Policies to Improve Affordability and Accountability

Increase Tax Credits for Health Insurance Premiums

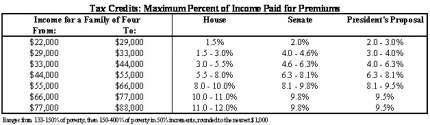

Health insurance today often costs too much and covers too little. Lack of affordability leads people to delay care, skip care, rack up large medical bills, or become uninsured. The House and Senate health insurance bills lower premiums through increased competition, oversight, and new accountability standards set by insurance exchanges. The bills also provide tax credits and reduced cost sharing for families with modest income. Health reform improves the affordability of health care by increasing the tax credits for families. Relative to the Senate bill, health reform lowers premiums for families with income below $44,000 and above $66,000. Relative to the House bill, reform makes premiums less expensive for families with income between roughly $55,000 and $88,000.

Over the long-term, the Administration and Congressional leaders believe the reductions in health care cost growth will allow these health tax cuts to continue to expand at the rate of health care cost growth. However, in order to ensure that the bill as a whole achieves substantial deficit reduction in the second decade and beyond, the health reform legislation includes a failsafe fiscal responsibility policy. Beginning in the second decade, if the total cost of the premium tax credits in the bill exceeds 90 percent of the level that CBO projects, individual tax credits will continue to be adjusted upward, but at the rate of general inflation. If in subsequent years the total cost of the tax credits falls back below 90 percent of CBO’s estimate, the growth rate of the tax credits will revert back to the rate of health care costs guaranteed in the first decade. This general approach is similar to other trigger mechanisms in the bill, including in IPAB.

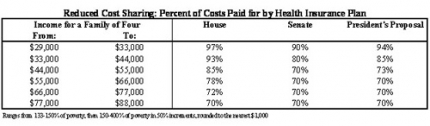

Health reform also improves the cost sharing assistance for individuals and families relative to the Senate bill. Families with income below $55,000 will get extra assistance; the additional funding to insurers will cover between 73 and 94% of their health care costs. It provides the same cost-sharing assistance as the Senate bill for higher-income families and the same assistance as the House bill for families with income from $77,000 to $88,000.

Close the Medicare Prescription Drug “Donut Hole”.

The Medicare drug benefit provides vital help to seniors who take prescription drugs, but under current law, it leaves many beneficiaries without assistance when they need it most. Medicare stops paying for prescriptions after the plan and beneficiary have spent $2,830 on prescription drugs, and only starts paying again after out-of-pocket spending hits $4,550. This “donut hole” leaves seniors paying the full cost of expensive medicines, causing many to skip doses or not fill prescriptions at all – harming their health and raising other types of health costs. The Senate bill provides a 50% discount for certain drugs in the donut hole. The House bill fully phases out the donut hole over 10 years. Both bills raise the dollar amount before the donut hole begins by $500 in 2010.

Relative to the Senate bill, health reform fills the “donut hole” entirely. It begins by replacing the $500 increase in the initial coverage limit with a $250 rebate to Medicare beneficiaries who hit the donut hole in 2010. It also closes the donut hole completely by phasing down the coinsurance so it is the standard 25% by 2020 throughout the coverage gap.

Invest in Community Health Centers.

Community health centers play a critical role in providing quality care in underserved areas. About 1,250 centers provide care to 20 million people, with an emphasis on preventive and primary care. The Senate bill increases funding to these centers for services by $7 billion and for construction by $1.5 billion over 5 years. The House bill provides $12 billion over the same 5 years. Bridging the difference, health reform invests $11 billion in these centers.

Extend Consumer Protections against Health Insurer Practices.

The Senate bill includes a “grandfather” policy that allows people who like their current coverage, to keep it. The health reform legislation adds certain important consumer protections to these “grandfathered” plans. Within months of legislation being enacted, it prohibits rescissions, bans lifetime limits on benefit payments, and requires new plans and certain grandfathered plans to cover child dependents up to age 26. The reform legislation also adds new protections on group health plans that restrict annual limits and ban pre-existing condition exclusions for children. When the exchanges begin in 2014, these plans – along with all new plans – will not be able to impose any annual benefit limits or deny anyone coverage because of a pre-existing condition.

Improve Individual Responsibility.

All Americans should have affordable health insurance coverage. This helps everyone, both insured and uninsured, by reducing cost shifting, where people with insurance end up covering the inevitable health care costs of the uninsured, and making possible robust health insurance reforms that will curb insurance company abuses and increase the security and stability of health insurance for all Americans. The House and Senate bills require individuals who have affordable options but who choose to remain uninsured to make a payment to offset the cost of care they will inevitably need. The House bill’s payment is a percentage of income. The Senate sets the payment as a flat dollar amount or percentage of income, whichever is higher (although not higher than the lowest premium in the area). Both the House and Senate bill provide a low-income exemption, for those individuals with incomes below the tax filing threshold (House) or below the poverty threshold (Senate).The Senate also includes a “hardship” exemption for people who cannot afford insurance, included in health reform. It protects those who would face premiums of more than 8 percent of their income from having to pay any assessment and they can purchase a low-cost catastrophic plan in the exchange if they choose.

The health reform adopts the Senate approach but lowers the flat dollar assessments, and raises the percent of income assessment that individuals pay if they choose not to become insured. Specifically, it lowers the flat dollar amounts from $495 to $325 in 2015 and $750 to $695 in 2016. Subsequent years are indexed to $695 rather than $750, so the flat dollar amounts in later years are lower than the Senate bill as well. Health reform raises the percent of income that is an alternative payment amount from 0.5 to 1.0% in 2014, 1.0 to 2.0% in 2015, and 2.0 to 2.5% for 2016 and subsequent years – the same percent of income as in the House bill, which makes the assessment more progressive. For ease of administration, health reform changes the payment exemption from the Senate policy (individuals with income below the poverty threshold) to individuals with income below the tax filing threshold (the House policy). In other words, a married couple filing jointly with income below $18,700 will not have to pay the assessment. Health reform also adopts the Senate’s “hardship” exemption.

Strengthen Employer Responsibility.

Businesses are strained by the current health insurance system. Health costs eat into their ability to hire workers, invest in and expand their businesses, and compete locally and globally. Like individuals, larger employers should share in the responsibility for finding the solution. Under the Senate bill, there is no mandate for employers to provide health insurance. But as a matter of fairness, the Senate bill requires large employers (i.e., those with more than 50 workers) to make payments only if taxpayers are supporting health insurance coverage for their workers. The assessment on the employer is $3,000 per full-time worker obtaining tax credits in the exchange if that employer’s coverage is unaffordable, or $750 per full-time worker if the employer has a worker obtaining tax credits in the exchange but doesn’t offer coverage in the first place. The House bill requires a payroll tax for insurers that do not offer health insurance that meets minimum standards. The tax is 8% generally and phases in for employers with annual payrolls from $500,000 to $750,000; according to the Congressional Budget Office (CBO), the assessment for a firm with average wages of $40,000 would be $3,200 per worker.

Health reform is consistent with the Senate bill in that it does not impose a mandate on employers to offer or provide health insurance, but does require them to help defray the cost if taxpayers are footing the bill for their workers. Health reform improves the transition to the employer responsibility policy for employers with 50 or more workers by subtracting out the first 30 full-time workers from the payment calculation (e.g., a firm with 51 workers that does not offer coverage will pay an amount equal to 51 minus 30, or 21 times the applicable per employee payment amount). It changes the applicable payment amount for firms with more than 50 employees that do not offer coverage to $2,000 – an amount that is one-third less than the average House assessment for a typical firm and less than half of the average employer contribution to health insurance in 2009. It applies the same firm-size threshold across the board to all industries. It fully eliminates the assessment for workers in a waiting period, while maintaining the 90-day limit on the length of any waiting period beginning in 2014.

Under the final health reform legislation, small businesses will receive $40 billion in tax credits to support coverage for their workers beginning this year.