between 0.5 and 1 percentage point.

In addition to reshaping the unemployment insurance system, the President’s plan provides a targeted incentive for businesses to hire these out-of-work individuals. The President’s plan provides a bonus credit of up to $4,000 for businesses that hire the long-term unemployed.

The President’s plan for jobs and growth offers an aggressive strategy to expand employment opportunities for communities that have been particularly hard hit by the recession. Building on highly successful Recovery Act programs that provided job opportunities for low-income adults and youths, the President’s Pathways Back to Work Fund will make it easier for workers to remain connected to the workforce and gain new skills for long-term employment.

Support for American Workers and Families

The President’s plan would put more money in the pockets of working and middle-class Americans by providing tax relief to 160 million workers. The American Jobs Act extends the 2 percent payroll tax cut for all employees next year and expands it to 3.1 percent, or about $1,500 for the typical working family.

The cut in payroll taxes this year has provided vital support for families. Without the American Jobs Act, the typical working family would see its taxes go up by about $1,000 in 2012, an increase that independent forecasters have estimated would reduce growth next year by one-half percentage point or more.[20] The President believes that we not only must avoid this contraction, but we must maintain relief for middle class families who have been hit by unexpected hardships including higher energy prices.

The President has also instructed his economic team to work with Fannie Mae, Freddie Mac, the Federal Housing Finance Agency, major lenders, and industry leaders to remove the barriers that exist in the current refinancing program and help more Americans refinance their mortgages at today’s historically low interest rates. Many households stand to save at least $2,000 in mortgage payments if they are able to refinance at today’s low rates, which are roughly 4.1percent. Refinancing has the potential to keep more borrowers in their homes and to strengthen communities devastated by the housing crisis.

Conclusion

The American Jobs Act is what our economy needs now to spur economic growth and put more American back to work. The President’s plan will put more money in the pockets of households and businesses, increase consumer spending, boost consumer confidence, spur business investment, build critical infrastructure, help restore neighborhoods, and provide incentives for more hiring.

I would be happy to take your questions.

[1] Reinhart, Carmen M., and Rogoff, Kenneth S. (2009) This Time Is Different: Eight Centuries of Financial Folly. Princeton: Princeton University Press.

[2] Based on the Flow of Funds Accounts of the United States published by the Federal Reserve Board and CEA calculations. Wealth figures include nonprofit organizations.

[3] CoreLogic National Home Price Index Including Distressed Sales (not seasonally adjusted), measured at the end of the period.

[4] Based on the Wilshire5000 index, which was 14101 at the end of March 2011 and 14409 at the end of March 2007.

[5] Thomson/Reuters University of Michigan Surveys of Consumers.

[6] See the most recent assessment from the Congressional Budget Office, “Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output from April 2011 through June 2011” (August 2011), and Blinder and Zandi (2010), “How We Ended the Great Recession.” Studies that identify effects using more detailed data from the Recovery Act period are relatively new. These include Wilson (2011) “Fiscal Spending Jobs Multipliers: Evidence from the 2009 American Recovery and Reinvestment Act,” and Feyrer and Sacerdote (2011) “Did the Stimulus Stimulate? Real Time Estimates of the Effects of the American Readjustment and Recovery Act.”

[7] Evaluating the impact of countercyclical macroeconomic policy is inherently difficult because we do not observe what would have happened to the economy in the absence of policy. CEA evaluates the impact of the Recovery Act using estimates from standard macroeconomic models and compares these estimates with private sector forecasters and other public-sector analysts. The effects of the Act on employment are also compared with statistical models and, for some portions of the Recovery Act, with employment impact reports filed by the recipients.

[8] Real business investment in equipment and software has grown at an annual rate of 8.3 percent during the first half of 2011; it rose 16.6 percent during 2010. Real exports have grown at an annual rate of 5.4 percent during the first half of 2011; they rose 8.8 percent during 2010.

[9] Ben S. Bernanke, “The U.S. Economic Outlook,” September 8, 2011, http://www.federalreserve.gov/newsevents/speech/bernanke20110908a.htm.

[10] The University of Michigan Index of Consumer Sentiment fell from 74.3 in May to 55.7 in August.

[11] If sustained, the 13 percent decline in stock market wealth between the end of June and September 8th could push up the saving rate by about ¾ percentage point (assuming a marginal propensity to consume out of wealth of 0.03).

[12] The ISM Purchasing Managers’ Index has been recorded just above the threshold for a contraction in both July and August.

[13] The consensus among the Blue Chip economic forecasters has been marked down since the beginning of the year. They now expect real GDP to rise 1.3 percent over the four quarters of 2011, down from a forecast of 3.3 percent at the beginning of the year. Over the four quarters of 2012, the consensus now calls for GDP to rise 2.5 percent, down from a projection of 3.2 percent at the beginning of the year.

[14]Estimates of potential GDP by CBO are based on data prior to the July 2011 annual revision to the National Income and Product Accounts (NIPA). In the annual revision, GDP was revised down.1.6 percent in 2011:Q1.

[15] Firms must raise their payroll over last year’s level, and this benefit is capped at the first $50 million in payroll increases.

[16] Letter from Susan Eckerly, Senior Vice President of Federal Public Policy for the National Federation of Independent Business, to Representatives Walter Minnick and Aaron Schock, dated April 2, 2009.

[17] Congressional Budget Office (2010). “Policies for Increasing Economic Growth and Employment in 2010 and 2011.”

[18] Distinguished economists who supported a similar proposal in 2010, as noted by Christina Romer in a speech to NABE, were George Akerlof, Alan Blinder, Lawrence Katz, Joseph Stiglitz, and Laura Tyson.

[19] Joint statement U.S. Chamber of Commerce President and CEO Thomas J. Donohue and AFL-CIO President Richard Trumka, January 26, 2011.

[20] Macroeconomic Advisors (August 24, 2011) stated that extending the payroll tax holiday from 2011 into 2012 would boost real GDP growth ½ percentage point over the course of the year.