Second Estimate of GDP for the Third Quarter of 2014

Today’s upward revision affirms that economic growth in the third quarter was strong, consistent with a broad range of other indicators showing improvement in the labor market, increasing domestic energy security, and continued low health cost growth. Since the financial crisis, the U.S. economy has bounced back more strongly than most others around the world, and the recent data highlight that the United States is continuing to lead the global recovery. Nevertheless, there is more work to be done to boost growth in the United States and around the world. The President’s common-sense administrative actions on immigration—which CEA estimates will raise GDP by at least 0.4 percent over 10 years—will contribute to this effort, but only Congress can finish the job and make progress on other important steps like increased infrastructure investment.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

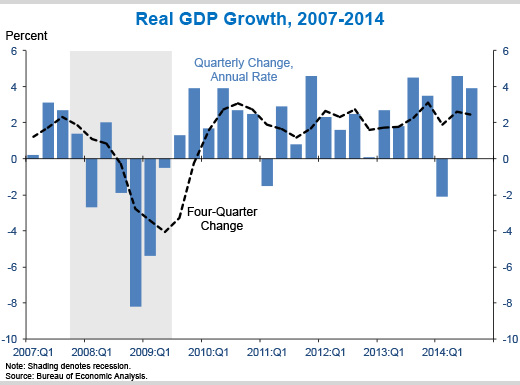

1. Real gross domestic product (GDP) grew 3.9 percent at an annual rate in the third quarter of 2014, according to the second estimate from the Bureau of Economic Analysis. The solid growth recorded in each of the last two quarters suggests that the economy has bounced back strongly from the first-quarter decline in GDP, which largely reflected transitory factors like unusually severe winter weather and a sharp slowdown in inventory investment. In the third quarter, net exports made a large positive contribution to growth, while consumer spending and business investment remained positive contributors but grew at a somewhat slower pace than the previous quarter. Real gross domestic income (GDI), an alternative measure of the overall size of the economy, was up 4.5 percent in Q3.

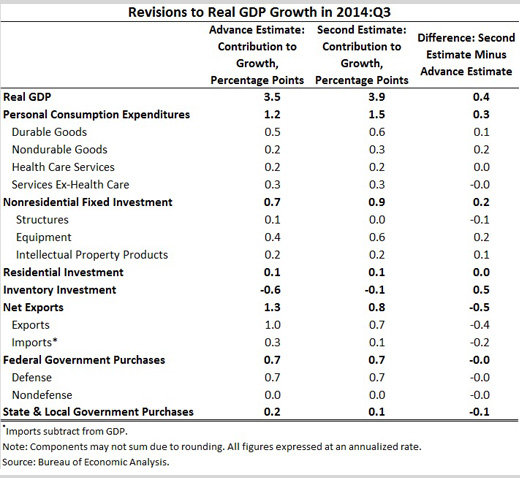

2. Third-quarter real GDP growth was revised up 0.4 percentage point from the advance estimate released in October. The contributions of consumer spending and business investment were revised up 0.3 and 0.2 percentage point, respectively, as spending on goods and investment in equipment grew faster than previously reported. These two components are among the more stable and persistent components of GDP. At the same time, two more volatile components experienced offsetting revisions. The contribution of inventory investment was revised up by 0.5 percentage point while the contribution of net exports was revised down by the same amount. Other revisions were small and offsetting.

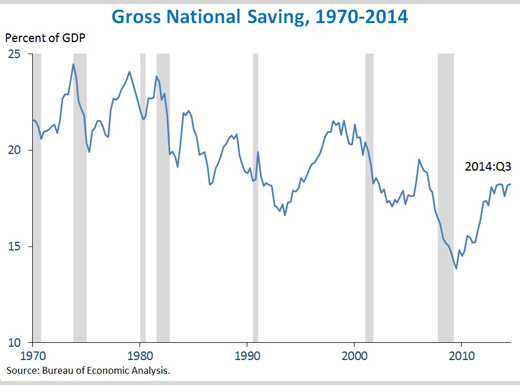

3. In the third quarter, gross national saving edged up to reach its highest level as a share of GDP since the end of 2006. Indeed, gross national saving as a fraction of GDP has increased 4.4 percentage points since its 2009 trough. This is mostly due to the reduction in the Federal budget deficit at the fastest pace since the demobilization after World War II, as a falling deficit increases national saving. At the same time, saving by businesses and households is much higher relative to the years immediately preceding the crisis. These changes put the U.S. economy in a more sustainable position for the future, including helping to reduce America’s borrowing from the rest of the world.

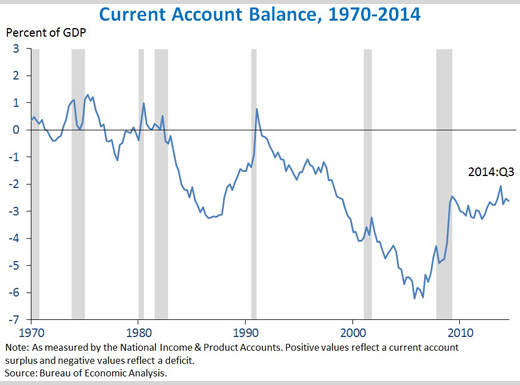

4. The current account deficit remained near its lowest level since the late 1990s, as the United States continues to ease its dependence on foreign capital. The current account balance is a measure of net transactions between the United States and the rest of the world, including our trade balance and other income flows across our borders. When the current account is in deficit, as it has been for most of the past thirty years, the United States borrows from abroad to finance its spending. But our current account deficit has narrowed sharply since the crisis, indicating reduced reliance on foreign borrowing. The U.S. current account deficit now stands at 2.6 percent of GDP, down from more than 6 percent in 2005. This is another imbalance that is improving in this recovery.

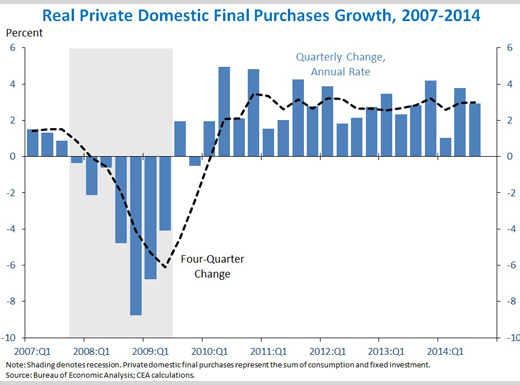

5. Real private domestic final purchases (PDFP)—the sum of consumption and fixed investment—is up 3.0 percent over the last four quarters, a faster four-quarter growth rate than real GDP. Real PDFP growth is generally a more stable and forward-looking indicator than real GDP because it excludes highly volatile components like inventory investment and net exports. In the first and second quarters of this year, GDP growth fluctuated widely, but PDFP was positive in both quarters, showing a less sharp pattern of decline and rebound. In the third quarter, PDFP grew a bit more slowly than GDP, but on balance, it has risen faster over the past year and continued its historical pattern of more steady growth.

As the Administration stresses every quarter, GDP figures can be volatile and are subject to substantial revision. Therefore, it is important not to read too much into any one single report and it is informative to consider each report in the context of other data that are becoming available.

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues