The Employment Situation in July

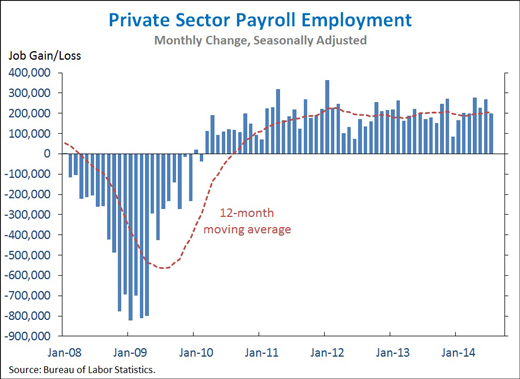

Total job growth exceeded 200,000 for the sixth straight month in July, the first time that has happened since 1997. This encouraging trend in the labor market is consistent with other recent economic indicators, including the strong second-quarter GDP growth reported on Wednesday. To ensure this momentum can be sustained, the President is pressing Congress to act to create jobs and expand opportunity, while simultaneously using his own executive authority to encourage investment in the United States, boost the income of working families, and ensure safe and fair treatment of American workers.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF LABOR STATISTICS

1. The private sector has added 9.9 million jobs over 53 straight months of job growth, the longest streak on record. Today we learned that total nonfarm payroll employment rose by 209,000 in July, mainly reflecting a 198,000 increase in private employment. Private-sector job growth in May and June were revised up slightly, so that over the past twelve months, private employment has risen by a total of 2.5 million.

2. The labor force participation rate edged up to 62.9 percent in July, and has been relatively stable, on balance, since last October—during which time the unemployment rate has fallen by a full percentage point. Over the recovery as a whole, the participation rate has fallen, in large part because of two simultaneous events that hit in 2008: the worst recession since the Great Depression, and the beginning of a retirement boom as the first Baby Boomers became eligible for Social Security. Last month, the Council of Economic Advisers released a report elaborating on these and other factors driving the decline in the participation rate. Updating the model to account for today’s data, CEA estimates that of the 3.0 percentage point decline in the participation rate from 2007:Q4 to July 2014, 1.7 percentage point is due to the natural aging of the population and 0.5 percentage point is due to standard business-cycle effects. The remaining 0.9 percentage point is a “residual” that could reflect either less-well-understood pre-existing trends or a lingering hangover from the unusual severity of the Great Recession. Although the effect of an aging population is likely to exert downward pressure on the participation rate for years to come, the CEA report lays out a number of policy steps that can help support labor force participation and in turn, the economy’s long-run potential output.

3. Looking at a range of indicators of unemployment, it is clear that we are far into the economic recovery—and that progress has been broadly shared—but we are not all the way there yet. The official unemployment rate is 80 percent of the way back to its pre-recession level, after rising from a 2001-07 average of 5.3 percent to a peak of 10.0 percent. In July, it was 6.2 percent. A range of other indicators also show that we have made progress but more work remains:

First, looking at most unemployment rates across sex, race, and education shows a similar pattern of recovery. Most of these rates are around 70-80 percent of the way back to their pre-recession average. While the chart suggests that the extent of recovery is broadly similar across groups, this fact is less comforting for some groups, like African Americans, that saw larger percentage point increases in their unemployment rates in the recession and that had substantially higher unemployment rates even before the recession. (From 2001-07, the African American unemployment rate averaged 9.8 percent.)

Second, the broader measures of labor underutilization published by BLS have also experienced a substantial recovery. Measures that include discouraged workers or people who want jobs but are no longer looking have recovered nearly as much as the official unemployment rate.

Third, the long-term unemployment rate, which more than quadrupled as a result of the recession, still has the furthest to go to recover to its pre-recession average. In contrast, short-term unemployment has fully recovered.

A longer discussion of the recovery in these labor market indicators is available in a recent speech I gave on “Opportunities and Challenges in the U.S. Labor Market.”

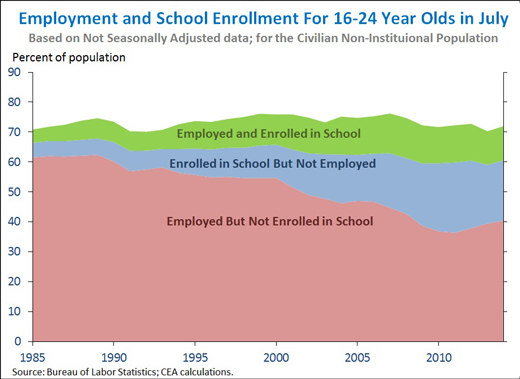

4. Youth summer employment generally peaks in July, although the patterns of youth activity during the month have evolved substantially over time. In July 1985 (the first year published data on school enrollment is available), 71 percent of 16-24 year olds were working, enrolled in school, or both. In July 2014, that overall fraction was very similar, at 72 percent. However, over this time there has been a large shift in the underlying pattern of youth activity during July, as the share of young people only working has fallen, while the share of young people only enrolled in school or both working and enrolled has increased (left chart).

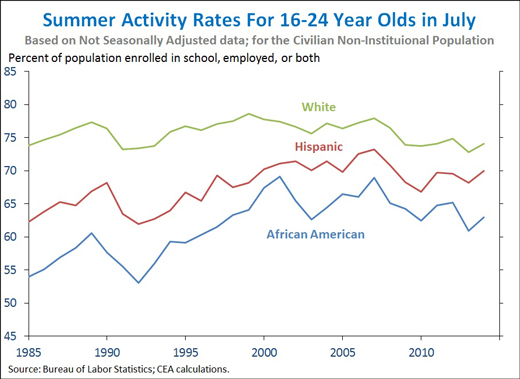

Moreover, there continue to be substantial gaps in July “summer activity rates” (the share of the population employed, enrolled in school, or both) across racial groups (right chart). The summer activity rate for white 16-24 year olds was 74 percent in July 2014, above the rate for blacks (63 percent) and Hispanics (70 percent). While these gaps have narrowed over time, it is important to recognize that the labor market data is based on the civilian non-institutional population; including the incarcerated population may suggest that the gaps today are still wider than appear below. Ultimately, both the labor market and incarceration disparities are why the President has launched the My Brother’s Keeper initiative to make progress in this critical area.

5. Several industries performed notably in July. Manufacturing, construction, and State and local government all saw job growth that was in the high end of the range observed over the last 53 months. In contrast, private educational services underperformed relative to its average monthly growth since March 2010. Across the 17 industries shown below, the correlation between the most recent one-month percent change and the average percent change over the last twelve months fell to 0.60, suggesting that the pattern of job growth across industries in July was a bit more divergent from recent trends than it had been earlier this year.

As the Administration stresses every month, the monthly employment and unemployment figures can be volatile, and payroll employment estimates can be subject to substantial revision. Therefore, it is important not to read too much into any one monthly report and it is informative to consider each report in the context of other data that are becoming available.

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues