Advance Estimate of GDP for the Second Quarter of 2015

Real GDP rose faster in the second quarter than in the first, even after a large upward revision to first-quarter growth. Strong personal consumption led the rebound as consumers spent more of the windfall gains from lower oil prices that they had saved in the first quarter, and many of the temporary factors that restrained growth in the first quarter faded. The President is committed to pushing Congress to increase investments in infrastructure as part of a long-term transportation reauthorization, to open our exports to new markets with new high-standards free trade agreements, and to ensure that fiscal brinksmanship or the sequester does not return in the next fiscal year as outlined in the President’s FY2016 Budget.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

1. Real gross domestic product (GDP) rose 2.3 percent at an annual rate in the second quarter according to the BEA’s advance estimate, while first-quarter GDP growth was revised up from a 0.2 percent decline to a 0.6 percent increase. The revision to first-quarter GDP growth is mostly accounted for by higher fixed investment growth than previously estimated, in both the business and residential sectors. In the second quarter, the rise in GDP growth was led by a faster pace of personal consumption growth than the first quarter and a shift from negative to positive net export growth. The drag from declining structures investment was also much less negative for overall growth in the second quarter than in the first. Incorporating the effects of the annual GDP revision released today (see point 2), real GDP has now risen 2.3 percent over the past four quarters.

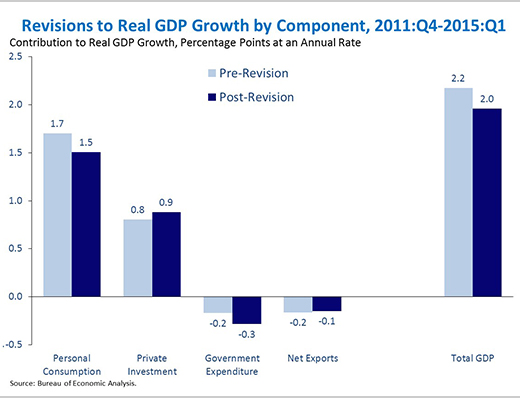

2. The Bureau of Economic Analysis (BEA) announced revisions to historical GDP figures based on a number of technical factors including new and revised source data, updated seasonal adjustment factors, and methodological changes. The revisions occurred primarily in 2012, 2013, and 2014. On average, real GDP growth increased 2.0 percent per year from 2011:Q4 to 2015:Q1—a downward revision of 0.2 percentage point. Most of that revision is accounted for by slower personal consumption growth than previously estimated. The consumption revision largely reflects a new methodology for calculating the price of financial services spending and revisions to source data on services. Government spending growth was also revised downward, mostly reflecting lower-than-estimated State and local spending, but also lower-than-estimated Federal defense spending. Faster-than-estimated private investment growth, mostly concentrated in the first quarter of 2015, partially offset these shifts. Most of the downward revision was concentrated in the first two years subject to revision—2012 and 2013—while real GDP growth over the four quarters of 2014 was revised up, from 2.4 percent to 2.5 percent.

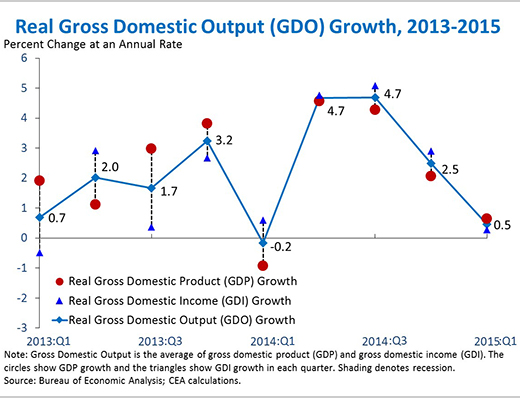

3. Today’s release marks the BEA’s first publication of the “average of GDP and GDI,” which CEA terms “Gross Domestic Output (GDO).” Output is traditionally measured either by tracking all expenditures on final goods and services produced domestically (GDP) or by tracking all the income received by producers of that output (Gross Domestic Income, or “GDI”). GDP and GDI are conceptually identical, but they differ due to measurement error. GDO is the arithmetic average of GDP and GDI. It can be a more accurate measure of economic activity because averaging across the two metrics reduces that measurement error. The first estimate of GDO growth for the second quarter of 2015 will be released next month.

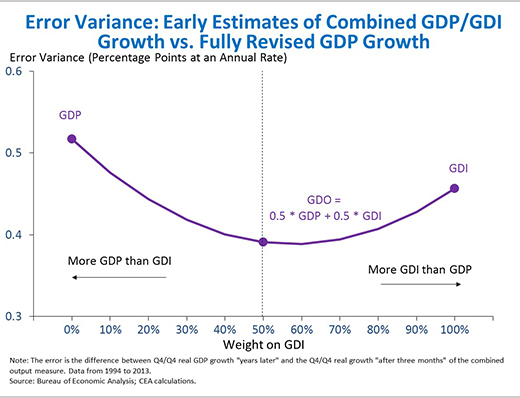

4. GDO is a more accurate measure of output in real-time than either GDP or GDI alone. The BEA publishes an estimate of GDP growth nearly one month after each quarter’s end, and revises it in each of the next two months. Three months after each quarter’s end, we have estimates of output growth from both the product side (GDP) and the income side (GDI)—but those estimates are based on preliminary and incomplete data and are still subject to further revision years later. The Council of Economic Advisers (CEA) finds that the “after three months” reading of GDO is a better predictor of the “years later” revisions to GDP than either GDP or GDI alone. The 50/50 average of GDP and GDI is very close to the weighted average that minimizes the error variance in forecasting the latest and thus most accurate measure of GDP in the same quarter.

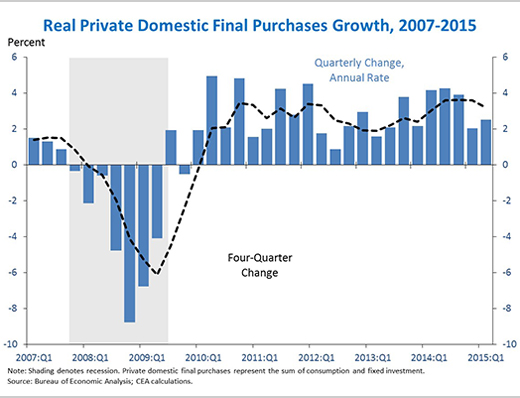

5. Real private domestic final purchases (PDFP)—the sum of consumption and fixed investment—rose 2.5 percent at an annual rate in the second quarter, slightly faster than overall GDP but below the pace observed over the past year. Real PDFP—which excludes noisy components like net exports, inventories, and government spending—is generally a more reliable measure of future GDP growth than current GDP. While GDO aims to more accurately measure output growth in a given quarter by minimizing measurement error, PDFP aims to measure signals of future economic growth by eliminating some of the noise in GDP. Over the past four quarters, PDFP grew 3.2 percent, a faster rate than overall GDP. Beginning with today’s release, BEA will begin publishing PDFP (under the name “final sales to private domestic purchasers”) as part of the normal monthly GDP release.

As the Administration stresses every quarter, GDP figures can be volatile and are subject to substantial revision. Therefore, it is important not to read too much into any one single report, and it is informative to consider each report in the context of other data that are becoming available.

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues