The Recovery Act Blog

First Recovery Act Electric Vehicle Delivered Today

Posted by on May 13, 2010 at 3:04 PM ESTFor months now, a team at an Indiana plant has been hard at work preparing to manufacture electric delivery trucks that are entirely powered by plug-in power. They’ve been installing equipment, retrofitting an old manufacturing facility, assembling parts, testing the new technology – and today they became the very first Recovery Act recipient to deliver an electric vehicle with the advanced battery and electric drive grants the President announced last year as they unveiled their new truck today and handed the keys off to the customer.

Perhaps the President was on to something last year when he chose Navistar’s Wakarusa plant as the location to announce these awards – because that Indiana team marking this important milestone today is none other than the fine folks at Navistar. You may remember some of them from this video of the President’s visit there last year. Their community was hard-hit when a local employer, RV manufacturer Monaco Coach, went bankrupt during the economic downturn. Like communities across the country, they’re still making their way to back to economic recovery – but they’re starting to see a brighter future thanks to the Recovery Act. The electric truck being unveiled today? It was manufactured at one of Monaco’s old facilities - which is today Navistar’s new electric vehicle facility. And it was made with the help of some former Monaco employees – who, thanks to the Recovery Act, are now on the job at Navistar.

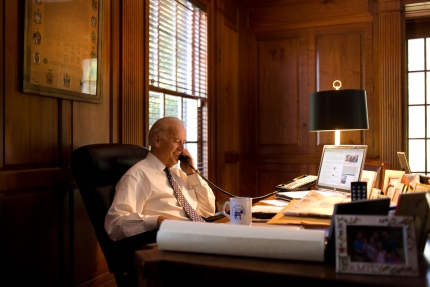

The folks at Navistar took a few minutes in the middle of their busy launch day to take a phone call from a special guest.

Vice President Biden congratulated the team not only reaching this important milestone, but on playing a leading role in putting Recovery Act dollars to work manufacturing smarter, cost-efficient vehicles and helping build an industry that will create good middle-class jobs for years to come. This is just the beginning for Navistar’s electric vehicle program – they plan to eventually develop and deploy 400 of these trucks and put sixty people to work in the process thanks to the Recovery Act investment.

And this wasn’t just an accomplishment for Navistar, but for the entire advanced battery and electric vehicle industry. In fact, the battery that is powering the new electric delivery truck unveiled today was built in Michigan by Michigan workers at A123 Systems – also thanks to a Recovery Act award announced last year.

It’s easy to get a look at this electric delivery truck and the other advanced technology the Recovery Act awardees are producing and think this is just about the future. But Navistar and companies like it are bringing the future to market today. In fact, this truck isn’t a model or test vehicle – it’s going to be immediately put on the road by the customer making deliveries in a smarter, more cost-efficient way. A plug-in powered vehicle that can carry in excess of 2 tons a distance of up to 100 miles per charge – that’s not the future, that’s today.

And because of the advances the more than 40 recipients of the Recovery Act’s $2.4 billion investment in electric vehicles are making today, we’re going to go from two advanced vehicle battery factories last year to 30 by 2012. We’ll go from two percent of the world’s advanced vehicle battery market share to 20 percent by 2012. And we’re not just making the parts here at home, we’re also helping plant the power stations to fuel electric cars all over the country. So while Navistar’s customer will hit the road with a brand new electric vehicle soon – it may not be long before you do too.

Liz Oxhorn is Recovery Act Communications Director

Learn more about EconomyThe Direct and Indirect Benefits of the Recovery Act

Posted by on April 26, 2010 at 4:45 PM ESTThe National Association for Business Economics (NABE) has a new survey of 68 of its members out today that shows that the group, which is made up of private sector and industry trade association economists, is newly optimistic about hiring and job growth. That’s good news – and right in-line with what many public and private forecasters have had to say about our economy recently.

