Council of Economic Advisers Blog

The Employment Situation in November

Posted by on December 5, 2014 at 9:30 AM ESTJob growth in November was strong, and the economy has now already added more jobs in 2014 than in any full calendar year since the late 1990s. To create an environment in which this progress can continue, it is critical that Congress take the basic steps needed to fund the government and avoid creating disruptive and counterproductive fiscal uncertainty. We have an opportunity to work together to support the continued growth of higher-paying jobs by investing in infrastructure, reforming the business tax code, expanding markets for America’s goods and services, making common sense reforms to the immigration system, and increasing the minimum wage.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF LABOR STATISTICS

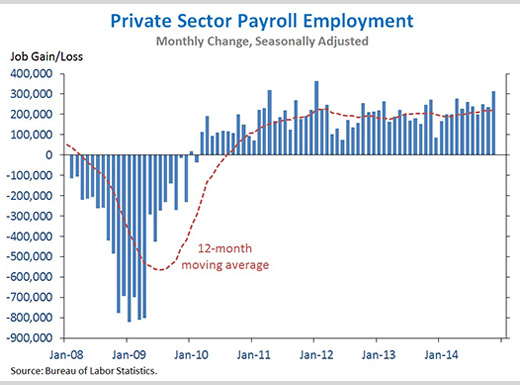

1. The private sector has added 10.9 million jobs over 57 straight months of job growth, extending the longest streak on record. Today we learned that total nonfarm payroll employment rose by 321,000 in November, mainly reflecting a 314,000 increase in private employment—the third strongest month for private payrolls over the past 57 months. Private-sector job growth was revised up for September and October by a combined 32,000, so that over the past three months, private-sector job growth has averaged 266,000 per month. Private employment has risen by at least 200,000 for ten consecutive months, the first time that has happened since the 1990s. In addition, the average workweek in the private sector rose to 34.6 hours in November, the highest since 2008.

Learn more about , , Economy, Working Families

Learn more about , , Economy, Working FamiliesHistorically Slow Growth in Health Spending Continued in 2013, and Data Show Underlying Slow Cost Growth Is Continuing

Posted by on December 3, 2014 at 5:06 PM ESTNew data out today from the Office of the Actuary at the Centers for Medicare and Medicaid Services confirmed that 2013 was another year of historically slow growth in health care spending and that 2011, 2012, and 2013 saw the slowest growth in real per capita health care spending on record. Today’s data make it increasingly clear that the recent slow growth in the cost of health care reflects more than just the 2007-2009 recession and its aftermath, but also structural changes in our health care system, including reforms made in the Affordable Care Act. As we have noted previously, if even a portion of the recent slowdown continues, the benefits for Federal and State budgets, families’ budgets, and the economy as a whole will be dramatic.

The remainder of this blog post takes a closer look at today’s report and what it can tell us about the drivers of recent trends. We also take a look ahead at 2014 using other data that are already available. Available data suggest that aggregate spending may be growing more quickly as millions of people gain health insurance coverage and access needed care. But the available data also show that health care prices, premiums, and per-enrollee costs—the factors that determine the costs families face—have continued to grow very slowly during 2014.

Learn more about Health CareSecond Estimate of GDP for the Third Quarter of 2014

Posted by on November 25, 2014 at 9:35 AM ESTToday’s upward revision affirms that economic growth in the third quarter was strong, consistent with a broad range of other indicators showing improvement in the labor market, increasing domestic energy security, and continued low health cost growth. Since the financial crisis, the U.S. economy has bounced back more strongly than most others around the world, and the recent data highlight that the United States is continuing to lead the global recovery. Nevertheless, there is more work to be done to boost growth in the United States and around the world. The President’s common-sense administrative actions on immigration—which CEA estimates will raise GDP by at least 0.4 percent over 10 years—will contribute to this effort, but only Congress can finish the job and make progress on other important steps like increased infrastructure investment.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

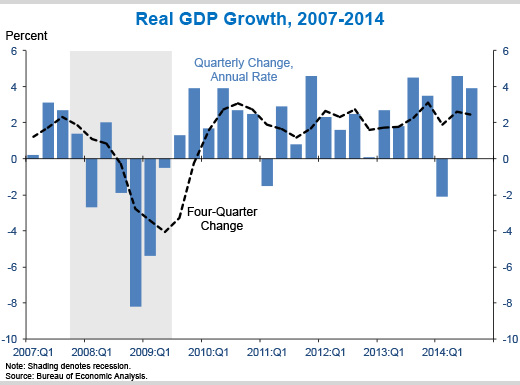

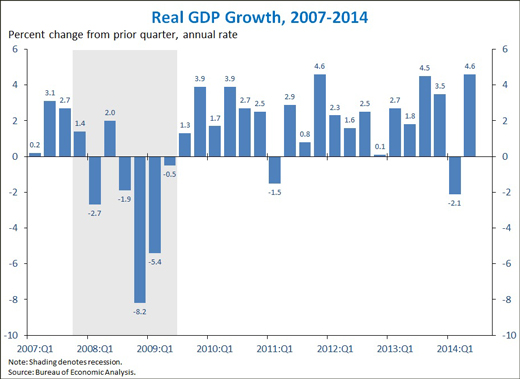

1. Real gross domestic product (GDP) grew 3.9 percent at an annual rate in the third quarter of 2014, according to the second estimate from the Bureau of Economic Analysis. The solid growth recorded in each of the last two quarters suggests that the economy has bounced back strongly from the first-quarter decline in GDP, which largely reflected transitory factors like unusually severe winter weather and a sharp slowdown in inventory investment. In the third quarter, net exports made a large positive contribution to growth, while consumer spending and business investment remained positive contributors but grew at a somewhat slower pace than the previous quarter. Real gross domestic income (GDI), an alternative measure of the overall size of the economy, was up 4.5 percent in Q3.

Learn more about , , , Economy

Learn more about , , , EconomyAdvance Estimate of GDP for the Third Quarter of 2014

Posted by on October 30, 2014 at 8:30 AM ESTEconomic growth in the third quarter was strong, consistent with a broad range of other indicators showing improvement in the labor market, rising consumer sentiment, increasing domestic energy security, and continued low health cost growth. Since the financial crisis, the U.S. economy has bounced back more strongly than most others around the world, and the recent data highlight that the United States is continuing to lead the global recovery. Nevertheless, more must still be done to boost growth both in the United States and around the world by investing in infrastructure, manufacturing, and innovation; and to ensure that workers are feeling the benefits of that growth, by pushing to raise the minimum wage and supporting equal pay.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

1. Real gross domestic product (GDP) grew 3.5 percent at an annual rate in the third quarter of 2014, according to the advance estimate from the Bureau of Economic Analysis. The strong growth recorded in each of the last two quarters suggests that the economy has bounced back strongly from the first-quarter decline in GDP, which largely reflected transitory factors like unusually severe winter weather and a sharp slowdown in inventory investment. In the third quarter, net exports made a large positive contribution to growth, while consumer spending and business investment grew at a somewhat slower pace than the previous quarter.

Learn more about Economy

Learn more about EconomyThe Employment Situation in September

Posted by on October 3, 2014 at 8:30 AM ESTWith today’s report, America’s businesses extended the longest streak of private-sector job gains on record. The data underscore that six years after the Great Recession—thanks to the hard work of the American people and in part to the policies the President has pursued—our economy has bounced back more strongly than most others around the world. But even as we take stock of the progress that has been made, too many Americans do not yet feel enough of the benefits. Yesterday, the President set out his vision for steps that can lay a new foundation for stronger growth, rising wages, and expanded economic opportunity.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF LABOR STATISTICS

1. The private sector has added 10.3 million jobs over 55 straight months of job growth, extending the longest streak on record. Today we learned that total nonfarm payroll employment rose by 248,000 in September, mainly reflecting a 236,000 increase in private employment. Private-sector job growth was revised up for July and August, so that over the past twelve months, private employment has risen by 2.6 million. So far this year, private employment has risen by nearly 2 million, on pace for the strongest year of private-sector job growth since 1998.

Learn more about , EconomyThird Estimate of GDP for the Second Quarter of 2014

Posted by on September 26, 2014 at 8:30 AM ESTToday’s revision confirms that economic growth in the second quarter was strong, and other recent data suggest that this momentum has continued into the subsequent months. While these indicators demonstrate that the economy has come a long way in recovering from the Great Recession, there is more work to do to both boost growth and ensure that growth translates into greater financial security for working families. The President will continue to do everything in his power to support investments in job creation and encourage higher incomes for workers.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

1. Real gross domestic product (GDP) increased 4.6 percent at an annual rate in the second quarter of 2014, the fastest pace since the fourth quarter of 2011, according to the third estimate from the Bureau of Economic Analysis. The strong second-quarter growth represents a rebound from a first-quarter decline in GDP that largely reflected transitory factors like unusually severe winter weather and a sharp slowdown in inventory investment. Growth in consumer spending and business investment picked up in the second quarter, and residential investment increased following two straight quarters of decline. Additionally, State and local government spending grew at the fastest quarterly rate in five years. However, net exports subtracted from overall GDP growth, as imports grew slightly faster than exports. Real gross domestic income (GDI), an alternative measure of the overall size of the economy, was up 5.2 percent at an annual rate in the second quarter.

Learn more about Economy

Learn more about Economy

- &lsaquo previous

- …

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- …

- next &rsaquo

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues