Council of Economic Advisers Blog

The Employment Situation in March

Posted by on April 4, 2014 at 8:39 AM ESTThe economy continued to add jobs in March at a pace consistent with job growth over the past year. Additionally, the unemployment rate was steady while the labor force participation rate edged up. While today’s data indicates that the recovery is continuing to unfold, the President still believes further steps must be taken to strengthen growth and boost job creation. In this regard, the Senate’s decision yesterday to move forward with the consideration of a bill to reinstate extended unemployment insurance was an important step in the right direction. In addition to encouraging this and other action in Congress, such as raising the minimum wage and passing the Paycheck Fairness Act, the President will continue to act on his own executive authority wherever possible to expand economic opportunity for American families.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF LABOR STATISTICS

1. The private sector has added 8.9 million jobs over 49 straight months of job growth. Today we learned that total nonfarm payroll employment rose by 192,000 in March, entirely due to an increase in private employment, while government employment was unchanged on net. Job growth in January and February was revised up, so that that over the past twelve months, private employment has risen by 2.3 million, or an average of 189,000 a month. This is slightly faster than the pace of job gains over the preceding twelve-month period (175,000 a month).

Learn more about , EconomyThe 2014 Economic Report of the President

Posted by on March 10, 2014 at 9:00 AM ESTThis morning, the Council of Economic Advisers is releasing the 2014 Economic Report of the President, which discusses the progress that has been made in recovering from the worst recession since the Great Depression, and President Obama’s agenda to build on this progress by creating jobs and expanding economic opportunity. This year’s report highlights steps the Obama Administration is taking to address three key imperatives: continuing to restore the economy to its full potential, expanding the economy’s potential over the long-run, and ensuring that all Americans have the opportunity to realize their full individual potential.

Below are seven highlights from each of the seven chapters in this year’s Report:

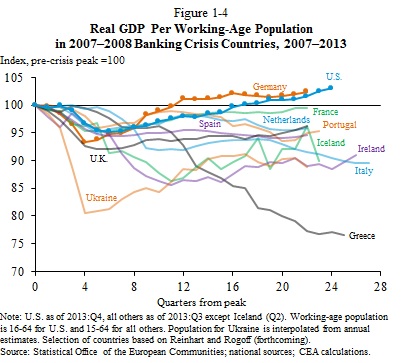

Chapter 1 introduces the Report and highlights several key areas where progress has been made, but it also lays out the areas where much more work remains to be done. In particular, recoveries from financial crises are uniquely challenging because heavy household debt burdens and tight credit conditions can linger for years, depressing spending and investment. However, as shown in Figure 1-4 of the Report, among the 12 countries that experienced a systemic financial crisis in 2007 and 2008, the United States is one of just two in which output per working-age person has returned to pre-crisis levels. The fact that the United States has been one of the best performing economies in the wake of the crisis supports the view that the full set of policy responses in the United States made a major difference in averting a substantially worse outcome—although it in no way changes the fact that more work remains to be done.

Learn more about Economy

Learn more about EconomyThe Employment Situation in February

Posted by on March 7, 2014 at 9:38 AM ESTFebruary 2014 was the 48th straight month of private-sector job growth, with businesses adding 8.7 million jobs over that time. Despite a major snowstorm that hit the East Coast during the reference week for the labor market surveys, the rate of job growth picked up from the December and January pace. Nevertheless, the unemployment rate remains elevated, and for too many Americans, wages have been slow to rise.

This week, the President put out a budget that can make progress on these issues by investing in education, job training, and innovation, by expanding tax credits for working Americans, and by extending the emergency unemployment benefits that has expired for 2 million Americans. And while the President encourages Congress to act on his proposals, he will also continue to take action on his own wherever possible to support job growth and expand economic opportunity.

FIVE KEY POINTS IN TODAY'S REPORT FROM THE BUREAU OF LABOR STATISTICS

1. The private sector has added 8.7 million jobs over 48 straight months of job growth. Today we learned that total non-farm payroll employment rose by 175,000 in February, with 162,000 of that increase in the private sector. Revisions to private employment in the previous months were small and offsetting, so that that over the past twelve months, private employment has risen by 2.2 million, or an average of 183,000 a month. This is almost identical to the pace of job gains over the preceding twelve-month period (182,000 a month).

Learn more about , EconomyCongressional Budget Office Report Finds Minimum Wage Lifts Wages for 16.5 Million Workers

Posted by on February 18, 2014 at 3:24 PM ESTThe new Congressional Budget Office (CBO) report finds that 16.5 million workers would get a raise from increasing the minimum wage to $10.10 per hour and this would help millions of hard-working families, reduce poverty, and increase the overall wages going to lower-income households.

On employment, CBO’s central estimate is that raising the minimum wage to $10.10 per hour would lead to a 0.3 percent decrease in employment and CBO acknowledges that the employment impact could be essentially zero. But even these estimates do not reflect the overall consensus view of economists which is that raising the minimum wage has little or no negative effect on employment. For example, seven Nobel Prize winners and more than 600 other economists recently stated that: “In recent years there have been important developments in the academic literature on the effect of increases in the minimum wage on employment, with the weight of evidence now showing that increases in the minimum wage have had little or no negative effect on the employment of minimum-wage workers, even during times of weakness in the labor market.”

The following are six key points from the latest CBO report. For more information, last week the Council of Economic Advisers (CEA) released a summary of the economic case for raising the minimum wage.

1. CBO finds that raising the minimum wage to $10.10 per hour would directly benefit 16.5 million workers. According to today’s CBO report, 16.5 million people making less than $10.10 per hour would get a raise if the minimum wage is increased. This figure does not include CBO’s estimate of as many as 8.0 million workers who currently earn just above $10.10 an hour but could also potentially see a raise due to the “ripple effect” of a shifting wage structure.

2. CBO finds that raising the minimum wage would increase income for millions of middle-class families, on net, even after accounting for its estimates of job losses. Middle class families earning less than six times the poverty line (i.e., $150,000 for a family of four in 2016) would see an aggregate increase of $19 billion in additional wages, with more than 90 percent of that increase going to families earning less than three times the Federal poverty line (i.e., $75,000 for a family of four in 2016). On net CBO estimates that national income would rise.

This finding is consistent with the fact that 62 percent of expert economists polled by the University of Chicago Booth School of Business agreed that the benefits of raising the minimum wage outweigh any potential costs, as compared to only 16 percent who disagreed.

Learn more about EconomyThe Fifth Anniversary of the American Recovery and Reinvestment Act

Posted by on February 17, 2014 at 1:00 PM ESTFive years ago, on February 17, 2009, less than a month into his first term, President Obama signed into law the American Recovery and Reinvestment Act of 2009. At the time, the country was experiencing the worst economic crisis since the Great Depression. Private employers had already cut almost 4 million jobs, trillions in dollars in household wealth had been wiped out, and the economy’s total output was in the midst of its sharpest downturn of the postwar era.

As part of the accountability and transparency provisions included in the Recovery Act, the Council of Economic Advisers was charged with providing to Congress quarterly reports on the Act’s effects. The final report in this series—and available HERE—affirms that the Recovery Act had a substantial positive impact on the economy, helped to avert a second Great Depression, and made targeted investments that will pay dividends long after the Act has fully phased out.

In the four years following the Recovery Act, the President built on this initial step, signing into law over a dozen fiscal measures that extended key features of the Act and provided new sources of support. These measures included a temporary payroll tax cut for 160 million working Americans, additional extensions to the Emergency Unemployment Compensation program, expanded business tax incentives, small business tax cuts, and funding to protect teacher jobs.

Learn more about , EconomyThe Economic Case for Raising the Minimum Wage

Posted by on February 12, 2014 at 11:57 AM ESTUpdate: Read President Obama's remarks on the importance of raising the minimum wage before signing today's Executive Order

In his 2014 State of the Union address, President Obama announced his intention to move forward using his own authority and raise the minimum wage for workers on new and replacement Federal service contracts to $10.10 an hour. As the President said, “If you cook our troops’ meals or wash their dishes, you shouldn’t have to live in poverty.” Today, the President will sign an Executive Order making this vision a reality.

This step is a smart business decision for the government because it will make Federal procurement more economical and efficient. An extensive body of research suggests that giving a raise to lower-income workers reduces turnover and raises morale, and can thus lower costs and improve productivity. In addition, firms that already pay a decent wage and realize these kinds of efficiencies should not have to radically alter their bids to comply with the Executive Order. This means the new rule can allow Federal agencies to select from a higher-quality group of bidders without a marked increase in costs—a fact that is borne out by empirical studies of municipal government contracts.

This Executive Order will also give a boost to hardworking Americans struggling to make ends meet, and the President still believes that Congress should act to do the same for millions more.

A presentation prepared by the Council of Economic Advisers, “The Economic Case for Raising the Minimum Wage,” can be viewed below.

Learn more about Economy

- &lsaquo previous

- …

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- …

- next &rsaquo

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues