Health Care Blog

Expanding the Healthcare Tax Credit for Small Businesses

Posted by on February 16, 2012 at 2:06 PM EDTEd. Note: This was originally posted on Open for Business, the U.S. Small Business Administration blog.

Right now, small businesses across America pay an average of 18 percent more to provide health insurance than large businesses. While the insurance exchanges included in the Affordable Care Act will bring these costs down starting in 2014, we need to make it easier for small business owners to provide insurance to their employees right now. One important part of President Obama’s Fiscal Year 2013 budget proposal expands a tax credit that does exactly that.

The Small Business Health Care Tax Credit has benefited hundreds of thousands of small businesses since the Affordable Care Act passed in 2010. After listening to business owners around the country, the President is proposing to make the tax credit available to more businesses and easier to claim. The budget increases the maximum size of eligible companies from 25 employees to 50, proposes more generous phase-out provisions and simplifies the credit, making it easier to claim. It is estimated that if the President’s proposal were enacted, the tax credit will benefit about half a million employers who provide healthcare to 4 million workers in 2012 alone. Over the next decade, this proposal would provide an additional $14 billion in tax credits to small employers across the country.

These changes will help small business owners hire more employees and create an economy built to last. Take for example, Mark Hodesh, who owns Downtown Home and Garden in Ann Arbor, Michigan. He started offering healthcare about 15 years ago to attract and retain talented employees so that he could compete with bigger stores and to help address skyrocketing healthcare costs his employees were facing.

In 2010, after qualifying for the small business healthcare tax credit, he got back nearly $9,000, almost 30 percent of his costs, for offering coverage to 11 full-time employees. The money he saved helped him hire a new employee, and now, with 12 employees, his tax credit could be go up to about $10,000 if the President’s proposal to expand the tax credit is adopted by Congress.

Learn more about Economy, , Health CareThe State of Latino Health Twitter Chat

Posted by on February 16, 2012 at 12:55 PM EDTEd note: This has been cross-posted from the HealthCare.gov blog.

Not all Americans have equal access to health care – or similar health care outcomes. Racial and ethnic minorities, and other underserved populations often have higher rates of disease, fewer treatment options, and reduced access to care. This is because many Latinos have less access to health insurance and half of Latinos don’t have a regular doctor. Because of this unequal access to health care, troubling health disparities have emerged.

But the good news is that the health care law, the Affordable Care Act, is the most powerful legislation in decades for reducing health disparities. The law will help reduce grave health disparities by: expanding preventive care like cancer screenings and immunizations at no additional costs, better coordinating care like home visits for expectant mothers, expanding diversity and cultural competency, ending insurance discrimination so people who have been sick can’t be excluded from coverage or charged higher premiums, and making care more available in underserved communities by investing in our primary care workforce and community health centers.

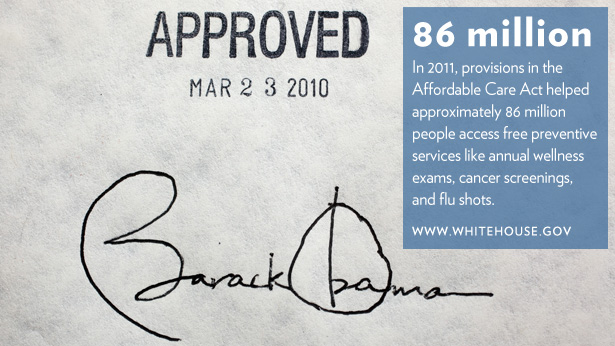

Learn more about Health CareBy the Numbers: 86 Million

Posted by on February 15, 2012 at 7:30 PM EDT

In 2011, the Affordable Care Act provided approximately 54 million Americans with at least one new free preventive service through their private health insurance plans, and an estimated 32.5 million people with Medicare received at least one free preventive benefit in 2011. Together, this means an estimated 86 million Americans were helped by provisions in the health reform law that encourage prevention.

One of the major goals of the Affordable Care Act is to help people stay healthy by giving them the tools they need to take charge of their own health and supporting a culture of prevention, rather than focusing on treatment after people get sick.

To do this, the health reform law requires many insurance plans to provide no-copay coverage for a variety of preventive health services, such as colonoscopy screenings for men, Pap smears and mammograms for women, well-child visits, and flu shots for all children and adults. The law also makes proven preventive services free for most people on Medicare.

Read more about the preventive services private insurers cover at no charge as a result of the Affordable Care Act here, and click here to learn about preventive services available through Medicare.

Learn more about Health Care$40 Means an Inhaler for My Little Girl

Posted by on February 15, 2012 at 3:18 PM EDTPresident Obama yesterday asked Americans to share their stories, and tell him what losing $40 per paycheck would mean to their family. Of the thousands that responded, many were single moms, who sent us photos, tweets, and emails that illustrate just how important decisions made in Washington are to regular people across the country.

At the end of this month, a two-month extension of the payroll tax cut will expire. If Congress doesn't act, taxes will go up on 160 million hardworking Americans. For a family making about $50,000 a year, the payroll tax cut amounts to about $1,000 a year, or about $40 in every paycheck. It may not seem like a lot of money to some people, but for single moms who wrote to us today, that money can make a big difference. Here are some of their stories:

I'm a single mom and $40.00 means an inhaler for my little girl! She suffers from asthma and her insurance only covers (with co-payment) one inhaler a month and sometimes I have to purchase 2 - 3 a month. So, $40 may not be much for some but it means I can provide for my kid's well being. -- Kathy from Florida

I'm a single mom and $40.00 means an inhaler for my little girl! She suffers from asthma and her insurance only covers (with co-payment) one inhaler a month and sometimes I have to purchase 2 - 3 a month. So, $40 may not be much for some but it means I can provide for my kid's well being. -- Kathy from Florida $40 a month helps me pay for the things my daughter needs to play for her high school softball team. Her sports drinks, her cleats, or gloves or whatever it may be that she needs. I am a single mom trying to give my daughter things my parents couldn't afford. Please don't take those $40 a pay away -- Annette from New Jersey

$40 a month helps me pay for the things my daughter needs to play for her high school softball team. Her sports drinks, her cleats, or gloves or whatever it may be that she needs. I am a single mom trying to give my daughter things my parents couldn't afford. Please don't take those $40 a pay away -- Annette from New Jersey I am a single mom and I have one son still at home. He is 14 and injured his knee in October, and $40 a month means I can afford the $30 co-pay for the orthopedic surgeon visits or the out-of-pocket deductible for his physical therapy. But more than that, if he hadn't had this injury, that $40 a paycheck would still mean a lot to both of us. It might mean he and I could go to the movies and get burgers afterwards, or I could buy him a pair of jeans, or a tank of gas for our car. It would mean we could have a little bit more and that has been nice. I have so very much appreciated the tax relief and the extra money this bill has provided and I know millions of others Americans like me feel the same -- Deborah from Ohio

I am a single mom and I have one son still at home. He is 14 and injured his knee in October, and $40 a month means I can afford the $30 co-pay for the orthopedic surgeon visits or the out-of-pocket deductible for his physical therapy. But more than that, if he hadn't had this injury, that $40 a paycheck would still mean a lot to both of us. It might mean he and I could go to the movies and get burgers afterwards, or I could buy him a pair of jeans, or a tank of gas for our car. It would mean we could have a little bit more and that has been nice. I have so very much appreciated the tax relief and the extra money this bill has provided and I know millions of others Americans like me feel the same -- Deborah from Ohio $40 dollars puts one tank of gas in my economy car. It gives me the gas money I need to drive my son to school. When you are a single mother trying to send a child through college every penny counts -- Marie from New Mexico

$40 dollars puts one tank of gas in my economy car. It gives me the gas money I need to drive my son to school. When you are a single mother trying to send a child through college every penny counts -- Marie from New MexicoMore voices:

Obama Administration’s Unprecedented Fraud Fighting Pays Off

Posted by on February 14, 2012 at 1:23 PM EDTMore than most seniors, Jacqueline Jefferson of Philadelphia, PA, knows that bad actors looking to defraud Medicare have lots of tricks up their sleeves – and persistence.

Seven years ago, Jacqueline was reviewing her Medicare medical statement and noticed a number of false charges. She did the right thing and alerted Medicare. She also realized that many of her fellow Medicare patients may not know they are at risk for fraud – or may be afraid to step forward. The experience inspired her to join the Senior Medicare Patrol (SMP) – a group of senior citizen volunteers who educate and empower their peers to identify, prevent and report health care fraud.

Thanks to the Obama Administration, funding for the SMP has increased by 75 percent from FY 2008 to FY 2011. In 2010, nearly 5,000 volunteers helped educate about 300,000 Medicare patients at 8,300 community anti-fraud events. And those volunteers held more than 70,000 one-on-one counseling sessions on potential Medicare fraud, waste or abuse cases – more than double the number in 2009.

That’s a good thing – because, like many seniors, Jacqueline was the target of yet another fraud attempt. She was contacted multiple times by telemarketers offering free diabetic supplies in exchange for her Medicare number – even though she isn’t a diabetic. You can see her story here.

These efforts are part of the unprecedented focus the Obama Administration has brought to both stopping fraud before it happens, and recovering fraudulent Medicare payments and prosecuting fraudsters.

Learn more about Economy, Health CarePresident’s Budget Request Reflects Strong Commitment on Global AIDS

Posted by on February 13, 2012 at 7:24 PM EDT

Ed note: this post originally appeared on Dipnote, the State Department's official blog

Today, the Obama Administration issued the President's budget request for fiscal year (FY) 2013. It demonstrates that the United States remains fully committed to the fight against global AIDS, and will meet the President's ambitious targets for HIV/AIDS treatment and prevention announced on World AIDS Day 2011. I am so proud that, even in a challenging budget environment with strict budget caps, the Administration has continued to make this work a priority.

This budget will enable PEPFAR to achieve the President's stated goals for the program, including on prevention and supporting 6 million people on treatment by the end of 2013. As we move towards creating an AIDS-free generation, President Obama and Secretary Clinton are focused on improving and saving lives -- these outcomes are the most important metric of success. The results to date speak for themselves:

- We have more than doubled the number of individuals on lifesaving anti-retroviral treatment (nearly 4 million in FY 2011, up from 1.7 million in FY 2008).

- We averted 200,000 infant HIV infections in FY 2011, through increased commitment to prevent mother-to-child transmission.

- We supported care services for almost 13 million people (including 4 million orphans and vulnerable children) in FY 2011, a 55 percent increase from FY 2008.

Under this Administration, PEPFAR has matured. We've become more efficient, increasing the impact of our work. The FY 2013 request reflects this focus on finding efficiencies and continuing to drive down costs. By using generic drugs, shipping commodities more cheaply, task-shifting to nurses and community health workers as appropriate, and linking AIDS services to other programs (such as maternal and child health), we have dramatically decreased the per-patient cost of providing treatment and other services. We have reduced PEPFAR treatment costs per person from $1,100 to $335 per person and costs continue to fall -- every dollar we invest is going farther.

The growth in country ownership of programs is another critical piece of the story. Middle income countries with PEPFAR programs have begun to increase their investments in health programs, further reducing our direct costs. South Africa is the leading example of a country that has ramped up its investment (now over $1 billion) and indicates that it will continue to do so -- a key development, as it has the largest number of people living with HIV in the world.

- &lsaquo previous

- …

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- …

- next &rsaquo