Economic growth in the second quarter was strong, consistent with the recent further improvement in the labor market and other indicators. The economy could do even better if Congress does its part to help — starting with taking the steps needed to ensure that work on our roads and bridges is not brought to a halt this fall. But to make further progress, the President is pressing ahead on his own authority, taking action to facilitate investments in American manufacturing, energy, and infrastructure.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

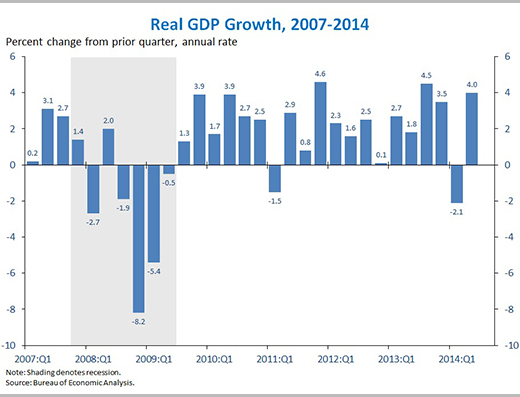

1. Real gross domestic product (GDP) increased 4.0 percent at an annual rate in the second quarter of 2014, according to the advance estimate from the Bureau of Economic Analysis. The second-quarter increase in GDP follows a first-quarter decline that was slightly less steep than previously reported. In the second quarter, growth in consumer spending and business investment picked up from the previous quarter, and residential investment increased following two straight quarters of decline. Additionally, state and local government spending grew at the fastest quarterly rate in five years. However, net exports subtracted from overall GDP growth, as imports grew faster than exports. Over the last four quarters, real GDP has risen 2.4 percent.

2. The revisions to historical data released today altered the pattern of growth over the last several years but had little net effect on the overall magnitude of the recovery. Real GDP growth in 2011 and 2012 was revised down to an average annual rate of 1.6 percent, but growth in 2013 was revised up to 3.1 percent. The strong growth in 2013 reflects especially rapid growth in the second half of the year. From the end of the recession in 2009:Q2 to the end of 2013, the economy grew at an average annual pace of 2.3 percent, little changed from what was previously reported.

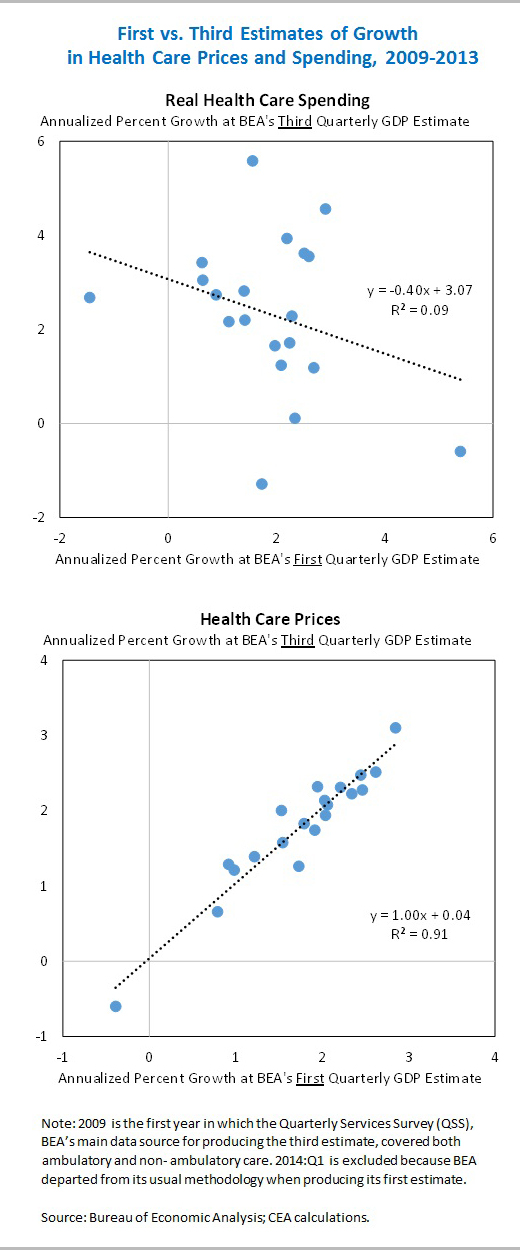

3. Health care prices rose at a 1.8 percent annual rate in 2014:Q2, continuing the unusually slow health care price inflation seen in recent years; today’s release does not contain useful information on growth in health care spending. This quarter’s increase in health care prices is lower than overall inflation and is roughly in line with the 1.6 percent increase over the last four years. As we have noted previously, the United States is currently in the midst of a sustained period of unusually slow health care price inflation, to the significant benefit of health care consumers.

The Bureau of Economic Analysis (BEA) also reported that real health care spending grew at a very slow 0.7 percent rate in the second quarter. However, as we noted last quarter, BEA has very limited data on health care spending when constructing its first and second estimates, so those estimates contain little useful information on actual health care spending.

This fact was strikingly illustrated last quarter, when BEA first estimated growth in real health care spending at 9.9 percent, but ultimately revised that estimate down to -1.4 percent. More generally, as depicted below, BEA’s first estimate of health care spending growth has been a consistently poor predictor of its third estimate in recent years. By contrast, BEA’s first estimate of growth in health care prices is generally reliable, reflecting the fact that BEA has access to much better data on health care prices when producing the first estimate.

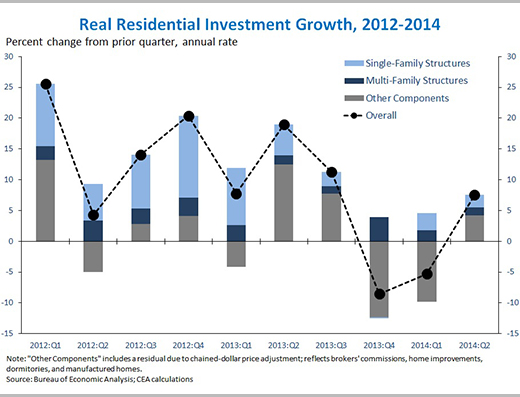

4. Real residential investment rose 7.5 percent at an annual rate in the second quarter, following two straight quarters of decline. Previously, residential investment had expanded in 10 straight quarters from 2011:Q2 through 2013:Q3. The weakness in residential investment in 2013:Q4-2014:Q1 was in large part due to a drop in brokers’ commissions and other ownership transfer costs, which are included in residential investment but are generally reflective of home sales rather than construction activity. In the second quarter, the “other” components of residential investment (brokers’ commissions, home improvements, dormitories, and manufactured homes) returned to growth, and single- and multi-family construction continued to grow, leading to a gain in overall residential investment. Nevertheless, the level of residential construction activity represented 3.2 percent of GDP in the second quarter, still well below its average of 4.6 percent from 1960 to 2000.

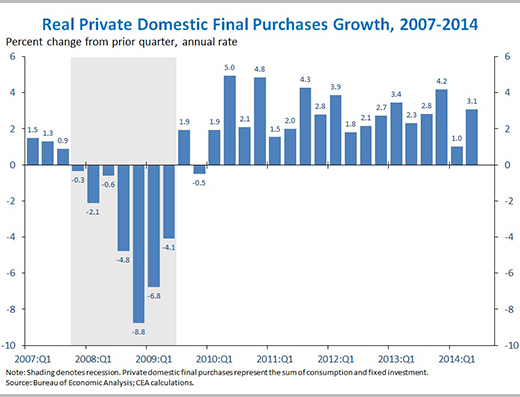

5. Real private domestic final purchases (PDFP)—the sum of consumption and fixed investment—rose 3.1 percent at an annual rate in the second quarter. Real PDFP growth is generally a more stable and forward-looking indicator than real GDP because it excludes highly volatile components like inventory investment and net exports. For instance, in the first quarter, consumption and fixed investment posted positive growth, while the decline in overall GDP mostly reflected drops in the inventory investment and net export components. In the second quarter, consumption and fixed investment grew strongly, but by somewhat less than overall GDP, which received a boost from inventory investment that was only partially offset by falling net exports.

As the Administration stresses every quarter, GDP figures can be volatile and are subject to substantial revision. Therefore, it is important not to read too much into any one single report and it is informative to consider each report in the context of other data that are becoming available.