The Employment Situation in September

With today’s report, America’s businesses extended the longest streak of private-sector job gains on record. The data underscore that six years after the Great Recession—thanks to the hard work of the American people and in part to the policies the President has pursued—our economy has bounced back more strongly than most others around the world. But even as we take stock of the progress that has been made, too many Americans do not yet feel enough of the benefits. Yesterday, the President set out his vision for steps that can lay a new foundation for stronger growth, rising wages, and expanded economic opportunity.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF LABOR STATISTICS

1. The private sector has added 10.3 million jobs over 55 straight months of job growth, extending the longest streak on record. Today we learned that total nonfarm payroll employment rose by 248,000 in September, mainly reflecting a 236,000 increase in private employment. Private-sector job growth was revised up for July and August, so that over the past twelve months, private employment has risen by 2.6 million. So far this year, private employment has risen by nearly 2 million, on pace for the strongest year of private-sector job growth since 1998.

2. The overall unemployment rate fell to 5.9 percent in September, the lowest since July 2008, and is down 1.3 percentage point over the last year. Notably, the 1.3 percentage point decline in the unemployment rate is nearly the largest drop in any one-year period since 1984 (behind only the 1.4 percentage point drop from June 2013 to June 2014). Of this drop, about 60 percent is due to declining long-term unemployment, even though the long-term unemployed represent about one-third of the jobless.

The magnitude of the drop in the overall unemployment rate since last September has been matched or exceeded by the declines in the broader measures of labor underutilization also published by the Bureau of Labor Statistics. These measures include varying combinations of persons who have withdrawn from the labor force or who are working part-time for economic reasons. Reflecting the large measure of progress that has been made in the recovery, the measures of labor underutilization shown below are between 67 and 87 percent of the way back to their pre-recession averages. The broadest alternative measure of labor underutilization—the U-6 rate—still exhibits the greatest degree of elevation relative to its pre-recession average, but it is falling faster than the other measures, down 1.8 percentage point over the last year.

3. Total job growth in August was revised up by 38,000, continuing a pattern seen over the past several years of substantial upward revisions to the initial August report. From 2010-2012, the first estimate of job growth in August was revised up by an average of 84,000 at the time of the third estimate. Notably, the initial August 2011 estimate of no change in employment was subsequently revised to a gain of more than 100,000. While the average first-to-third estimate revision for August has been larger than for any other month, by the time of the annual benchmark revision, other months have been revised up as much or more. One reason that the August jobs number may be particularly susceptible to revision is that there tend to be large seasonal employment flows during the month, as many school districts begin instruction, temporary summer jobs come to an end, and autoworkers return from the yearly July shutdown for plant retooling.

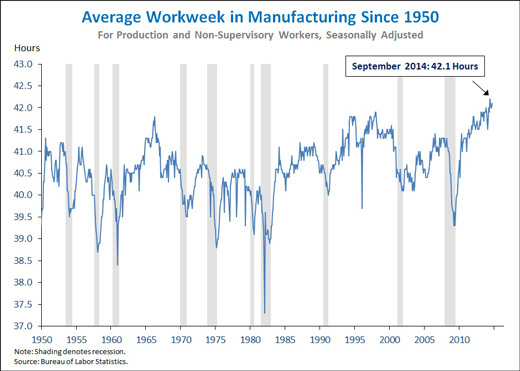

4. On the occasion of Manufacturing Day, we take stock of the major gains in the manufacturing sector seen over the course of the economic recovery—including more than 700,000 jobs added and an increase in the average workweek to levels not seen since World War II. The job growth in manufacturing since February 2010 includes 212,000 jobs added in motor vehicles and parts, 203,000 jobs in fabricated metal products, and 155,000 jobs in machinery. In addition, the average workweek for production and nonsupervisory workers in the manufacturing sector ticked up to 42.1 hours in September, near its highest level in over sixty years. Prior to last year, the average workweek in manufacturing had not reached 42 hours since World War II.

5. The pattern of job growth across industries in September was generally in line with recent trends. Some of the industries that had above-average performances include professional and business services, which had one of its strongest months of the recovery, and retail trade, which added 35,000 jobs, roughly offsetting last month’s below-trend performance in this industry. Furthermore, state and local governments combined posted a net gain of 14,000 jobs, double the average over the last twelve months. Across the 17 industries shown below, the correlation between the most recent one-month percent change and the average percent change over the last twelve months was 0.74, suggesting that the pattern of job growth across industries in September was broadly in line with recent trends.

As the Administration stresses every month, the monthly employment and unemployment figures can be volatile, and payroll employment estimates can be subject to substantial revision. Therefore, it is important not to read too much into any one monthly report and it is informative to consider each report in the context of other data that are becoming available.

Jason Furman is Chairman of the Council of Economic Advisers.

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues