Council of Economic Advisers Blog

The Dramatic Slowdown in Health Costs and What It Means for the Economy, Families and the Budget

Posted by on September 19, 2013 at 10:30 AM ESTNew data out yesterday from the Centers for Medicare and Medicaid Services (CMS) and discussed in a piece in Health Affairs show that economy-wide health spending continues to grow at a historically slow rate. After adjusting for inflation, health spending growth was 1.7 percent (3.9 percent nominal) in 2011, is estimated at 2.1 percent in 2012 (3.9 percent nominal), and is projected at 2.3 percent (3.8 percent nominal) for 2013. Assuming the projections hold, these rates of spending growth are the three lowest on record, well below the 4.2 percent average inflation-adjusted rate observed over the decade ending in 2010 and the 5.5 percent average inflation-adjusted rate from 1965 to 2010. As the President said earlier today, these reductions in health cost growth are good for American companies’ bottom lines, good for our economy, and good for jobs.

Learn more about Economy, Health Care

Learn more about Economy, Health CareNew Data: Most of the Increase in Employment is in Full-Time Positions Since the Affordable Care Act Became Law

Posted by on September 6, 2013 at 2:40 PM ESTEd. Note: This post was updated February 10, 2014 to reflect the most recent data.

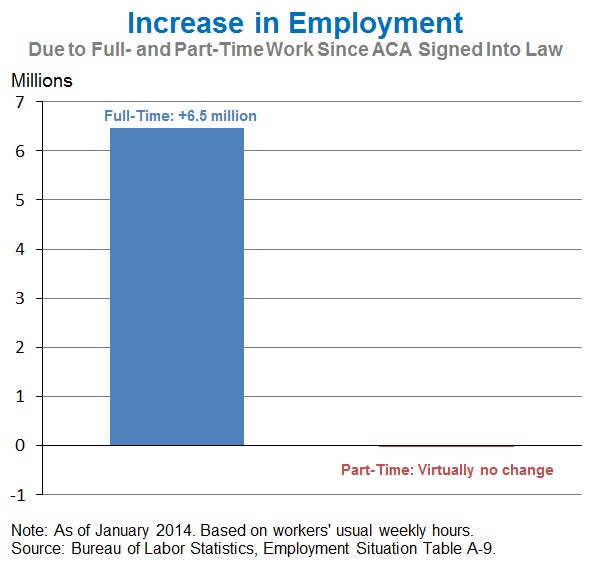

Data from the Bureau of Labor Statistics show that of the overall increase in employment since the Affordable Care Act became law, more than 9 out of 10 positions have been full-time.

The Affordable Care Act continues to improve the functioning of labor markets in a range of ways including helping to slow the growth of premiums, creating affordable new options for small businesses, reducing the “job lock” that can keep workers from taking the best job for them, and generally improving health outcomes and reducing absenteeism. We are already seeing tangible changes in affordability, including employer premium growth at less than one-third the rate of the late 1990s and early 2000s.

Businesses owners who are looking to take advantage of tax credits, and other benefits under the law aimed at making coverage more affordable are encouraged to visit Business.USA.gov/healthcare for more information.

Moreover, to date there is no economy-wide evidence that the employer responsibility requirement, which is scheduled to go into effect in 2015, has increased part-time employment. In fact, a range of labor market data shows that our patterns of part-time employment are typical given our current economic recovery. This finding was reinforced by a recent Congressional Budget Office (CBO) report, which concluded that there is “no compelling evidence that part-time employment has increased as a result of the ACA.” Five charts make five key points in this area:

1. Since the Affordable Care Act became law, the economy has created 6.5 million full-time jobs, while the number of part-time jobs has been essentially unchanged. Over the 46 months since the Affordable Care Act was signed into law, the number of employed people has increased by 6.4 million, reflecting a 6.5 million increase in the number of people with full-time jobs and a negligible decline in the number of people with part-time jobs. The net increase in employment over this period is therefore due entirely to an increase in full-time work.

The Employment Situation in August

Posted by on September 6, 2013 at 8:50 AM ESTOver the last four years, we’ve cleared away the rubble from the financial crisis and begun to lay a new foundation for stronger, more durable economic growth. With continued solid job gains, today’s employment report is another sign of progress, but we must continue to pursue policies that move our economy forward and restore middle class security.

