OMBlog

Reducing Costs and Improving Efficiency Through Federal Shared Service Providers for Financial Management

Posted by on May 2, 2014 at 12:02 PM ESTAs part of the President’s Management Agenda, the Administration is pursuing initiatives to streamline the way government delivers services internally, with a particular focus on the core administrative functions that are common across the government. One of our key initiatives in this effort is to expand the use of high-quality, high-value shared services among Federal agencies.

Today, the Office of Management and Budget (OMB) and the U.S. Department of the Treasury are announcing the designation of four shared service providers for financial management to provide core accounting and other services to Federal agencies.

Following today’s announcement, offices from the Departments of Agriculture, Treasury, Interior, and Transportation will lead the administration’s efforts to use shared services for future financial management systems modernizations across the government. These shared services designations are another step in the implementation of OMB’s March 2013 Memorandum to Federal agencies (M-13-08 “Improving Financial Systems through Shared Services”).

As agencies migrate to the four providers, the government will achieve economies of scale and standardization. Using a financial management shared service provider will help agencies reduce the risk of new system implementations, allow for faster and less expensive technological innovation, provide long-term cost savings, and meet government-wide requirements and deadlines. As a result of these improvements, agencies will be able to focus more of their resources and leadership attention on mission-based programs.

With the designation of the four providers, more agencies can begin the process of migrating their financial systems. The Department of Agriculture’s National Finance Center, the Department of the Interior’s Interior Business Center, the Department of Transportation’s Enterprise Services Center, and Treasury’s Administrative Resource Center are ready to support agencies for financial systems modernizations.

Treasury and OMB designated these organizations after a comprehensive application process that included leadership commitments, system evaluations, reviews of plans for scaling operations, and determinations that the providers have the capabilities to address the requirements of cabinet level agencies. Additional providers or product offerings may be designated in the coming years as more agencies look to move to shared services and lessons are learned from the initial four providers.

Beth Cobert is the Deputy Director for Management at the Office of Management and Budget

Dick Gregg is Fiscal Assistant Secretary at the U.S. Department of the Treasury

Learn more aboutCreating a 21st Century Government: Enhancing Productivity and Achieving Cost Savings by Reducing Fragmentation, Duplication, and Overlap

Posted by on April 8, 2014 at 12:02 PM ESTToday, the Government Accountability Office (GAO) released its fourth annual report identifying opportunities for Congress and the Executive Branch to reduce fragmentation, duplication, and overlap, and achieve cost savings across the Federal government. In addition, GAO provided a progress report on its previous recommendations.

We appreciate the valuable work GAO continues to do on this important topic. Since the beginning of the Administration, the President has made it a priority to identify and eliminate inefficient, unnecessary, or duplicative spending.

GAO’s findings recognize the progress that has been made in addressing the recommendations previously identified in its reports. For example:

- GAO found that Congress and the Executive Branch have made progress on addressing 130 of the 162 (80 percent) broad areas needing attention.

- GAO found that the Executive Branch addressed or partially addressed 267 of the 323 (83 percent) recommended actions directed to the Executive Branch.

- GAO found that Congress addressed or partially addressed 28 of the 66 (42 percent) recommended actions directed to Congress.

Many of GAO’s recommendations deal with some of the most complex and challenging areas across the Federal government. Fully addressing them is a long-term process that in many cases will take years to implement – a fact that GAO recognizes.

The Administration is committed to continuing to make progress in this important area through the President’s Second Term Management Agenda, building on efforts to reduce administrative overhead, cut improper payments, reduce real estate costs, reform military acquisition, and consolidate data centers.

The Administration is also continuing efforts to reorganize and consolidate Federal programs to reduce duplication and improve efficiency; and the President is again asking Congress to revive an authority that Presidents had for almost the entire period from 1932 through 1984 – the ability to submit proposals to reorganize the Executive Branch via a fast-track procedure.

The President’s FY 2015 Budget included a number of specific proposals to address duplication and overlap in the Federal government, such as:

- Streamline Farm Service Agency (FSA) Operations. The FSA is focused on ensuring that it has the right workforce in the right places to deliver the best customer service possible. FSA has conducted a review of 2,100 field offices, and in an effort to modernize its field structure proposes closing or consolidating 250 offices as part of streamlining efforts that will save an estimated total of $39 million in 2015.

- Reorganizing STEM Education Programs. The President’s FY 2015 Budget proposes a fresh Government-wide reorganization of science, technology, engineering, and mathematics (STEM) education programs designed to enable more strategic investment in STEM education and more critical evaluation of outcomes. In 2012, there were more than 200 STEM education programs across Government. Already, a substantial number of program consolidations and eliminations have been implemented or will be completed this year largely through administrative action. The Budget continues to reduce STEM fragmentation by proposing 33 additional program consolidations or eliminations, and focuses ongoing efforts around the five key areas identified by the Federal STEM Education 5-Year Strategic Plan.

- Expanding Use of Strategic Sourcing. The Administration’s efforts to leverage the Government’s buying power through the use of strategic sourcing has saved over $300 million since 2010 on commonly purchased goods and services. Creation of central procurement vehicles that can be used by all Federal agencies has reduced contract duplication and reduced prices for some common office supplies by over 65 percent.

In each of the President’s first three Budgets, the Administration identified, on average, more than 150 terminations, reductions, and savings proposals, totaling nearly $25 billion each year. In the 2013 and 2014 Budgets, the Administration detailed more than 200 cuts, consolidations, and savings proposals, again totaling roughly $25 billion each year. The President’s FY 2015 Budget included 136 cuts, consolidations, and savings proposals, which are projected to save nearly $17 billion in 2015. The cuts, consolidations, and savings proposals this year reflect the deep spending reductions that occurred in 2013, some of which have continued in 2014, and the fact that many of the Administration’s previous cuts, consolidations, and savings proposals have now been implemented.

The Administration looks forward to continuing to work with GAO and Congress to maximize the value of every taxpayer dollar while increasing the productivity and quality of Government services.

For a Fact Sheet on the GAO Duplication Report, please click HERE.

Beth Cobert is the Deputy Director for Management at the Office of Management and Budget

Learn more aboutHouse Republican Budget Resolution Would Harm Economy, Seniors, the Middle Class, and Those Most in Need

Posted by on April 1, 2014 at 1:24 PM ESTHouse Republicans today released a budget resolution for fiscal year (FY) 2015 that would harm the economy, seniors, the middle class, and those most in need, while not using any savings from ending inefficient tax breaks to help reduce the nation’s deficits. The proposal stands in stark contrast to the President’s FY 2015 Budget, which would accelerate economic growth and expand opportunity for all Americans, while continuing to improve the nation’s long-term fiscal outlook.

The President’s Budget provides a roadmap for ensuring the country reaches its full potential. It accelerates growth and creates jobs by investing in infrastructure, research, and manufacturing. It expands opportunity by ensuring health care is affordable and reliable, investing in job training and preschool, and providing pro-work tax cuts. It ensures our long-term fiscal strength by fixing our broken immigration system and addressing the primary drivers of long-term debt and deficits, health care cost growth and inadequate revenues to meet the needs of our aging population. And it supports efforts to make our government more efficient, effective, and supportive of economic growth.

