Council of Economic Advisers Blog

The Employment Situation in February

Posted by on March 6, 2015 at 9:30 AM ESTWith another strong employment report, we have now seen twelve straight months of private-sector job gains above 200,000 -- the first time that has happened since 1977. Moreover, 2014 was the best year for job growth since the late 1990s and 2015 has continued at this pace. But additional steps are needed to continue strengthening wages for the middle class. As outlined in the 2015 Economic Report of the President, the optimal environment for sustained middle-class income growth features policies that grow productivity, promote a more equitable distribution of income, and support labor force participation. The President’s focus on middle-class economics is designed with those goals in mind.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF LABOR STATISTICS

1. The private sector has added 12.0 million jobs over 60 straight months of job growth, extending the longest streak on record. Today we learned that total nonfarm payroll employment rose by 295,000 in February, largely due to a 288,000 increase in private-sector employment. Although private-sector job gains in December and January were revised down, the private employment gains over the past twelve months total 3.2 million—the largest 12-month increase since 1998.

Learn more about , , , , EconomyFormer Top Economic Advisers Show Strong Bipartisan Support for Passing Trade Promotion Authority

Posted by on March 5, 2015 at 6:30 PM ESTToday, fourteen former chairs of the President’s Council of Economic Advisers sent a letter to the leadership in Congress expressing their strong support for renewal of Trade Promotion Authority (TPA). The economists signing the letter have served each of the last seven Presidents—all the way back to President Ford—demonstrating the rich, bipartisan history of support for Trade Promotion Authority.

In his State of the Union, the President called on Congress to work with him to secure approval of bipartisan trade promotion legislation – building on the 80 year history of Democrats and Republicans working together to promote American exports that support American jobs that pay higher-than-average wages. Export-related jobs pay up to 18 percent more, on average, than non-export-related jobs. TPA establishes clear procedures for the consideration of trade agreements and reaffirms that U.S. negotiators and the President have the support of Congress when fighting for the interests of American workers and American small businesses.

As detailed in the recently released Economic Report of the President authored by our current Council of Economic Advisers, exports driven by high-standard trade agreements like the ones the President is negotiating can have profoundly positive impacts here at home – including yesterday’s announcement by the Department of Commerce that exports of goods and services supported 11.7 million jobs in the United States in 2014. Today’s letter signers agree, stating in the letter that:

Expanded trade through these agreements will contribute to higher incomes and stronger productivity growth over time in both the United States and other countries. U.S. businesses will enjoy improved access to overseas markets, while the greater variety of choices and lower prices trade brings will allow household budgets to go further to the benefit of American families.

Trade Promotion Authority will help us secure the best possible agreements with the Trans-Pacific Partnership (TPP) and the Transatlantic Trade and Investment Partnership (T-TIP). Yet, TPA hasn't been updated in over a decade. Today’s letter is another powerful statement that it’s time to get it done.

Learn more about , EconomySecond Estimate of GDP for the Fourth Quarter of 2014

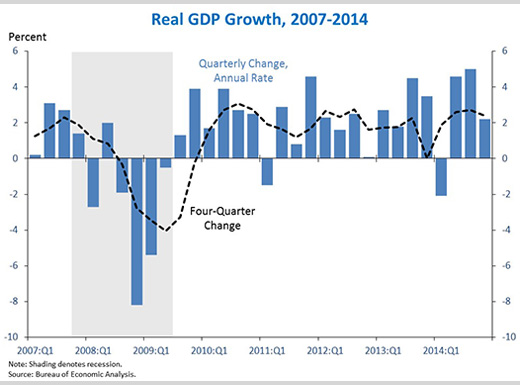

Posted by on February 27, 2015 at 9:51 AM ESTToday’s estimate of fourth-quarter economic growth affirms the strong underlying trend of the largest and most persistent components of output, while reflecting downward revisions to more volatile sectors. The combination of personal consumption and business fixed investment—known as private domestic final purchases—grew at a somewhat faster pace than in the third quarter, indicating the same positive trend. Meanwhile, the more volatile and transitory factors that boosted growth in the third quarter subtracted from it in the fourth. Overall, today’s report is consistent with a wide range of indicators showing further labor market strengthening, increasing domestic energy security, continued low health cost growth, and resiliency in the face of slower growth in the global economy. The President’s approach to middle-class economics would build on this growth while helping to ensure that our recovery is widely shared with all American families.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

1. Real gross domestic product (GDP) grew 2.2 percent at an annual rate in the fourth quarter of 2014, according to the second estimate from the Bureau of Economic Analysis. The report reflects especially strong consumption growth, an upward revision to business fixed investment, and continued residential investment increases. At the same time, the large third-quarter increase in Federal defense spending reversed, and inventory investment was revised down (see point 2). Overall, real GDP has risen 2.4 percent versus the fourth quarter of 2013.

Learn more about Economy

Learn more about EconomyTaking Action to Unlock the Economic Contributions of Americans-in-Waiting

Posted by on February 24, 2015 at 2:23 PM ESTThe President is continuing to take action, within his legal authority, to fix our broken immigration system. Today, the Administration announced a final rule that will allow spouses of certain high-skilled workers to contribute to the economy while they wait to obtain lawful permanent residence status (or a “green card”) through their employer. America needs a 21st century immigration system that lives up to our heritage as a nation of laws and a nation of immigrants—and that grows our economy. This change, as well as the other actions announced by the President this past November, will do just that.

The President’s Council of Economic Advisers (CEA) has also released an updated report on the economic impact of the President’s executive actions, which are now estimated to boost the nation’s GDP by as much as $250 billion over ten years, due in part to increases in the size of the American workforce and to increased innovation from high-skill workers. These actions will also increase the productivity and wages of all American workers, not just immigrants, as evidenced by a large body of academic work cited in the CEA report.

By finalizing this rule, the Department of Homeland Security (DHS) is taking an important step forward in executing the President’s immigration executive actions and locking in these economic benefits. The changes included in this rule will—for the first time—allow employment authorization for the spouses of certain high-skill workers who are here on H-1B visas, as long as those workers have begun the process of applying for a green card. This rule change, which was recommended in a “We the People” petition to the White House, will empower these spouses to put their own education and skills to work for the country that they and their families now call home.

Learn more about , ImmigrationThe Effects of Conflicted Investment Advice on Retirement Savings

Posted by on February 23, 2015 at 9:45 AM ESTAmericans’ retirement income is derived from many sources, including Social Security, traditional pensions, employer-based retirement savings plans such as 401(k)s, and Individual Retirement Accounts (IRAs). While this landscape is familiar today, it reflects a dramatic change from the landscape 40 years ago. The share of working Americans covered by traditional pension plans—which offer a guaranteed income stream in retirement—has fallen sharply. Today, most workers participating in a retirement plan at work are covered by a defined contribution plan, such as a 401(k). Importantly, the income available in retirement from a defined contribution plan depends on both the amount initially saved and the return on those savings. The shift from traditional pensions to defined contribution plans raises important policy issues about investment responsibilities and the roles of individual households, employers, and investment advisers in ensuring the retirement security of Americans.

Defined contribution plans and IRAs are intricately linked, as the overwhelming majority of money flowing into IRAs comes from rollovers from an employer-based retirement plan, not direct IRA contributions. Collectively, more than 40 million American families have savings of more than $7 trillion in IRAs. More than 75 million families have an employer-based retirement plan, own an IRA, or both. Rollovers to IRAs exceeded $300 billion in 2012 and are expected to increase steadily in the coming years. The decision whether to roll over one’s assets into an IRA can be confusing and the set of financial products that can be held in an IRA is vast, including savings accounts, money market accounts, mutual funds, exchange-traded funds, individual stocks and bonds, and annuities. Selecting and managing IRA investments can be a challenging and time-consuming task, frequently one of the most complex financial decisions in a person’s life, and many Americans turn to professional advisers for assistance. However, financial advisers are often compensated through fees and commissions that depend on their clients’ actions. Such fee structures generate acute conflicts of interest: the best recommendation for the saver may not be the best recommendation for the adviser’s bottom line.

CEA’s new report The Effects of Conflicted Investment Advice on Retirement Savings examines the evidence on the cost of conflicted investment advice and its effects on Americans’ retirement savings, focusing on IRAs. Investment losses due to conflicted advice result from the incentives conflicted payments generate for financial advisers to steer savers into products or investment strategies that provide larger payments to the adviser but are not necessarily the best choice for the saver.

CEA’s survey of the literature finds that:

- Conflicted advice leads to lower investment returns. Savers receiving conflicted advice earn returns roughly 1 percentage point lower each year (for example, conflicted advice reduces what would be a 6 percent return to a 5 percent return).

- An estimated $1.7 trillion of IRA assets are invested in products that generally provide payments that generate conflicts of interest. Thus, we estimate the aggregate annual cost of conflicted advice is about $17 billion each year.

- A retiree who receives conflicted advice when rolling over a 401(k) balance to an IRA at retirement will lose an estimated 12 percent of the value of his or her savings if drawn down over 30 years. If a retiree receiving conflicted advice takes withdrawals at the rate possible absent conflicted advice, his or her savings would run out more than 5 years earlier.

- The average IRA rollover for individuals 55 to 64 in 2012 was more than $100,000; losing 12 percent from conflicted advice has the same effect on feasible future withdrawals as if $12,000 was lost in the transfer.

The conclusions of the report are based on a careful review of the relevant academic literature but, as with any such analysis, are subject to uncertainty. However, this uncertainty should not mask the essential finding of this report: conflicted advice leads to large and economically meaningful costs for Americans’ retirement savings. Even a far more conservative estimate of the investment losses due to conflicted advice, such as half of a percentage point, would indicate annual losses of more than $8 billion. On the other hand, if conflicted advice affects a larger portion of IRA assets than the $1.7 trillion considered here—or if the estimate were extended to other forms of retirement savings—the total annual cost would exceed $17 billion.

Learn more about EconomyThe 2015 Economic Report of the President

Posted by on February 19, 2015 at 6:00 AM ESTThis morning, the Council of Economic Advisers released the 69th-annual Economic Report of the President, which reviews the United States’ accelerating recovery and ways to further support middle-class families as the recovery continues. The economy is recovering from the Great Recession at an increasing pace, growing at an annual rate of 2.8 percent over the past two years, compared with 2.1 percent over the first three-and-a-half years of the recovery. The speed-up is especially clear in the labor market, where job gains have reached a pace not seen since the 1990s. But it is essential that a broad range of households benefit from the United States’ resurgent growth, so this year’s Report focuses on factors that are important to middle-class incomes: productivity, labor force participation, and income inequality. The President’s approach to economic policies, what he calls “middle-class economics,” aims to improve each of these long-standing elements and ensure that Americans of all income levels share in the accelerating recovery.

Below are some highlights from each of the seven chapters in this year’s Report:

Chapter 1 reviews the progress of the recovery and explores the long-term factors that drive middle-class incomes. The U.S. recovery has accelerated in terms of both output and employment, with job growth rising 30 percent faster in 2014 than in 2013 (Figure 1-2). Indeed, the unemployment rate has fallen to levels that, as recently as 2013, were not expected until after 2017. These labor market improvements have begun to translate into wage gains for middle-class workers, but nevertheless, this recent progress cannot make up for decades of sub-par middle-class income growth. The chapter provides historical and international context for middle-class income growth and the three key factors that influence it: productivity growth, changes in labor force participation, and income inequality. The increasing strength of our current recovery provides an opportunity to address these long-standing challenges, and the President supports a wide range of policies, detailed in this Report, that will strengthen all three key factors.

- &lsaquo previous

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- …

- next &rsaquo

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues