OMBlog

Acquisition 360

Posted by on March 18, 2015 at 12:06 PM ESTSuccessful acquisitions depend on a clear understanding of the market’s capabilities and dynamics, and this requires early and meaningful engagement with industry and the application of strong management practices within the agency. Today, in an effort to further that goal, I issued guidance to agencies directing them to seek feedback from vendors and internal stakeholders – such as contracting officers and program managers – on how well certain high-dollar IT acquisitions perform. We will be using Acquisition 360, the first ever transaction-based feedback tool that allows agencies to identify strengths and weaknesses in their acquisition processes with the focus on pre-award activities, contract execution, and certain post award activities, such as debriefings.

It has long been the case where ineffective communication between federal agencies and vendors, amongst other complex processes, lead to unnecessary burden on vendors, higher government costs and unfavorable outcomes for taxpayers. These shortcomings have been the premise of the Office of Federal Procurement Policy’s (OFFP) open dialogue with both internal and external stakeholders. And these conversations have led to greater improvements in early vendor engagement and timely and specific feedback from key stakeholders that we will build upon today.

Acquisition 360 will significantly increase the efficiency with which federal agencies carry out procurements, as well as give OFFP greater insight into how the process can be further streamlined to better use every American’s tax dollars. I am very proud of the progress that we have made in this effort already and look forward to continuing to build upon it moving forward.

Anne Rung is the Administrator of the Office of Federal Procurement Policy at the White House Office of Management and Budget.

Learn more aboutAccelerating Progress and Institutionalizing Retrospective Review

Posted by on March 17, 2015 at 3:26 PM ESTIn 2011, President Obama called on federal agencies to undertake an unprecedented government-wide regulatory review to identify rules on the books with outdated requirements or unjustified costs. Retrospective review continues to be a key priority for the Obama Administration. Since the release of Executive Order 13563 in 2011, federal agencies have been continually identifying outdated and duplicative regulations and have taken action to modify or eliminate them where possible. And the Administration has made significant progress. For example, the Department of Transportation, the Centers for Medicare and Medicaid Services (CMS), the Environmental Protection Agency, and Department of Homeland Security (DHS) have already finalized significant retrospective review initiatives. To date, the retrospective review process is expected to achieve $20 billion in savings over five years, and is on track to eliminate over 100 million paperwork burden reduction hours.

Today, agencies released their bi-annual retrospective review plans, identifying recently completed initiatives as well as outlining what they are working to accomplish on retrospective review over the next year. As their plans outline, agencies across the government have continued to find ways to improve and streamline regulations on the books. Here are a few of the successes and ongoing initiatives worth noting:

- The Social Security Administration (SSA) is developing an online application to allow certain members of the public to apply for replacement social security cards electronically without having to visit an office or mail in an application. In the proposed rule, an adult U.S. citizen meeting certain qualifications would have the option to file for an SSN replacement card online.

- The Department of Housing and Urban Development published a proposed rule regarding housing voucher portability in March of 2012. The agency plans to finalize this streamlining regulation this year. The goal of this rulemaking is to make the voucher program more flexible and maximize family choice in locating housing. Reducing the administrative burdens involved with processing portability requests will enable Public Housing Agencies to better serve families and expand housing opportunities.

- In December 2014, the Centers for Medicare and Medicaid Services finalized a fraud protection final rule that helps prevent fraudulent entities from enrolling in Medicare by increasing the criteria for denying enrollment including: a felony conviction, relationship with a previously enrolled provider or supplier that had Medicare debt, pattern of submitting claims that don't meet Medicare standards, and limiting the ability of ambulance suppliers to bill for services performed prior to enrollment. CMS anticipates this that this could lead to reduced payments of about $327 million dollars to such potentially fraudulent actors.

Agency retrospective review efforts complement and advance many initiatives designed to improve the interaction of the American people with their government. For example, through Executive Order 13604, the Administration has worked to integrate ongoing agency efforts to identify specific changes to existing regulations that would help streamline, modernize and improve the efficiency of the federal permitting process for infrastructure projects. Pursuant to Executive Order 13659, DHS in coordination with the Department of Treasury is leading a whole-of-government effort to streamline the import/export process by developing a national “single window” through which businesses will submit the data required for international trade transactions. This effort will result in substantial burden reduction by significantly decreasing paperwork obligations and reducing redundant information collections.

In conjunction with producing their bi-annual retrospective review plans, federal agencies have also recently submitted to OMB written plans for stakeholder engagement. The goal of these plans is to get input on promising themes and specific targets for review and reform from parties with a stake in regulation. For example, the Department of Labor (DOL) launched an interactive “IdeaScale” website to seek public input on developing its preliminary retrospective review plan. This initiative allows individuals to submit their own recommendations for retrospective review and to vote on others. DOL plans to expand on this robust, technology-driven engagement effort to identify opportunities for regulatory reforms. This initiative will feed into the Department’s July 2015 retrospective review report.

We are proud of the progress made to date on retrospective review, but we know we can do more. To that end, we have begun to step up our collective efforts in the remaining months of the Administration to significantly accelerate progress and to better institutionalize retrospective review. We are focusing our efforts in four key areas:

- Reducing regulatory and compliance burdens for state and local government;

- Reducing regulatory burden for industry, with a focus on flexibility for small and new businesses;

- Regulatory modernization; and

- Identifying areas with regulatory gaps or where regulations need to be strengthened.

As the President said in 2011, “We should have no more regulation than the health, safety, and security of the American people require. Every rule should meet that commonsense test.” OIRA, together with our agency colleagues, is determined to build upon the progress we have made since the President spoke those words. We will continue to expand the use of retrospective review, carefully consider ideas and input from the public as we make regulatory changes, and work to further institutionalize retrospective review in order to make government work more efficiently and effectively for the American people. We look forward to showing even more progress going forward.

Howard Shelanski is the Administrator of the Office of Information and Regulatory Affairs.

Learn more aboutThe Long-Term Budget Outlook

Posted by on March 11, 2015 at 1:31 PM ESTToday, I had the honor to speak before the Economic Club of Washington, D.C. on the economy and the President’s FY 2016 Budget. I made three key points that I believe should frame the budget debates going forward: (1) we have made both near-term and medium-to-long term fiscal progress; (2) the President’s FY16 Budget prioritizes both fiscal responsibility and economic growth; and, (3) we face a critical choice in whether we will return to austerity or continue the economic progress we’ve seen. I would like to dig into the first point a bit more here than I was able to do in my speech and explain the medium and long term fiscal progress we’ve made.

The President’s Budget provides official projections for spending, revenues, deficits, and debt over the next 10 years, reflecting the President’s proposed policies, including ending sequestration, investing in growth and opportunity, and reducing deficits and debt. But each year, the Budget also includes projections for the path of the Nation’s finances over the longer term. These long-term projections are highly uncertain, because they are driven by economic, demographic, and other predictions for the next 25 years. However, they can still provide valuable information about key fiscal trends. This year’s Analytical Perspectives chapter on the long-term budget outlook has three main findings.

1. The medium-term and long-term budget outlook have improved substantially over the last five years. Since the President took office, deficits as a share of the economy have fallen by about two thirds. Less well known, but equally as important, projected deficits and debt have also fallen substantially.

Learn more aboutBehind the Buy: New OFPP Podcast Series

Posted by on March 11, 2015 at 12:00 PM ESTAuthor’s Note: The "Behind the Buy" podcast features audio stories told by members of the Federal acquisition workforce who have successfully executed best practice IT contracting strategies from the TechFAR and Digital Services Playbook to help their agency meet its mission.

Last year, the Administration released two crucial tools to build upon successful efforts to fundamentally improve the way Government delivers services to the public. The Digital Services Playbook outlines key "plays" drawn from private and public-sector best practices to help Federal agencies deliver services that work well for users and require less time and money to develop and operate. The TechFAR Handbook explains how agencies can execute key plays in the Playbook in ways consistent with the Federal Acquisition Regulation (FAR), which governs how the Government buys goods and services from the private sector.

To share best practices from tools like the Playbook and TechFAR, members of the Federal acquisition community recommended we use more innovative communication channels. The workforce wanted an interactive way to send and receive solutions that enhance the value of IT procurements for customers and taxpayers. Those suggestions led to the creation of the Behind the Buy audio series, or podcast, a human-centered design approach that allows procurement and program offices to listen and learn about innovative IT contracting strategies while carrying on their daily work responsibilities.

In this inaugural Behind the Buy podcast series, OFPP Administrator Anne Rung interviews Mark Naggar, the project manager for the Buyers Club at the Department of Health and Human Services. During the episode, Mark explains how the TechFAR and play #4 from the Playbook, Build the Service Using Agile and Iterative Practices, enabled his procurement team to quickly compete and contract for development of IT system prototypes from multiple vendors, which increased customer satisfaction and vendor engagement and ultimately cut time to delivery from six months to eight weeks.

Both the Playbook and TechFAR are edited on GitHub, where they serve as living documents that can be shared and shaped by digital experts across the country. If you have a “Playbook or TechFAR-related” experience, let us know! We’d like to hear about your success story and take the Federal community Behind the Buy.

Anne Rung is the Administrator of the Office of Federal Procurement Policy. Mark Naggar serves as the Project Manager for the Buyers Club at the Department of Health and Human Services.

Learn more about TechnologyCommemorating the 50th Anniversary of the Selma-to-Montgomery March and the Voting Rights Act of 1965

Posted by on March 9, 2015 at 11:18 AM ESTOn Sunday, March 8, 2015, I had the tremendous opportunity to speak at the historic Brown Chapel A.M.E. Church in Selma, Alabama, to commemorate the 50th anniversary of the Selma-to-Montgomery March and the Voting Rights Act of 1965.I told the audience my story of seeking a deeper understanding of the civil rights movement and the experiences of those who were there. Twenty-four years ago, my best friend and I decided to bike the path of the Freedom Riders to mark the anniversary of the Freedom Summer. We launched our ride by sharing dinner with Congressman John Lewis at a Chinese restaurant in DC. I went to Birmingham with James Farmer, and crossed the bridge in Selma that year. That experience meant so much to me then and has helped shape the person that I am today.I thanked all the foot soldiers of the Civil Rights movement who dedicated their lives to the noble legacy that we honored last weekend. It is that legacy that President Obama honored just this weekend when he signed a bill recognizing the foot soldiers of the Civil Rights movement. And it is that legacy that made me proud to announce, in Selma and on this historic occasion, that the President’s Budget proposes $50 million to restore and highlight key Civil Rights Monuments across the country.This funding includes critical investments in specific National Park Service sites associated with the Civil Rights movement, such as the Selma to Montgomery National Historic Trail, the Little Rock Central High School National Historic Site, the Brown v. Board of Education National Historic Site, and the Martin Luther King, Jr. National Historic Site.These sites are not only critical to Southern heritage, or African-American history – they are part of the fabric of our Nation’s history and should be preserved and maintained for generations to come so that we may always remember the bridges we’ve crossed and the battles we’ve won.As Dr. King famously said, the arc of the moral universe is long – but it bends toward justice.I believe it does. Each of us must continue the work to ensure that we again cross bridges of hope and unity together. I have no doubt we will.Shaun Donovan is Director of the Office of Management and Budget.

Learn more about Civil Rights

Learn more about Civil RightsTransforming the Federal Marketplace: A 90 Day Progress Report from the Administrator

Posted by on March 6, 2015 at 9:51 AM ESTLast December, I laid out a strategic plan to create a more innovative, effective and efficient acquisition system to support the needs of a 21st century government. This roadmap was built around three core elements: (1) build stronger vendor relationships, (2) buy as one through category management, and (3) drive innovation. I’m pleased to report on our progress over the last three months.

Vendor Relationships

Our ability to save taxpayer dollars and reduce duplication in our acquisition and management practices depends on having strong partnerships with industry. OFPP has taken several steps, including the launch of its first online national dialogue with industry last year and partnering with GSA to improve customer-facing tools, but more can be done. On March 18th I will issue guidance to agencies directing them to seek feedback from vendors and internal stakeholders – such as contracting officers and program managers – on how well certain high-dollar IT acquisitions perform. We’ll use Acquisition 360, the first ever transaction-based feedback tool that allows agencies to identify strengths and weaknesses in their acquisition processes with the focus on pre-award activities, contract execution, and certain post award activities, such as debriefings.

Additionally, the Office of Federal Procurement Policy (OFPP) is preparing for a second open dialogue beginning this spring to get industry feedback on steps being taken to ease contractor reporting and improve commercial item acquisitions – issues raised by stakeholders in our last open dialogue. One important step is laid out in a notice issued by the General Services Administration (GSA) this week which announces a Federal Supply Schedules pricing pilot to test alternative and more effective ways to negotiate Schedule pricing without the burdens often cited by industry associated with current pricing practices. The dialogue will be announced in the Federal Register. We encourage you to review and comment on the pilot and participate in our next dialogue.

Category Management

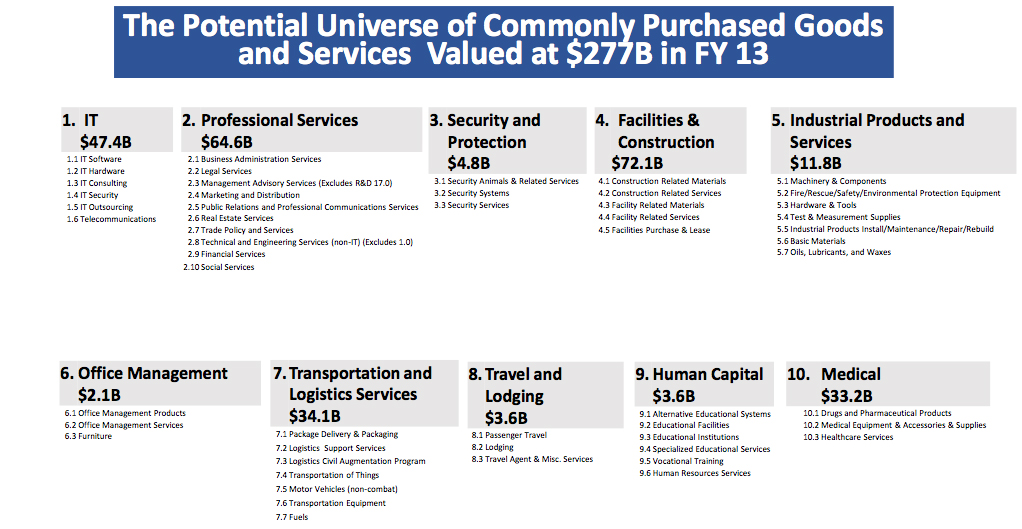

To help streamline spending for common every day items, like office supplies and furniture, we are working to implement and institutionalize Category Management, a practice adopted from industry that breaks down federal spending into 10 common categories such as IT, travel, and construction and treats them as individual business units. Through this effort, category leads with expert knowledge will examine wasteful spending and duplicative practices that hamper the acquisition process and waste money.

A key part of category management is creating greater transparency into federal contracting. In partnership with GSA, we have started to collect and share important contract and pricing information in a central location called the Acquisition Gateway. (Please check it out and help us “connect and collect.”) This site will make the acquisition workforce aware of existing contracting solutions and avoid creating duplicative contracts. It will also help drive down the vast price disparity that exists for identical items by shedding light on prices paid. This first version of the site covers key contract information for a range of commonly purchased goods and services, like office supplies, computers, and small package delivery. In accordance with our December 2014 memorandum, the Strategic Sourcing Leadership Council, now called the Category Management Leadership Council (CMLC), has prioritized the collection of IT contracts. In a few short months, the government acquisition workforce will have access to key contract information for all major IT commodity contracts across government, including bureau-wide, agency-wide, and government-wide contracts.

Additionally, to help launch the IT category, we will hire an IT Category Manager at OMB, who will work with me and our new Federal CIO, Tony Scott, to improve our buying and demand management practices for the more than $25 billion spent annually on IT commodities, such as hardware and software. GSA is hiring an IT vendor manager who will provide full-time focus on improving relationships with key types of vendors – especially those who have multiple contracts for similar goods and services with many agencies

Driving Innovation

Progress has been made in bringing greater innovation into the acquisition system. We will soon launch a “TechFAR Hub” on the Acquisition Gateway as a follow-on to the TechFAR handbook which helps agencies utilize regulatory flexibilities to produce better results for IT acquisitions. The Hub will allow agencies to accelerate information exchange on the use of agile software development and other techniques used by industry. To ensure these practices take hold, we have drafted an initial plan for training and deploying a cadre of certified digital IT acquisition professionals to agencies to assist in this area. We will encourage agencies to stand up “Buyers Clubs,” as HHS did last summer, to test, document, and scale new ideas. We are emphasizing strategies that are designed to produce quality results in a budget-constrained environment, such as those in the Digital Services Playbook. We are working with initiative-taking agencies to explore other cost-savings ideas, such as no-cost contracting (where certain public services performed by a contractor are paid for by user fees). Finally, as described in the President’s Budget, we are seeking Congressional support for legislative proposals that can help us acquire innovative solutions from both existing federal contractors and new contractors. One proposal, aimed at existing contractors who sell inexpensive services, would raise the simplified acquisition threshold from $150,000 to $500,000.

We’re sprinting, trying new approaches, gathering experiences and moving ahead to make your government work better. I look forward to working with all of you on the exciting initiatives underway to strengthen the acquisition process.

Anne Rung is the Administrator of the Office of Federal Procurement Policy at the Office of Management and Budget.

Investing in Adolescent Girls' Education, Safety, and Health

Posted by on March 4, 2015 at 9:12 AM ESTThis week, the President and First Lady announced Let Girls Learn, a new whole-of-government initiative that will support adolescent girls around the world. Building on USAID education programs that reach more than a million adolescent girls every year, the initiative will both improve access to quality education and target the barriers that can keep adolescent girls out of school, including gender-based violence and child marriage.

These interventions are essential because of the close link between girls’ education and international development. Countries with higher levels of female secondary-school enrollment have lower infant mortality rates, lower birth rates, lower HIV/AIDS rates, and better child nutrition. Further, every year of secondary school education is correlated with an 18 percent increase in a girl’s future earning power.

The President’s Budget proposes spending $250 million in new and reallocated funds for Let Girls Learn. The initiative will elevate existing programs in several countries, supporting a wide range of adolescent girl-focused interventions aligned with the USAID Education Strategy. Through new investments in areas of conflict and crisis—including in Afghanistan—Let Girls Learn will support adolescent girls where education access is especially difficult. Of course, quality education must be part of a broader set of opportunities. In addition to USAID education programming, the initiative will complement other adolescent girl-focused efforts across the government, such as interventions in the President's Emergency Plan for AIDS Relief (PEPFAR) to reduce HIV infections in young women.

This new initiative recognizes that empowering adolescent girls will require enlisting the support of other partners. That’s why the Budget also provides funds for a new, USAID-based mechanism to mobilize new ideas—from agencies, partner governments, NGOs, the private sector, and foundations—to support innovative approaches to adolescent girls’ education.

Innovations will also come from the Let Girls Learn Peace Corps program, where hundreds of new Volunteers will work directly with communities to help keep adolescent girls in school. The new program launches this spring in 11 countries.

As with other Administration initiatives, Let Girls Learn will build upon ongoing efforts and improve coordination among government agencies and other partners. With 62 million girls worldwide out of school—half of whom are adolescent—and millions more whose potential goes unrealized, support for Let Girls Learn in the President’s Budget will help deepen our commitment to this critical population.

Shaun Donovan is Director of the Office of Management and Budget.

Learn more aboutClean Energy RD&D Investments Make Us Stronger

Posted by on February 25, 2015 at 5:06 PM ESTThe American Energy Innovation Council (AEIC), a bipartisan collection of business leaders focused on creating economic growth through public and private investment in new energy technology, recently issued a report calling for a boost in investment in energy research, development, and deployment (RD&D). The report reinforces the fact that investments are critical to America’s ability “to sustain its international competitiveness, reinforce its economic security and resiliency, and protect the environment.” The report concludes that “public investments in energy RD&D are crucial.” We couldn’t agree more.

The 2016 Budget vigorously advances the President’s commitment to strengthen the middle class and make America a magnet for jobs in the 21st century global economy by investing in manufacturing and innovation. The Budget supports clean energy technology programs that position America as a global clean energy leader with a strong and modern energy infrastructure. Specifically, the Budget proposes approximately $7.4 billion for clean energy RD&D across the Federal government, a nearly $1 billion increase over the current enacted level.

Clean energy RD&D investments – and research and development investments more generally – help illustrate an important principle reflected in the President’s proposal: A Budget that locks in sequestration going forward would be bad for our security and bad for our growth.

Learn more about Energy and EnvironmentTaking Action to Unlock the Economic Contributions of Americans-in-Waiting

Posted by on February 24, 2015 at 2:23 PM ESTThe President is continuing to take action, within his legal authority, to fix our broken immigration system. Today, the Administration announced a final rule that will allow spouses of certain high-skilled workers to contribute to the economy while they wait to obtain lawful permanent residence status (or a “green card”) through their employer. America needs a 21st century immigration system that lives up to our heritage as a nation of laws and a nation of immigrants—and that grows our economy. This change, as well as the other actions announced by the President this past November, will do just that.

The President’s Council of Economic Advisers (CEA) has also released an updated report on the economic impact of the President’s executive actions, which are now estimated to boost the nation’s GDP by as much as $250 billion over ten years, due in part to increases in the size of the American workforce and to increased innovation from high-skill workers. These actions will also increase the productivity and wages of all American workers, not just immigrants, as evidenced by a large body of academic work cited in the CEA report.

By finalizing this rule, the Department of Homeland Security (DHS) is taking an important step forward in executing the President’s immigration executive actions and locking in these economic benefits. The changes included in this rule will—for the first time—allow employment authorization for the spouses of certain high-skill workers who are here on H-1B visas, as long as those workers have begun the process of applying for a green card. This rule change, which was recommended in a “We the People” petition to the White House, will empower these spouses to put their own education and skills to work for the country that they and their families now call home.

Learn more about , ImmigrationBudgeting for Climate Preparedness and Resilience

Posted by on February 20, 2015 at 1:55 PM ESTThe National Climate Assessment was clear: The intensity of storms and rates of rainfall associated with hurricanes are projected to worsen with the warming climate. For the folks who live on the frontlines of the impacts of climate change– like the communities in Southeast Florida – the ruthless reality of extreme weather events are all too familiar. For them, and for countless communities from coast-to-coast, the economic case for investment in climate preparedness and resilience is also much too familiar. That is why these communities are taking action; and that is why resilience is becoming a bigger part of the public discourse – like yesterday’s Urban Institute event with Shaun Donovan, Director of the Office of Management and Budget, Judith Rodin, President of The Rockefeller Foundation and Sarah Rosen Wartell, President of The Urban Institute. The discussion focused on building resilient communities, the role of philanthropy in partnering with public leaders, and the impact of disasters on vulnerable populations.

Director Donovan noted that the President’s 2016 Budget provides the necessary tools, technical assistance, and on-the-ground partnership to support investment in climate preparedness and resilience.

The motivation to act now is simple: Why wait until after extreme weather hits?

When it came to their children’s health, Southeast Floridians decided they would not wait. In 2001, the community decided to invest in a robust retrofit of the Miami Children’s Hospital – they decided to build a glass fiber reinforced concrete “cocoon” around the hospital. That investment paid off: When Hurricanes Frances and Jeanne hit, the Children’s Hospital didn’t miss a beat. In fact, it provided a safe place to over 60 children who lived at home, were evacuated, and needed access to ventilators or other electrically-powered medical equipment. The theory proved right: The community took action, and, in the face of extreme weather, the Children’s Hospital endured.

Southeast Florida had good partners. The $11.3 million project was supported by a $5 million grant from the Federal Emergency Management Agency (FEMA). And studies – concluding that Americans save $3-$4 for every dollar invested in pre-disaster mitigation – show that these types of Federal grants are regularly a good investment, not just in Southeast Florida. That is why the President’s Budget scales up investment in programs like the FEMA Pre-disaster Mitigation Grant Program, proposing $200 million to help protect people and structures. This is an increase of $175 million over current funding levels.

The goal for investment in climate preparedness and resilience is clear: to proactively reduce the risks communities and ecosystems face, rather than waiting until after disaster strikes. These forward-thinking investments will not only save lives, but will save communities and taxpayers the costs associated with recovering from the next weather-related emergency for which they were not prepared; they include:

- Flood Resilience. The Budget includes $400 million for National Flood Insurance Program Risk Mapping efforts, an increase of $184 million over current funding levels to help communities and businesses understand what areas pose flood risks. The Budget also includes $200 million for the United States Department of Agriculture (USDA) to emphasize watershedscale planning and land treatment efforts and aid communities in planning and implementing mitigation and adaptation projects for extreme weather events.

- Drought Resilience. The Budget strongly supports USDA in its efforts to integrate climate considerations into existing programs and to use programs to drive resilience. For example, through its regional Climate Hubs, the Department will provide information and guidance to farmers, ranchers, and forest landowners on the latest technologies and risk management strategies to help them implement climate-smart tactics. This effort is complemented by $89 million for the Department of Interior (DOI) WaterSMART program, which promotes water conservation initiatives and technological breakthroughs.

- Wildland Fire Resilience. The Administration is committed to ensuring that adequate funds are available to fight wildland fires, protect communities and human lives, and implement appropriate land management activities to improve the resiliency of the Nation’s forests and rangelands. To accomplish this, the Budget proposes to establish a new funding framework for wildland fire suppression, similar to how other natural disasters are currently funded.

- On-the-Ground Partnership with Local Communities. The Budget provides $4 million to support a Resilience Corps pilot program at the Corporation for National and Community Service. This pilot program will support roughly 200 AmeriCorps members to assist communities in planning for and addressing the impacts of climate change. The Budget also includes $2 million for the National Oceanic and Atmospheric Administration (NOAA) to train the Resilience Corps members. In addition to standing up a new Resilience Corps, the Budget also scales up on-the-ground programs that are already at work—such as the Army Corps of Engineers’ Silver Jackets—by providing $31 million for the Corps of Engineers to provide local communities with technical and planning assistance regarding the development and implementation of nonstructural approaches to manage and reduce flood risk.

The exposure of the Federal budget to climate risks provides yet another call to action for policymakers. Over the last decade, the Federal Government has incurred over $300 billion in direct costs due to extreme weather and fire alone, including domestic disaster response and relief ($176 billion), flood insurance ($24 billion), crop insurance ($61 billion), and wildland fire management ($34 billion). While it is not possible to identify the portion of these costs incurred as a result of climate change, costs for each of these Federal programs have been increasing and can be expected to continue to increase as the impacts of climate change intensify.

Communities like Southeast Florida – a White House Climate Action Champion – are modeling how we should respond to one of the most significant long-term challenges that our country and our planet faces. The President’s Budget provides the necessary tools, technical assistance, and on-the-ground partnership to support communities like theirs, and the countless others from coast-to-coast that are dealing with the impacts of climate change in the best way: by taking action.

Ali Zaidi is the Associate Director for Natural Resources, Energy and Science at the Office of Management and Budget.

Learn more about Energy and EnvironmentThe Next U.S. Chief Information Officer

Posted by on February 5, 2015 at 4:47 PM ESTThe President’s announcement today of Tony Scott as the next United States Chief Information Officer is an important opportunity for our Nation. With the radical evolution of information technology (IT), the Federal Government has unprecedented opportunity to enhance how we deliver services to the American people and spark greater innovation in the digital age.

Over the past six years, this Administration has embarked on a comprehensive approach to fundamentally improve the way Government delivers results and technology services to the public. From adopting game-changing technologies such as cloud solutions, optimizing IT investments to save taxpayers nearly $3 billion, standing up the United States Digital Service to transform government’s ability to deliver critical services like healthcare and veterans benefits, to opening government assets to foster economic growth. This tremendous progress is a result of a President who recognizes the opportunity to harness advances in technology to make government work better for the American people.

That is why we are pleased the President announced Tony Scott as the next U.S. CIO and Administrator of OMB’s Office of Electronic Government and Information Technology. Under Tony’s leadership, we will continue to build on the remarkable work done by the Nation’s first CIOs Vivek Kundra and Steve VanRoekel in changing the way the Federal government manages IT.

Tony will bring will over 35 years of global leadership and management experience to build upon our progress and drive continued success. Tony is the right person to drive the Administration’s Smarter IT Delivery Agenda and the core objectives across the Federal IT portfolio – (1) driving value in Federal IT investments, (2) delivering world-class digital services, and (3) protecting Federal IT assets and information.

In the coming weeks, we will have more on Tony’s role and upcoming work. Until then, join us in welcoming Tony Scott.

Shaun Donovan is the Director at the White House Office of Management and Budget.

Beth Cobert is the Deputy Director for Management at the White House Office of Management and Budget.

FACT SHEET: Middle Class Economics: The President’s Fiscal Year 2016 Budget

Posted by on February 2, 2015 at 7:37 AM ESTFACT SHEET: Middle Class Economics: The President’s Fiscal Year 2016 Budget

The President's 2016 Budget is designed to bring middle class economics into the 21st Century. This Budget shows what we can do if we invest in America's future and commit to an economy that rewards hard work, generates rising incomes, and allows everyone to share in the prosperity of a growing America. It lays out a strategy to strengthen our middle class and help America's hard-working families get ahead in a time of relentless economic and technological change. And it makes the critical investments needed to accelerate and sustain economic growth in the long run, including in research, education, training, and infrastructure.

These proposals will help working families feel more secure with paychecks that go further, help American workers upgrade their skills so they can compete for higher-paying jobs, and help create the conditions for our businesses to keep generating good new jobs for our workers to fill, while also fulfilling our most basic responsibility to keep Americans safe. We will make these investments, and end the harmful spending cuts known as sequestration, by cutting inefficient spending and reforming our broken tax code to make sure everyone pays their fair share. We can do all this while also putting our Nation on a more sustainable fiscal path. The Budget achieves about $1.8 trillion in deficit reduction, primarily from reforms to health programs, our tax code, and immigration.

QuestionEnd

*****************************************

WHAT THE PRESIDENT’S BUDGET DOES:

MIDDLE CLASS ECONOMICS FOR THE 21ST CENTURY

In last month’s State of the Union, the President laid out his vision for middle class economics: restoring the link between hard work and opportunity, and ensuring that every American has the chance to share in the benefits of economic growth. To achieve this, the Budget invests in helping working families make their paychecks go further, preparing hardworking Americans to earn higher wages, and creating the infrastructure that allows businesses to thrive and create good, high-paying jobs.

Helping Middle-Class Families Get Ahead

Middle class economics means ensuring that all Americans have the opportunity to succeed in our global economy and all working families can afford the cornerstones of economic security: child care, college, health care, a home, and retirement. The Budget supports working families by reforming the tax code to help middle-class families get ahead, tripling the child care tax credit, expanding child care assistance, encouraging state paid leave initiatives, ensuring access to quality, affordable health care, making two years of community college tuition-free for responsible students, bolstering job training so it leads to careers, expanding access to child care and early education, supporting and rewarding work, and helping families save for retirement.

Improving Access to High-Quality Child Care and Early Education – High-quality child care and early education for young children serves the important functions of supporting parents in the workforce and helping support healthy child development and school readiness. The Budget aims to ensure that children have access to high quality learning starting at birth, making several key investments:

- Expands access to quality, affordable child care. The Budget proposes a historic investment in child care to ensure that quality, affordable care is available to all eligible low- and moderate-income working families with young children, as opposed to the small share of children who receive this help today. This proposal will expand access to high-quality care for more than 1.1 million additional children under age four by 2025 and help States build a supply of quality care that families can access.

- Cuts taxes for families paying for child care with a credit of up to $3,000 per child. The Budget triples the maximum Child and Dependent Care Tax Credit (CDCTC) for families with children under age five and makes the full CDCTC available to families with incomes of up to $120,000, benefiting families with young children, older children, and dependents who are elderly or have disabilities. The child care tax reforms would benefit 5.1 million families, helping them cover costs for 6.7 million children.

- Increases the duration of Head Start programs and invests in high quality infant and toddler care. The Budget expands access to high-quality care for tens of thousands of additional infants and toddlers through Early Head Start-Child Care Partnerships, and provides over $1 billion in additional funding for Head Start to make sure children are served in full-day, full-year programs that research shows lead to better outcomes for children.

- Supports universal preschool. The Preschool for All initiative, in partnership with the States, provides all four-year-olds from low- and moderate-income families with access to high-quality preschool, while encouraging States to expand those programs to reach additional children from middle-class families and establish full-day kindergarten policies.

- Lays the groundwork for Preschool for All. The Budget provides $750 million for the Department of Education's Preschool Development Grants, a substantial increase of $500 million over the 2015 level. Preschool Development Grants are currently helping 18 States develop and expand high-quality preschool programs in targeted communities; the Budget will increase that number to over 40 States.

- Invests in voluntary, evidence-based home visiting. The Budget extends and expands evidence-based, voluntary home visiting programs, which enable nurses, social workers, and other professionals to connect families to services to support the child's health, development, and ability to learn.

Improving Opportunity for All Students – Title I is the Department of Education's largest K-12 grant program and the cornerstone of its commitment to supporting low-income schools with the funding necessary to provide high-need students with access to an excellent education. The Budget increases Title I funding by $1 billion and proposes additional funding to support districts that are using their Federal formula funds for evidence-based interventions. The Budget also makes other important investments in improving K-12 education, increasing. For example, it:

· Increases funding for special education and efforts to assist English language learners. The Budget provides additional funding to help students who face academic hurdles meet rigorous academic standards so that all students can succeed.

· Provides broad support for educators at every phase of their careers. The Budget invests in developing strong teachers before they reach the classroom and supporting their growth and success throughout their careers.

· Invests more than $3 billion on science, technology, engineering, and math (STEM) education. The Budget provides strong support for STEM education, including a new $125 million competitive program to promote the re-design of America's high schools by integrating deeper learning and student-centered instruction, with a particular focus on STEM-themed high schools that expand opportunities for girls and other groups underrepresented in STEM fields.

Reforming the Tax Code to Reward and Support Work – When both spouses work, a family incurs additional costs in the form of commuting costs, professional expenses, child care, and, increasingly, elder care. To address these challenges, the Budget proposes a new $500 “second earner” tax credit, which will benefit 24 million dual-earner couples. It also proposes to expand the Earned Income Tax Credit (EITC) for workers without children and non-custodial parents, promoting employment while reducing poverty and hardship for 13.2 million low-income workers struggling to make ends meet. In addition, the Budget continues to propose making permanent improvements to the EITC and Child Tax Credit that augment wages for 16 million families with 29 million children each year but are scheduled to expire at the end of 2017. Allowing these benefits to expire would result in a roughly $1,700 tax increase for a full-time minimum wage worker with two children.

Encouraging State Paid Leave Initiatives – Too many American workers must make the painful choice between caring for their families and a paycheck they desperately need. A handful of States have enacted policies to offer paid leave. The Budget encourages additional States to develop paid family leave programs by providing funding for the initial set-up and half of the benefit costs for as many as five States through the Paid Leave Partnership Initiative. It also provides support and technical assistance to those States that are still building the infrastructure they need to launch programs in the future through the State Paid Leave Fund.

Ensuring Access to Quality, Affordable Health Care – The Budget supports the Affordable Care Act, which is already providing coverage for millions of Americans through the Health Insurance Marketplaces, the delivery of tax credits to make coverage affordable, and the expansion of Medicaid.

Helping All Workers Save for Retirement – Millions of working Americans lack access to a retirement savings plan at work. Fewer than 10 percent of those without plans at work save in a retirement account on their own. In 2015, retirement security will be one of the key topics of the White House Conference on Aging. The Budget would make it easy and automatic for workers to save for retirement through their employer – giving 30 million more workers access to a workplace savings opportunity. The Budget also ensures that long-term part-time employees can participate in their employers’ retirement plans and provides tax incentives to offset administrative expenses for small businesses that adopt retirement plans.

Partnering With Communities to Expand Opportunity – The Budget improves the coordination of resources to meet unique community needs and growth opportunities, including through the Administration's Promise Zones initiative, which is creating partnerships between the Federal Government, local communities, and businesses to create jobs, increase economic security, expand educational opportunities, increase access to quality, affordable housing, and improve public safety. The President named the first five Promise Zones in 2014 and will designate an additional 15 Zones by the end of calendar year 2016. In support of Promise Zones, the Budget requests $250 million for the Department of Housing and Urban Development's Choice Neighborhoods program and $150 million for the Department of Education's Promise Neighborhoods program. The Budget also includes Promise Zone tax incentives to stimulate growth and investments in targeted communities.

Supporting Innovative Projects to Improve Upward Mobility – Building on Promise Zones, the budget also includes a new initiative, the Upward Mobility Project, that will allow up to ten communities, States or consortia of States and communities to combine funds from four existing block grant programs designed to promote opportunity and economic development and reduce poverty to test and validate promising approaches to help families become more self-sufficient, improve children's outcomes, and revitalize communities so they can provide more opportunities for their residents. Projects must utilize evidence-based strategies, track program performance, and evaluate intervention effectiveness. The funding streams that States and communities can apply to use – including the Department of Health and Human Services' Social Services Block Grant and Community Services Block Grant, and the Department of Housing and Urban Development's Community Development Block Grant, and HOME Investment Partnerships Program – share a common goal of promoting opportunity and reducing poverty. In addition to these funds, participating communities will be eligible to receive a total of $1.5 billion in new funding over five years, to combine with the added flexibility with currently provided resources.

