Congratulations to Emmanuel Saez

Posted by on April 27, 2009 at 01:47 PM EST

My co-author and friend Emmanuel Saez was awarded the John Bates Clark Medal on Friday. The prize, which is awarded to the best American economist under the age of forty, is one of the highest honors the economics profession can bestow upon one of its own. Emmanuel is deeply deserving of the honor—his work on income inequality and taxation has helped to shape my own thinking on these matters, and it had no small influence on the President's Budget.

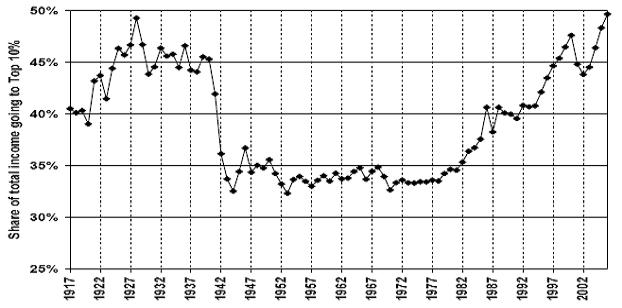

Emmanuel is perhaps best known for his detailed examination of how wages at the top end of the U.S. income distribution have evolved over the past century. He and his co-author Thomas Piketty discovered that the overall pattern for the share of income accruing to those in the top 10 percent is U-shaped (see chart 1 below). Thus, the share going to the top 10 percent was around 45 percent from the mid-1920s to 1940, but then declined to approximately 33 percent during World War II. Emmanuel attributes this fall-off to the sharp reduction in capital incomes brought about by the war and the revenue increases needed to finance the war effort. After the war, the share of income accruing to the top 10 percent remained essentially flat until the late 1970s, when it began climbing dramatically, ultimately surpassing its pre-war highs. Indeed, in 2006, the top 10 percent earned 50 percent of national income, a higher share than even in 1928, the peak year of the "roaring twenties" stock market bubble.

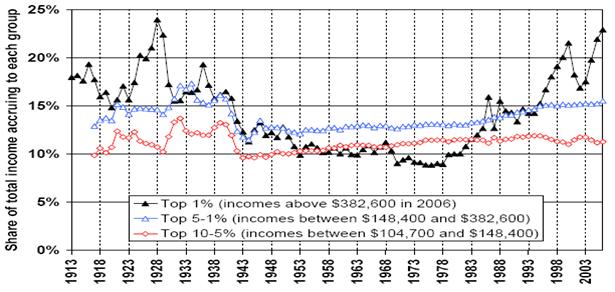

Perhaps even more interesting than his findings about the evolution in earnings for the top 10% is what he found when he isolated data from just the top 1 percent of earners—namely, that virtually all the historical fluctuation in the share of income going to the top 10 percent was due to fluctuations in income within the top percentile alone (see chart 2 below). Stated differently, the dramatic changes in income inequality seen in the United States over the last century are almost entirely a function of how well the very highest earners did at any given point in time.

And in the most recent past, the very highest earners did very well indeed, capturing almost three-quarters of total income growth in the economic expansion of 2002 to 2006, while the remaining 99 percent of the U.S. population split among themselves the final 25 percent of the increase. (What makes this trend all the more concerning is something that Emmanuel and his co-authors demonstrated in another paper: that this dramatic increase in incomes at the very top has not been mitigated by an increase in income mobility, which can be seen in the relatively stable probability of staying in the top 1 percent of earners from one year to the next since the early 1970s.)

Emmanuel's work on income inequality has helped to point the way for the Administration in its pledge to rebalance the tax code, with a tax cut going to 95 percent of working Americans while asking those at the very top to contribute more. The inequality that has arisen over the past three decades is not going to go away overnight, and it has been driven by many factors—including a decline in the growth rate of college-educated workers. But where the prior administration used changes in the tax code to exacerbate these trends, this Administration thinks that the tax code should be used to mitigate them because an economy in which all can enjoy success is one that is strong for us all.

Emmanuel's energy, intelligence, and dedication are deeply impressive—as was his ability to explain, despite his French accent, a complicated research project that I worked on with him to a group of H&R Block workers administering it. I look forward to reading his work for years and decades to come.

Emmanuel is perhaps best known for his detailed examination of how wages at the top end of the U.S. income distribution have evolved over the past century. He and his co-author Thomas Piketty discovered that the overall pattern for the share of income accruing to those in the top 10 percent is U-shaped (see chart 1 below). Thus, the share going to the top 10 percent was around 45 percent from the mid-1920s to 1940, but then declined to approximately 33 percent during World War II. Emmanuel attributes this fall-off to the sharp reduction in capital incomes brought about by the war and the revenue increases needed to finance the war effort. After the war, the share of income accruing to the top 10 percent remained essentially flat until the late 1970s, when it began climbing dramatically, ultimately surpassing its pre-war highs. Indeed, in 2006, the top 10 percent earned 50 percent of national income, a higher share than even in 1928, the peak year of the "roaring twenties" stock market bubble.

Chart 1: Share of Total U.S. Income Accruing to the Top 10%, 1917-2006

Perhaps even more interesting than his findings about the evolution in earnings for the top 10% is what he found when he isolated data from just the top 1 percent of earners—namely, that virtually all the historical fluctuation in the share of income going to the top 10 percent was due to fluctuations in income within the top percentile alone (see chart 2 below). Stated differently, the dramatic changes in income inequality seen in the United States over the last century are almost entirely a function of how well the very highest earners did at any given point in time.

Chart 2: Decomposing the Top 10% of U.S. Income Share into Three Groups, 1913-2006

And in the most recent past, the very highest earners did very well indeed, capturing almost three-quarters of total income growth in the economic expansion of 2002 to 2006, while the remaining 99 percent of the U.S. population split among themselves the final 25 percent of the increase. (What makes this trend all the more concerning is something that Emmanuel and his co-authors demonstrated in another paper: that this dramatic increase in incomes at the very top has not been mitigated by an increase in income mobility, which can be seen in the relatively stable probability of staying in the top 1 percent of earners from one year to the next since the early 1970s.)

Emmanuel's work on income inequality has helped to point the way for the Administration in its pledge to rebalance the tax code, with a tax cut going to 95 percent of working Americans while asking those at the very top to contribute more. The inequality that has arisen over the past three decades is not going to go away overnight, and it has been driven by many factors—including a decline in the growth rate of college-educated workers. But where the prior administration used changes in the tax code to exacerbate these trends, this Administration thinks that the tax code should be used to mitigate them because an economy in which all can enjoy success is one that is strong for us all.

Emmanuel's energy, intelligence, and dedication are deeply impressive—as was his ability to explain, despite his French accent, a complicated research project that I worked on with him to a group of H&R Block workers administering it. I look forward to reading his work for years and decades to come.

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues