Council of Economic Advisers Blog

The Economics of Big Data and Differential Pricing

Posted by on February 6, 2015 at 3:58 PM ESTThis morning, the White House released an update to the big data working group’s May 2014 report on big data, describing progress in implementing the working group’s recommendations throughout the government. As part of that process, the Council of Economic Advisers released a new study on big data and differential pricing.

Differential pricing is the practice of charging different prices to different customers. Economic textbooks typically refer to this as “price discrimination.” Everyday examples include discounts for senior citizens at the movie-theater and higher priced tickets for last minute business travelers.

Economists have studied differential pricing for many years, and while big data seems poised to revolutionize pricing in practice, it has not altered the underlying principles. Perhaps surprisingly, those principles suggest that differential pricing is often good for both firms and their customers. When prices reflect a buyer’s ability to pay, sellers can often serve customers who would otherwise get priced out of the market, as with need-based financial aid for college students. Price differences can also reflect the cost or risk of serving different customers, which can discourage inappropriate risk-taking and expand the size of the market.

The benefits of differential pricing indicate that it can play an important positive role in the overall economy. However, our report also explains how discriminatory pricing can pose difficult trade-offs and present serious concerns about fairness, especially when consumers are unaware of how sellers are using information about them, or when pricing is based on factors outside of individuals’ control. One way to limit to unfair or inaccurate applications of big data in this context is to give consumers increased visibility into the types of information that companies collect, and more control over how it is used, as proposed in the President’s Consumer Privacy Bill of Rights.

Big data allows companies to collect more information about customers and use it to create new kinds of measures, raising the likelihood differential pricing will become more common and more personalized over time. Our review of differential pricing online revealed that companies are presently experimenting with three broad pricing strategies: (1) experiments that randomly manipulate prices to learn about demand; (2) efforts to steer consumers towards particular products without altering their prices; and (3) using big data to customize prices to individual buyers. Research on the prevalence of these pricing practices suggests that experiments and steering are common at some web sites, while cases of personalized pricing remain limited. Nevertheless, there is some evidence that personalized pricing could prove very profitable, providing strong incentives for companies to continue experimenting with these tools.

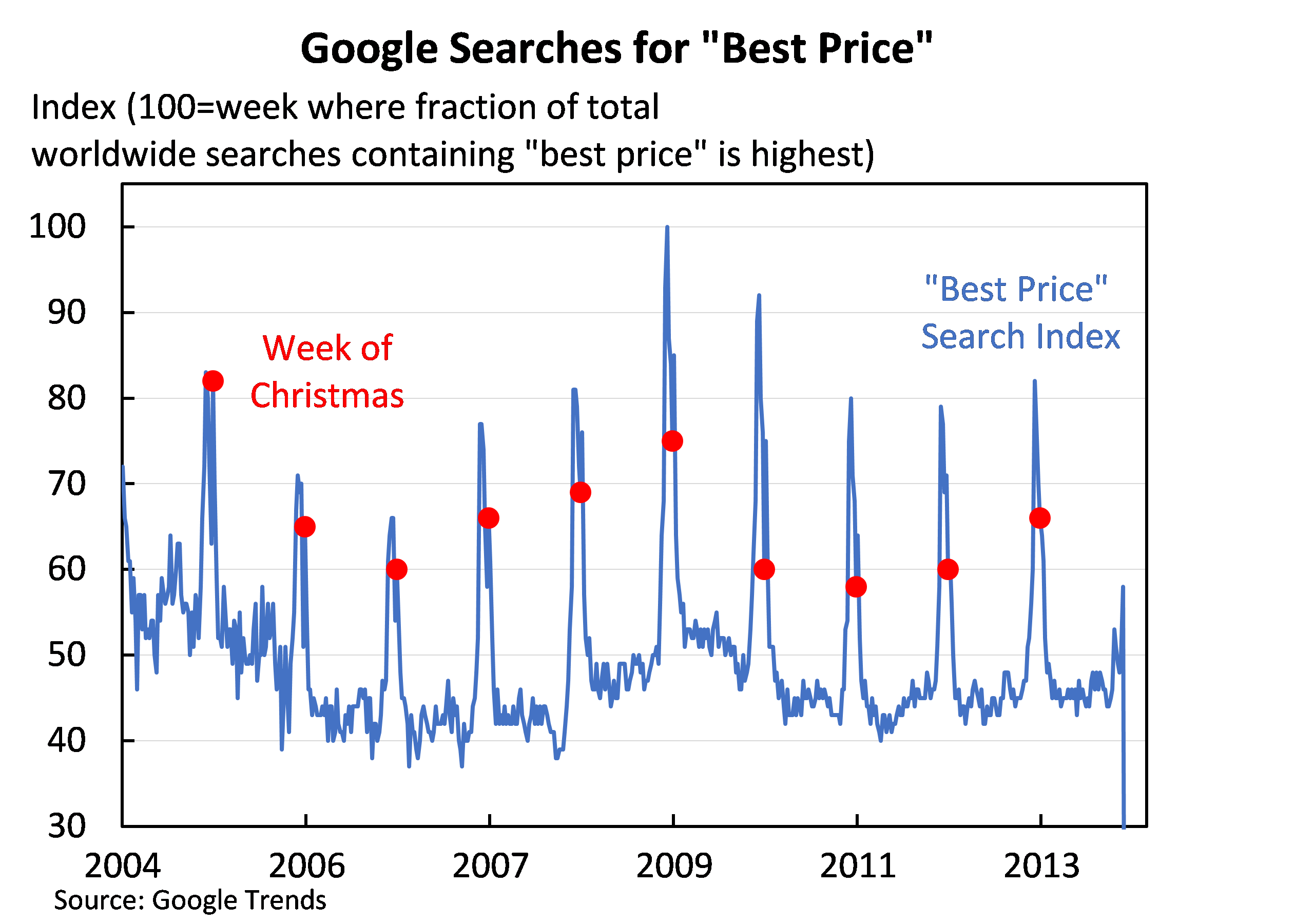

Our report also finds evidence that big data and related technologies can empower individual buyers. In the online environment, for example, many Internet browsers have privacy settings that allow users to control their personal information. Buyers can also use tools like price tracking and comparison web sites, or even a simple search engine, to seek out the best available price. For example, the chart below shows the relative frequency of Google searches on the term “best price” and how it is strongly correlated with the holiday shopping season. Partly because of these tools, and the competition they foster, Americans are using the Internet to shop in rapidly growing numbers.

Differential pricing in high-stakes transactions such as employment, insurance or credit provision can raise substantial concerns regarding privacy, data quality and fairness. In these settings, big data may facilitate discriminatory pricing strategies that target consumers based on factors outside their own control, or run afoul of antidiscrimination provisions in existing laws such as the Fair Credit Reporting Act or Civil Rights Act. Here too, however, big data can be a tool that works for consumers. For example, where the law protects specific groups against discriminatory pricing, big data can be used to conduct audits for disparate impact that help detect problems, both before and perhaps after a discriminatory algorithm is used on real consumers.

Given the speed at which both the technology and business practices are evolving, the CEA report on Big Data and Differential Pricing provides only a first look at a set of issues that will keep economists, engineers and policy makers busy for many years. The long-run challenge in this area is to promote the use of big data and differential pricing where they help to expand markets, while preventing unfair discrimination based on sensitive information that consumers may not understand they have revealed.

Learn more about EconomyThe Employment Situation in January

Posted by on February 6, 2015 at 9:30 AM ESTWith today’s strong employment report, we have now seen eleven straight months of job gains above 200,000—the first time that has happened in nearly two decades. We are also seeing nominal wage growth exceed the latest inflation readings, but additional steps are still needed to overcome the long-standing challenges affecting wages and family incomes. America is poised for another strong year, and so it is critical to avoid brinksmanship and unnecessary austerity, and instead to make investments in our future growth. That’s why earlier this week the President released a budget proposal that will help hardworking families make ends meet, while boosting America’s productivity and giving workers the tools they need to secure well-paying jobs in the 21st-century global economy.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF LABOR STATISTICS

1. The private sector has added 11.8 million jobs over 59 straight months of job growth, extending the longest streak on record. Today we learned that total nonfarm payroll employment rose by 257,000 in January due to a 267,000 increase in private-sector employment. Private-sector job growth was revised up for November and December by a combined 149,000 jobs, so that over the past twelve months, private employment has risen by 3.1 million, the largest twelve-month gain since 1998.

Learn more about , , , EconomyAdvance Estimate of GDP for the Fourth Quarter of 2014

Posted by on January 30, 2015 at 9:30 AM ESTEconomic growth in the fourth quarter was consistent with a broad range of other indicators showing solid improvement in the labor market, rising consumer sentiment, increasing domestic energy security, and continued low health cost growth. The combination of consumer spending and fixed investment grew at about the same strong pace as in the third quarter, while more volatile factors that elevated the overall growth rate in the third quarter subtracted from it in the fourth quarter. The President’s approach to middle-class economics, including the proposals he will release in his Budget on Monday, would build on this growth while helping to ensure that our recovery is widely shared with all American families.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

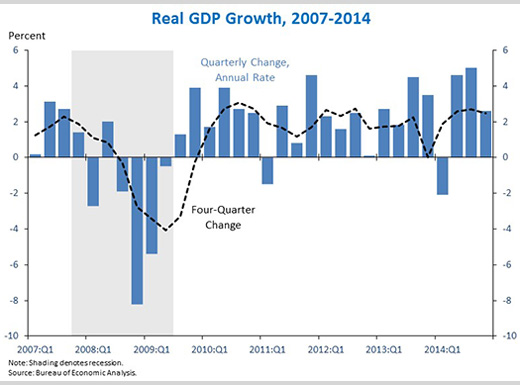

1. Real gross domestic product (GDP) grew 2.6 percent at an annual rate in the fourth quarter of 2014, according to the advance estimate from the Bureau of Economic Analysis. The report reflects very strong consumption growth, continued increases in residential investment, weaker business investment after two quarters of strong growth, an unusually large decline in federal spending that reversed last quarter’s above-trend increase, and stronger imports, which while subtracting from GDP, partly reflect improved consumer sentiment. Overall, real GDP rose 2.5 percent versus the fourth quarter of 2013. Indeed, today’s report affirms the underlying pattern of resurgence in the economy.

Learn more about Economy

Learn more about EconomyThe Employment Situation in December

Posted by on January 9, 2015 at 9:30 AM ESTToday’s solid employment report caps off a strong year for the U.S. labor market, which achieved a number of important milestones in 2014. Total job growth last year was the strongest since 1999, while the unemployment rate fell at the fastest pace in three decades. Although nominal wages fell in December, inflation-adjusted wages have generally been rising, and job growth has picked up in sectors that traditionally provide good, middle-class jobs. This week, the President has been laying out his vision to build on this progress by increasing access to community college, supporting the recovery in the housing sector and investing in U.S. manufacturing. On top of these steps, the President looks forward to working with Congress and taking action on his own authority to invest in America’s infrastructure, close tax loopholes and encourage job creation in America, support working families, expand overseas markets for American goods and services, make common-sense reforms to the immigration system, and raise the minimum wage.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF LABOR STATISTICS

1. The private sector has added 11.2 million jobs over 58 straight months of job growth, extending the longest streak on record. Today we learned that total nonfarm payroll employment rose by 252,000 in December, mainly reflecting a 240,000 increase in private employment. Private-sector job growth was revised up for October and November by a combined 50,000 so that over the past three months, private-sector job growth has averaged 280,000 per month. Private employment has risen by at least 200,000 for 11 consecutive months, the first time that has happened since the 1990s.

Learn more about , EconomyThird Estimate of GDP for the Third Quarter of 2014

Posted by on December 23, 2014 at 9:30 AM ESTToday’s upward revision indicates that the economy grew in the third quarter at the fastest pace in over a decade. The strong GDP growth is consistent with a broad range of other indicators showing improvement in the labor market, increasing domestic energy security, and continued low health cost growth. The steps that we took early on to rescue our economy and rebuild it on a new foundation helped make 2014 already the strongest year for job growth since the 1990s. Indeed, 2014 was a breakthrough year for the United States across a wide range of metrics important to middle-class families. Nevertheless, there is more work to be done to ensure that all Americans can share in the accelerating recovery.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

1. Real gross domestic product (GDP) grew 5.0 percent at an annual rate in the third quarter of 2014—the strongest single quarter since 2003—according to the third estimate from the Bureau of Economic Analysis. While quarterly growth reports are volatile, and some of the growth in Q3 reflected transitory factors, the recent robust growth data indicate a solid underlying trend of recovery. Indeed, the strong growth recorded in each of the last two quarters suggests that the economy has bounced back strongly from the first-quarter decline in GDP, which largely reflected transitory factors like unusually severe winter weather and a sharp slowdown in inventory investment. Consumer spending, business investment, and net exports all remained positive contributors this quarter. Real gross domestic income (GDI), an alternative measure of the overall size of the economy, was up 4.7 percent in Q3.

Learn more about Economy

Learn more about Economy2014 Has Seen Largest Coverage Gains in Four Decades, Putting the Uninsured Rate at or Near Historic Lows

Posted by on December 18, 2014 at 11:00 AM ESTEarlier this week, the National Center for Health Statistics released new data on health insurance coverage during the second quarter of 2014, the first federal survey data that largely capture the effects of the Affordable Care Act’s first open enrollment period. These new data confirm earlier findings that 2014 has seen dramatic reductions in the share of Americans without health insurance, reductions that correspond to an estimated 10 million people gaining coverage since before the start of open enrollment.

This progress is even more striking when viewed in historical context. Building on work by other researchers, the Council of Economic Advisers has constructed estimates of the share of Americans without health insurance extending back to 1963. These estimates show that the drop in the nation’s uninsured rate so far this year is the largest over any period since the early 1970s, years in which the Medicaid program was still ramping up and the Medicare and Medicaid programs were expanded to people with disabilities.

With this year’s decline, the nation’s uninsured rate is now at or near the lowest level recorded across five decades of data. Furthermore, new data out today on Medicaid enrollment and data on Marketplace plan selections from earlier this week show that progress in reducing the number of uninsured Americans is continuing.

Learn more about Health Care

- &lsaquo previous

- …

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- …

- next &rsaquo

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues