Eighty years ago today, President Franklin D. Roosevelt signed into law the Social Security Act, changing the landscape of American society by ensuring a basic level of financial security for retired workers and their families. As President Obama stated on the Act’s 75th anniversary, Social Security “is a lasting promise that we can retire with dignity and peace of mind, that workers who become disabled can support themselves, and that families who suffer the loss of a loved one will not live in poverty.” In honor of its 80th birthday, we recognize a few of the ways in which Social Security provides protection against life’s many uncertainties.

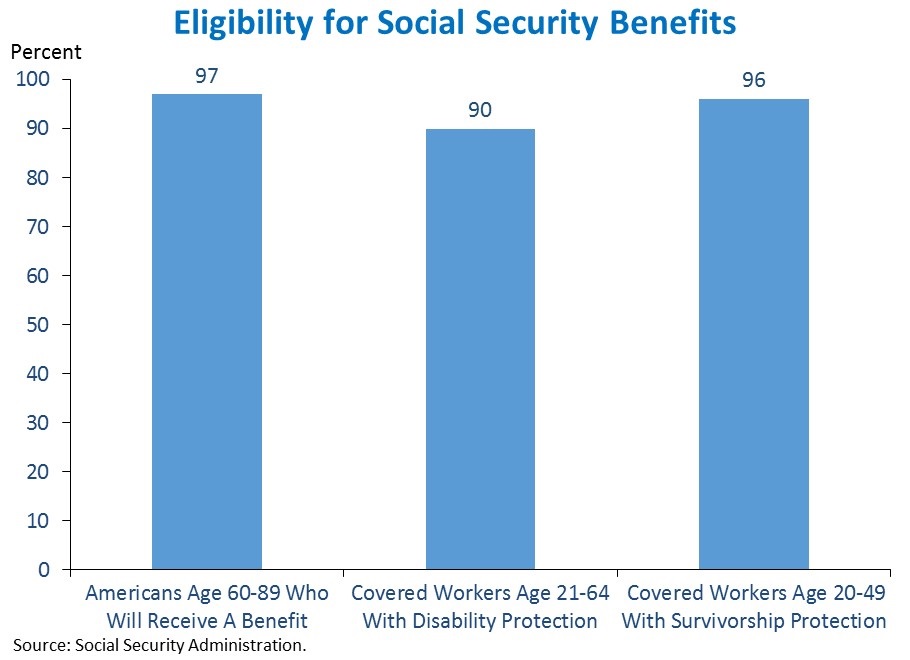

1. Social Security forms the foundation for retirement security through universal, guaranteed benefits. 97 percent of Americans age 60-89 either receive benefits today or will receive benefits in the future. More than 40 million Americans currently receive retirement benefits based on their work history or their spouse’s work history.

2. Social Security Disability Insurance helps protect 150 million American workers against a catastrophic loss of income due to disability. For 11 million current beneficiaries—workers with disabilities, their spouses, and their dependent children—Social Security Disability Insurance helps pay the rent and put food on the table. On average, beneficiaries worked for 22 years before receiving benefits. 90 percent of workers 21-64 in employment covered by Social Security have worked and paid into the program long enough to earn disability insurance, protecting them from severe hardship if they become unable to work due to disability.

3. Social Security provides survivors insurance, helping to ensure financial security for a worker’s family in the event of an untimely death. 96 percent of workers 20-49 in employment covered by Social Security have worked and paid into the program long enough to earn survivors insurance for their dependent children, ensuring that their families will receive this important support if they die. Nearly 2 million children of deceased workers currently receive survivors benefits, a crucial source of financial support for families coping with a loss.