Unfortunately, the House Republican Budget pursues a different course. Rather than advancing policies that accelerate economic growth both now and in the future, such as investing in infrastructure, research, and education, it sets out a path to cut these investments well below the already untenable levels resulting from sequestration. Rather than promoting economic opportunity, it would undermine the hard work of those struggling to put food on the table and keep their families healthy by cutting food stamps and Medicaid. Rather than strengthening Medicare for seniors while improving accountability, it would end Medicare as we know it, turning it into a voucher program and risking a death spiral in traditional Medicare. Rather than asking the wealthiest to contribute to reducing our deficits, it would raise taxes on middle class families with children by an average of at least $2,000 while refusing to use any revenue from ending wasteful tax loopholes to help reduce the deficit.

And rather than expanding health coverage for all Americans and making it more affordable, it would repeal the Affordable Care Act, raising health care costs on families and businesses and eliminating coverage for the 3 million young adults who have gained coverage by staying on their parent’s plan, the millions of people who have already signed up for private insurance plans through the Marketplaces, and millions more who can continue to gain coverage through Medicaid. It would also wipe out other progress already made under the Affordable Care Act. For example it would:

- repeal the closure of the donut hole in prescription drug coverage, which saved the typical Medicare beneficiary who hit the donut hole roughly $900 on prescription drugs in 2013;

- allow insurance companies to raise premiums and deny coverage because of a pre-existing condition and charge women higher rates;

- allow insurance companies to reinstate lifetime dollar limits on plans;

- no longer require insurance companies to allow parents to keep their children up to age 26 on their insurance plans; and

- no longer require insurance companies to cover recommended preventive services at no cost under new plans.

Although the House Republican Budget adheres to the 2015 discretionary funding levels agreed to in the Bipartisan Budget Act, it proposes to drastically reduce non-defense discretionary funding in 2016 and beyond, reaching below sequester-level amounts. Although the resolution does not specify what it would cut to reach those levels, we know that if the cuts were distributed equally across Budget, it would result in reductions of 15 percent or more below the levels the President has identified as needed to help our economy reach its full potential. If those impacts were felt today, some of the results would be:

- Head Start, which provides comprehensive early learning and development services, would serve about 170,000 fewer of the nation's most vulnerable children.

- Title I, which helps ensure students receive support to meet challenging academic standards, would be unable to support the equivalent of roughly 8,000 schools and 3.4 million disadvantaged students, potentially resulting in 29,000 fewer teachers and aides with jobs.

- The Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), which provides critical food assistance to pregnant and postpartum women, infants and children would be able to assist more than 200,000 fewer postpartum women and children.

- TIGER grants, which fund critical highway, transit, rail and port projects, would be reduced by the equivalent of $90 million from 2014, despite the high need for the program that was only able to award 4 percent of requested funding in the most recent round of grants and is an important part of investing in growth and jobs.

- Job Training – More than 3.5 million fewer individuals would receive employment and training services through Department of Labor job training programs.

- The National Institutes of Health could be forced to reduce the number of new NIH grants awarded by about 1,400, slowing research that could lead to new treatments and cures for diseases such as cancer, Alzheimer's, and diabetes.

- The National Science Foundation could be forced to issue thousands of fewer research awards, affecting tens of thousands of researchers, students, and technicians.

- Customs and Border Protection – 3,300 fewer Customs and Border Protection Officers (CBPOs) would be funded, impacting travel and trade at our nation's air, land, and sea ports of entry. A decrease in CBPOs of this magnitude could lead to job and GDP losses, and tens of thousands fewer enforcement actions taken.

- Criminal Justice – Over 3,500 fewer Federal agents would be funded to combat violent crime, pursue financial crimes, and ensure national security, as well as more than 3,100 fewer prison guards to maintain the safe and secure confinement of inmates in Federal prisons.

Moreover, the House Republican Budget fails to tackle some of the most fundamental issues that hold the key to further economic growth and job creation. It fails to propose a multi-year solution for financing infrastructure improvements across the country that would create jobs and repair roads and bridges that have fallen into disrepair. And it offers no solutions for our broken immigration system, even though independent economists of all stripes have said that commonsense immigration reform would grow our economy and reduce our deficits.

The Administration strongly disagrees with the House Republican approach, and believes it would weaken our economy and our country. At the same time, we are encouraged by the bipartisan agreements reached over the past year to return to a regular budget process that provides certainty for individuals, businesses and the economy. The Administration looks forward to working with both parties in Congress throughout the coming year to maintain this progress and advance policies that will grow the economy and expand opportunity for all Americans.

Sylvia Mathews Burwell is Director of the Office of Management and Budget.

Learn more aboutA Roadmap for Growth, Opportunity, and Fiscal Responsibility

Posted by on March 18, 2014 at 3:22 PM ESTEd. Note: This op-ed originally appeared in regional newspapers across the country.

The President’s 2015 Budget provides a roadmap for accelerating economic growth and expanding opportunity for all while continuing to improve the nation’s long-term fiscal outlook.

Despite the significant progress we have made in recovering from the worst recession since the Great Depression, too many Americans are still struggling to join the middle class or stay there. That is why the President’s top priority remains growing the economy and building ladders of opportunity for all Americans to get ahead.

To create jobs and accelerate growth, the Budget includes an ambitious four-year plan that will put people to work repairing and modernizing our nation’s transportation infrastructure, paid for with one time revenue generated by pro-growth business tax reform. It invests in American innovation and strengthens our manufacturing base by supporting the President’s goal of creating a national network of 45 manufacturing institutes. And it supports ground-breaking research to fight disease, protect the environment, and develop new technologies.

The Budget also enhances the Administration’s efforts to deliver a 21st Century government that is more effective, efficient, and supportive of economic growth, focusing on areas directly impacting citizens and businesses. For example, it expands the President’s initiative to modernize the Federal permitting process for major infrastructure projects, cutting red tape to get more construction workers on the job faster, while still protecting communities and the environment.

To expand opportunity, the Budget doubles the maximum value of the Earned Income Tax Credit for childless workers to build on the EITC’s success in encouraging people to enter the workforce and reducing poverty. It invests on the President’s vision of making access to high-quality preschool available to every four-year-old child. And it invests in new efforts to drive greater performance and innovation in workforce training to equip American workers with skills that match the needs of employers.

To ensure the nation’s long-term fiscal strength, the Budget focuses on the primary drivers of long-term debt and deficits. It builds on the reforms in the Affordable Care Act with another $400 billion in health care savings, continuing to slow health care cost growth and improve the quality of care. It curbs inefficient tax breaks that benefit the wealthiest, and calls for pro-growth immigration reform, which the Congressional Budget Office has found would increase economic growth and reduce the deficit by about $160 billion in the next decade and by almost $1 trillion over the next twenty years.

Under the President’s leadership, the deficit has already been cut in half as a share of the economy, the largest sustained period of deficit reduction since World War II. By paying for new investments and tackling our true fiscal challenges, the Budget continues that progress, reducing deficits as a share of the economy to 1.6 percent by 2024, stabilizing debt as a share of the economy by 2015 and putting it on a declining path after that.

In recognition of the important bipartisan funding compromise reached by Congress in December, the Budget adheres to the 2015 spending levels that were agreed to in that deal. And it shows the tradeoffs and choices the President would make at those levels.

However, those levels are not sufficient – both in 2015 and beyond – to ensure the nation is achieving its full potential. For that reason, the Budget also includes a fully paid for $56 billion Opportunity, Growth, and Security Initiative – split evenly between defense and non-defense priorities – which presents additional investments in critical areas, such as education, research, manufacturing, and security. And the Initiative is fully paid for with a balanced package of spending cuts and tax reforms, so it does not add a dime to the deficit.

The President’s Budget provides a responsible, balanced, and concrete plan that can serve as a guide for Congress in its work over the coming year and help ensure that all of our citizens enjoy the benefits of a strong and prosperous America for generations to come.

Sylvia Mathews Burwell is the Director of the Office of Management and Budget.

Learn more aboutSetting New Goals to Deliver a More Effective and Efficient Government

Posted by on March 10, 2014 at 12:40 PM ESTSince the President took office, the Administration has worked hard to improve the effectiveness and efficiency of the Federal Government. A key component of this effort has been setting clear, measurable goals to drive better outcomes for the American people. These include agency-specific goals and government-wide goals in areas benefiting from cross-agency collaboration.

To continue our progress in this area, today, the Administration is announcing new two-year Agency Priority Goals (APG) and new longer-term Cross-Agency Priority (CAP) Goals, as well as releasing agency Strategic Plans outlining strategies for improving performance over the coming years. The new goals were selected based on their importance in accelerating economic growth, expanding opportunity, and ensuring the nation’s long-term fiscal strength.

For example:

- A new CAP goal is being established to spur job growth by encouraging more foreign direct investment (FDI) in the U.S. Over the last ten years, U.S. affiliates of foreign companies employed more than five million workers, mainly in high-paying manufacturing jobs, which, on average, pay up to 30 percent more than non-FDI jobs. The National Economic Council, together with the Department of Commerce and the Department of State, will lead this effort. They will be responsible for improving coordination across the Government and enhancing Federal investment tools and resources.

- A new CAP goal led by the General Services Administration and the Office of Management and Budget (OMB) is focused on increasing Government efficiency by establishing cost and quality benchmarks in areas such as human resources, acquisition, IT and property management. These new benchmarks will give agencies better data so they can make more informed choices about allocating resources and improving processes.

- The Department of Veteran Affairs, in partnership with the Department of Housing and Urban Development, is setting a joint APG of eliminating Veterans’ homelessness in 2015, ensuring that our veterans receive the care and quality of life they deserve.

This spring, goal teams will release detailed implementation plans with specific metrics and milestones for Cross-Agency Priority Goals. Cross-Agency Priority Goals efforts will be co-led by leadership from the Executive Office of the President and Federal agencies, allowing for more broad-based ownership of cross-agency initiatives. This year also marks the first time that all agencies have revised their Strategic Plans at the same time, allowing for better interagency coordination.

As we have done with prior goals, we will track progress on a quarterly basis on Performance.gov, allowing the public to see how we are doing, and judge what is working well and what is not. Last month, OMB released a report on recently completed APGs and ongoing CAP Goals that showed significant progress across the Government. We look forward to building on that progress as we work to achieve the new goals announced today.

Beth Cobert is Deputy Director for Management at the Office of Management and Budget

Learn more aboutUpdating Guidance on Use of Voluntary Consensus Standards to Promote Smarter Regulation, Collaboration, and Technological Innovation

Posted by on February 14, 2014 at 5:59 PM ESTThe computer, tablet, or smartphone you are using to read this blog is comprised of parts and components that were developed, manufactured, and assembled in different locations around the United States and the globe, yet was carefully designed to ensure that your device is safe and interoperable with other devices. We don’t spend much time thinking or worrying about how our electronics work or if they are safe, due largely to the ingenuity of the companies that make these products and their willingness to collaborate with each other to develop technologies that are safe, innovative, and interoperable. While these companies do an excellent job in designing our products, it is important to remember that governments also play a critical role in ensuring the products that impact our daily lives are safe, effective, and protective of the environment.

Since the enactment of the National Technology Transfer and Advancement Act in 1995, U.S. Federal regulatory agencies have been guided by the Office of Management and Budget’s (OMB) Circular A-119, “Federal Participation in the Development and Use of Voluntary Consensus Standards and in Conformity Assessment Activities.” In 1998, OMB issued a revised version of Circular A-119, which has been guiding agencies on the use of voluntary consensus standards in regulation and on conformity assessment ever since.

Over the intervening years since those revisions, the scope of economic activity and technology innovation has become increasingly global, and its complexity requires governments to collaborate more closely with the private sector, other stakeholders, and each other. Many of the regulations that U.S. agencies issue every year rely on the work of standards developers and providers of conformity assessment services in the private sector. Many of these regulations impact companies, workers, and consumers both inside and outside the United States. As the worlds of regulation, standards, and trade increasingly intersect, and domestic and international interests increasingly overlap, close collaboration within the U.S. government on these issues has become critical, as has a more comprehensive approach.

In light of these significant changes that have taken place since 1998, OMB has joined together with the Office of the United States Trade Representative (USTR) and the National Institute of Standards and Technology (NIST) to develop a comprehensive proposal to update Circular A-119. This forward-looking proposal includes important and timely updates to U.S. policies on how standards and conformity assessment support regulation, procurement, international regulatory cooperation, and other government functions. The proposed changes will help:

- strengthen implementation of international trade rules, helping prevent the creation of trade barriers, and avoiding unnecessary regulatory differences with key trading partners;

- support a flexible, transparent, and innovative U.S. standards system for the 21st Century that promotes economic growth, competitiveness, and job creation;

- reduce regulatory complexity, duplication and costs on companies, workers, consumers and the U.S. Government itself, as well as cumulative burdens on the economy, through promoting retrospective review of existing regulations and increased reliance on private sector solutions, where appropriate; and

- ensure that U.S. regulations reflect state of the art technical solutions for purposes of interoperability, as well as to protect the health, safety, and welfare of the American public and our environment.

This effort represents an important part of our ongoing work to strengthen our regulatory practices to help create jobs, grow the economy, and expand opportunity for the American people. We invite you to review our proposal and submit your comments, which you may do online here. OMB, USTR, and NIST will also be hosting a workshop this spring to obtain additional public input on the proposed changes.

Howard Shelanski is the Administrator of the Office of Information and Regulatory Affairs of the Office of Management and Budget

Miriam Sapiro is the Deputy United States Trade Representative

Patrick Gallagher is the Director of the National Institute of Standards and Technology at the Department of Commerce

Learn more aboutReal Progress in Meeting Agency Performance Goals

Posted by on February 13, 2014 at 10:53 AM ESTStarting in 2009, the Administration established a common-sense approach to improving the performance of government. Following successful evidence-based practices used in the private and public sectors, the Administration began engaging senior Federal leaders in establishing two-year Agency Priority Goals in areas where agencies were focused on accelerated performance improvement. The Administration also established government-wide Cross-Agency Priority Goals in areas benefiting from collaboration across multiple agencies.

Today, the Administration is posting performance results on Performance.gov for the 4th Quarter of 2013, which represents the final quarterly update for the 2012-2013 Agency Priority Goals. The agency reports show significant progress across the government in delivering results and positive impact for the American people.

Below are some highlights:

- As part of the cross agency efforts to support the President’s National Export Initiative, the Department of Commerce, as Chair of the Trade Promotion Coordinating Committee (TPCC), has taken actions to help achieve a record level of exports of $2.3 trillion in 2013, which supported an additional 1.3 million U.S. jobs. For example, in 2013, the Department of Commerce’s International Trade Administration (ITA) met its goal of increasing the annual number of new markets that current U.S. exporters enter with ITA assistance to 6,100, a 7 percent increase. The Department of Commerce and other TPCC agencies continue to advance the interests of U.S. exporters, especially small and medium sized, in markets beyond the United States.

- The Department of the Treasury estimates that it has saved the American people hundreds of millions of dollars by creating an Agency Priority Goal around increasing electronic transactions with the public to improve service, prevent fraud, and reduce costs. Included in this goal was an effort to modernize the Federal government’s payment and collection systems, which resulted in paper benefit payments dropping from 131 million in 2010 to 39 million in 2013, allowing us to get money to beneficiaries and back into the economy faster than ever. At the same time, electronic collections jumped from 85 percent of total collections in 2010 to 97 percent in 2013, reducing costs to the Federal government.

- After designating the improvement of business loan efficiency as an Agency Priority Goal, the Small Business Administration (SBA) has made considerable progress in making it more efficient for small businesses to get loans, while also reducing cost. The SBA increased the use of paperless processing in their 7(a) loan program (which provides financing for various business uses, such as working capital and real estate) from 72 percent in 2011 to 90 percent in 2013, and from 55 percent to 76 percent in their 504 loan program (which provides financing for real estate and major equipment). The adoption of electronic loan processing also contributed to a 5.6 percent increase in loan volume from 2012 to 2013, growing the number of small businesses assisted.

- The Department of State set an Agency Priority Goal of using its diplomatic mission overseas to increase the number of market-oriented economic and policy activities by 15 percent, helping to expand U.S. exports, create opportunities for U.S. businesses abroad, and increase economic growth and job creation. State uses its more than 200 diplomatic missions to promote U.S. manufactured goods and services, analyze and address foreign trade and investment barriers, and provide counseling on exports to new firms. State has exceeded its goal by 43 percent, achieving a total of 971 “success stories” – instances where an export deal is achieved, a dispute is favorably resolved, or a foreign policy is changed to help U.S. businesses expand opportunities abroad.

- After establishing an Agency Priority Goal focused on preventing Americans at-risk of foreclosure from losing their homes, the Department of Housing and Urban Development (HUD) initiated a number of measures to improve agency operations and help borrowers at the very early stages of delinquency when interventions can prevent serious delinquency. HUD increased the number of households assisted with early intervention by 31 percent between 2010 and 2013. HUD also reduced six month re-default rates from 17 percent in 2011 to 8 percent in 2013 among those who were helped by the agency’s mitigation programs.

Bringing more robust performance management practices to Federal agencies is a priority for this Administration, and we are pleased to see these efforts gaining momentum. In the coming months, the Administration will set new performance strategic plans, establish new two-year Agency Priority Goals, and select new Cross-Agency Priority Goals that span the government.

To learn more about the Administration’s performance improvement efforts, visit Performance.gov, our public portal for tracking and reporting performance progress.

Beth Cobert is the Deputy Director for Management of the Office of Management and Budget

Learn more aboutA Positive Step Forward for Our Nation and Economy

Posted by on January 16, 2014 at 7:56 PM ESTToday’s passage of the Consolidated Appropriations Act, 2014 marks a positive step forward for the Nation and our economy. This bipartisan legislation provides funding for investments in areas like education, infrastructure, and innovation – investments that will help grow our economy, create jobs, and strengthen the middle class. It supports our national security by providing needed relief for the Defense Department from the untenable sequestration cuts that were undermining military readiness. It ensures the continuation of critical services the American people depend on. And it brings us closer to returning the budget process to regular order.

Passage of this legislation ensures that we have appropriations for every agency in the Federal government, enabling them to more efficiently and effectively serve the American people and bringing greater certainty to businesses and communities across the country. Key areas that are positively impacted by the legislation include:

- Early Learning: The legislation fully restores funding cuts to the Head Start program that were caused by sequestration and provides dedicated resources to improve early education by supporting State efforts to expand preschool for 4-year olds. And the legislation provides additional funding to expand access to high-quality early education for tens of thousands of additional children through the launch of Early Head Start-Child Care Partnerships.

- Health Care: The legislation helps ensure we can continue to move forward in providing quality, affordable health care for millions of Americans through implementation of the Affordable Care Act. The Affordable Care Act improves many aspects of the Nation's health care system, such as preventing those with pre-existing conditions from being dropped or denied coverage. It also provides tax credits to help pay for coverage and slows the growth of health care costs.

- College Affordability: Funding is included to help bolster American competitiveness by supporting the development of innovative strategies to make college more affordable and help more students graduate on time with high-quality degrees that lead to good jobs.

- Gun Safety: The legislation supports the Administration’s efforts to strengthen school safety and mental health initiatives to help protect our children from gun violence and provide those suffering from mental illness with the treatment they need. It also includes funding for the Comprehensive School Safety Initiative, which will fund pilot sites for school districts to develop and implement innovative approaches to school safety.

Learn more about EconomyThe 2013 SAVE Award Winner

Posted by on December 20, 2013 at 5:37 PM ESTAnd the 2013 SAVE Award winner is… Department of Veterans Affairs employee Kenneth Siehr of Milwaukee, Wisconsin! Kenneth’s proposal received more than 16,000 votes out of more than 33,000 cast.

The Department of Veterans Affairs sends the majority of outpatient prescriptions to patients via mail. Currently, in order for Veterans to track the delivery of mailed prescription medications they must call their local VA Medical Center directly. Kenneth recommends saving pharmacy staff time and enhancing customer service by making the package tracking information available to Veterans online through the Veterans Health Administration’s existing web-based portal, MyHealtheVet.

Keeping with tradition, Kenneth will have the opportunity to meet with President Obama in person in the Oval Office to discuss his winning idea. Each of the finalists’ ideas will be incorporated in the President’s Budget and all other submissions will be considered for potential inclusion.

These ideas alone won’t solve our Nation’s long-term fiscal challenges, but they represent common-sense steps to improve the efficiency and effectiveness of our government and ensure taxpayer dollars are spent wisely.

We thank everyone who submitted ideas for this year’s SAVE Award and congratulate our 2013 SAVE Award winner Kenneth Siehr.

Sylvia Mathews Burwell is the Director of the Office of Management and Budget

Making Further Progress on Improper Payments

Posted by on December 20, 2013 at 3:42 PM ESTOver the last four years, this Administration has made reducing the government-wide improper payment rate a priority. Improper payments – those Federal payments made to the wrong entity, in the wrong amount, or for the wrong reason – represent a waste of taxpayer resources and undermine the integrity of critical government programs.

When the President took office in 2009, payment error rates were on the rise. In fiscal year (FY) 2009, the improper payment rate was 5.42 percent. Since then, the Administration, working together with Congress, has significantly reduced improper payments by strengthening accountability and transparency through yearly reviews by agency inspectors general, and expanded audits for high priority programs.

As a result of this concerted effort, the improper payment rate declined to 3.53 percent in FY 2013 when factoring in Department of Defense commercial payments, compared to 3.74 percent in FY 2012 under the same accounting. Over the past year, we reduced improper payment rates in major programs across the government, including Medicaid, Medicare Advantage (Part C), Unemployment Insurance, the Supplemental Nutrition Assistance Program (SNAP - Food Stamps), Pell Grants, and two Social Security programs – Supplemental Security Income (SSI) and Retirement, Survivors, and Disability Insurance. Furthermore, agencies recovered more than $22 billion in overpayments through payment recapture audits and other methods in FY 2013.

In programs administered at the local level, the Federal government has been working directly with States to ensure that appropriate corrective actions are put in place to reduce improper payments. For example, through the Medicaid Integrity Program, Federal staff specializing in program integrity provide support to States in their efforts to combat Medicaid provider waste, fraud, and abuse. In other instances, Federal agencies have implemented innovative techniques to ensure that benefit payments are accurate. For example, the SSI program is using new methods to verify bank account balances and ensure beneficiaries meet program asset thresholds.

The Administration is also advancing data analytics and improved technology to prevent improper payments before they happen. For example, in January 2013, the President signed into law the Improper Payments Elimination and Recovery Improvement Act which reinforces and accelerates the Administration’s “Do Not Pay” efforts, requiring all Federal agencies to check the “Do Not Pay” list before issuing payments and awards.

OMB has also begun conducting a comprehensive analysis of agency-specific corrective actions to identify programs with the highest return-on-investment or potential for substantially reducing improper payments. This analysis will help shape guidance on improper payments to be released in the months ahead.

Improper payments represent an unacceptable waste of taxpayer resources. Moving forward, this Administration will continue its efforts to be effective stewards of taxpayer dollars by reducing improper payments and other instances of waste, fraud, and abuse.

Beth Cobert is the Deputy Director for Management of the Office of Management and Budget

Improving Outcomes by Reducing Red Tape for Financial Assistance

Posted by on December 19, 2013 at 9:52 AM ESTThe Office of Management and Budget today published new guidance that significantly reforms and strengthens Federal grant-making to improve outcomes for the American people while reducing bureaucratic red-tape. The new guidance is a key component of the Administration’s larger effort to more effectively focus Federal grant resources on improving performance and outcomes while ensuring the financial integrity of taxpayer dollars. By streamlining eight Federal regulations into a single, comprehensive policy guide, the government can better administer the $600 billion awarded annually for grants and other types of financial assistance by decreasing administrative burden for recipients and reducing the risk of waste, fraud and abuse.

The new uniform grants guidance improves on current policy by:

- Eliminating duplicative and conflicting guidance;

- Focusing on performance over compliance for accountability;

- Encouraging efficient use of information technology and shared services;

- Providing for consistent and transparent treatment of costs;

- Limiting allowable costs to make the best use of Federal resources;

- Setting standard business processes using data definitions;

- Encouraging non-Federal entities to have family-friendly policies;

- Strengthening oversight; and

- Targeting audit requirements on risk of waste, fraud, and abuse.

This guidance is the culmination of a two-year collaborative effort across the Federal government and its partners -- State and local governments, Indian tribes, research and higher education institutions, nonprofit organizations, and the audit community -- to rethink and reform the rules that govern our stewardship of Federal dollars.

The reform effort embodies principles set forth by the President, who directed OMB to work with key stakeholders to evaluate potential reforms to Federal grants policies in Executive Order 13520 on Reducing Improper Payments and in the Presidential Memorandum on Administrative Flexibility, Lower Costs, and Better Results for State, Local, and Tribal Governments. In addition, OMB and its partners are continuing complementary work to strengthen program outcomes through innovative and effective use of grant-making models, performance metrics, and evaluation, as described in OMB Memorandum M-13-17 on Next Steps in the Evidence and Innovation Agenda.

Looking ahead, implementation of the new guidance will be spearheaded by the cross-agency Council on Financial Assistance Reform (COFAR), which worked closely with OMB on its development. The COFAR will work with stakeholders to facilitate implementation, evaluate effectiveness, and keep this important reform effort moving forward. We still have more to do, but we’re proud to announce these changes. For more information, please visit www.cfo.gov/COFAR.

Beth Cobert is the Deputy Director for Management of the Office of Management and Budget

The 2013 SAVE Award Final Four

Posted by on December 16, 2013 at 12:40 PM ESTSince its creation in 2009, the President’s SAVE Award [Securing Americans Value and Efficiency] has tapped the knowledge and expertise of frontline Federal workers to help improve government performance and ensure taxpayer dollars are spent wisely.

Over the last five years, Federal employees have submitted tens of thousands of ideas through the SAVE Award on how to curb unnecessary spending and increase the efficiency and effectiveness of government operations.

Last year’s winning idea came from Frederick Winter of the Department of Education, who proposed that all Federal employees who receive public transit benefits shift from regular transit fare to the reduced senior fare as soon as they are eligible. Fred’s idea, along with other SAVE Award proposals, was included in the President’s FY 2014 Budget.

Today, we are pleased to announce the finalists for the 2013 SAVE Award. Keeping with tradition, the winner will present his or her idea to the President in the Oval Office, and other proposals will be directed to agencies for potential action or inclusion in the President’s FY 2015 Budget.

With today’s announcement, public voting begins to select this year’s winner. Voting can be done through the White House website at: www.whitehouse.gov/save-award.

Here are the 2013 finalists:

Kenneth Siehr, Online Tracking of Veterans Mail Prescription Deliveries. The Department of Veterans Affairs sends the majority of outpatient prescriptions to patients via mail. Currently, in order for Veterans to track the delivery of mailed prescription medications they must call their local VA Medical Center directly. Kenneth recommends saving pharmacy staff time and enhancing customer service by making the package tracking information available to Veterans online through the Veterans Health Administration’s existing web-based portal, MyHeatheVet.

Patrick Mindiola, Electronic Passport Notification. The State Department sends thousands of Information Request Letters (IRLs) in response to passport applications via regular mail. These mailings delay the processing time for applications and result in unnecessary added costs. Patrick recommends saving time and money by responding via email first, requesting any additional information needed and asking the applicants to verify submitted information. Mail notifications would be used only when email addresses are missing or returned, or if no response is received.

Dirk Renner, Share Certifications Across Agencies. Dirk has worked for multiple federal agencies and recently found out that his USDA Forest Service All-Terrain Vehicle (ATV) training was not transferable to the Department of the Interior’s Fish and Wildlife Service, where he now works. Dirk recommends allowing comparable agency certifications to transfer from agency to agency or between departments. This change would save time and reduce duplicative training and travel costs for employees across the government.

Buyar Hayrula, Collect Custom Fines and Penalties Online. Buyar suggests creating a secure website to allow Custom and Border Protection (CBP) officers and agriculture specialists to collect payments by credit card at land ports of entry. Currently, payment requests are often sent via mail when a cashier is not available. Automating this payment process would increase revenue collections and operational efficiencies at CBP while also helping reduce wait times for individuals entering the U.S. at land ports of entry.

As we have noted before, these ideas alone won’t solve our Nation’s fiscal challenges, but they represent common-sense ways to reduce costs and improve our government for the American people. Please take a moment to pick your favorite idea from the list and help us select the winner of this year’s SAVE Award.

Sylvia Mathews Burwell is the Director of the Office of Management and Budget

Open Data Round Up

Posted by on December 9, 2013 at 4:34 PM ESTOn May 9, 2013, President Obama signed an Executive Order, Making Open and Machine Readable the New Default for Government Information, directing historic steps to make government-held data more accessible to the public, entrepreneurs, and others as fuel for innovation, economic growth, and government efficiency.

Under the terms of the Executive Order and the Administration’s Open Data Policy, all newly-generated government data are required to be made available in open, machine-readable formats, which greatly enhances their accessibility and usefulness while continuing to ensure privacy and security. Federal agencies are also required to:

- Create a Single Agency Data Inventory. Agencies are required to catalogue their data assets, just like they would inventory computers or desk chairs, to better manage and use these resources.

- Publish a Public Data Listing. On their agency.gov/data pages, agencies are required to publish a list of their data assets that are public, or could be made public.

- Develop New Public Feedback Mechanisms. Agencies are required to set up feedback mechanisms to engage the public about where agencies should focus open data efforts, such as facilitating and prioritizing the release of datasets. Agencies are also required to identify public points of contacts for agency datasets.

While there is still much more work to do, we are excited to see the great progress being made by Federal agencies to unleash the power of open data.

Over a dozen agencies have launched webpages at agency.gov/data, making it easier for the public to find, understand, and use government data. Many agencies have released—and will continue to release—new datasets, which are now available both on agencies’ public data webpages and on Data.gov.

Federal agencies are also working to put processes in place to manage data more strategically. In fact, over 15 agencies have launched data working groups inside their agency to improve coordination around data management, data security and protection, and data release efforts.

Some examples of agency-specific efforts include:

- The Department of Energy is offering a suite of new application programming interfaces (APIs) that allow software developers to access tools like a solar energy resource finder, vehicle gas mileage estimates, and a utility rate database, among others. The agency recently launched the American Energy Data Challenge to identify great ideas for using energy data to solve some of America’s most pressing energy challenges. Read more here.

- The Department of Transportation has made more than 2,000 datasets publicly available and easily accessible. This includes data from the National Highway Traffic Safety Administration (NHTSA) that powers a SaferCar app that consumers can use to: compare NHTSA safety ratings for different vehicle models; locate child safety seat installation information; and track vehicle recalls. Read more here.

- The Department of Veterans Affairs recently launched its agency open data webpage, which provides users with resources to connect to, and to more easily understand and navigate, the agency’s datasets. The webpage includes tools and resources that can be used to develop web and mobile applications and design data visualizations. The agency also highlights some of the datasets that are most valuable to its’ users, including a nationwide list of services for Homeless Vets including health care, mental health, job assistance, education, housing, and other benefits as well as a list of all benefits, services and resources available to family caregivers of veterans, including specific forms of compensation, support networks, and legal resources. Read more here.

- The Department of Education launched its new agency data page, “ED Data Inventory”, which includes K-12 school performance data, school demographics, and data about colleges—including enrollments, graduation rates, faculty, and student financial aid. Read more here.

- The Department of the Treasury continues to encourage the release of open data sets across the federal government that can help spur financial innovations and empower consumers to make informed choices about their money. For example, the agency’s new public data listing page includes an interactive tool using data released by the Bureau of Engraving and Printing on the number of notes printed each year in different denominations. The webpage also provides users new ways to learn from the agency’s aggregate IRS statistical data, which have long served to enhance market research, business planning, demographic analysis, state and local government research, and public policy analysis. On the new agency data webpage, the public can also access daily data summarizing the Treasury’s cash and debt operations, monthly statements, and more. Read more here.

- The United States Department of Agriculture features datasets and tools such as the USDA National Farmers Market Directory and API, visualizations and data sets in the Economic Research Service, and a dynamic API for the National Agricultural Statistics Service. The public can also now access key research information about the world’s plant gene banks as well as new satellite-powered data and mapping tools on the condition of crops across the country. Read more here.

Here at OSTP and OMB, we are also working to help agencies adopt the Administration’s Open Data Policy to unlock the potential of government data. We have made additional resources available to help Federal agencies make data open and available in machine-readable form, including guidance to agencies about how to inventory and publish their data assets, as well as free code, software tools, and case studies that any agency can use or add to, are available at the Project Open Data website.

The General Services Administration, which administers Data.gov, also continues to make improvements to the website. Check out Next.data.gov—a design prototype of the next generation of Data.gov. We are eager to hear your thoughts about how to make it even better. You can provide feedback about the proposed design and functionality via Twitter, Quora, Github, or by sending an email.

Responsibly making government data open and widely reusable is good for the American people and our economy. We look forward to continuing the work ahead to increase access to our Nation’s valuable information resources, to improve government transparency and efficiency, and to fuel economic growth.

Nick Sinai is U.S. Deputy Chief Technology Officer

Haley Van Dyck is Senior Advisor to the U.S. Chief Information Officer

Impacts and Costs of the Government Shutdown

Posted by on November 7, 2013 at 3:38 PM ESTAs the President has said, the shutdown that occurred last month inflicted completely unnecessary damage on our economy and took a toll on families and businesses across the country. Today, OMB is releasing a report that catalogs the breadth and depth of this damage, and details the various impacts and costs of the October 2013 Federal government shutdown.

The report explains in detail the economic, budgetary, and programmatic costs of the shutdown. These costs include economic disruption, negative impacts on Federal programs and services that support American businesses and individuals, costs to the government, and impacts on the Federal workforce.

While the report covers a variety of areas, it highlights five key impacts and costs.

First, Federal employees were furloughed for a combined total of 6.6 million days, more than in any previous government shutdown. At its peak, about 850,000 individuals per day were furloughed. That number fell once most Department of Defense civilian employees were able to return to work as the Pentagon implemented the Pay Our Military Act.

Second, the shutdown cost the Federal government billions of dollars. The payroll cost of furloughed employee salaries alone – that is, the lost productivity of furloughed workers – was $2.0 billion. Beyond this, the Federal government also incurred other direct costs as a result of the shutdown. Fees went uncollected; IRS enforcement and other program integrity measures were halted; and the Federal government had to pay additional interest on payments that were late because of the shutdown.

Third, the shutdown had significant negative effects on the economy. The Council of Economic Advisers has estimated that the combination of the shutdown and debt limit brinksmanship resulted in 120,000 fewer private sector jobs created during the first two weeks of October. And multiple surveys have shown that consumer and business confidence was badly damaged.

The report highlights some of the more direct impacts the shutdown had on the economy by shutting down government services. For example:

- Federal permitting and environmental and other reviews were halted, delaying job-creating transportation and energy projects.

- Import and export licenses and applications were put on hold, negatively impacting trade.

- Federal loans to small businesses, homeowners, and families in rural communities were put on hold.

- Private-sector lending to individuals and small businesses was disrupted, because banks and lenders couldn’t access government income and Social Security Number verification services.

- Travel and tourism was disrupted at national parks and monuments across the country, hurting the surrounding local economies.

Fourth, the shutdown impacted millions of Americans who rely on critical programs and services halted by the shutdown. For example:

- Hundreds of patients were prevented from enrolling in clinical trials at the National Institutes of Health.

- Almost $4 billion in tax refunds were delayed.

- Agencies from the Food and Drug Administration to the Environmental Protection Agency had to cancel health and safety inspections, while the National Transportation Safety Board was unable to investigate airplane accidents in a timely fashion.

- Critical government-sponsored scientific research was put on hold. Notably, four of the five Nobel prize winning scientists who work for the Federal government were furloughed during the shutdown.

Fifth, the shutdown could have a long-term impact on our ability to attract and retain the skilled and driven workforce that the Federal government needs. The shutdown followed a three-year pay freeze for Federal employees, cuts in training and support, and, for hundreds of thousands of workers, administrative furloughs earlier this year because of sequestration. These cuts will make it harder for the government to attract and retain the talent it needs to provide top level service to the American people.

The report makes clear that the costs and impacts of the shutdown were significant and widespread, and demonstrates why this type of self-inflicted wound should not occur again.

Sylvia Mathews Burwell is the Director of the Office of Management and Budget.

Refining Estimates of the Social Cost of Carbon

Posted by on November 1, 2013 at 3:02 PM ESTAs part of our ongoing effort to measure the impact of reducing carbon emissions, today we are issuing updated values for the Social Cost of Carbon (SCC), which are used to estimate the value to society of reducing carbon emissions. These updated values reflect minor technical corrections to the estimates we released in May of this year. For example, these technical corrections result in a central estimated value of the social cost of carbon in 2015 of $37 per metric ton of carbon dioxide (CO2), instead of the $38 per metric ton estimate released in May.

At the same time, in response to public and stakeholder interest in SCC values, OMB’s Office of Information and Regulatory Affairs (OIRA) will provide a new opportunity for public comment on the estimates in addition to the public comment opportunities already available through particular rulemakings. Details on this public comment process will be published soon in the Federal Register.

The estimate of the SCC has been developed over many years, using the best science available, and with input from the public. Rigorous evaluation of costs and benefits is a core tenet of the rulemaking process. It is particularly important in the area of climate change, which is already imposing tangible costs through impacts that include an increase in prolonged periods of excessively high temperatures, more heavy downpours, an increase in wildfires, more severe droughts, permafrost thawing, ocean acidification, and sea-level rise.

In February 2010, after considering public comments on interim values that agencies used in a number of rules, an interagency group of technical experts, coordinated by OMB and the Council of Economic Advisers (CEA), released improved SCC estimates. The interagency group estimated the improved SCC values using the most widely cited climate economic impact models. Those climate impact models, known as integrated assessment models, were developed by outside experts and published in the peer-reviewed literature. Recognizing that the models underlying the SCC estimates would evolve and improve over time as scientific and economic understanding increased, the Administration committed in 2010 to regular updates of these estimates.

In May of this year, after all three of the underlying models were updated and used in peer-reviewed literature, and agencies received public comments urging them to update their estimates, the interagency group released revised SCC values. The May 2013 estimates reflect values that are similar to those used by other governments, international institutions, and major corporations. Those estimates have been out for public comment in several proposed rulemakings since May, and agencies have already received comments that are under review.

The technical corrections to the May SCC values that we are issuing today represent the best available science and data on the economic impacts on society of climate change. We will continue to work to refine these estimates to ensure that agencies are appropriately measuring the social cost of carbon emissions as they evaluate the costs and benefits of rules.

Howard Shelanski is Administrator of the Office of Information and Regulatory Affairs at the Office of Management and Budget.

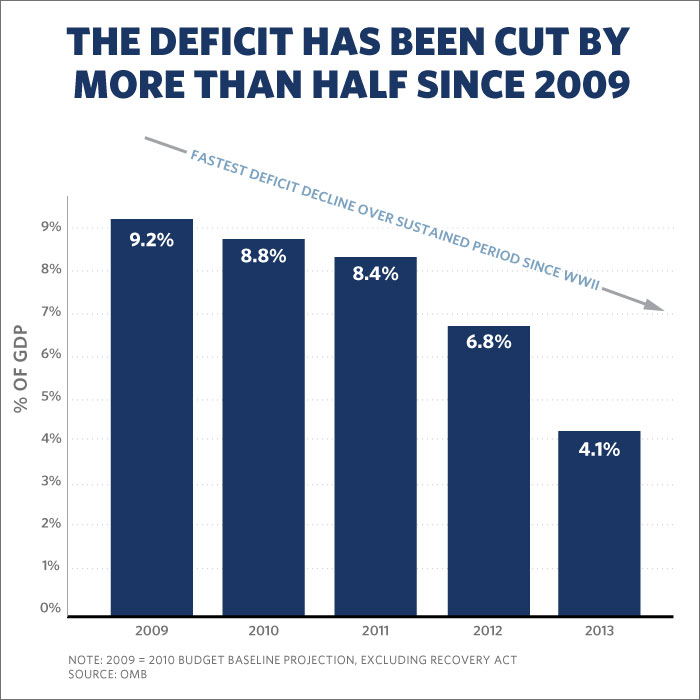

Deficit More Than Cut in Half Since 2009

Posted by on October 30, 2013 at 3:51 PM ESTThe Office of Management and Budget and the Department of the Treasury today released the fiscal year (FY) 2013 budget results, which show that we are continuing to make significant progress in reducing the deficit. The final 2013 deficit was $680 billion, $409 billion less than the 2012 deficit and $293 billion less than forecast in President Obama’s April Budget. As a percent of Gross Domestic Product (GDP), the deficit fell to 4.1 percent, representing a reduction of more than half from the deficit that the Administration inherited when the President took office in 2009. The deficit reduction since that point represents the fastest decline in the deficit over a sustained period since the end of World War II.

The President believes that growing our economy and creating more good jobs with higher wages must be our top economic priority. That is why he has consistently advocated a strategy to strengthen the middle class while improving our nation’s long-term fiscal position by cutting the deficit in a balanced way. Under the President's leadership, we have already locked in more than $2.5 trillion of deficit reduction over the next decade, through a combination of spending cuts and revenue increases from asking the wealthiest to pay their share.

In his 2014 Budget, the President presented a plan that would make critical investments to strengthen the middle class, create jobs, and grow the economy, while continuing to cut the deficit in a balanced way. It is a plan that demonstrates that we do not need to choose between growing the economy and taking further action to reduce the deficit – we can do both. Building on the $2.5 trillion in deficit reduction already locked in, the President’s plan would replace the economically damaging sequester while achieving additional deficit reduction to put Federal debt on a downward path as a share of the economy. And unlike sequestration, which includes no long-term deficit reduction, the President’s plan includes structural reforms that would generate growing savings in the second decade and beyond.

Learn more about EconomyLet’s Fill Those Empty Chairs

Posted by on August 28, 2013 at 10:28 AM ESTAs we commemorate the 50th anniversary of the March on Washington today, we are reminded that much work remains to be done to make sure every child has the opportunity to succeed in life. Investing in early education is one way to make meaningful progress toward that goal.

Yet splashed across local news broadcasts last week were images of empty chairs sitting outside Head Start centers. Each chair represented a child denied the chance at a strong start to his or her future due to the cuts imposed by sequestration.

According to new state-by-states estimates released by the Department of Health and Human Services, approximately 57,000 children are being cut from Head Start this year because of sequestration. That includes more than 51,000 fewer children in Head Start and nearly 6,000 fewer children, families, and pregnant women in Early Head Start.