Five Key Points in Today’s Report from the Bureau of Labor Statistics

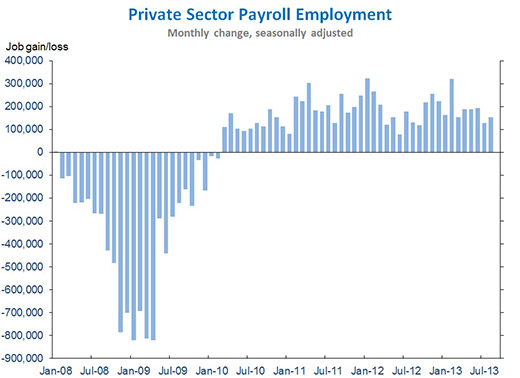

1. Private sector employment has risen for 42 consecutive months, with businesses adding a total of 7.5 million jobs over that period. Today we learned that total non-farm payroll employment rose by 169,000 in August, with the private sector accounting for 152,000 of that gain. Private sector job growth was revised down for June (to 194,000) and July (to 127,000), so that over the past three months, private sector employment has risen by an average of 158,000 per month. The monthly change is shown below.

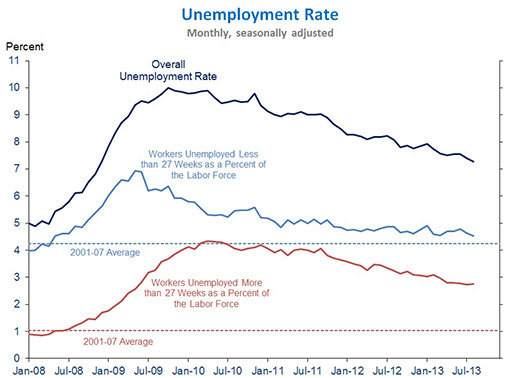

2. The overall unemployment rate ticked down 0.1 percentage point to 7.3 percent, the lowest since December 2008, with long-term unemployment remaining elevated. Although the unemployment rate remains too high, it has been trending down steadily since late 2009. The lingering elevation in the unemployment rate primarily reflects a large number of long-term unemployed (those unemployed for more than 27 weeks), while the share of the labor force that has been unemployed for less than 27 weeks has mostly returned to its average during the 2001-07 expansion period. That's why the administration continues to push for measures to spur job creation now and put the long term unemployed back to work.

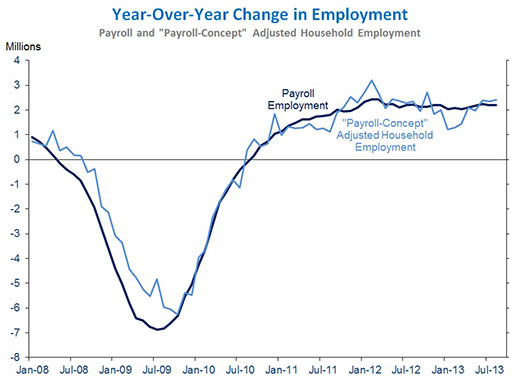

3. The economy has been consistently adding jobs at a pace of more than 2 million per year. Over the twelve months ending August 2013, total non-farm payroll employment rose by 2.2 million, similar to the gain in the year-earlier period. While the month-to-month figures can be volatile, the year-over-year changes indicate that the recovery has been durable in the face of several headwinds that have emerged in recent years. The separate household survey is more volatile month-to-month, but over a longer period, it tells the same story. When adjusted by the Bureau of Labor Statistics to be comparable to the concept of employment used in the payroll measure, household employment has risen by 2.4 million over the twelve months ending August 2013.

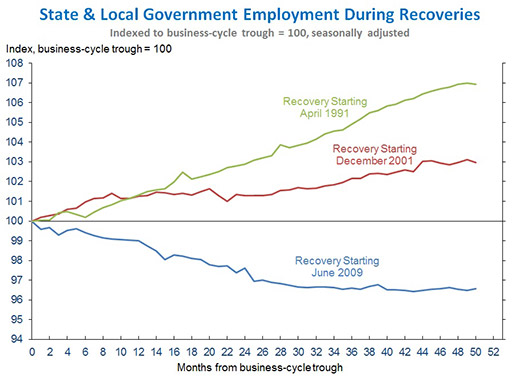

4. CEA estimates that if state and local government employment had held steady during the recovery, the unemployment rate would currently be below 7 percent. Unlike previous recoveries in which state and local government employment- like teachers, fire fighters and first responders-- expanded, public payrolls have declined in the current recovery (see chart). During the current 42-month consecutive streak of increasing private sector employment, state and local government employment has fallen by 507,000, including the loss of 267,000 education positions.

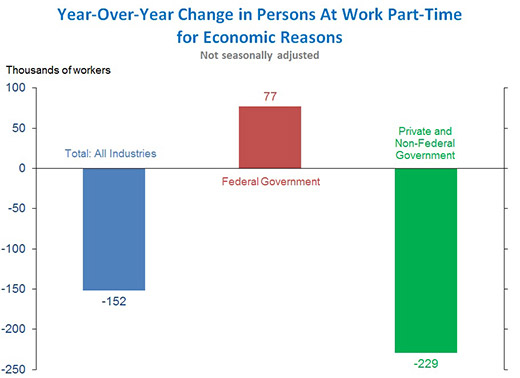

5. The number of persons working part-time for involuntary “economic reasons” has fallen by 152,000 over the past twelve months. Budget cuts due to sequestration led to an increase of 77,000 in the number of federal government employees at work part-time for economic reasons, so the number of persons part-time for economic reasons in private sector and non-federal government positions is down by an even larger 229,000 (see chart, based on not seasonally adjusted data). Measures of part-time employment can be volatile month-to-month, but the seasonally-adjusted 334,000 drop in persons working part-time for economic reasons in August almost entirely reversed the increase over the preceding two months.

As the Administration stresses every month, the monthly employment and unemployment figures can be volatile, and payroll employment estimates can be subject to substantial revision. Therefore, it is important not to read too much into any one monthly report and it is informative to consider each report in the context of other data that are becoming available. Nevertheless, incoming economic data broadly suggest that the recovery continues to make progress. It is therefore essential that policymakers avoid “self-inflicted wounds” that could derail the recovery and stay focused on policies that will help sustain and boost the pace of job creation.

Jason Furman is Chairman of the Council of Economic Advisers.

Learn more about , EconomyThe Employment Situation in June

Posted by on July 5, 2013 at 8:30 AM ESTWhile more work remains to be done, today’s employment report provides further confirmation that the U.S. economy is continuing to recover from the worst downturn since the Great Depression. It is critical that we remain focused on pursuing policies to speed job creation and expand the middle class, as we continue to dig our way out of the deep hole that was caused by the severe recession that began in December 2007.

Today’s report from the Bureau of Labor Statistics (BLS) indicates that private sector businesses added 202,000 jobs last month (see first chart below). Total non-farm payroll employment rose by 195,000 jobs in June. The economy has now added private sector jobs for 40 consecutive months, and a total of 7.2 million jobs has been added over that period. In spite of monthly volatility, over the past three years the pace of job growth has increased each year (see second chart below). So far this year, 1.23 million private sector jobs have been added.

The household survey showed that the unemployment rate remained at 7.6 percent in June down from 8.2 percent a year ago. The labor force participation rate rose by 0.1 percentage point for the second month in a row to 63.5 percent in June.

In the four years since the recession ended in June 2009, the economy has added 5.3 million jobs, thanks to the resilience of the American people and policies like the Recovery Act, which helped bring the recession to an end and put us on the path to recovery. With the recovery gaining traction, now is not the time for Washington to impose self-inflicted wounds on the economy. The President will continue to press Congress to act on the proposals he called for in his State of the Union address to make America a magnet for good jobs, help workers obtain the skills they need for those jobs, and make sure that honest work leads to a decent living.

Learn more about , EconomyRock and Roll, Economics, and Rebuilding the Middle Class

Posted by on June 12, 2013 at 2:00 PM ESTToday, at 7:00 pm EST, Chairman of the Council of Economic Advisers Alan Krueger will deliver remarks on income inequality and rebuilding the middle class at the Rock and Roll Hall of Fame.

As he'll discuss this evening, using rock and roll industry as a example is one of the best ways to explain economics -- many of the forces that are buffeting the U.S. economy can be understood in the context of the music industry.

Learn more about Economy, Urban PolicyThe Employment Situation in May

Posted by on June 7, 2013 at 8:30 AM ESTWhile more work remains to be done, today’s employment report provides further confirmation that the U.S. economy is continuing to recover from the worst downturn since the Great Depression. It is critical that we remain focused on pursuing policies to speed job creation and expand the middle class, as we continue to dig our way out of the deep hole that was caused by the severe recession that began in December 2007.

Today’s report from the Bureau of Labor Statistics (BLS) indicates that private sector businesses added 178,000 jobs last month. Total non-farm payroll employment rose by 175,000 jobs in May. The economy has now added private sector jobs every month for 39 straight months, and a total of 6.9 million jobs has been added over that period. So far this year, 972,000 private sector jobs have been added.

The household survey showed that the unemployment rate ticked up to 7.6 percent in May from 7.5 percent in April. However, the labor force participation rate also rose by 0.1 percentage point to 63.4 percent in May, as 182,000 more unemployed workers reentered the labor force in May than in April, a sign that more workers felt encouraged to search for a job.

Learn more about , Economy

- &lsaquo previous

- …

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- …

- next &rsaquo

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues