Council of Economic Advisers Blog

New Report: The Economic Benefits of Extending Unemployment Insurance

Posted by on December 5, 2013 at 9:00 AM ESTThe United States economy continues to recover from the worst economic crisis since the Great Depression, and while substantial progress has been made, more work remains to boost economic growth and speed job creation. Despite ten consecutive quarters of GDP growth and 7.8 million private sector jobs added since early 2010, the unemployment rate is unacceptably high at 7.3 percent, and far too many families are still struggling to regain the foothold they had prior to the crisis.

The Emergency Unemployment Compensation (EUC) program authorized by Congress in 2008 has provided crucial support to the economy and to millions of Americans who lost jobs through no fault of their own. Under current law, EUC will end on December 28, 2013[1].

This report argues that allowing EUC to expire would be harmful to millions of workers and their families, counterproductive to the economic recovery, and unprecedented in the context of previous extensions to earlier unemployment insurance programs.

Download the full report here or read a summary below, including state-by-state effects of allowing EUC benefits to expire.

Since their inception in 2008, extended unemployment insurance (UI) benefits have provided critical support to millions of workers and their families:

- Nearly 24 million workers have received extended UI benefits

- Recipients are a diverse group: roughly half have completed at least some college, including 4.8 million with bachelor’s degrees or higher

- Including workers’ families, nearly 69 million people have been supported by extended UI benefits, including almost 17 million children

- In 2012 alone, UI benefits lifted an estimated 2.5 million people out of poverty

Learn more about EconomyNew Report from the Council of Economic Advisers: The Recent Slowdown in Health Care Cost Growth and the Role of the Affordable Care Act

Posted by on November 20, 2013 at 12:34 PM ESTThe Affordable Care Act (ACA) was passed against a backdrop of decades of rapid growth in health care spending, and one of the ACA’s key goals was to root out serious inefficiencies in the United States health care system that increase costs and compromise patients’ quality of care. Recent data show that health care spending and prices are growing at their slowest rates in decades; it appears that something has changed for the better. While this marked slowdown likely has many causes, and these causes are not yet fully understood, the available evidence suggests that the ACA is contributing to these trends, and, moreover, is helping to improve quality of care for patients. Today the White House Council of Economic Advisers released a new report analyzing recent trends in health costs, the forces driving those trends, and their likely economic benefits. Read the full report here.

Key points in today's report from the Council of Economic Advisers:

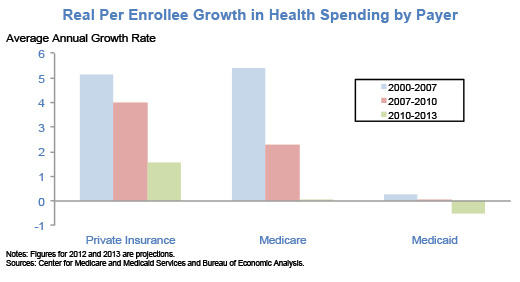

1. Health care spending is growing at the slowest rate on record: According to the most recent projections, real per capita health care spending has grown at an estimated average annual rate of just 1.3 percent over the three years since 2010. This is the lowest rate on record for any three-year period and less than one-third the long-term historical average stretching back to 1965. This slower growth in spending is reflected in Medicare, Medicaid, and private insurance.

2. Health care price inflation is at its lowest rate in 50 years: Measured using personal consumption expenditure price indices, inflation for health care goods and services is currently running at just 1 percent on a year-over-year basis, the lowest level since January 1962. (Health care inflation measured using the medical CPI is lower than at any time since September 1972.)

Learn more about Economy, Health CareThe Employment Situation in October

Posted by on November 8, 2013 at 10:08 AM ESTThe upward revisions to job growth in August and September, combined with solid third quarter GDP growth reported yesterday, suggest that the economy was gaining traction in the months leading up to the government shutdown. There should be no debate that the shutdown and debt limit brinksmanship inflicted unnecessary damage on the economy in October. The employment report shows differing accounts, with the more reliable payroll survey recording strong job growth and the much noisier household survey showing an increase in the unemployment rate and a large drop in employment. But the mission for Congress remains clear: to take steps that increase certainty, speed growth, and boost job creation.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF LABOR STATISTICS

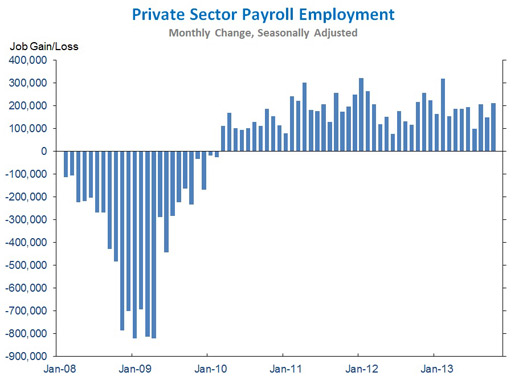

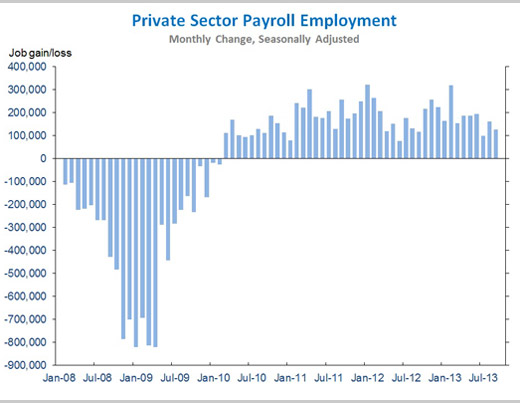

1. America’s resilient businesses have added jobs for 44 consecutive months, with private sector employment increasing by a total of 7.8 million over that period. Today we learned that total nonfarm payroll employment rose by 204,000 in October, due entirely to a 212,000 increase in private employment. Private sector job growth was revised up for August (to 207,000) and September (to 150,000) so that for the third quarter, private sector employment rose by an average of 152,000 per month (compared to the 129,000 per month average pace estimated in last month’s jobs report).

Learn more about Economy, Urban Policy

Learn more about Economy, Urban PolicyAdvance Estimate of GDP for the Third Quarter of 2013

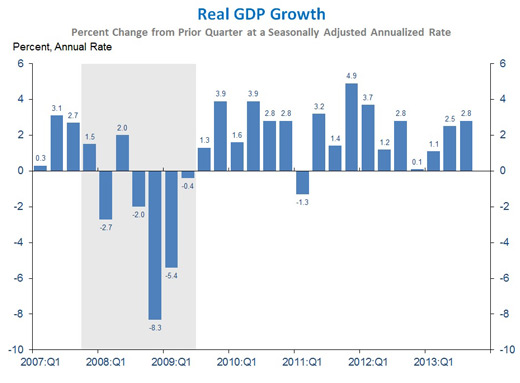

Posted by on November 7, 2013 at 9:30 AM ESTDuring the third quarter, the economy grew at its fastest pace in a year, an indication that the recovery was continuing to gain traction in the months before the government shutdown. GDP growth was boosted by a positive contribution from consumer durables purchases, the continued recovery in the housing sector, and net exports. We now have an opportunity to build on this progress by increasing certainty for businesses and investing in jobs and growth, while avoiding the types of self-inflicted wounds that restrained the economy in the early part of the fourth quarter.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

1. Real gross domestic product rose at a solid 2.8 percent annual pace in the third quarter, the fastest quarterly pace in the last year, and the 10th consecutive quarter of growth. The rate of growth picked up slightly from the also-solid 2.5 percent rate observed in the second quarter. The economy has made substantial progress since the end of the recession, with real GDP now 5.3 percent higher than it was at its peak prior to the recession. Nevertheless, more work must be done to increase economic growth and boost job creation.

Learn more about Economy

Learn more about EconomyEconomic Activity During the Government Shutdown and Debt Limit Brinksmanship

Posted by on October 22, 2013 at 4:16 PM ESTThe government shutdown and debt limit brinksmanship have had a substantial negative impact on the economy. A new report released today by the Council of Economic Advisers (CEA) attempts to estimate the actual impact of the shutdown and default brinksmanship on economic activity as measured by eight different daily or weekly economic indicators. Overall it finds that a range of eight economic indicators in what we call a “Weekly Economic Index” are consistent with a 0.25 percentage point reduction in the annualized GDP growth rate in the fourth quarter and a reduction of about 120,000 private sector jobs in the first two weeks of October (estimates use indicators available through October 12th). These estimates very likely understate the full economic effects of the episode because of its effects that continued, and will continue, past October 12th.

The shutdown directly affected the economy by withdrawing government services for a sixteen day period, which not only had direct impacts but also had a range of indirect effects on the private sector. For example the travel industry was hurt by the closing of national parks, businesses in oil and gas and other industries were hurt by the cessation of permits for oil and gas drilling, the housing industry was hurt by the cessation of IRS verifications for mortgage applications, and small businesses were hurt by the shutdown of Small Business Administration loan guarantees. In addition, a reduction in consumer confidence and an increase in uncertainty associated not just with the shutdown but also the brinksmanship over the debt limit affected consumer spending, investment and hiring decisions as well.

Learn more about EconomyThe Employment Situation in September

Posted by on October 22, 2013 at 8:45 AM ESTWhile job growth remained solid in September, there is no question that the focus of policy should be on how to achieve a faster pace of job growth by increasing certainty and investing in jobs, rather than the self-inflicted wounds of the past several weeks that increased uncertainty and inhibited job growth. Today’s delayed report describes the economy more than a month ago. More recent indicators suggest the labor market worsened in the month of October.

Five key points in today’s report from the bureau of labor statistics

1. Private sector employment has risen for 43 consecutive months, with businesses adding a total of 7.6 million jobs over that period. Today we learned that total non-farm payroll employment rose by 148,000 in September, with the private sector accounting for 126,000 of that gain. Private sector job growth was revised down for July (to 100,000) but up for August (to 161,000). In sum, private sector employment rose by an average of 129,000 per month in the third quarter, lower than we can be fully satisfied with, partially reflecting the effects of fiscal contraction. This underscores the continued importance of taking steps that speed the recovery and boost job creation, while avoiding self-inflicted wounds like a government shutdown and debt ceiling brinksmanship that have the opposite effect.

Learn more about Economy

Learn more about Economy

- &lsaquo previous

- …

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- …

- next &rsaquo

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues