Victories For Working Families and Jobs in the Agreement on Tax Cuts and Unemployment Insurance

Posted by on December 10, 2010 at 03:24 PM EST

The President is committed to promoting a strong, growing economy – one that’s creating jobs, fostering a thriving middle class, and extending opportunity to all American workers. That’s why he fought so hard to ensure that the priorities of working families were advanced in the agreement introduced today in the Senate.

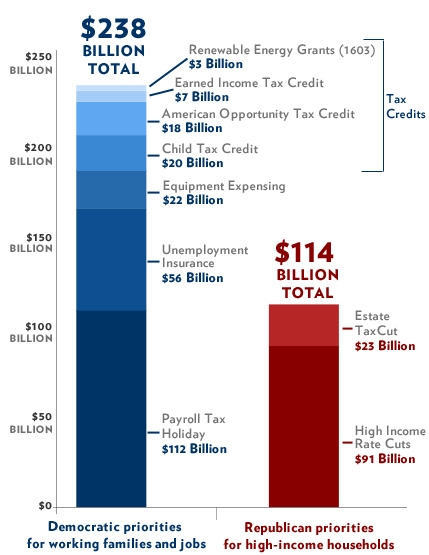

As the chart above demonstrates, the bipartisan agreement we’ve forged delivers several key victories – victories that will give the average American family assurance that there will be more money to pay the bills each month:

- An Employee-Side Payroll Tax Cut of Approximately 2%: The agreement includes an employee-side payroll tax cut for over 155 million workers – providing tax relief of about $112 billion next year.

- Extension of Unemployment Benefits: The agreement extends emergency unemployment benefits at their current level for 13 months, preventing an estimated 7 million workers from losing their benefits over the next year as they search for jobs.

- The Child Tax Credit: The $3,000 refundability threshold established in the Recovery Act for the Child Tax Credit will be extended under the agreement, ensuring an ongoing tax cut to 10.5 million lower-income families with 18 million children.

- The Earned Income Tax Credit: The agreement continues a Recovery Act expansion of the Earned Income Tax Credit worth, on average, $600 for families with 3 or more children, and reduces the “marriage penalty” faced by working married families. Together, these enhancements to the EITC will help 6.5 million working parents with 15 million children.

- The American Opportunity Tax Credit: The new American Opportunity Tax Credit – a partially refundable tax credit that helps more than 8 million students and their families afford the cost of college – would be continued under the agreement.

- 100 Percent Expensing: The agreement includes the President’s proposal to temporarily allow businesses to expense 100% of their investments in 2011, potentially generating more than $50 billion in additional investment in 2011, which will fuel job creation.

- 1603 Renewable Energy Grants: The agreement extends the 1603 program, which is helping to support tens of thousands of jobs in the wind and solar industries.

These victories all come on top of the extension of lower income tax rates for middle-class Americans.

See more about Taxes

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues