While job growth remained solid in September, there is no question that the focus of policy should be on how to achieve a faster pace of job growth by increasing certainty and investing in jobs, rather than the self-inflicted wounds of the past several weeks that increased uncertainty and inhibited job growth. Today’s delayed report describes the economy more than a month ago. More recent indicators suggest the labor market worsened in the month of October.

Five key points in today’s report from the bureau of labor statistics

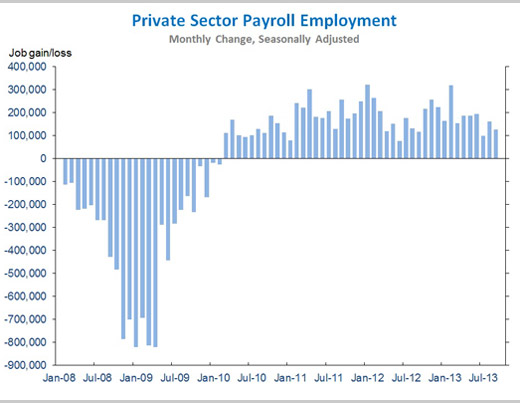

1. Private sector employment has risen for 43 consecutive months, with businesses adding a total of 7.6 million jobs over that period. Today we learned that total non-farm payroll employment rose by 148,000 in September, with the private sector accounting for 126,000 of that gain. Private sector job growth was revised down for July (to 100,000) but up for August (to 161,000). In sum, private sector employment rose by an average of 129,000 per month in the third quarter, lower than we can be fully satisfied with, partially reflecting the effects of fiscal contraction. This underscores the continued importance of taking steps that speed the recovery and boost job creation, while avoiding self-inflicted wounds like a government shutdown and debt ceiling brinksmanship that have the opposite effect.

2. Weekly employment indicators not in today’s report suggest that the labor market situation deteriorated in early October, coinciding with the shutdown and the threat of a possible default. Today’s employment report provides a snapshot of the economy in September, prior to the shutdown and debt limit brinksmanship. To understand more recent labor market developments we need to rely on other data that gives an initial indication of economic developments in October, including initial unemployment insurance claims and the Gallup Job Creation Index. Prior to the shutdown the four-week moving average of claims fell to 305,000, the lowest level since May 2007. But initial claims spiked in the first two weeks of October and reached their highest level since March (note the claims data do not include Federal employees).

Although the precise cause of changes in the number of initial claims can be difficult to discern, the uptick in claims was corroborated by a similar movement in Gallup’s Job Creation Index, which is based on a weekly survey of approximately 4,000 workers. The Gallup index represents the net percentage of respondents who say their employers are adding workers, and has tracked unemployment insurance claims in the past. Both indicators suggest that the shutdown and debt ceiling brinksmanship in the first half of October had a disruptive effect on the labor market. During the shutdown, hundreds of thousands of Federal workers went unpaid, families were unable to travel to national parks, oil and gas drilling permits were delayed, Small Business Administration loans were put on hold, licenses to export high-tech products could not be granted, and documentation required to get a mortgage could not be accessed, to name just a few effects.

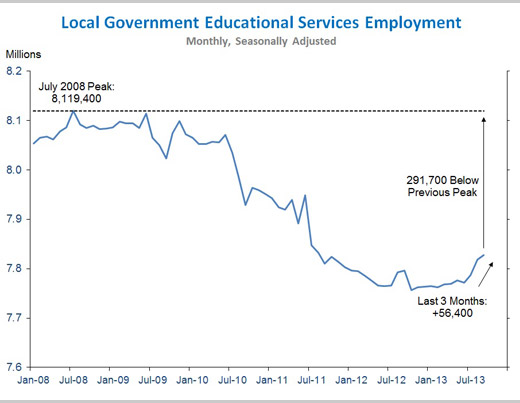

3. Local government educational services employment rose by 9,500 in September and is up 56,400 over the last three months – but remains well below pre-crisis levels. While local education jobs appear to have stabilized and even started increasing in recent months, there is much further to go. Employment in this sector remains 291,700 below its previous peak in July 2008—and given a growing student population this understates the teacher and education jobs gap. It is worth noting that local government educational services employment began to decline around the same time that support from the Recovery Act peaked and began to phase out, and the Administration continues to support proposals to boost the hiring of teachers and other local government workers that play a critical role in communities across the country.

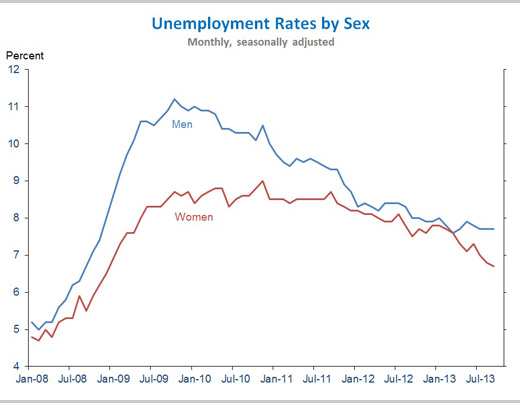

4. The unemployment rate for women ticked down to 6.7 percent in September, the lowest since December 2008 but still above pre-crisis rates. Industries that employ a larger fraction of men (for example, construction and manufacturing) were particularly hard hit the recession, so the unemployment rate for men rose much more rapidly than the unemployment rate for women. This pattern has been fairly typical of recent recessions. During the recovery, the unemployment rate for men fell more rapidly and the two unemployment rates converged. However, in the last six months the two rates have diverged and the unemployment rate for women has fallen more rapidly to 6.7 percent while the male unemployment rate has come down more slowly and is 7.7 percent.

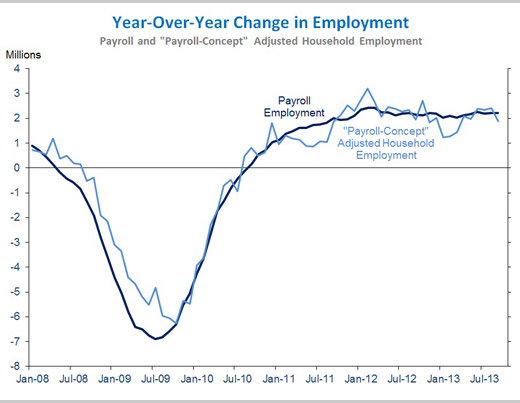

5. The economy has been adding jobs at a pace of more than 2 million per year. Over the twelve months ending September 2013, total non-farm payroll employment rose by 2.2 million, similar to the gain in the year-earlier period. While the month-to-month figures can be volatile, the year-over-year changes indicate that the recovery has been durable in the face of several headwinds that have emerged in recent years. The separate household survey is more volatile month-to-month, but over a longer period, it tells the same story. When adjusted by the Bureau of Labor Statistics to be comparable to the concept of employment used in the payroll measure, household employment has risen by 1.9 million over the twelve months ending September 2013.

As the Administration stresses every month, the monthly employment and unemployment figures can be volatile, and payroll employment estimates can be subject to substantial revision. Therefore, it is important not to read too much into any one monthly report and it is informative to consider each report in the context of other data that are becoming available.