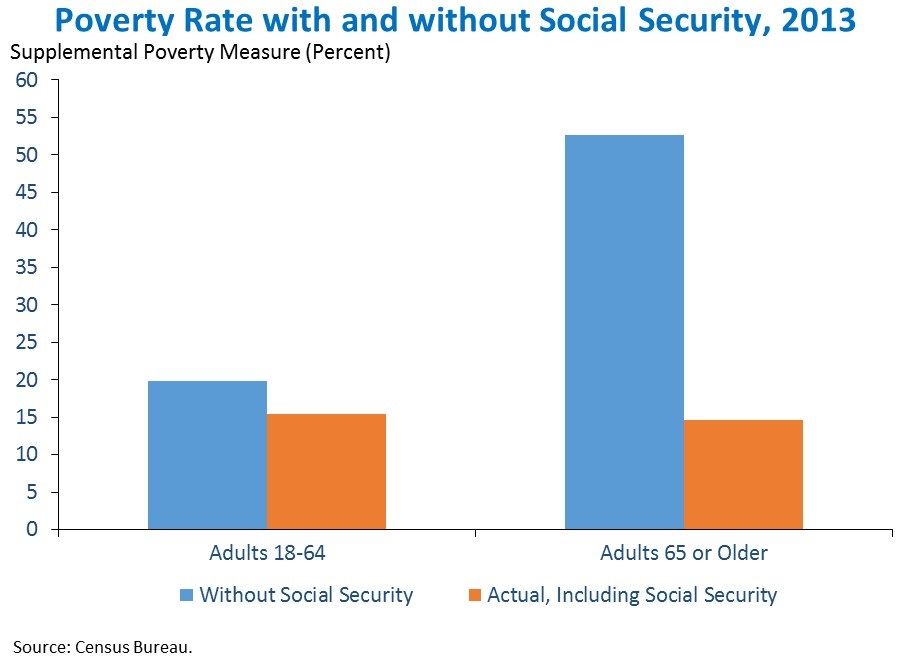

4. Social Security lifts millions of Americans 65 and older out of poverty and dramatically reduces the poverty rate. Excluding Social Security benefits, the elderly poverty rate—as measured by the supplemental poverty measure—would be more than 50 percent, far higher than its actual level of 15 percent. The poverty rate for Americans 65 and older has fallen dramatically since the 1960s, and economic research finds that Social Security played a crucial role in this decline.

5. For more than 60 percent of beneficiaries 55 and older Social Security represents the primary source of income. Social Security accounts for more than half of income for 62 percent of Social Security beneficiaries 55 and older. More than a third of beneficiaries in that age range rely on Social Security for at least 90 percent of their income. Social Security accounts for at least 90 percent of income for nearly half of beneficiaries 80 and older.

6. Social Security provides greater protection for the most vulnerable workers. While Social Security benefits increase with earnings, providing larger absolute benefits to higher-earning workers, the replacement rate—the share of a worker’s earnings that Social Security benefits replace during their retirement—is higher for workers with lower incomes during their career.

7. Social Security is especially important for populations with lower lifetime earnings and lower rates of pension coverage, including minorities. Among beneficiaries 65 and older, Social Security accounts for at least 90 percent of income for 53 percent of Hispanics, 46 percent of African Americans, and 44 percent of Asian Americans, compared to 36 percent for the population as a whole.

8. Social Security is also particularly important for women due to the combination of lower lifetime earnings, longer life expectancies, and higher probabilities of living into their 80s and 90s. While women make up 52 percent of the age-62 population, they account for 56 percent of beneficiaries 62 and older and roughly two-thirds of beneficiaries 85 and older. In addition, the overwhelming majority of beneficiaries receiving survivors benefits are women.

9. The shift from traditional pensions to 401(k)s and other defined contribution retirement plans has increased the importance of the guaranteed benefits provided by Social Security. In 1989, nearly 70 percent of workers participating in a retirement plan at work were covered by defined benefit plans, which provide life-long guaranteed income after retirement. In 2013 less than 30 percent of workers participating in a retirement plan at work were covered by defined benefit plans. The benefits received from 401(k)s and other defined contribution plans, which now account for the majority of plan participants, depend on investment returns and can run out over the course of retirement. For such workers Social Security may be the only source of guaranteed income.

On today’s 80th Anniversary of Social Security, the Obama Administration is committed to ensuring that Social Security remains a rock-solid, guaranteed benefit that every American can rely on, now and in the future—for retirees and people with disabilities, as well as their families and survivors. For all these reasons, we need keep Social Security strong—protecting its future solvency while strengthening retirement security for the most vulnerable Americans.

As part of this commitment, the President has proposed rebalancing the Social Security program to address a long-foreseen imbalance between the two Social Security trust funds that, respectively, pay benefits to retirees and to workers with disabilities. This simple step, which has been implemented many times before on a bipartisan basis, would ensure that workers with disabilities, retirees, and survivors receive the full amount of earned and expected benefits while policymakers develop longer-term policies to strengthen the Social Security program as a whole. However, if lawmakers fail to act, workers with disabilities could face deep and abrupt cuts in their benefits in 2016. Such a cut is completely unnecessary as the combined trust funds have enough resources to pay full disability, retirement, and survivors benefits for nearly two decades.