Helping Americans Upgrade Their Skills

America's education system led the world in the 20th Century, when we sent generations to college and cultivated the most educated workforce in the world, supporting an unparalleled period of economic growth and rising middle-class incomes. Since then, other countries have followed our lead to develop globally competitive education systems. As our economy changes, we need to ensure that Americans are prepared with the skills and knowledge necessary to compete in the 21st Century economy. The Administration invests in affordable post-secondary education and builds on the bipartisan Workforce Innovation and Opportunity Act (WIOA) with investments that connect workers with good jobs and prepare them with skills employers need.

Making a High-Quality College Education More Affordable

An estimated two-thirds of job openings will require some postsecondary education and training by 2020. The Budget:

- Provides Tuition-Free Community College for Responsible Students. The President's America's College Promise proposal creates new federal-state partnerships to provide two years of free community college to responsible students, while promoting key reforms to improve the quality of community college offerings to ensure that they are a gateway to a career or four-year degree. If all states participate, an estimated 9 million students could benefit from this proposal.

- Ensures that Pell Grants Keep Pace with Inflation. Pell Grants are central to our efforts to help low and moderate income students afford college. Since 2013, Pell Grants have been adjusted for inflation annually, but unless Congress acts, this will end in 2017 and the value of Pell Grants will start to erode. The Budget continues the President’s commitment to college affordability by ensuring that Pell Grants keep pace with inflation.

- Keeps Student Loans Manageable. The Administration is helping student borrowers with existing debt manage their obligations through income-driven repayment plans, such as the Pay-As-You-Earn (PAYE) plan, which caps student loan payments at 10 percent of monthly discretionary income. The Budget proposes to extend PAYE to all student borrowers and reform the PAYE terms to ensure that the program is well-targeted and to safeguard the program for the future.

- Simplifies and Expands Education Tax Benefits. While the creation of the American Opportunity Tax Credit (AOTC) in 2009 made college more affordable for millions of students and their families, our system of tax incentives for higher education is complex, and families are sometimes unable to take full advantage of the benefits. Building on bipartisan reform proposals, the Budget would simplify, consolidate, and expand higher education tax credits. It would cut taxes for 8.5 million families and students, simplify taxes for the more than 25 million families and students that claim education tax benefits, and would provide students working toward a college degree with up to $2,500 of assistance each year for five years. Building on recent bipartisan legislation, the Budget also includes a proposal to significantly simplify the Free Application for Federal Student Aid (FAFSA).

- Drives Performance and Innovation in Higher Education. The Budget invests in evidence-based efforts at colleges and universities to dramatically improve educational outcomes for all students through the First in the World Fund, which recognizes that leading the world in education requires higher college graduation rates, not just attendance.

Expanding Technical Training Programs for Middle Class Jobs. Community colleges, like those in Tennessee and Texas, that build strong employer partnerships and offer training in in-demand fields are creating career pathways to the middle class. The Budget requests $200 million for a new American Technical Training Fund to create or expand innovative, evidence-based job training programs in high-demand fields that provide a path to the middle class for hard-working, low-wage Americans. Projects would emphasize strong employer partnerships, work-based learning opportunities, accelerated training, and flexible scheduling for students to accommodate part-time work. Programs could be created within current community colleges, other innovative, non-traditional training providers, or these entities in partnership with secondary programs. This initiative would be housed in the Career and Technical Education Innovation Fund, jointly administered by the Department of Education and the Department of Labor and builds on the Trade Adjustment Assistance Community College and Career Training Grants (for which 2014 was the final year of funding).

Creating Pathways to High-Growth Jobs – Building on the important improvements to the Nation’s job training system through the WIOA, the Budget proposes to support more in-person career counseling and employment services that help unemployed workers find a career-path job or the training they need to prepare for one. It will double the number of workers receiving training through the workforce development system, with a focus on training partnerships for skills needed in industries and occupations experiencing significant growth in the years ahead.

Expanding Apprenticeships and Employer-Validated Credentials – The Budget makes investments to achieve the goal of doubling Registered Apprenticeships across the United States over the next five years to allow workers to learn skills while they are earning a paycheck, and ensures that training leads to high-quality jobs by investing in projects that feature strong industry partnerships and incent additional employer investment in worker training.

Helping Americans Launch and Sustain Their Own Businesses – The Budget funds training to launch and sustain businesses, including the business practices entrepreneurs need to translate a good idea into a growing business. The Small Business Administration's Boots to Business initiative that provides veterans transitioning to civilian life with the training and tools they need to start their own businesses and the Entrepreneurship Education initiative helps small business owners gain the skills and networks they need to grow their business and create new jobs.

Creating a 21st Century Economy

Creating jobs that pay good wages is the best way to grow our economy and the middle class. To compete in the 21st Century economy and make America a magnet for job creation and opportunity, we need to invest in American innovation, strengthening our manufacturing base, keeping our Nation at the forefront of technological advancement, and leading in the development of clean energy alternatives and the promotion of energy efficiency while moving toward energy security through safe and responsible domestic energy production. Because a 21st Century economy requires 21st Century infrastructure, the Budget proposes to modernize our ports and build stronger bridges, better roads, faster trains, and better broadband, creating jobs for thousands of construction workers and engineers, strengthening our communities, and making it easier to do business.

Expanding the National Network of Manufacturing Institutes – To create jobs, continue growth in the industry, and strengthen America’s leadership in advanced manufacturing technology, the Budget provides the resources to launch seven more institutes in 2016, building on the nine institutes already funded through 2015, and calls for the full investment required to complete a national network of 45 manufacturing institutes.

Investing in Home Grown Products and Ideas – The Budget launches a public-private investment fund for advanced manufacturing start-ups, known as the American Made Scale-Up Fund, to help ensure that if a technology is invented in the United States, it can be made in the United States. The Scale-Up Fund will help emerging American-made advanced manufacturing technologies reach commercial scale production in the United States, creating manufacturing jobs for the future and helping to ensure that America keeps making things the rest of the world wants to buy.

Rebuilding Our Infrastructure with Transition Revenue from Business Tax Reform – To create jobs, spur economic growth and provide States and localities the certainty they need to plan for the future, the Budget includes a $478 billion, six-year surface transportation reauthorization proposal paid for with transition revenue from pro-growth business tax reform. This transition tax would mean that companies have to pay U.S. tax right now on the $2 trillion they already have overseas, rather than being able to delay paying any U.S. tax indefinitely. The proposal would allow us to repair existing roads and bridges and modernize our infrastructure with new investments in highways, freight networks, and bus, subway, rapid transit, light rail, and passenger rail systems in our cities, fast-growing metropolitan areas, small towns and rural communities across the country.

Boosting Private Investment through a Rebuild America Partnership – The Budget boosts private investment in infrastructure through a Rebuild America Partnership by establishing an independent National Infrastructure Bank to leverage private and public capital to support infrastructure projects of national and regional significance. The Budget creates America Fast Forward Bonds, which build on the successful Build America Bonds program of taxable bonds. It also creates the new tax-exempt Qualified Public Infrastructure Bonds, which will help states and local communities to attract new sources of capital for infrastructure investment projects.

Cutting Red Tape in the Infrastructure Permitting Process – The Administration continues to modernize and improve the Federal permitting process for major infrastructure projects, cutting through red tape and getting more timely decisions on Federal permits and reviews while ensuring that projects lead to better outcomes for communities and the environment.

