Remarks by the President on Helping Responsible Homeowners

Private Residence

Reno, Nevada

12:00 P.M. PDT

THE PRESIDENT: Well, good afternoon, everybody. (Applause.) And thank you for arranging a beautiful day. This is just a spectacular afternoon and I’m thrilled to be here.

We all know how difficult these past few years have been for this country, but especially for this state. After the worst recession in our lifetimes -- a crisis that followed the collapse of the housing market -- it’s going to take a long time for the economy to fully recover. More time than any of us would like. But there are plenty of steps that we can take to speed up the recovery right now. There are things we can do right now to help create jobs and help restore some of the financial security that too many families have lost.

Now, I have to say that there are a few too many Republicans in Congress who don’t seem to be as optimistic as we are. They think that all we can do are try the things that have been done in the past -- things that they’ve tried in the past. So they want to cut more taxes, especially for the wealthiest Americans. They want to cut back on the rules that we put in place for banks and financial institutions. They’ve said that they want to let the housing market hit bottom, and just hope for the best. That’s it. We’ve heard those ideas before. That’s their economic agenda. And I’ll be honest with you, I don’t buy it. I think they’re wrong.

We tried their ideas for nearly a decade and they didn’t work. And I refuse to sell this country short by going back to the exact same ideas that helped to get us in this mess in the first place. Our goal is to build an economy where hard work and responsibility are rewarded -- where you can find a good job, make a good wage, own your own home, maybe start a business, send your kids to college. Hopefully, their lives will be even better than ours. That’s what I wish for Malia and Sasha, and I know you guys feel the same way who have kids.

And that’s where we need to go. I’ve been pushing Congress to help us get there by passing a few common-sense policies that we’re convinced will make a difference. We even made a handy “To-Do” list for Congress so they can just check them off -- it’s a list like Michelle gives me. (Laughter.) I know Paul is familiar with that list. He gets it from Val.

Now, there are only five things on this list -- because I don’t want to overload Congress with too much at once. But they’re ideas that will help create jobs and build a stronger economy right now.

So first up on the list -- it makes absolutely no sense that we actually give tax breaks to companies that ship jobs and factories overseas. That doesn’t make any sense at all. (Applause.) So we told Congress it’s time to end the tax breaks for companies that ship jobs overseas, and use that money to cover moving expenses for companies that bring jobs back to America. (Applause.)

Second, instead of just talking about job creators, Congress should help small businesses and help small business owners who create most of the new jobs in America. So we want to give them a tax break for hiring more workers and paying them higher wages.

The third thing on our “To-Do” list -- Congress should extend tax credits that are set to expire for our clean energy companies. These businesses are putting folks to work here in this state of Nevada. Last time I was here, in fact, I went to see a huge solar plant, solar energy plant. A lot of folks are working both in the construction of it and maintaining it. That’s happening all across the country. And so we’ve got to make sure that we are helping those folks, because that helps us break our dependence on foreign oil. Over the long term that will help drive down gas prices and it puts people to work right now. It’s the right thing to do. (Applause.)

Fourth, Congress should create a Veterans Jobs Corps so that we can help communities hire returning heroes -- our veterans -- as cops and firefighters and employees at national parks -- because nobody who fights for this country should ever have to come home and fight for a job or fight for a roof over their heads. (Applause.)

All right, so that’s four -- which brings me to the fifth. The fifth thing on the list, and that’s why I’m here today. I’m calling on Congress to give every responsible homeowner the chance to save an average of $3,000 a year by refinancing their mortgage. It’s a simple idea. (Applause.) It makes great sense. And I know it will have an impact.

Last October, I was in Clark County, where I announced new steps to help responsible homeowners refinance their homes. And at the time, Congress wasn’t willing to act, so we did. We went ahead and did what we could do administratively, without a new law being passed. And as a result, Americans who were previously stuck in high interest loans have been able to take advantage of these lower rates. And they’ve been able to save thousands of dollars every year.

And it turns out that two of those people are your neighbors, Paul and Valerie Keller. (Applause.) So I just had a chance to visit with Paul and Valerie and look at their beautiful home and check out the grill out back. (Laughter.) Valerie says Paul is a pretty good cook, so I’m going to take her word for it.

The Kellers have lived in this house for 14 years. Val works nearby, helping secure loans for farmers and ranchers. Paul is a retired electrical contractor who started a family business with their son. Last year, with mortgage rates at historic lows, the Kellers decided it would make sense for them to refinance. They thought it would be easy, since they’re current on their mortgage, they make their payments on time. So this is an example of responsible homeowners doing the right thing.

But when they tried to refinance, they were told they couldn’t do it. Because the Kellers’ house, like thousands of others in this state and probably some of the neighbors here, their house is underwater, which means that the price is currently lower than what they owe on it. So they were hit -- you were hit with a historic drop in housing prices which caused the value of the homes in their neighborhood to plummet. And a lot of banks historically have said, well, we’re not going to refinance you if your home is underwater.

Now, luckily, the Kellers saw my announcement that I had made down in Clark County. So I’m assuming it must have been Val because whenever something smart is done, it’s usually the wife in the house. (Laughter.)

So they called their lender, and within a few months, within 90 days, they were able to refinance under this new program that we set up. Their monthly mortgage bill has now dropped $240 dollars a month, and that means every year they’re saving close to $3000. (Applause.)

Now, Val says that they’ve been talking to some of their neighbors -- maybe some of you are here today -- and you’re saying, well, that sounds like a pretty good idea. And a lot of folks across the country recognize this is a smart thing to do not only for homeowners but for our economy, because if Paul and Val have an extra $240, $250 a month, then they might spend it on the local business. They might go to a restaurant a little more often. They might spoil their grandkids even more. (Laughter.) And that means more money in the economy, and businesses do better, and slowly home prices start rising again. So it makes sense for all of us.

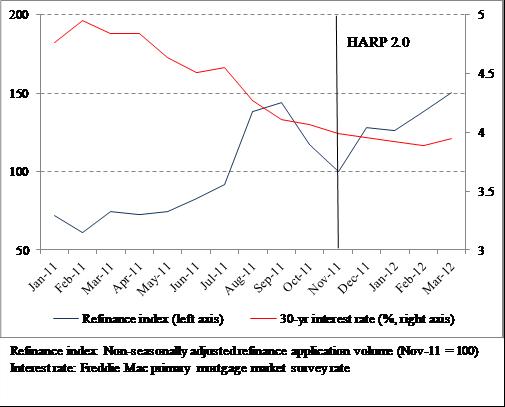

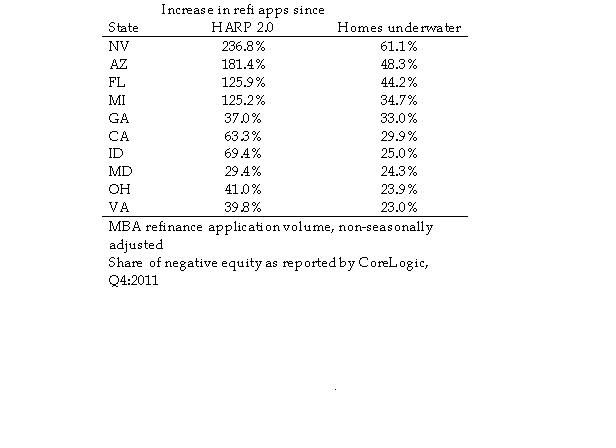

And the good news is, since I’ve made this announcement, refinancing applications have gone up by 50 percent nationwide and 230 percent here in Nevada alone. That’s the good news. People are taking advantage of this. (Applause.) That's what we want to see.

But here's the only catch -- and this is where you come in, because you're going to have to pressure Congress: The pool of folks who can refinance right now, when their homes are underwater, is still too small. The reason the Kellers were able to refinance is because the only thing that we could do without congressional action was to give opportunities for refinancing for folks with a government-backed loan, an FHA-backed loan. But in order to expand that opportunity -- we want to include everybody; people whose mortgages aren't government-backed. (Applause.) And in order to do that we've got to have Congress move.

There’s absolutely no reason why they can’t make this happen right now. If they started now, in a couple of weeks, in a month, they could make every homeowner in America who is underwater right now eligible to be able to refinance their homes -- if they're making their payments, if they're responsible, if they're doing the right thing. And think about all those families saving $3,000 on average a month year-- that's a huge boost to our economy. And for some of you who are underwater, you might say, instead of spending that money I can plow that back into equity in my home, and build that back up, which would further strengthen housing prices here in Nevada and around the country.

So it's the right thing to do. There's already a bill in the works. It's supported by independent, nonpartisan economists. It's supported by industry leaders. Congress should pass it right now. (Applause.)

And let me just say this -- maybe there are some members of Congress watching. (Laughter.) If you need some motivation to make this happen, then you should come to Reno and you should visit with folks like the Kellers. (Applause.) I'm not saying the Kellers want all these members of Congress up in their house. (Laughter.) It's bad enough having me and Secret Service in there. (Laughter.) But at least they -- they probably wouldn't mind saying hello and talking to them here in front of their house. (Laughter.) But they should talk to people whose lives are better because of the action that we took.

All over the country, there are people just like Paul and Val, folks just like you, who are doing everything they can to do the right thing -- to meet their responsibilities, to look after their families, to raise their kids right, give them good values. You're not looking for a handout. You just want to make sure that somebody is looking out for you, and that when you do the right thing that you're able to keep everything that you’ve worked for. That’s what folks are looking for, and that’s what they expect from Washington: to put the politics aside and the electioneering aside, and just do what’s right for people. (Applause.)

So I need all of you and everybody who’s watching to push Congress on their “To-Do” list. Nag them until they actually get it done. We need to keep moving this country forward. Send them an email. Tweet them. Write them a letter if you’re old-fashioned like me. (Laughter.)

But communicate to them that this will make a difference. It’s one small step that will help us create the kind of economy that all Americans deserve. And that’s an economy that’s built to last. An economy where everybody has a fair shot, everybody gets a fair share, everybody is playing by the same set of rules. That’s what made us great in the past. That’s what’s going to make us great in the future.

All right. Thank you, everybody. God bless you. God bless America. And give Paul and Val a big round of applause. (Applause.)

END

12:11 P.M. PDT