But you may have also noticed an item in their survey that stands in pretty stark contrast to what leading economists have found. According to NABE:

- The vast majority (73%) of respondents “reported the fiscal stimulus in February 2009 has had no impact on employment to date.”

Now we know that that the Recovery Act hasn’t just had an impact on employment so far – it’s had a BIG impact on employment. From private forecasters like Moody’s Economy.com and IHS Global to public economists like the non-partisan Congressional Budget Office, economists across the board have gone on-the-record saying that the Recovery Act is already responsible for millions of jobs nationwide and contributing to the economic growth that is fueling our recovery. Here are just a few of them:

- IHS Global Insight chief economist Nariman Behravesh: Without the stimulus, said Nariman Behravesh, chief economist at IHS Global Insight in Lexington, 3 million more Americans would be out of work and the national unemployment rate, just below 10 percent, would be 12 percent - or higher. “There is no doubt that it had an impact,’’ Behravesh said. “When there is a shortfall in private sector demand, there is a role for government to step in and fill the gap.’’ [The Boston Globe, 3/7/2010]

- Stuart Hoffman, chief economist at PNC Bank: "The stimulus worked," said Stuart Hoffman, chief economist at PNC Bank. Without it, "the unemployment rate would probably be closer to 11 percent and the economy might not have grown at all last year.” [ABC News, 2/18/10]

- Economist Stephen Herzenberg: “Cut through all the numbers, though, and this is what you find: The American Recovery and Reinvestment Act saved us from plunging into a second Great Depression… The Recovery Act brought the economy back from the brink. And these figures probably underestimate its impact, because they don't take market psychology into account. When the legislation passed, the economy was plunging at a pace similar to that of the 1930s. If Congress had sat on its hands, unemployment now could easily be 12 percent to 15 percent - and on its way to 20 percent.” [Philadelphia Inquirer, 1/17/10]

- Mark Zandi of Moody’s Economy.com: “The catalyst for the transition from recession to recovery was the unprecedented monetary and fiscal stimulus provided by government policymakers...The Recovery Act’s expanded unemployment insurance benefits, financial aid to state governments, tax cuts for households and businesses, and tax credits for home purchases all contributed to the turn in the economy. The recovery has gained traction in recent months as the sources of GDP growth have broadened to include consumer spending, business investment and exports. The job market has also stabilized. After declining by some 8.4 million jobs between December 2007 and February 2010, payroll employment expanded by 162,000 in March.” [Testimony before Senate Finance Committee, 4/14/2010]

And economic experts at major trade associations say that the Recovery Act has had a substantial impact on employment in their industry:

- Associated General Contractors economist Ken Simonson: “’The stimulus is saving construction jobs, driving demand for new equipment and delivering better and more efficient infrastructure,’ said Ken Simonson, an economist with Associated General Contractors, which represents a large part of the construction industry. Simonson calculated that roughly 15,000 jobs have been created or preserved for every $1 billion the government has spent on infrastructure projects, which is well above the Association’s year-ago estimate of 9,700 jobs. He said that stimulus-funded road construction projects alone have created 280,000 jobs over the past year, as well as an unknown number of ancillary jobs for subcontractors supplying equipment and raw materials.” [San Diego Union Tribune, 2/17/10]

- Rhone Resch, President and CEO of the Solar Energy Industries Association: “One year ago today, President Obama visited a solar installation to sign the American Recovery and Reinvestment Act. The purpose of the bill was to stimulate immediate job growth with a strong emphasis on clean energy technologies like solar. And that is exactly what happened. In 2009, the Recovery Act helped the solar industry create 18,000 new American jobs. More than 50 new solar energy manufacturing plants are under construction now with the support of ARRA.” [Solar Energy Industries Association, 2/17/10]

So how exactly did this group of 68 NABE members get it so wrong? Well, there is more than meets the eye here…

If you take a closer look at the survey, you will find that they were asked about conditions at their company:

- The NABE April 2010 Industry Survey report presents the responses of 68 NABE members to a survey conducted between March 25, 2010, and April 10, 2010, on business conditions in their firm or industry and reflects first-quarter 2010 results and the near-term outlook.

Now keep in mind that the Recovery Act was specifically designed to get the most employment bang for the taxpayer buck through a combination of targeted relief for hard-hit families and businesses and seed money to jump-start job-creating projects across a wide array of industries and communities. Those targeted investments multiply down the supply chain and across industries to grow the economy as a whole. What it wasn’t designed to be is a handout to every company across the country – so we wouldn’t expect that every company surveyed would have received Recovery Act funding. But interestingly, if 73 percent of the companies surveyed saw no impact on employment to-date, that could mean more than 25 percent of them did see a direct employment benefit – which would be a pretty impressive sign that the Recovery Act has had a broad reach so far.

And keep in mind that the Recovery Act hasn’t just created jobs directly by paying salaries for workers. Recent analysis from the Council of Economic Advisors found that about half of the jobs created by the Recovery Act so far were as a result of tax relief and income supports like unemployment benefits – money that doesn’t go to companies, but to consumers. When consumers have more money in their pockets, they spend it purchasing from companies just like the ones surveyed by NABE. So while the economic experts at these companies may not have seen the dollars themselves, they are no doubt seeing the impact of them as they, along with other companies nationwide, have helped create the roughly 2.5 million jobs supported by the Recovery Act so far.

But don’t just take our word for it. This is what NABE had to say as recently as last month about how the Recovery Act is helping grow the economy:

- "Eighty-three percent believe that GDP is currently higher than it would have been without the 2009 stimulus package (ARRA)."

- And more than half of the respondents to that survey “view[ed] the 2009 stimulus package as a positive factor for the economy over the longer term.”

Liz Oxhorn is Recovery Act Communications Director

Learn more about EconomyRecovery Act in Action: A Window into a Change of Heart

Posted by on April 1, 2010 at 7:02 PM ESTEditor's Note: In case you missed them, read Part 1, Part 2, Part 3 and Part 4.

For this week's episode of Recovery Act in action, I spoke to a business owner who started out skeptical about the benefits of the Recovery Act.In fact, he was so concerned that the Act wouldn't help the economy, he worried that the Recovery Act was "mortgaging the future."

Fast forward to the present, where the Recovery Act has created a wave of new demand for the energy efficient windows his company makes.Based on that demand, his sales have picked up such that he's added 100 new workers, in occupations ranging from line workers to managers.

"He" is Alan Levin, owner and CEO of Northeast Building Products, a Philadelphia-based manufacturer of energy-efficient windows.When the Recovery Act was passed last February, he figured it was another government program that was going to bypass the little guy.A small business like his would never see any of the benefits.

"I was skeptical," Alan told me when I reached him this week."These numbers people were throwing around—hundreds of billions of dollars—they're unfathomable. We see ourselves as just a little mom and pop operation and I never imagined a program like this would reach down and help the way it has."

Yet just a few months after the Act went into effect, he was getting calls for new orders generated by two different measures in the Recovery Act.

One is a grant program for cities and states to do energy-efficient retrofits of public housing.The other is a program that gives homeowners a tax credit for putting in high-efficiency windows and making other energy-saving improvements to their own homes.

That tax credit can put up to $1,500 straight into a homeowner's pocket, not to mention the savings on energy bills from the windows themselves.

The way Alan tells the story, the credit has had a dramatic impact on his industry. "It used to be the contractors wanted to know, ‘What's your cheapest window?' Now they're asking, ‘What's the most energy efficient window at the best price? They're looking at value in a way they never have before."

In other words, not only are these programs providing jobs for Alan's new hires and income for their families, they're "greening" the market while lowering energy bills for his customers.For middle-class families feeling squeezed, those lower bills provide some much-needed relief to their budgets.

In fact, this tax credit is still available, so it's not too late to take advantage of it yourself (check out this new tool to learn about this and other Recovery Act tax benefits).You can get up to $1,500 to make your home more energy efficient, save yourself some money by cutting down on your energy bills, and maybe even put someone back to work at a business like Alan's.

Jared Bernstein is Chief Economic Advisor to the Vice President

Learn more about EconomyRecovery Act in Action #4: A 48C Story

Posted by on March 24, 2010 at 12:33 PM ESTEditor's Note: In case you missed them, read Part 1, Part 2 and Part 3.

Today’s Recovery Act in Action episode takes place in Durham, NC at Cree, Inc., America’s foremost producer of LED lighting. It’s a tale of many important economic advances coming together: cutting- edge energy-saving technology, export-led growth, and most importantly, good manufacturing jobs here in the US. And at the center of the story is a Recovery Act tax credit that helped to pull a lot of this together.

Cree was chosen for a $39 million tax credit through this Recovery Act program, which is called the Advanced Energy Manufacturing Tax Credit, nicknamed 48C for its line in the tax code. So far, the investments they’re using the credit to make, along with the private capital they’re putting into those investments, have led to 375 new factory jobs in the last year, and they’re planning to add 300 more next year.

The 48C credit has a unique characteristic that makes it especially important in today’s economic landscape. For years, we’ve used the tax code to subsidize the generation and use of clean, renewable energy. That’s a good thing, and wholly consistent with President Obama’s environmental vision.

But another part of that vision calls for the growth of new, clean energy industries, providing American workers with the opportunities to build the equipment of the renewable revolution here in the US. The 48C tax credit incentivizes exactly that: it’s a 30% credit going to domestic companies building domestic capacity to meet this new and growing source of demand. And that means instead of importing these goods, we can build them here for our markets, and like Cree, sell them abroad into others’ markets (80% of Cree’s revenue comes from exports).

The Recovery Act included $2.3 billion for the 48C program, but we quickly got more applications than we had money for. Given that a) we have a bunch of good applications we’d like to support, and b) we want to keep planting those seeds to grow new jobs today and new industries tomorrow, the President took the logical step of calling for a $5 billion expansion of the program.

Well, it’s one thing to hang around DC and try to make the case for the extension, but we thought we should also hit the road with the Vice President’s Middle-Class Taskforce and check this Cree story out for ourselves.

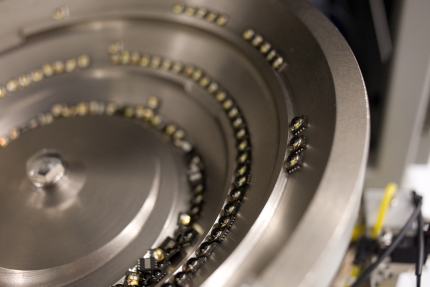

The factory was incredibly impressive. They employ about 1,500 workers in their Durham headquarters, and a couple of the engineers were kind enough to show me and Ron Bloom (the Administration’s Senior Counselor for Manufacturing Policy) part of the production process, the part where they test the LED lights to make sure they’re flawless.They’ve got multiple layers of quality control and when it’s all done, you end up with this strip of LED lights, ready to go into a huge variety on end-user products. LEDs can light up your smart phone or your parking lot, and relative to conventional lights, they can reduce energy use by more than 60%.

We spoke to Cree’s CEO about the tax credit and he stressed two points. One, it was instrumental in their decision to hire 375 new workers this year and their plans to add 300 more next year. But it was also a critical motivator in bringing in private capital from the sidelines. Once investors saw that the Federal government was serious about seeding investment in clean energy, they were ready to take the plunge themselves. This public/private partnership is essential to bringing these investments, and the jobs they create, to scale.

Cree, the Recovery Act, and 48C are a true American success story. We’re going to do all we can to keep that story going.

Jared Bernstein is Chief Economic Advisor to the Vice President

Learn more about EconomyTax Returns Are Up 10% - Find Out If You Qualify for Recovery Act Tax Credits

Posted by on March 22, 2010 at 12:09 PM ESTThanks in large part to tax benefits in the Recovery Act, taxpayers are seeing larger refunds from their 2009 tax returns this season -- according to the IRS, average tax returns are up by almost 10 percent this year.

While these tax return averages are interesting ... the question you're probably asking is "Do I qualify for any of those benefits?" To help you get answers, we've launched an interactive Tax Savings Tool to help you understand which Recovery Act tax benefits you should include in your filing.

Check it out: http://obamawhitehouse.archives.gov/recovery/tax-saving-tool

This morning, the Vice President talked about the benefits for taxpayers on the Today Show (video):

The big guys know all the credits and deductions to claim during tax season, but we want middle class families to know just how much is out there for them this year thanks to the Recovery Act – and how to take advantage of it. From help with college expenses to credits for cost-saving, energy-efficiency home improvements, these Recovery Act tax credits not only provide some needed relief for working Americans, but also help them invest in their families’ futures.

Here is a quick run-down of some key tax benefits available thanks to the Recovery Act:

- Making Work Pay: 95 percent of working families are receiving the Work Pay tax credit of $400 for an individual or $800 for married couples filing jointly in their paychecks in 2009.

- College Expenses: Families and students are eligible for up to $2500 in tax savings under the American Opportunity Credit.

- Purchase of First Home: Homebuyers can get a credit of up to $8000 for first homes purchased by April 30, 2010 under the First Time homebuyer tax credit.

- Energy Efficiency and Renewable Energy Incentives: Taxpayers are eligible for up to $1500 in tax credits for making some energy-efficiency improvements to their homes.

- New Vehicle Purchases: Taxpayers can deduct state and local sales taxes or fees for vehicle purchases under the vehicle sales tax deduction.

- Expanded Family Credits: Moderate income families with children may be eligible for an increase under the Earned Income Tax Credit and the additional Child Tax Credit.

- Unemployment Benefits Tax Free in 2009: the Recovery Act made the first $2400 of unemployment benefits received in 2009 tax free.

The Recovery Act’s tax benefits of nearly $300 billion are not only providing some relief for middle class families, but also helping to jumpstart the economy and create more clean-energy, manufacturing, and construction jobs. To learn more, visit Recovery.gov.

The Master Recovery Act Transportation Map

Posted by on March 11, 2010 at 2:57 PM ESTSometimes it's good to look up close at how a single Recovery Act project is changing a community for the better and putting people to work. Other times it's instructuve to take a few steps back and look at the big picture. As an example of the latter, the web team at the Federal Highway Administration created an online map of the U.S. that shows over 12,000 Recovery Act road projects. Each of the dots represented on the map represents a project. The full, interactive version on the map allows you to click the dots in order to learn more about these projects.

Secretary Ray LaHood’s Blog talks more about the Recovery Act map:

More important than the number of dots is that every dot in every state represents jobs. And whether we're keeping someone from unemployment or hiring someone back, these Recovery Act projects are creating jobs. Tens of thousands of jobs.

Those dots also add up to a lot of safer, smoother miles for you, your loved ones, and the commercial truck drivers who transport the goods we use from place to place.

In October 2009, President Obama spoke about the benefits that the construction industry was seeing as a result of the Recovery Act, including thousands of highway projects which also helped to create private sector jobs.

What makes these kinds of projects so important isn't just that we're creating so many jobs. It's that we're putting Americans to work doing the work that America needs done. We're rebuilding our crumbling roads, our bridges, our waterways. We've already approved nearly a thousand transportation projects to upgrade airports, railroads, mass transit systems, and shipyards. We're strengthening our nation's infrastructure in ways that will leave lasting benefits to our communities, making them stronger, making them safer, and making them better places to live.

Visit WhiteHouse.gov/Recovery or Recovery.gov to learn more about the Recovery Act and projects in different states.

Learn more about Rural

- &lsaquo previous

- …

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- …

- next &rsaquo

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues