Third Estimate of GDP for the First Quarter of 2014

First-quarter GDP was revised down today, largely reflecting updated estimates of consumer spending on health care, which was substantially lower than originally reported, as well as exports, which were below the initial estimates. The GDP data can be volatile from quarter to quarter; a range of other data show a more positive picture for the first quarter, and more up-to-date indicators from April and May suggest that the economy is on track for a rebound in the second quarter. The recovery from the Great Recession, however, remains incomplete, and the President will continue to do everything he can to support the recovery, either by acting through executive action or by working with Congress on steps that would boost growth and speed job creation.

FIVE KEY POINTS IN TODAY’S REPORT FROM THE BUREAU OF ECONOMIC ANALYSIS

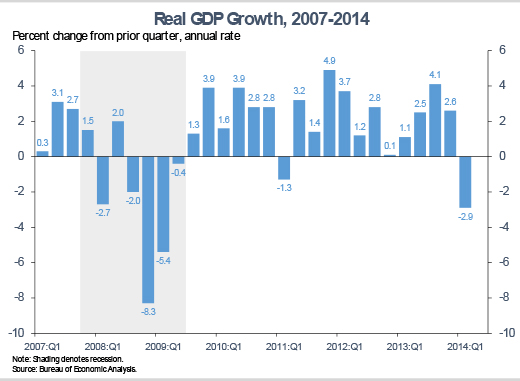

1. Real gross domestic product (GDP) fell 2.9 percent at an annual rate in the first quarter of 2014, according to the third estimate from the Bureau of Economic Analysis. This drop follows an increase of 3.4 percent at an annual rate in the second half of 2013. The entire decline in overall GDP in the first quarter can be accounted for by a decline in exports and a slowdown in inventory investment, two particularly volatile components of GDP. In addition, several components were likely affected by unusually severe winter weather, including consumer spending on food services and accommodations, which fell for the first time in four years.

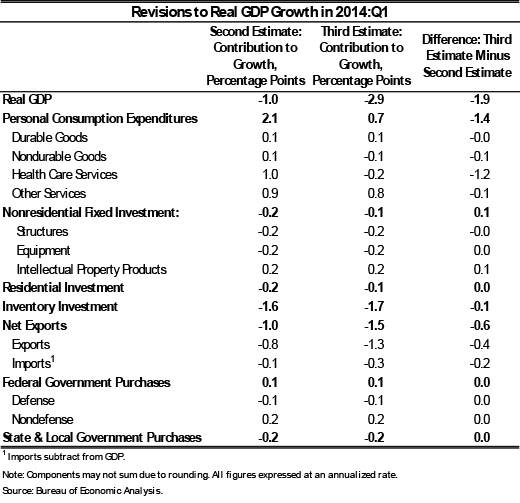

2. The downward revision to first-quarter GDP growth was concentrated in two areas: consumer spending on health care services and net exports. As discussed in greater detail below, the contribution of spending on health care services was revised down 1.2 percentage point, while the net export contribution was revised down 0.6 percentage point. Revisions to other components were small and offsetting. The revisions to estimates of first-quarter GDP growth have been historically large. In the mid-1980s, the Bureau of Economic Analysis began releasing GDP data according to the same timing pattern it uses today. Looking over this period, the estimates of GDP growth for 2014:Q1 represent the largest revision from an advance estimate to a third estimate, as well as the largest revision from a second estimate to a third estimate, in the roughly thirty years the Bureau of Economic Analysis has done these estimates.

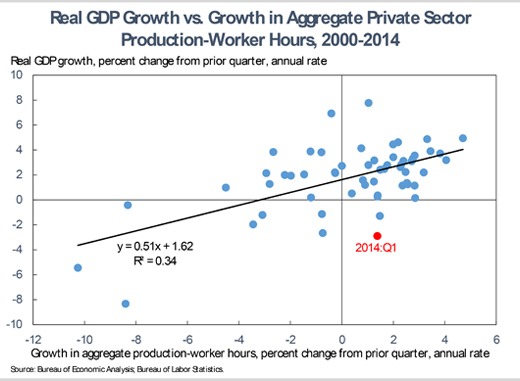

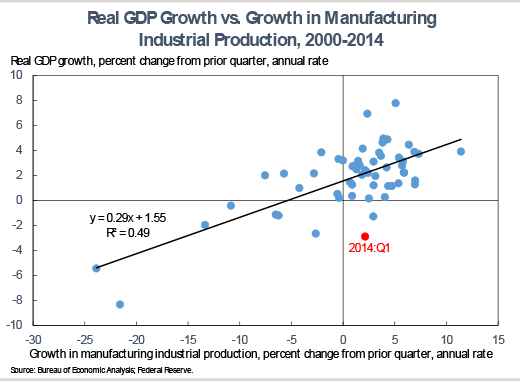

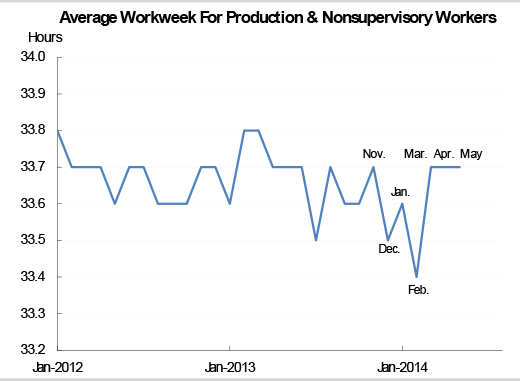

3. The performance of the economy in the first quarter as measured by GDP was significantly below other independently calculated measures. For instance, aggregate hours worked by private-sector production and nonsupervisory workers as measured by the Bureau of Labor Statistics grew 1.4 percent at an annual rate in the first quarter (left chart), while industrial output in the manufacturing sector as measured by the Federal Reserve increased 2.1 percent at an annual rate (right chart). Looking at the historical relationship between these two proxies for output and GDP since 2000, one would have expected positive GDP growth of 2 to 2.5 percent at an annual rate in the first quarter. The roughly 5 percentage point prediction error seen this quarter is more than twice the standard deviation of the distribution of historical prediction errors, suggesting that such a large negative error only occurs about two percent of the time.

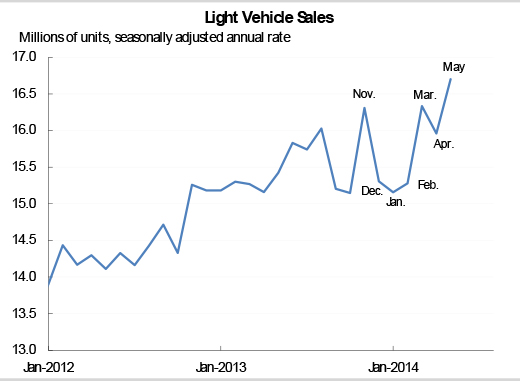

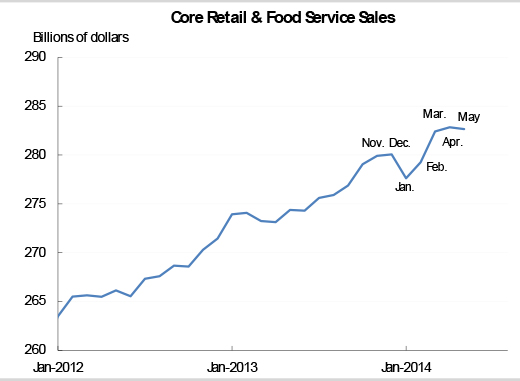

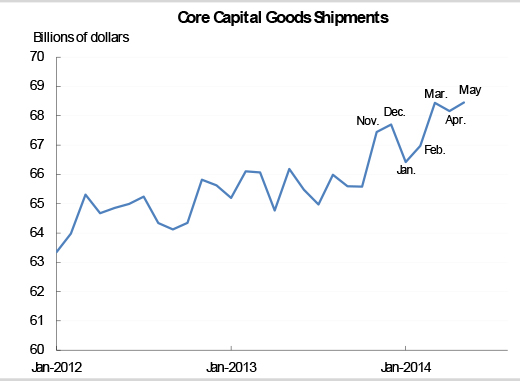

4. Within the first quarter, several key indicators were lower in January and/or February before rebounding strongly in March, suggesting that the severe weather had a disruptive effect that only began to abate at the end of the quarter. Light vehicle sales, average weekly hours, core retail and food service sales, and core capital goods shipments dipped starting in December and/or January before bouncing back in March, and so were left little changed for the quarter as a whole. One outside group has estimated that the elevated snowfall in the first quarter slowed the annual rate of GDP growth by 1.4 percentage point, with all of that lost activity to be made up in the second quarter.

Additionally, it is worth noting that consumer spending on utilities surged more than 40 percent at an annual rate in the first quarter, the largest increase on record (with data back to 1959). While this weather-related jump in utilities spending added to GDP growth, it was likely more than offset by the constraining effect of severe weather on other categories, including other components of consumer spending (like autos, household furnishings, and restaurants), some components of private and public fixed investment, and exports.

Source: Bureau of Economic Analysis; Bureau of Labor Statistics; Census Bureau.

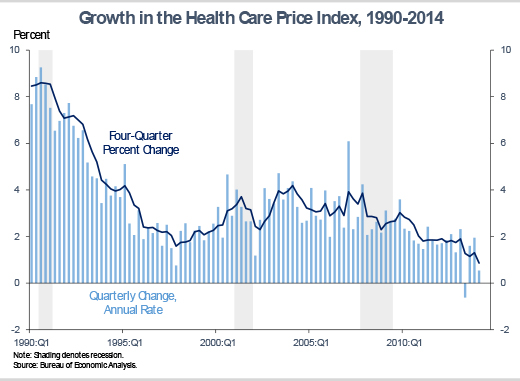

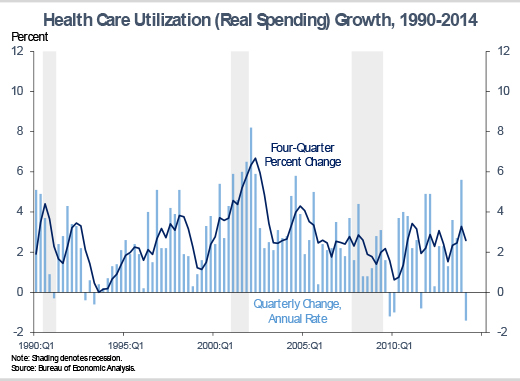

5. Health care prices continued to rise exceptionally slowly in the first quarter, growing at an annual rate of just 0.5 percent, while utilization (real health care spending) fell 1.4 percent at an annual rate, leading to an outright decline in nominal spending in 2014:Q1. Because health care spending can be volatile on a quarter-to-quarter basis (2013:Q4, for example, was estimated to have seen growth somewhat above the recent trend), it can be useful to look at a longer time period. On a year-over-year basis, health care prices are up just 0.9 percent, while utilization is up 2.6 percent.

As we wrote in discussing the advance estimate, “It is important to note that the main survey BEA uses to track health care spending will not report first-quarter estimates until June, and the expansion of insurance coverage under the Affordable Care Act during the first quarter complicates the interpretation of other available data. For this reason, today’s estimates could be revised significantly.”

Today’s report thus shows that the historically slow growth in health care prices and spending seen in recent years, which is thanks in part to the Affordable Care Act, continued through 2013 and into early 2014. Slow growth in health care costs is making it easier for businesses to hire workers or pay a good wage and improving the Nation’s fiscal outlook.

Looking ahead, it is likely that the coming quarters will see faster growth in total health care spending as the millions of people who gained health insurance coverage during the Affordable Care Act’s first open enrollment period begin to use their new coverage, fulfilling the law’s goal of expanding access to health care services. Importantly, this type of uptick in total spending would not mean that people who had coverage before the Affordable Care Act are facing higher costs. Rather, what matters for those who are continuously insured are the prices and premiums they face. Today’s data, as well as a variety of other recent data, show that health care prices and per-enrollee spending (the key driver of premiums) are continuing to grow at unusually slow rates.

As the Administration stresses every quarter, GDP figures can be volatile and are subject to substantial revision. Therefore, it is important not to read too much into any one single report and it is informative to consider each report in the context of other data that are becoming available.

Jason Furman is Chairman of the Council of Economic Advisers.

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- AIDS Policy

- Alaska

- Blueprint for an America Built to Last

- Budget

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Equal Pay

- Ethics

- Faith Based

- Fiscal Responsibility

- Foreign Policy

- Grab Bag

- Health Care

- Homeland Security

- Immigration

- Innovation Fellows

- Inside the White House

- Middle Class Security

- Open Government

- Poverty

- Rural

- Seniors and Social Security

- Service

- Social Innovation

- State of the Union

- Taxes

- Technology

- Urban Policy

- Veterans

- Violence Prevention

- White House Internships

- Women

- Working Families

- Additional Issues