New data out today from the Office of the Actuary at the Centers for Medicare and Medicaid Services confirmed that 2013 was another year of historically slow growth in health care spending and that 2011, 2012, and 2013 saw the slowest growth in real per capita health care spending on record. Today’s data make it increasingly clear that the recent slow growth in the cost of health care reflects more than just the 2007-2009 recession and its aftermath, but also structural changes in our health care system, including reforms made in the Affordable Care Act. As we have noted previously, if even a portion of the recent slowdown continues, the benefits for Federal and State budgets, families’ budgets, and the economy as a whole will be dramatic.

The remainder of this blog post takes a closer look at today’s report and what it can tell us about the drivers of recent trends. We also take a look ahead at 2014 using other data that are already available. Available data suggest that aggregate spending may be growing more quickly as millions of people gain health insurance coverage and access needed care. But the available data also show that health care prices, premiums, and per-enrollee costs—the factors that determine the costs families face—have continued to grow very slowly during 2014.

2013 Was Another Year of Record-Low Growth in Aggregate Health Care Spending

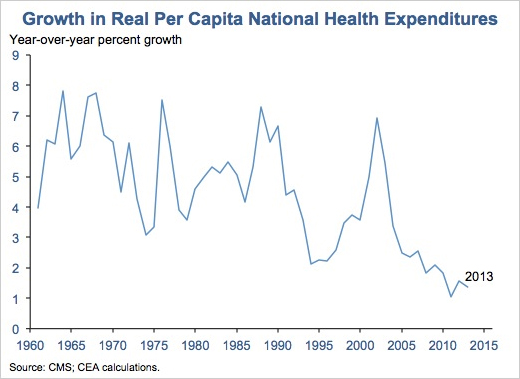

The data reported by the Actuaries today show that 2013 was another year of historically slow growth in national health expenditures. National health expenditures rose just 1.4 percent in real per capita terms in 2013, slower than the 1.5 percent increase in real per capita GDP in 2013. The last three years—2011, 2012, and 2013—are the three slowest years of growth in real per capita national health expenditures since record-keeping began in 1960.

Slow Growth Affected All Major Insurance Types

This continued slow growth in aggregate spending was driven by continued slow growth in per-enrollee spending across all three major insurance types, as the Actuaries estimate that overall insurance coverage increased slightly from 2012 to 2013. In both private insurance and Medicare, per-enrollee spending grew more slowly than the average rate over the prior two years. Per-enrollee Medicaid spending growth picked up relative to recent experience, but remained at a relatively low absolute level.

Trends in Per Capita Spending Across Major Health Care Categories

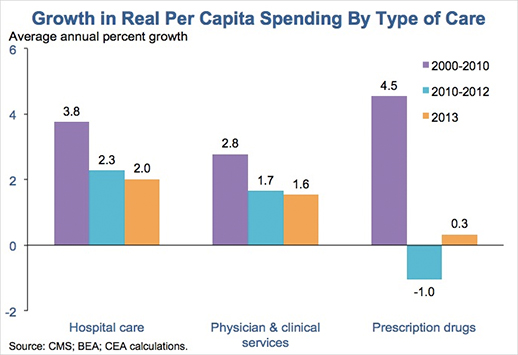

Slow growth in health care spending also continued for the three largest categories of health care goods and services: hospital care, physician and clinical services, and prescription drugs. Growth in hospital and physician spending actually ticked down in 2013 relative to the average over the prior two years. Prescription drug spending growth picked up modestly, but remained very low in historical terms.

Increasingly Likely that Slow Health Care Spending Growth Reflects Structural Factors

The exceptionally slow growth in health care spending in recent years has spurred a lively debate among economists and others about its causes, with some arguing that the recent slow growth primarily reflects the 2007-2009 recession and its aftermath and others arguing that structural changes in the health care system are playing a leading role.

The deep recession almost certainly put downward pressure on private-sector health care spending growth during the downturn itself and its immediate aftermath as workers lost employer coverage and tight budgets caused families and businesses cut back on spending. But two features of today’s data add to the evidence that structural changes in the nation’s health care system are playing a major role in recent trends:

-

Slow growth has been seen in Medicare, not just private insurance: Like other recent years and as shown above, 2013 saw very slow growth in per enrollee costs in Medicare, not just private insurance. But the Medicare program and its beneficiaries are largely insulated from developments in the broader economy, and economists at the Congressional Budget Office have demonstrated empirically that weak macroeconomic performance does not appear to increase Medicare spending growth. The fact that Medicare spending has nevertheless seen very slow growth suggests that structural factors are major contributors to recent slow growth.

-

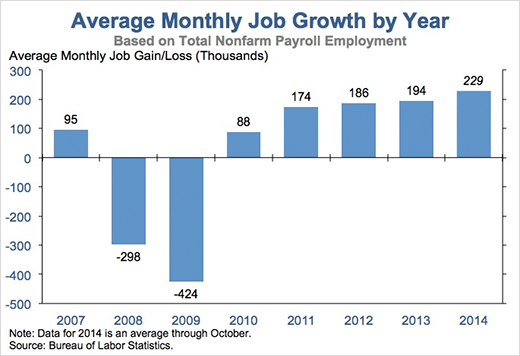

2013 was the fourth full year of the economic recovery: With each passing year, it becomes increasingly difficult to explain why and how the 2007-2009 recession could still be exerting significant downward pressure on health care spending growth and, thus, increasingly implausible that the recession is the main explanation for that slow growth. That challenge is particularly acute for 2013, the fourth full year of an economic recovery in which the pace of job gains have strengthened steadily over time.

Proponents of the view that recessions have large and long-lasting effects on health care spending growth generally rely upon evidence from “time series” analyses that examine the historical correlation between economic growth and health care spending growth. However, such analyses may erroneously conclude that slow economic growth causes long-lasting declines in health care spending growth if slow economic growth has merely coincided with slow growth in health care spending historically.

Other methodologies avoid this problem by comparing health care spending growth in states or localities experiencing stronger and weaker economic growth at the same point in time. These approaches generally find that the effects of weak economic performance on health care spending are much smaller and shorter-lived. While these alternative methodologies could miss some channels through which economic performance affects health care spending, their starkly different results raise serious questions about whether the time series evidence provides a reliable lens for interpreting recent trends.

The ACA Is Contributing to Recent Slow Growth in Health Care Costs

Research continues on what non-recession factors have influenced health care spending trends in recent years, and, in all likelihood, a variety of factors are playing a role. In 2013, the implementation of sequestration reduced Medicare spending growth (although real Medicare spending per beneficiary would have been roughly flat even removing sequestration’s effect). Similarly, slow growth in prescription drug spending appears to have resulted in part from a larger-than-normal number of drugs losing patent protection in recent years.

The Affordable Care Act has also made a meaningful contribution to recent trends by introducing payment reforms in Medicare and other public programs. These reforms, described below, are generating significant savings in Medicare and, if recent research results are correct, catalyzing changes in the private sector that are generating additional savings:

-

Reductions in excessive Medicare payments to Medicare providers and private insurers: The Congressional Budget Office estimated that these provisions would generate billions of direct savings for the Federal government in 2013. The savings from these provisions grow over time and will continue to subtract from the growth rate of national health expenditures in future years.

- Changes to the structure of Medicare payment systems: The Affordable Care Act also introduced reforms to the structure of Medicare payment in order to encourage more efficient, higher-quality care. These reforms are showing promising early results in improving the efficiency and quality of care.

For example, the law’s Hospital Readmissions Reduction Program, which gives hospital financial incentives to reduce the number of patients who must return to the hospital soon after discharge, has helped to sharply reduce Medicare’s hospital readmission rate, a decline that corresponds to 150,000 avoided readmissions in 2012 and 2013.

The law has also created more than 330 Accountable Care Organizations in 47 states, groups of medical providers who can share in the savings generated when they provide high-quality care, but do so more efficiently. Results from the first outside evaluation of one of the Federal government’s Accountable Care Organization payment models found that the program generated promising results in its first year.

Economic research implies that these reforms are likely to generate savings beyond Medicare. This research finds that changes in the level and structure of Medicare payments are frequently adopted, at least in part, by private insurers, generating savings throughout the health care system. Because care insured by Medicare accounts for only about one-quarter of total health care spending, focusing solely on the direct effects of these reforms on Medicare spending could dramatically understate the effects on overall national health expenditures.

Slow Cost Growth Has Continued in 2014, Even as Coverage Expands

Today’s report from CMS does not include data for 2014, but a variety of other data provide glimpses of how health care costs have evolved during this year. Those data show that health care cost growth has remained at very low levels in both the public and private sectors:

-

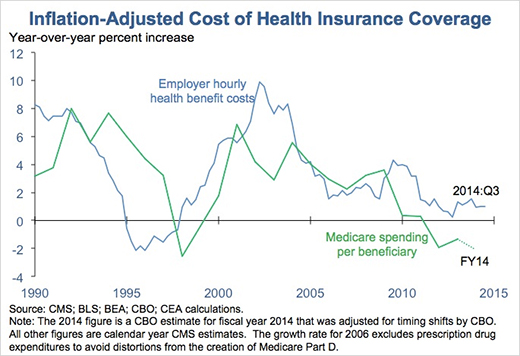

Medicare spending per beneficiary: Medicare spending per beneficiary was approximately flat in fiscal year 2014 in nominal terms and fell in inflation-adjusted terms, based on data from the Congressional Budget Office.

-

Employer health benefit spending: Leading measures of growth employer benefit costs have remained slow as well. According to the Kaiser Family Foundation/Health Research and Education Trust, the average premium for employer-based family coverage rose just 3 percent in nominal terms in 2014, tied for the smallest increase since the survey began in 1999. Data from the Bureau of Labor Statistics on employers’ hourly health benefits costs show similarly slow growth.

- Health care prices: The prices of health care goods and services are up just 1.5 over the 12 months ending in October 2014, smaller than the 1.6 percent increase for all consumer prices over that period. Over the full period since the Affordable Care Act became law, health care prices have risen at an annual rate of just 1.7 percent. Comparable rates have not been seen in nearly 50 years.

Even as slow growth in health care prices and per-enrollee spending continues, recent data have suggested that aggregate health care spending may be accelerating, likely reflecting increased utilization of health care by the millions of people who have gained health insurance coverage—or gained better coverage—under the Affordable Care Act during 2014.

Modestly faster growth in aggregate health spending due to expanding coverage is not a surprise, and it will last only until coverage stabilizes at its new, higher level. This utilization-driven increase in aggregate spending is also not cause for concern. Increased utilization of health care by the newly insured is, of course, a good thing; the best evidence shows that this additional health care improves mental and physical health. The fact that the previously uninsured are getting needed care also does not mean that individuals who previously had coverage are facing higher costs. Rather, their costs are determined by the underlying trends in health care prices and premiums, which are continuing to see exceptionally slow growth, as described above.

Jason Furman is Chairman of the Council of Economic Advisers. Matt Fiedler is a Senior Economist with the Council of Economic Advisers.