In this globally competitive, knowledge-based economy, higher education has never been more important. Simply put, America cannot lead in the 21st century without the best educated, most competitive workforce in the world. Nations that out-educate us today will out-compete us tomorrow, which is why some form of higher education is an absolute must.

We also know that college costs have never been higher -- or more difficult to manage. The Administration has already provided aid to millions of students with historic investments in programs like Pell Grants and the American Opportunity Tax Credit. But we realize that many borrowers are struggling to both pay off their loans and make ends meet every month. And fear of being saddled with debt in the long run may deter many potential students from enrolling in college. They need help now.

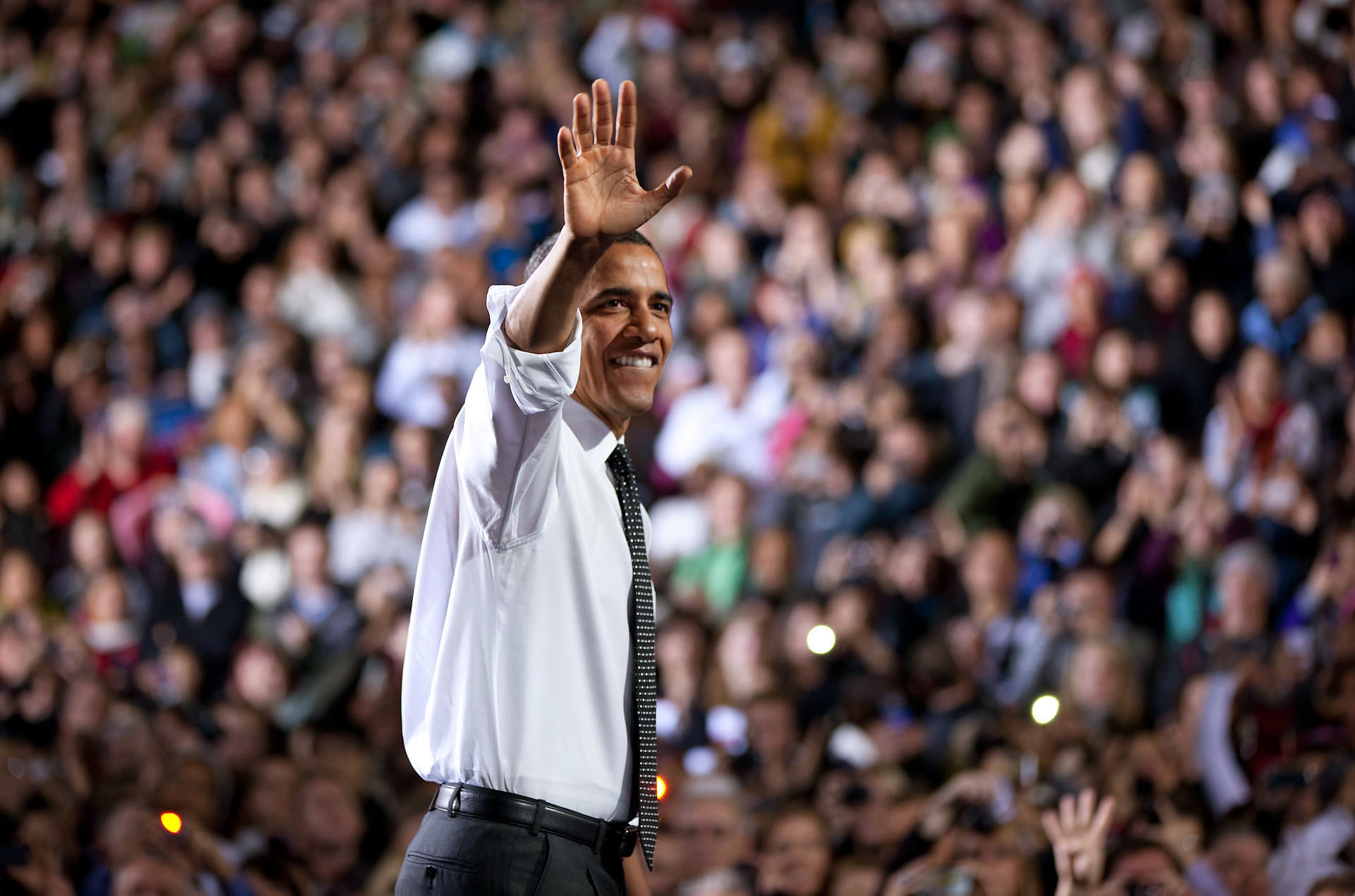

That’s why today, President Obama announced new efforts to make college more affordable by helping millions of borrowers better manage their federal student loan debt. We’re taking executive action with two measures that will bring relief to borrowers by lowering their monthly loan payments -- at no cost to taxpayers.

First, for some students we are proposing to cap student loan repayment at 10 percent of a borrower’s discretionary income, starting next year. For many who worry about managing their debt while working in lower-paying fields -- including teachers, nurses, public defenders, and social workers -- this could reduce their payments by hundreds each month.

We also want to provide immediate relief to borrowers already repaying their loans. While the pay-as-you-earn proposal would only apply to some current students and recent graduates, millions more borrowers may already be eligible for our current income-based repayment plan, which caps payments at 15 percent of a borrower’s discretionary income. We know there are folks who are struggling in repayment now -- and for them the current Income Based Repayment (IBR) plan may be a great option. To learn more about this plan to see if it makes sense for you, visit www.studentaid.ed.gov/ibr.

Second, beginning in January we will offer 6 million borrowers the chance to consolidate their loans and reduce their interest rates. Currently, these borrowers are repaying loans from two different programs, requiring them to submit separate payments and adding red tape that makes them more likely to default. Our special consolidation plan will allow these borrowers to make a single payment each month, with incentives to encourage on-time repayment. Borrowers who take advantage of this option will be eligible to receive a reduction in the interest rate on some of their loans by up to 0.5 percent, lowering their monthly payments and saving hundreds in interest. We will start reaching out to eligible borrowers in early 2012 to introduce them to this program.

In addition to these steps, the Consumer Financial Protection Bureau and the U.S. Department of Education have teamed up to launch a new Know Before You Owe project, and today they are releasing a Financial Aid Shopping Sheet -- a draft model financial aid disclosure form. This form is a tool that colleges can use to help students better understand the type and amount of aid they qualify for, and will allow potential students to easily compare aid packages offered by different institutions.

The form will also make the total costs -- and risks -- of a student’s loans clear before enrollment, by outlining what a student’s monthly loan payment would be and providing an estimate of their total loan debt. Ultimately, this provides students and their families with useful information that can help them make a more informed decision about where to attend college and better understand the debt burden they may be left with.

These are changes that will make a big difference in the lives of college students and recent graduates entering one of the toughest job markets in recent memory. We’re helping provide them with key information on the front end, and we have a way to help them save money by consolidating their debt and capping their loan payments. And all of this will be done at no cost to taxpayers. This is not just a no-brainer – it’s the right thing to do.

President Obama also can't wait for Congress to: