Manufacturers’ new orders for durable goods, which fell 1.3% in March, is the first item discussed in the Commerce Department’s press release, and is the item headlined by many news organizations. But this orders series does not tell us much about the actual direction of the economy because it is extremely volatile. A key source of this volatility of the overall orders series is its inclusion of orders of aircraft. Aircraft orders are often made in bunches, while, in contrast, shipments of finished aircraft trickle out more smoothly following production lags of several years. Excluding transportation equipment (the sector that includes aircraft), new orders increased 2.8%, well above market expectations of 0.7%.

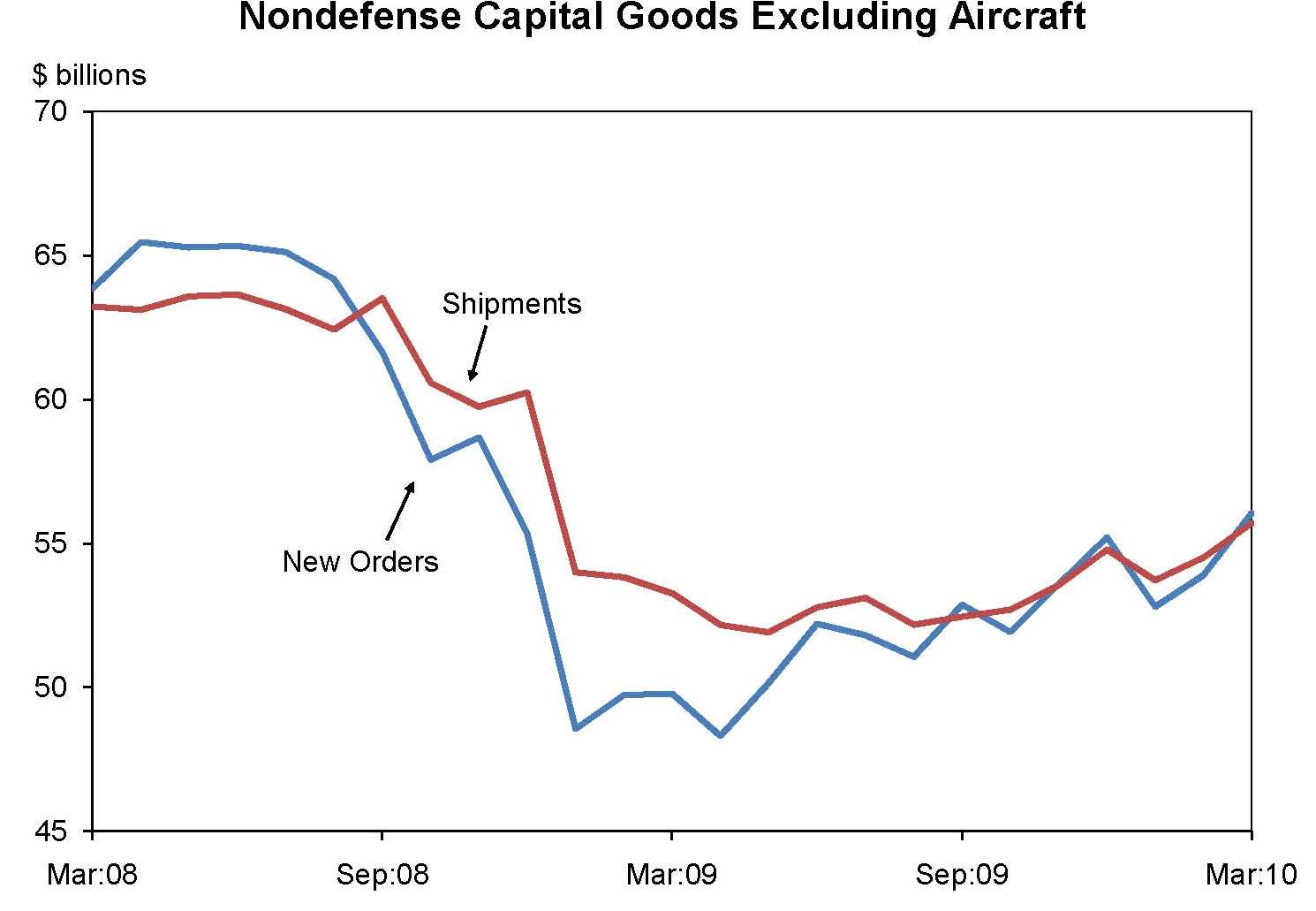

Shipments of nondefense capital goods excluding aircraft increased 2.2% in March, from an upwardly revised February level (see the chart below). Shipments of nondefense capital goods excluding aircraft are the component of this report most directly linked to the equipment and software component of GDP. New orders of nondefense capital goods excluding aircraft increased 4.0 percent in March, suggesting that this sector is likely to remain strong in the near future. Shipments of aircraft are also part of equipment and software investment, and the information in this report suggests a sharp decline in this component of investment in the first quarter.

Overall, equipment and software investment appears stronger than it did a month ago because of the increase in shipments of core capital goods in March and the upward revision in February. Despite the decline in aircraft shipments, equipment and software investment in the first quarter is likely to be positive due to the increase in capital goods shipments excluding aircraft, a quarterly increase in motor vehicle sales, and a persistent increase in software investment. This, together with indicators of manufacturing production and employment, suggest continued recovery in the manufacturing sector.

Steven Braun is the Director of Macroeconomic Forecasting at the Council of Economic Advisers.