If we continue to disinvest in our children and their futures, the harmful effects could last a lifetime. We need to get back on a path of smart investments in areas like early learning, which research has shown to be effective in improving school performance and putting students on the path to higher-paying jobs. This is particularly true for low-income children, who often start kindergarten academically behind their peers by many months, though early education is valuable for middle-class families as well.

The President’s FY 2014 Budget proposes a fully-paid for initiative to make high quality preschool available to all four-year olds, the creation of new Early Head Start-Child Care partnerships, and the extension and expansion of evidence-based voluntary home visiting services. Together, these investments will help provide children with a strong foundation for success in school and in life.

Martha B. Coven is Associate Director for Education, Income Maintenance, and Labor Programs

Progress Toward Opening Government Data Resources

Posted by on August 16, 2013 at 1:22 PM ESTIn May, the President signed an Executive Order to make government-held data more accessible to the public and to entrepreneurs and others as fuel for innovation, economic growth, and government efficiency. Under the terms of the Executive Order and a new Open Data Policy all newly generated government data will be required to be made available in open, machine-readable formats, greatly enhancing their accessibility and usefulness, while ensuring privacy and security.

Today, we are building on this effort by releasing additional resources to help Federal agencies make data open and available in machine-readable form. Specifically, we are releasing additional guidance to agencies about how to inventory and publish their data assets, new FAQs about how open data requirements apply to Federal acquisition and grant-making processes, and a framework for creating measurable goals that agencies can use to track progress. All of this is openly available on the Project Open Data website, where additional case studies and free software tools for the agencies are also available.

Opening up a wide range of government data means more entrepreneurs and companies using those data to create tools that help Americans find the right health care provider, identify a college that provides good value, find a safe place to live, and much more. It also empowers decision makers within government, giving them access to more information to enable smarter, data-driven decisions. Responsibly making government data open and widely reusable is good for the American people, and good for the American economy.

And to make it easier for the public and entrepreneurs to find, understand, and use open government data, we’re working to improve the central website about US government data – check out Next.Data.gov – a design prototype of the next generation of Data.gov. The team at Data.gov is shipping code every two weeks, and is eager to hear your thoughts about how to make it even better. You can provide feedback on Quora, Github, or Twitter.

Nick Sinai, U.S. Deputy CTO, Office of Science and Technology Policy

Dominic Sale, Supervisory Policy Analyst, Office of Management and BudgetRegulatory Lookback Eliminates Major Paperwork Burden

Posted by on August 8, 2013 at 11:42 AM ESTTruck drivers have a tough job, and one that is essential to the U.S. economy. They work for small businesses and large; many are small business owners in their own right. They put in long days on the road. And at the beginning and end of every one of those days, they have to inspect their trucks and file a report—even if they don’t find any problems. It’s a lot of paperwork—about 50 million hours per year, if you add up all the daily inspection reports filed by drivers across the country.

But due to an initiative that President Obama launched in 2011 to eliminate unnecessary regulation, that’s about to change. Last week, the Department of Transportation announced a proposed rule that would ensure that drivers only have to file reports when they identify vehicle problems or have reason to think that problems might exist. Drivers will still make inspections to ensure safety on the road, but they will no longer need to file reports when there’s nothing to report. If finalized, this rule could save truckers, businesses, and American consumers $1.7 billion dollars annually in paperwork costs.

As Administrator of the White House Office of Information and Regulatory Affairs, it is my job to review Federal agency regulations before they are issued. Regulations are critical to protecting our health, safety, and environment. But some regulations that were well crafted when first issued can become unnecessary over time as conditions change—and regulations that aren’t providing real benefits to society need to be streamlined, modified, or repealed. No one should be filing paperwork just for the sake of filing paperwork.

That is why President Obama, in January 2011, issued an Executive Order that called on agencies to streamline, modify, or repeal regulations on the books that impose unnecessary burdens or costs. And he has since followed up with additional orders asking agencies to report regularly on their progress in reviewing existing rules, and asking independent agencies to perform a similar review of regulations on their books.

This regulatory retrospective review, or “lookback,” initiative is producing real results—and last week’s Department of Transportation announcement is only one example. More than two dozen agencies have produced review plans, and almost twenty independent agencies have also done so, addressing hundreds of rules across the government.

Just a small fraction of the retrospective review rules already finalized will save around ten billion dollars for the American public in the near term. For example, the Department of Health and Human Services (HHS) removed unnecessary regulatory and reporting requirements on hospitals and other healthcare providers, saving more than $5 billion over the next five years. And the Department of Labor (DOL) simplified and improved hazard warnings for workers, producing net benefits of more than $2.5 billion over the next five years, while strengthening worker safety. Notably, many of the agency review efforts focus especially on benefitting small businesses, which are crucial engines of growth in our economy.

When the President launched this initiative in 2011, he stated that “We can make our economy stronger and more competitive, while meeting our fundamental responsibilities to one another.” That statement is as true today as it was back then. Review of existing regulations is a crucial part of ensuring that protecting our nation’s health, safety, and environment remains consistent with creating jobs and prosperity. This Administration will expand and further institutionalize our regulatory lookback efforts to ensure that we continue to identify rules that need to be modified, streamlined, or repealed. And we will continue to carefully consider ideas and input from the public as we make these regulatory changes. After all, no one should face unnecessary red tape. It’s not good for truck drivers; it’s not good for the economy; and it’s not good for the American people.

Howard Shelanski is Administrator of the Office of Information and Regulatory Affairs at the Office of Management and Budget.

The American Dream, Aided By Open Government Data

Posted by on August 7, 2013 at 9:57 AM ESTYesterday in Phoenix, President Obama laid out his plan to create a better bargain for responsible, middle-class homeowners. And today, the President will answer questions submitted by homeowners, renters, and prospective buyers during a live conversation with the real estate site Zillow.

For most Americans, buying a home is the largest purchase of their lives. That’s where a company like Zillow comes in -- helping families make informed decisions about buying a home and where to raise a family. Zillow is powered, in part, by open government data – including freely available data from the Bureau of Labor Statistics, Federal Housing Finance Agency, and the Census Bureau. Zillow uses these data sets to do things like help home buyers in a given region understand the point in years at which buying a home is more financially advantageous than renting the same home.

Making government data resources publicly available in machine-readable form as fuel for new private-sector products and businesses is one example of how the President is working to make government smarter and more innovative for the American people.

In May, the President issued a landmark Executive Order, Making Open and Machine Readable the New Default for Government Information, and took historic steps to make large-scale additional government data resources publicly accessible, findable and usable. As the President said, “That’s going to help launch more start-ups. It’s going to help launch more businesses. It’s going to help more entrepreneurs come up with products and services that we haven’t even imagined yet.”

We’re excited about what innovative companies like Zillow, Trulia, Estately, Redfin, and others have done and can do with open government data to help people looking for the right homes for their families. This is innovation born of the potent combination of open data and private sector entrepreneurship – innovation that helps Americans and creates jobs.

Check out the President’s answers to your housing questions right here at 1:00 p.m. ET.

Todd Park, U.S. CTO and Assistant to the President. Steven VanRoekel, U.S. CIO and Acting Deputy Director of Management.

- &lsaquo previous

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- …

- next &rsaquo

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues