A good way to build a stronger economy is to create a fairer and more efficient tax code -- one that promotes business investment and job creation in the United States. That is why the President has proposed business tax reform that will simplify the tax code by lowering the corporate tax rate and closing wasteful loopholes.

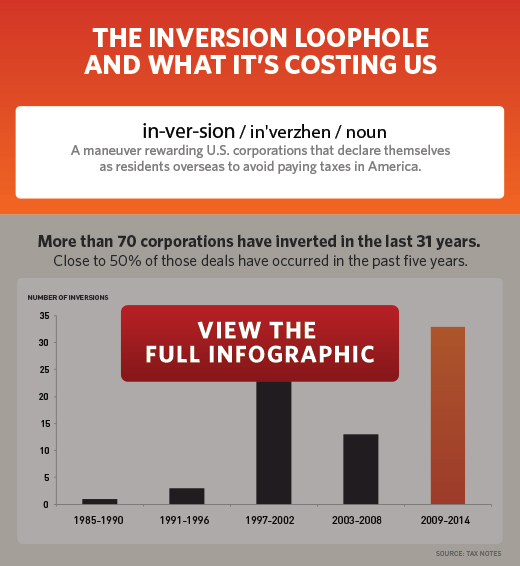

Congress has yet to act on the President’s proposal, and in the meantime, some companies continue to exploit unfair tax loopholes. One such loophole allows U.S. corporations to undertake an "inversion," whereby a company relocates their tax residence overseas, while changing very little else about its operations or business, in order to avoid paying taxes. With a simple change of paperwork, these companies can dramatically reduce their taxes, leaving other businesses and middle-class taxpayers to pick up the tab.

Dozens of U.S. corporations have taken advantage of the inversions loophole in recent years, and more are looking to follow suit. By renouncing their U.S. citizenship, these companies will cost our country nearly $20 billion over the next decade -- critical dollars that could be used to grow and expand the middle class.

The Treasury Department is using its authority to take initial, targeted steps to discourage American companies from inverting by limiting the benefits they would receive from such action. You don’t get to pick your tax rate, and neither should corporations.

Take a look at why the President has called on Congress to close the inversion tax loophole: