The guiding principle of health reform was simple: put American families and small businesses – not the health insurance companies – in charge of their own health care.

One of the immediate benefits of the health reform legislation signed by the President is a substantial tax credit for small businesses, designed to help them offer health insurance coverage for the first time or maintain coverage they already have. The tax credit takes effect this year, so we want to make sure word gets out to small business owners far and wide.

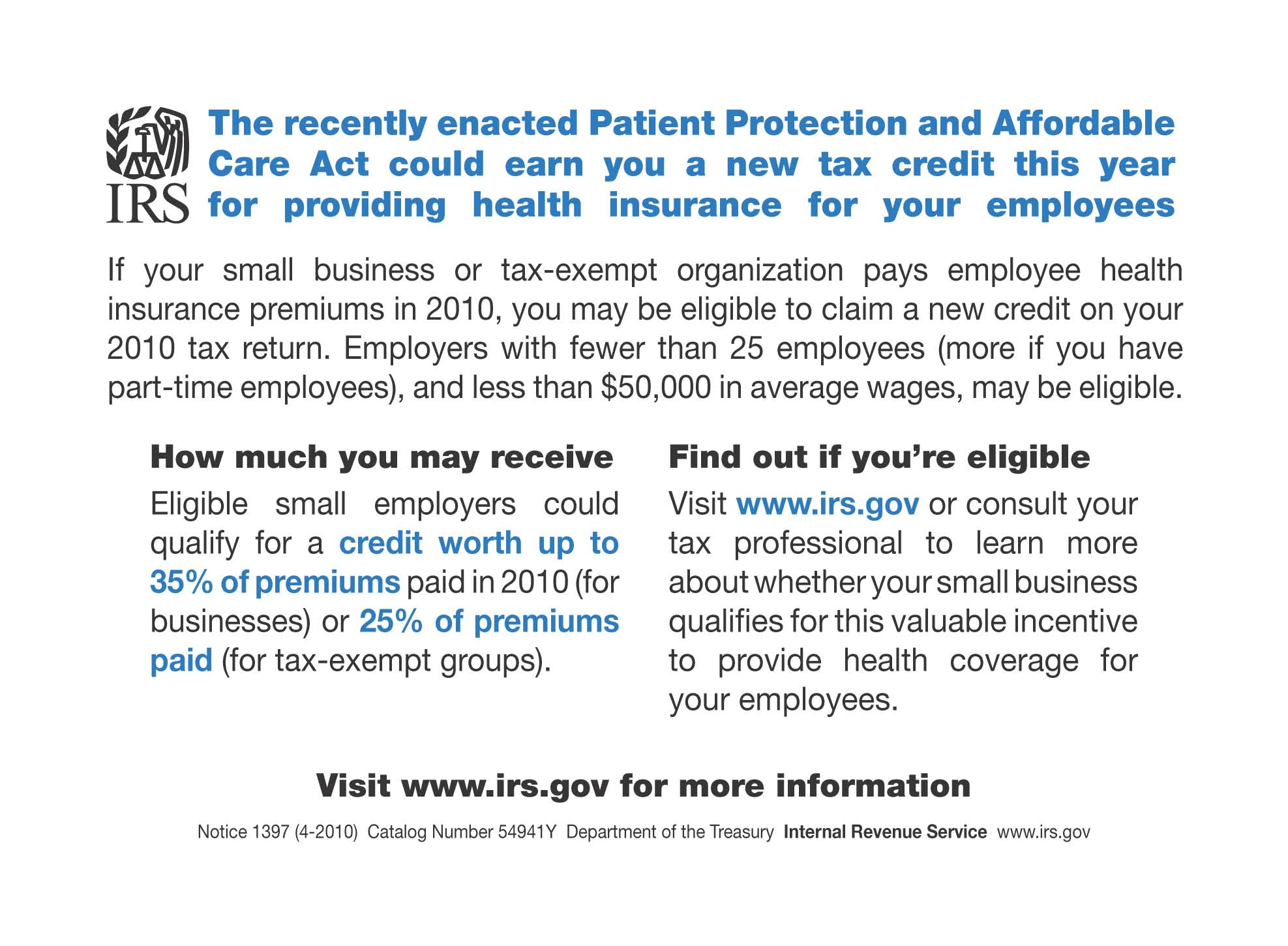

That’s why today the Internal Revenue Service today began mailing postcards to more than four million small businesses and tax-exempt organizations to make them aware of the tax credit.

Businesses aren’t required to provide coverage, but what we’ve heard over and over from small business owners is that they want to provide coverage but just can’t afford it – for them and their employees, this tax credit can be a tremendous help, but only if they know to take advantage of it!

The IRS postcard mailing is intended to get the attention of small employers and encourage them to find out more. We urge every small employer to take advantage of this credit if they qualify. In general, the credit is available to small employers that pay at least half the cost of single coverage for their employees in 2010. The credit is specifically targeted to help small businesses and tax-exempt organizations that primarily employ low- and moderate-income workers.

Of course, now that you’re here on WhiteHouse.gov, we encourage you to learn more, including who qualifies and for how much, from the small business page of our Health Reform section.