Investing in Innovative Research and Development – Our long-term economic competitiveness depends upon continued robust investment in R&D. The Budget provides a 6 percent increase for R&D, including significant investments in basic research and advanced manufacturing technology. The Budget invests in biomedical research—like the BRAIN initiative, which is developing tools and technologies to offer new insight into diseases like Alzheimer’s, and Precision Medicine, which can improve health outcomes and better treat diseases. It also emphasizes agricultural research, looking at climate resilience and sustainability.

Investing in Homegrown Clean Energy – In order to secure America's energy future and protect our children from the impacts of climate change, the Budget invests in clean energy, improving energy security, and enhancing preparedness and resilience to climate change. These investments support the President's Climate Action Plan, helping to expand American leadership in the clean energy economy with new businesses, jobs, and opportunities for American workers.

Keeping Americans Safe at Home and Abroad

Economic growth and opportunity can only be achieved if America is safe and secure. The Budget provides $561 billion in base discretionary funding for national defense—$38 billion above sequestration levels—and $58 billion for Overseas Contingency Operations to provide the resources needed to sustain the President’s national security strategy, protecting the country’s security and well-being both at home and abroad.

Degrading and Defeating the Islamic State of Iraq and the Levant (ISIL) – The Budget provides the necessary resources to degrade and ultimately defeat ISIL, address the ongoing humanitarian crisis in the region, continue efforts to train and equip the Iraqi security forces, support regional partners, and bring stability and promote the conditions for a negotiated settlement to end the conflict in Syria.

Countering Russian Pressure and Aggressive Action Together with our European Allies – In response to the Russian Federation’s aggressive acts, the Budget includes proposals for political, economic, and military support to NATO allies and partner states in Europe, including the governments most targeted by Russian pressure. This includes funding to support efforts to bolster democracy and good governance, increase the capabilities of security forces, strengthen the rule of law and anti-corruption measures, and promote European Union integration, trade, and energy security.

Promoting Prosperity, Security and Good Governance in Central America – The Budget provides $1 billion to support a long-term, comprehensive strategy for Central America designed to contribute to the evolution of an economically-integrated Central America that is fully democratic, provides greater economic opportunities to its people, promotes more accountable, transparent, and effective public institutions and ensures the safety of its citizens, addressing the challenges that have resulted in an influx of migration from the region.

Protecting our Nation Against Cyber-Attacks – No system is immune to infiltration by those seeking to steal commercial or Government information and property or perpetrate malicious and disruptive activity. The Budget provides $14 billion to support cybersecurity efforts across the Government to strengthen U.S. cybersecurity defenses and make cyberspace more secure, allowing the Government to more rapidly protect American citizens, systems, and information from cyber threats.

Confronting the Threat Posed by Infectious Diseases – The Budget provides resources to support the Global Health Security Agenda, increases funding to eradicate polio and other global health challenges, and creates a new Impact Fund for targeted global HIV/AIDS efforts. In addition, the Budget increases funding for domestic preparedness efforts to more effectively and efficiently respond to potential future outbreaks here at home. The Budget also makes investments to address the domestic HIV epidemic to help States develop HIV implementation plans to support the goals of the National HIV/AIDS Strategy.

Combatting Prescription Drug and Heroin Abuse – The Budget includes more than $100 million in new investments across HHS to reduce abuse of prescription opioids and heroin, which together take the lives of 20,000 Americans per year. These new resources will increases funding for every state to expand existing Prescription Drug Monitoring Programs; expand and improve the treatment for people who abuse heroin and prescription opioids; and support dissemination of naloxone, an opioid antagonist that reverses the effects of opioid overdose, by first responders in an effort to prevent overdose deaths in high risk communities.

Honoring Our Commitment to Veterans – The Budget invests in the five pillars the President has outlined to support our Nation’s veterans: providing the resources and funding they deserve, ensuring high-quality and timely health care, getting veterans their earned benefits quickly and efficiently, ending veteran homelessness, and helping veterans and their families get good jobs, education, and access to affordable housing.

Creating a Government for the Future

The President is committed to creating a Government that makes a significant, tangible, and positive difference in the economy and the lives of the American people, and to driving lasting change in how Government works. This Administration has launched successful efforts to eliminate wasteful IT spending, reduce the Federal real property footprint, modernize and improve citizen-facing services, and open tens of thousands of Federal data sets to spur innovation in the private sector.

Supporting the President’s Management Agenda – The Budget includes initiatives to improve the service we provide to the American public; to leverage the Federal Government’s buying power to bring more value and efficiency to how we use taxpayer dollars; to open Government data and research to the private sector to drive innovation and economic growth; to promote smarter information technology; create new Idea Labs to support employees with promising ideas, and, to attract and retain the best talent in the Federal workforce.

Supporting Digital Service Delivery for Citizens – In 2014 the Administration piloted the U.S. Digital Service, a unit of innovators, entrepreneurs, and engineers. This team of America’s best digital experts has worked in collaboration with Federal agencies on their high impact, citizen-facing programs to improve how citizens and businesses experience government services. The Budget includes $105 million to scale and institutionalize this approach and create digital services teams in 25 key agencies. It also includes increased funding to scale up the central USDS team to aid in building the agency teams, increase oversight and accountability for IT spending, improve IT procurement, and improve agency cybersecurity and cyber readiness.

Building Evidence and Encouraging Innovation – The Budget invests in developing and testing effective practices, recruiting social and behavioral sciences experts, and providing better information on what works in key areas ranging from improving college completion to creating greater accountability for job training programs to improving the data available on Indian Country.

Reforming the Government to Win in the Global Economy – The Budget also includes proposals to consolidate and reorganize Government agencies to make them leaner and more efficient, and it increases the use of evidence and evaluation to ensure that taxpayer dollars are spent wisely on programs that work.

Achieving Fiscal Sustainability and Promoting Sustainable Growth

This year’s Budget supports the President’s ambitious vision for supporting growth and opportunity, and does so while meeting a key test of fiscal stability: reducing deficits to below 3 percent of GDP, stabilizing debt as a share of the economy, and putting it on a declining path. It achieves these goals by replacing mindless austerity with smart reforms, paying for all new investments, and obtaining $1.8 trillion in deficit reduction primarily from health, tax, and immigration reforms.

Reversing Mindless Austerity – Returning to the mindless austerity of sequestration in 2016 would bring discretionary funding to its lowest level, adjusted for inflation, since 2006. The Budget proposes to end sequestration, fully reversing it for domestic priorities in 2016, matched by equal dollar increases for defense funding. These investments are more than paid for with smart spending cuts, program integrity measures, and commonsense loophole closers – including, for example, targeted reforms to crop insurance programs; program integrity investments across a range of programs; and closing the “carried interest” tax loophole.

While many of the investments described above are made possible by reversing sequestration, the contrast between what can be achieved under sequestration versus under the President’s Budget is particularly stark in a few key areas:

· Research and Development. Under 2016 sequestration levels, assuming roughly current funding patterns, research funding adjusted for inflation would reach its lowest levels since 2002 – other than when sequestration was in full effect in 2013. By comparison, the President’s Budget would increase R&D funding by nearly 6 percent over 2015, including investments in Precision Medicine, the Brain Initiative, and other areas.

· Early Learning. The last time sequestration took full effect in 2013, more than 57,000 children lost access to Head Start and Early Head Start, with enrollment falling to the lowest level since 2001. Researchers have established that supporting children during this critical stage yields benefits that far outweigh the costs of the investment. The President’s Budget makes major investments in early learning (described above), including, for example, making sure children can be served in full-day, full-year Head Start programs that research shows lead to better outcomes for kids.

· National Security. The Joint Chiefs have made clear that a return to sequestration-level cuts would significantly reduce the military’s ability to fully implement the President’s defense strategy. The military would be unbalanced and eventually too small and insufficiently modern to meet the needs of our strategy, leading to greater risk of longer wars with higher casualties for the United States and our allies and partners. In contrast, the Budget makes the investments needed to protect the Nation’s security and well-being both at home and abroad.

Paying for all new investments – Every investment in the Budget – including the new and expanded tax credits for middle-class and working families, and mandatory investments in community college and preschool – is more than fully paid for through spending or tax reforms. In particular, the Budget pays for many of its investments in helping middle class families get ahead through three important reforms to the tax system. First, it would eliminate what may be the largest single loophole in the tax code – a provision known as “stepped-up basis” that lets wealthy households avoid taxes on hundreds of billions in capital gains taxes each year. Second, it would raise the top capital gains and dividend rate for high-income households to 28 percent, the rate under President Reagan. Third, it reforms financial sector taxation to make it more costly for large, highly-leveraged financial firms to finance their activities with excessive borrowing, reducing risks to the broader economy.

Reducing Deficits through Health, Tax, and Immigration Reform – While the Budget’s new investments are paid for with smart reforms across a range of programs, as well as commonsense tax loophole closers, the $1.8 trillion in deficit reduction in the Budget is achieved primarily by focusing on the key drivers of our Budget challenges: health care cost growth and inadequate revenue levels in the face of an aging population. Specifically, the Budget includes:

· $400 Billion in Health Savings. Over the last few years, we’ve seen historically slow rates of health care cost growth, which are already yielding fiscal dividends. The Budget includes $400 billion in health savings that build on the Affordable Care Act to help maintain slower cost growth while improving health care quality – complementing the Administration’s other efforts on delivery system reform. Notably, the Budget’s health savings grow over time – raising about $1 trillion in the second decade, and extending the Medicare Hospital Insurance trust fund solvency by approximately 5 years.

· $640 Billion in Net Deficit Reduction from Tax Reforms. The Budget raises about $640 billion in net revenue for deficit reduction from curbing high-income tax expenditures. These savings come from limiting tax benefits that are not efficient in achieving social goals, raising revenue without raising tax rates.

· $160 Billion in Savings from Immigration Reform. This year’s Budget again reflects the President’s support for commonsense, comprehensive immigration reform along the lines of the bipartisan Senate-passed bill. In part because it helps balance out an aging population, immigration reform helps both the Budget – by almost $1 trillion over two decades – and the Social Security Trust Fund, closing about 8 percent of the Trust Fund shortfall and moving insolvency out two years. It also strengthens the economy by boosting GDP growth, reducing the deficit, raising average wages for U.S.-born and immigrant workers, increasing the size of the labor force, and raising productivity.

Through these policies, the President’s Budget brings annual deficits well below the 40-year historical average of 3.2 percent of GDP during every year of the budget window. A key test of fiscal sustainability is whether debt is stable or declining as a share of the economy, resulting in interest payments that consume a stable or falling share of the Nation’s resources over time. The Budget meets that test, showing that investments in growth and opportunity are compatible with also putting the Nation’s finances on a strong and sustainable path.

###

The GAVI Pledge: An Investment in Future Generations

Posted by on January 27, 2015 at 10:00 AM ESTIt’s a rite of passage — parents taking their children to a doctor or nurse to be immunized against diseases that once threatened their grandparents’ generation. Yet, still today, too many children in the world’s poorest countries suffer from vaccine-preventable, life-threatening illnesses such as measles, diarrheal diseases, and pneumonia. And even here at home, we are seeing increasing outbreaks of measles due to gaps in vaccine coverage.

Today, the United States has joined our friends and allies to take a giant leap forward to address these preventable tragedies. Consistent with President Obama’s vision to end extreme poverty and fight disease, the United States is committing $1 billion over four years to GAVI, The Vaccine Alliance.

An Improbable Public Interest Start Up

Posted by on January 21, 2015 at 12:05 PM EST[To apply and learn more about the U.S. Digital Service, check us out here.]

A year ago, I returned to California after working on the rescue team to fix Healthcare.gov. I slept for a couple of weeks, and I began the task of processing what I had seen and done. I knew that Healthcare.gov was the most important work I had been a part of. I saw that technology in parts of the government was in bad shape.

But there was hope. When asked, some of the very best engineers and troubleshooters in the world willingly put their lives on hold to dedicate their time to this very difficult problem. When they got there, they found government officials and contractors

,who also wanted nothing more than to fix the site and who were ready and willing to work together to make it happen. There was limitless opportunity to do more.In May, we started to talk about creating the U.S. Digital Service. This was a daunting idea—because the challenges we face are so complicated and so important. But, I had seen first-hand how we can make a real difference when we bring the best talent to our toughest problems. Knowing what I knew, it would have been disgraceful not to try. So in August, I moved to Washington, D.C., to start the U.S. Digital Service with one other employee, Erie Meyer. Since then, she and now many others have helped me navigate, Forrest Gump-like, a series of milestones and major events that I only partially understand.

Today, we have a few dozen world-class technologists working at the U.S. Digital Service. We have technology experts working on the veterans' disability claim backlog, Freedom of Information Act, climate change action plan, Ebola, and so many pressing issues that make a real difference in people’s lives. We kept quiet for a while to see if our ideas proved out, but now it is time to go bigger. We need more technologists to join us as we strive to:

- Deliver veterans their earned benefits faster.

- Connect all people with student loan debt to their best, most affordable repayment options.

- Make Social Security benefits as simple to manage as a social media profile.

- Unlock capital and other resources available to startups through the Small Business Administration.

- Create visa applications and passport renewals to be as clear as ordering a book online.

Lots of people have asked me what's been most surprising about my time in government so far--I think they're expecting me to say the bureaucracy, the Blackberrys, or the curious practice of writing everything in Powerpoint form before printing it and handing it out.

But what's truly been the biggest surprise is how the very best engineers, technologists, and designers are ready to give up the perks of the private sector and work alongside equally talented government colleagues to take on the toughest problems in government. They are seizing the tremendous opportunity we have to transform the way government delivers services to people. They are not discouraged by challenges. They are energized. Mastering technology is one of the greatest challenges facing our government, and our generation is answering the call.

Our team already includes the lead developer on Google Chrome, the third engineer ever hired at Amazon, and the former Operations Director at Twitter--all people who had likely never considered serving in government, until they were asked to. And now they are applying their cutting-edge skills to fixing the very services that their friends, neighbors, and so many others depend on.

We are recruiting talented professionals like these to form Digital Service teams throughout the government. We are partnering with dedicated public servants to embed these teams into agencies where they can gain traction on mission critical problems that have the most impact on everyday people. We are lucky to already have 18F at the General Services Administration, and the White House's Office of Science and Technology Policy, as part of the team.

We're especially proud of our work at the Department of Veterans Affairs, where we're helping build a Digital Service team. In its short time on the ground, this team has already worked on projects like the Veteran's Employment Center. This one tool, built in three months, delivered the functionality of three different planned IT systems an entire year early and eliminated about $14 million in planned procurements and contracts. The cost savings matter. But most important are the stories of customers like Vickie, a homeless vet in Seattle who—with the help of the tool—landed two job offers.

I don't blame you if you are skeptical that we can fix the biggest problems in government. I used to be, too. But every day, I am reminded of a quote by President Kennedy that is sewn into the Oval Office rug: "No problem of human destiny is beyond human beings."